With the promise of solving the volatility issue inherent to cryptocurrencies all the while retaining the main benefits of crypto and blockchain, stablecoins have been all the rage these past two years, with now more than 130 stablecoin projects in development, according to a new report by blockchain research company Blockdata.

Stablecoins are cryptocurrencies that are pegged to or backed by real-world assets. Stablecoins arose as an attractive solution to the volatility issue of cryptocurrencies, promising to make these usable for everyday means of exchange and as a store of value, but also provide liquidity to cryptocurrency exchanges as well as allow investors to dip in and out of the market.

A new research paper released on June 26 by Blockdata, titled Stablecoins: An Overview of the Current State of Stablecoins, takes a look at the stablecoin market and dives into these projects’ main characteristics and what the future holds for the technology.

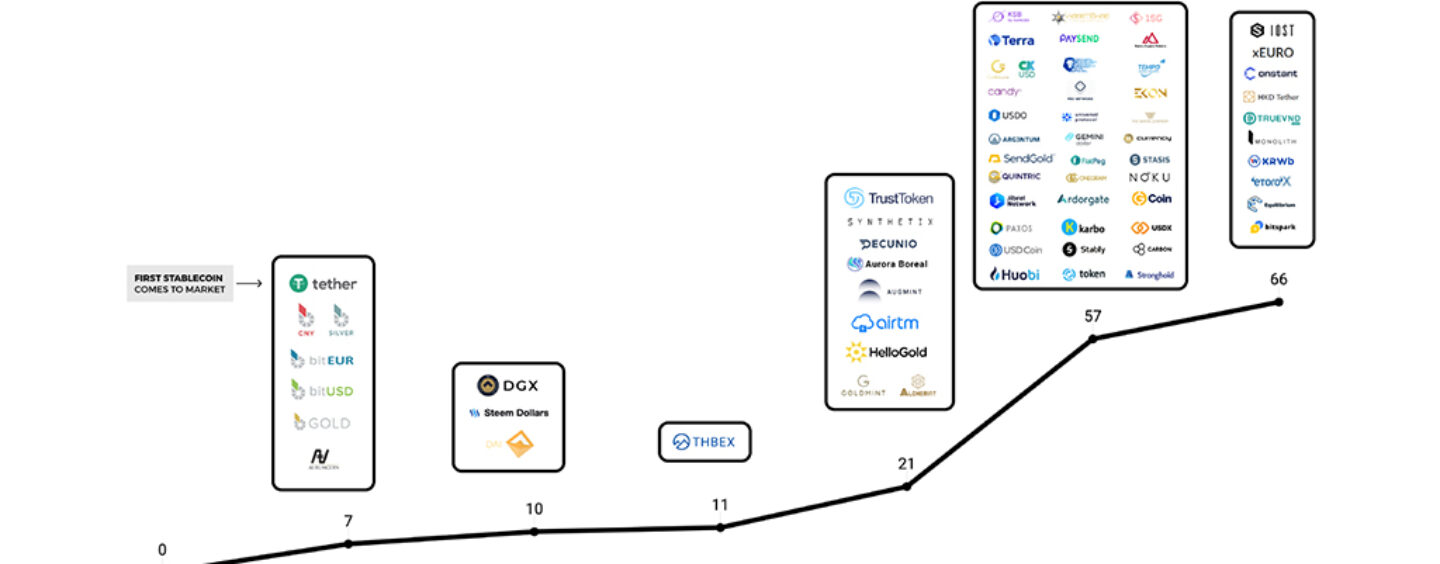

According to the research, since the start of 2017, 134 stablecoin projects have been announced but are still in development. Blockdata expects most of these to be released over the next 18 months.

Only 66 stablecoins, or 30% of the total number of stablecoins, are currently operational. Most of these projects have been announced in the past year, reflecting on the recent frenzy surrounding the technology. These projects include for instance Terra, Paxos Standard, USD Coin by Coinbase, and Gemini Dollar.

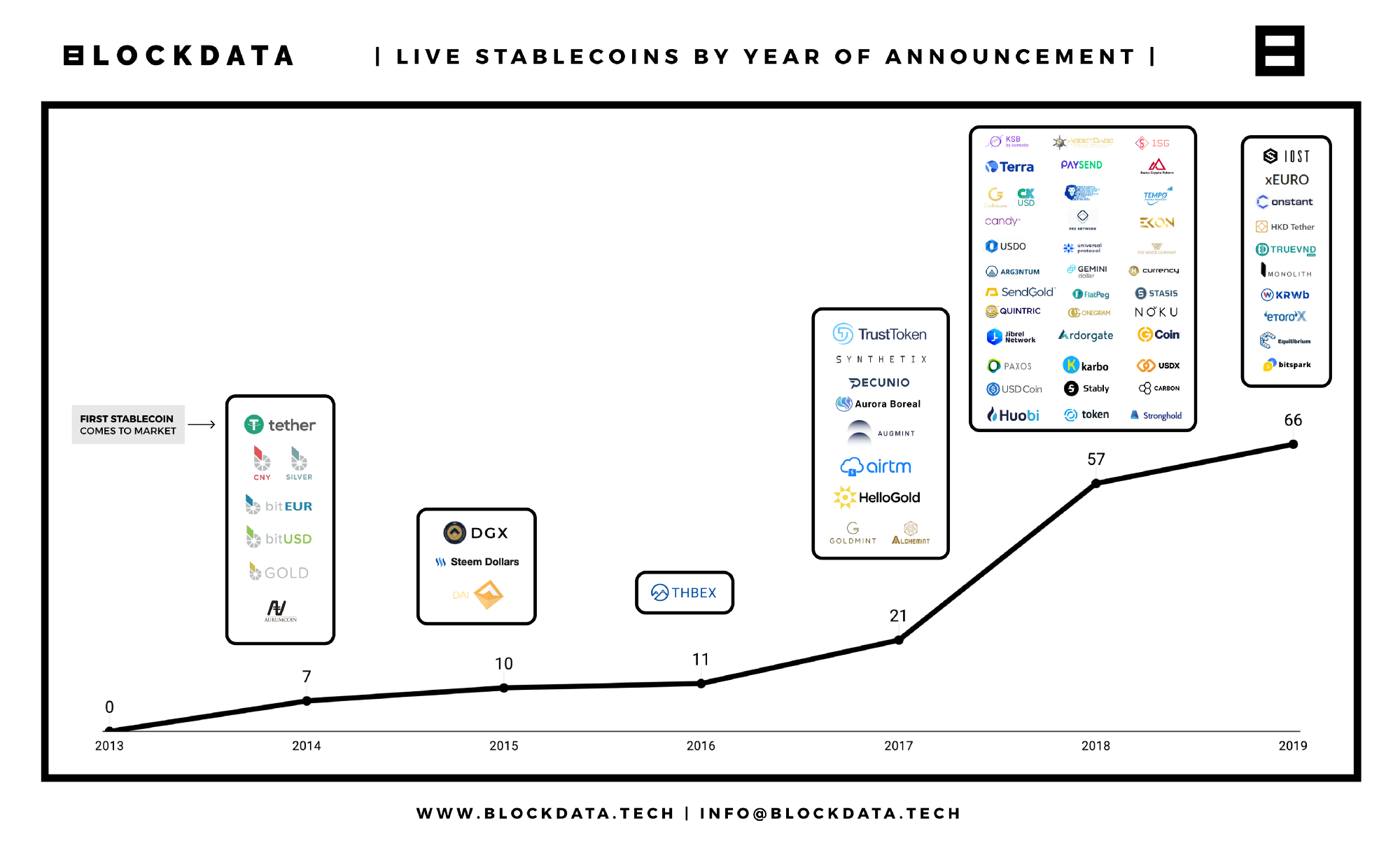

The vast majority (95%) of active stablecoins are asset-backed, either by fiat currencies or commodities (off-chain backed) such as the USD, the euro (USD Coin, Tether, Gemini Dollar), previous metals (HelloGold, DGX, OneGram), or backed by cryptocurrencies (on-chain backed) such as ether (Steem, Maker).

A lesser used type of stablecoin is the seigniorage-style (algorithmic) stablecoin (Terra, Karbo), which relies on a combination of algorithms and smart contracts to maintain price equilibrium and requires continual network growth and investment to provide capital and to support a failing currency value.

Half of active stablecoins (33) are developed on the Ethereum network, which by far is the most popular development platform for blockchain projects. These use the ERC-20 token standard that allows for easy interoperability with other Ethereum-compatible software and hardware wallets.

After Ethereum, Bitshares (8) and Stellar (6) are the second and third most used platforms for stablecoins.

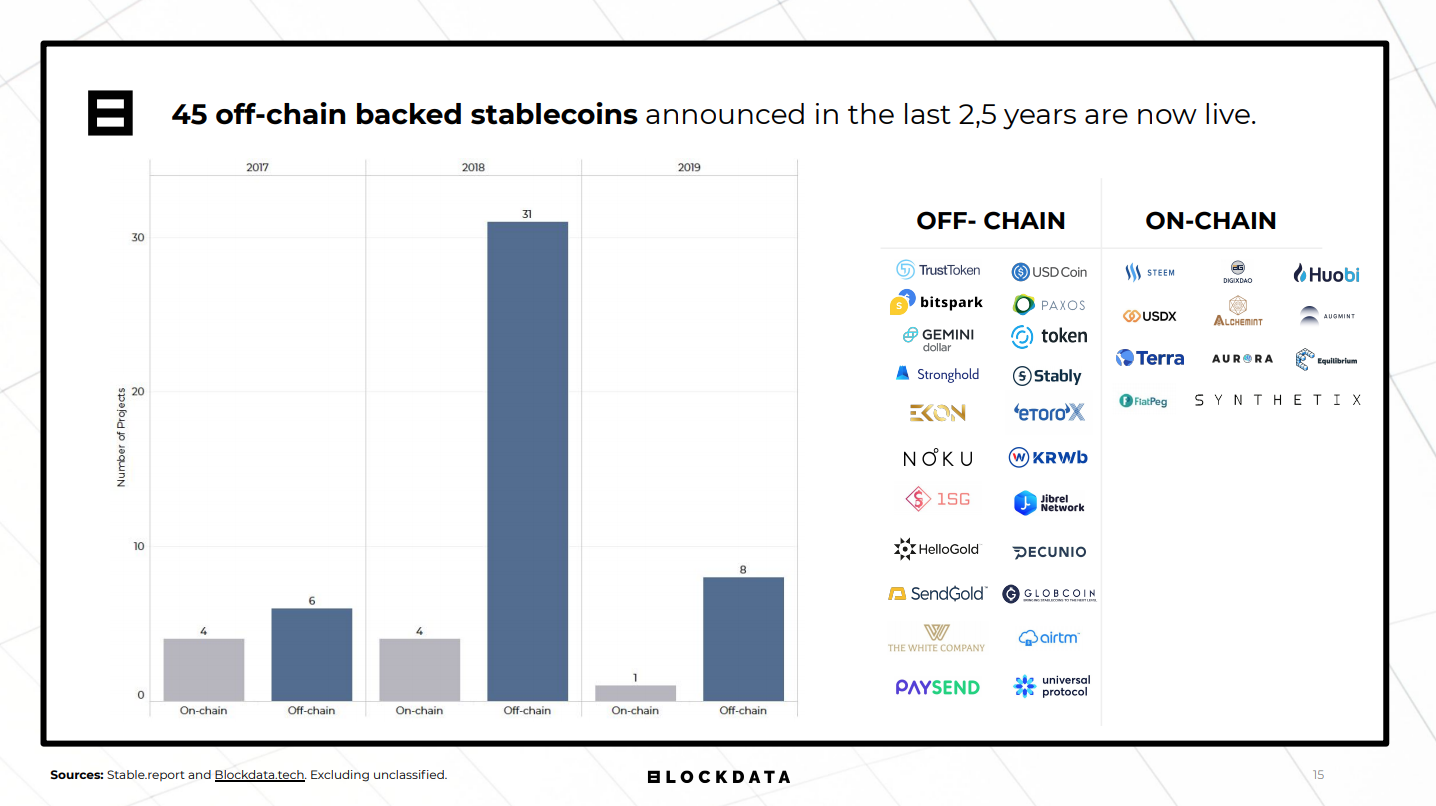

25 out of the 66 active stablecoins are externally funded, either through initial coin offerings (ICOs), venture capital (VC) investments, or both. Top VC investors come from the US and include Digital Currency Group (eToroX, Paxos, USD Coin), Blockchain Capital (Paxos, USD Coin, AlphaPoint), Andreessen Horowitz (TrustToken, Celo) and Plug and Play (Token, PaySend).

So far in 2019, stablecoin projects have raised US$1.240 billion in funding with Tether alone raising a whopping US$1 billion through an initial exchange offering (IEO). This makes Tether the most well-funded stablecoin project to date, followed by USD Coin (US$246 million) and eToroX (US$222.7 million).

The research also found that the main challenges faced by stablecoin projects currently are regulatory restraints, with regulators such as the US Securities and Exchange Commission (SEC) arguing that stablecoins may be violating current securities laws; centralization, as most stablecoin projects are being undertaken and governed by private companies compared to decentralized, distributed systems like Bitcoin or Ethereum; and, nevertheless, volatility, as commodity and crypto-backed stablecoins are subject to their price volatility.

“There is clearly a big appetite for stablecoin projects, with over 100 currently in development,” Blockdata says. “With the fifth largest company in the world joining the party, it seems as though stablecoins are here to stay if they can withstand scrutiny from regulators and lawmakers. But as things go with crypto, don’t expect this road to be without bumps.”

In June, social media giant Facebook unveiled plans for a new stablecoin called Libra that’s set to launch as early as 2020. The goal, Facebook says, is to avoid the high fluctuations of value inherent to cryptocurrencies so that Libra can be used for everyday transactions across the firm’s numerous platforms.

Libra will be overseen by the Libra Association, a non-profit entity that counts members such as Visa, Mastercard, PayPal, Uber and Vodafone. The fund will be made up of bank deposits and other low risk government securities.

Though supporters have argued that Libra could help create mass awareness of cryptocurrencies, the project has also sparked fear and criticism among regulators and financial analysts.

The Financial Times’ Alphaville calls it “a glorified exchange traded funded which uses blockchain buzzwords to neutralize the regulatory impact of coming to market without a license as well as to veil the disproportionate influence of Facebook in what it hopes will eventually become a global digital reserve system.”

In Europe, politicians are calling for tighter regulation of the company, citing privacy, money laundering and monetary risks as key areas of concerns.