Artificial intelligence (AI) has become a critical aspect in financial services.

Financial institutions around the world are making large-scale investments in AI and the trend isn’t expected to slow down anytime soon. The World Economic Forum (WEF) projects this number to reach US$10 billion by 2020.

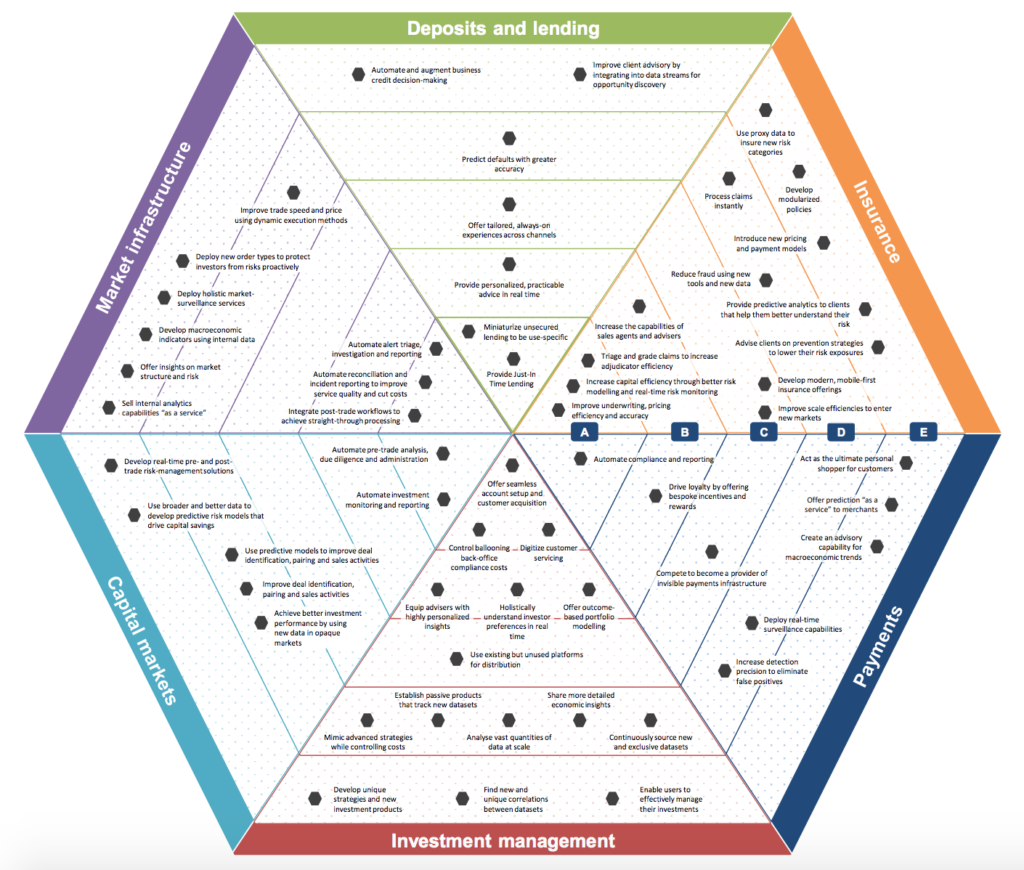

AI is enabling financial institutions to drive new efficiencies and deliver new kinds of value in all areas of insurance and finance, from deposits and lending, and payments, to market infrastructure, investment management and capital markets.

But to grasp the full potential of AI, all stakeholders including financial institutions and regulators, will need to collaborate to address new types of risks and prepare the labor force to new needs, according to a new report by WEF called the New Physics of Financial Services.

Diagram from the New Physics of Financial Services, World Economic Forum

Released earlier this month, the report explores the impact of AI on financial services and highlights the following keys findings and predictions:

Institutions will increasingly turn AI-enabled back-office operations into external services. Existing examples of software ‘as a service’ offerings and providers include Amazon Web Services, Microsoft Azure, BlackRock and Ping An.

AI is enabling new ways to differentiate offerings and win clients. Financial institutions are seeking to differentiate themselves by using AI to build new products and data ecosystems. The Royal Bank of Canada for instance is piloting a forecasting tool for car dealers to predict demand for vehicle purchases based on customer data, and Lloyds Banking Group is looking to become an ecosystem provider and “trusted guardian of data.”

Artificial intelligence, Pixabay

AI can deliver a radically reimagined customer experience by allowing customers’ finances to run themselves. A growing number of financial institutions are applying AI to customer advice and interactions including Citi, which recently launched a mobile app that allows customers to link their accounts across providers, Bank of American, which launched a new AI-powered financial assistant in May, and services such as Clarity Money and MoneyLion are using AI to offer mass advice and customization to help improve customers’ financial positions.

Collaborative AI-driven tools, built on shared datasets, can enable a safer and more efficient financial system. Collective institutions such as SWIFT and EarlyWarning have started developing service offerings that will leverage AI and the collective power of data to address regulatory, fraud prevention and risk mitigation requirements.

The economics of AI will push market structures to extremes, favoring scale players and agile innovators at the expense of mid-sized firms.

Managing partnerships with competitors and potential competitors will be critical. Partnerships are already proliferating across the financial services ecosystem, but only time will tell if these relationships drive sustained value. These include for instance the partnership between JPMorgan Chase, Amazon and Berkshire Hathaway to build a health insurance alliance. In the EU, the result of open banking is enabling new entrants such as N26, Squirrel and Klarna to expand more quickly.

Regulations governing the privacy and portability of data will shape the ability of financial and non-financial institutions to deploy AI. Currently, global data regulations are undergoing a period of big change with the revised PSD2 of the EU, and open banking regulations in the UK, for instance.

Talent transformation will be the most challenging speed limit on institutions’ implementations of AI. Financial institutions will need help to conceptualize the union of talent and technology. Institutions such as Mizuho Financial Group for example is developing AI tools to increase efficiency across both the front and back office, which they say could replace 19,000 staff, or a third of its staff, and close 30 branches.

Mitigating the social and economic risks of AI in financial services will require multi-stakeholder collaboration.

In recent years, numerous fintech startups leveraging AI to better serve customers have been established around the world. Some of the most notable ventures are based in the US and include ZestFinance, a company that applies its unique credit-deaccessioning technology platform — based on data science and machine learning — to help lenders effectively predict credit risk so they can increase revenues, reduce risk and ensure compliance, Upstart, the first lending platform to leverage AI and machine learning to price credit and automate the borrowing process, Affirm, which has developed a point-of-sale consumer financing technology that uses AI algorithms to perform an almost instantaneous credit check on customers, Cape Analytics, which uses AI and geospatial imagery to provide instant property intelligence so insurers can more accurately assess a property’s risk and value, and Numerai, an AI-run, crowd-sourced hedge fund.

Switzerland is home to a growing AI startup community with ventures operating in fintech, insurtech, but also agriculture, e-commerce, and robotics.

Swiss fintech startups that uses AI include Accounto, an online invoicing and accounting solution, InvestGlass, a startup that provides an integrated wealth advisor platform, NetGuardians, a regtech startup that provides fraud and risk assurance solutions, and WealthArc, a cloud-based fintech platform.