Efma, Microsoft and Avanade Announce Major Fintech Initiative

by Fintechnews Switzerland March 22, 2016Efma, Microsoft and Avanade have teamed up to launch a major global fintech initiative intended to bring under one roof the fintech community, retail banks and insurance firms.

The new Fintech Portal, set to go live on April 14, 2016 during the Distribution Summit Gala in London, aims at being a global platform and “a unique portal that enables the fintech offer to meet the demands of financial institutions,” according to Vincent Bastid, CEO of Efma.

Banks should not fear new entrants but rather consider collaborating with these players and leverage their competitive advantages and technologies.

Many have advised traditional financial institutions to opt for a collaborative approach, and consider these players as potential enablers rather than threats.

In the same lines, the Fintech Portal intends to become a hub where banks and insurers can discover the best fintech partners “to support them on their journey to become true digital businesses,” said Violetta Senda, Avanada Europe digital strategy lead.

“This unique forum for networking and collaboration will enable financial services insitutions to adopt best-in-class fintech solutions to transform their business, strengthen customer relationships, and empower employees,” Senda said.

European fintechs struggling to raise funding

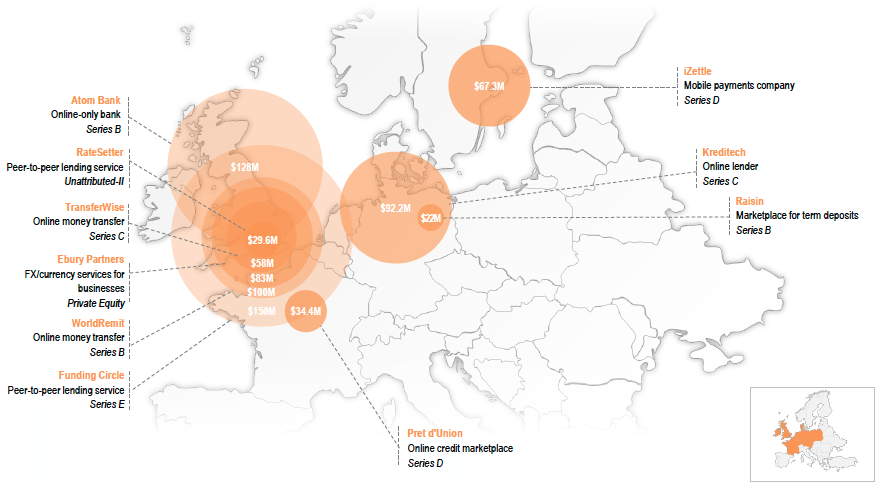

In 2015, European fintech companies raised a total of US$1.48 billion in funding from VCs across 125 deals, behind North America (US$7.7 billion through 378 deals) and Asia (US$4.5 billion through 130 deals), according to CB Insights and KPMG’s “The Pulse of Fintech, 2015 in Review” report.

Europe’s wide variety of cultures, languages and regulatory environments have somewhat hinder the ability to grow startups. This has been slowly easing as a result of growing collaboration aimed at reducing regulatory barriers and increasing banking sector efficiencies across Europe.

While regulatory issues are being addressed, individual countries are working to create and foster fintech ecosystems with the belief of the sector’s massive potential. Business accelerators and incubators, including the Copenhagen Fintech Innovation Research Association, Holland Fintech, Fintech France and Level39 in London, are all working towards developing the community and increasing collaboration across the fintech space in Europe.

London still leading the way

The UK still leads the way in Europe with 60% of all European fintech startups based in the country. In 2015, UK-based companies attracted US$962 million: that’s 65% of the total amount raised by all VC-backed fintech businesses in Europe.

The 10 largest European fintech rounds of 2015, The Pulse of Fintech, 2015 in Review, CB Insights and KPMG

London-based Level39 is one of the most successful initiatives in Europe, attracting more than 170 startups and continuing to deliver innovative approaches in developing the community, from hackathons to educational and networking events.

Level39 in London, via Level39.io

The success of London has been a catalyst for other major European cities. The Copenhagen Fintech Innovation Research Association (CFIR) in Denmark is a non-profit association that develops research, innovation and education within financial technology. CFIR initiates projects and analysis and uses professional knowledge to stimulate debate.

Similarly to CFIR, Holland Fintech is aimed at creating an internationally connected ecosystem to enable maximum acceleration and adoption of fintech. Within a year Holland Fintech managed to create a network of 68 companies, in addition to a number of partnerships with other countries.

Fintech France, which emerged in June last year, is a group of 36 startups that have come together to form a non-profit organization designed to promote the industry domestically and overseas. The organization intends to share experience, knowledge and information within its membership, as well as build relationships with other digital associations in France and abroad.

Efma’s fintech portal is the latest initiative to emerge with the intention to foster the ecosystem with a collaborative approach.

During the Efma Distribution Summit Gala in April, a jury of 50 banking and insurance executives will select nine of the best-in-class fintech solutions to receive the Efma Fintech Award. The winning teams in each category will receive awards from Santander, BNP Paribas, Intesa Sanpaolo, Caixa Bank and other world leading financial institutions.

The Fintech Portal will be introduced during that day. It is expected to be a repository of leading fintech solutions and services that retail financial services organization can search and collaborate with.

Featured image: Tower Bridge London Twilight, via Wikipedia.

3 Comments so far

Jump into a conversationThe goal of the initiative is to create a global fintech community that brings retail banks, insurance companies and fintech businesses into one platform so they can collaborate and develop products and services. new service.

Other major European cities have followed suit, such as the Copenhagen Fintech Innovation Research Association (CFIR) in Denmark, which aims to develop research, innovation, and education within fintech, and Holland Fintech, which has created a network of 68 companies and partnerships with other countries.