Crypto Related Crime Surged to US$ 1.2 Billion in Q1 of 2019

by Fintechnews Switzerland July 16, 2019Crypto related thefts, scams and fraud surged in the first quarter of 2019 to US$1.2 billion, or 70% of the entire year 2018 at US$1.7 billion, according to a report by cryptocurrency security firm CipherTrace.

During Q1 2019, criminals stole more than US$356 million from exchanges and infrastructure, and losses from fraud and misappropriated funds amounted to US$851 million.

Among these losses, exit scams robbed cryptocurrency users of nearly US$195 million, according to CipherTrace’s Q1 2019 Cryptocurrency Anti-Money Laundering Report.

Among the major exchange thefts, New Zealand-based Cryptopia suffered a US$16 million heist in January, Singapore-based exchange CoinBene lost an estimated US$45 million in cryptocurrency in a cyberattack in March, and Bithumb, the largest cryptocurrency exchange in South Korea, was hacked in March and attackers made away with around US$13 million.

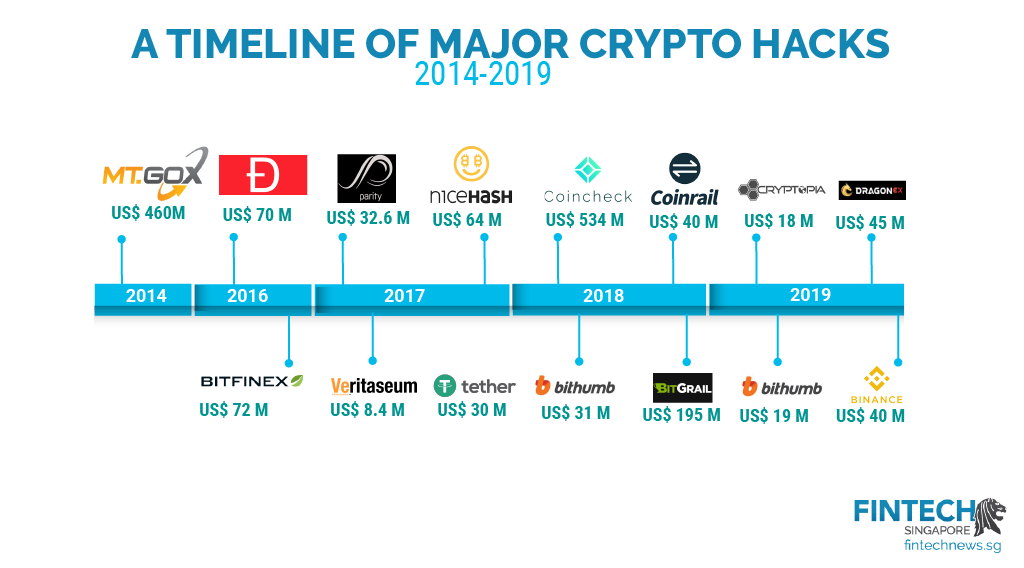

A separate report by our sister site Fintech News Singapore lays out the timeline of major crypto hacks that have occurred in recent times

Q1 2019 saw two exit scams, according to the report, where founders and/or executives of an exchange platform or cryptocurrency project embezzle users’ crypto funds.

QuadrigaCX, once Canada’s largest cryptocurrency exchange, made headlines earlier this year when it announced it was filing for creditor protection and owed upwards of US$130 million to its customers. QuadrigaCX’s founder and CEO mysteriously died in India, allegedly along with the passwords to virtually all of the exchange’s assets, but CipherTrace believes the loss was actually theft and the result of misappropriation.

The other exit scam is Coinbin, a South Korean cryptocurrency exchange, which lost US$26 million as the result of an inside job and had to declare bankruptcy.

But perhaps one of the most notable ongoing scandals in the crypto world is the Bitfinex and Tether saga. Earlier this year, the New York attorney general’s (NYAG) office brought suit against the parent company of Bitfinex and Tether, iFinex Inc., alleging that the cryptocurrency exchange had lost US$851 million and then secretly transferred funds from its sister company, Tether, to cover the loss. The source of the loss was a Panamanian payment processor also used by QuadrigaCX.

Crypto crime diversifies

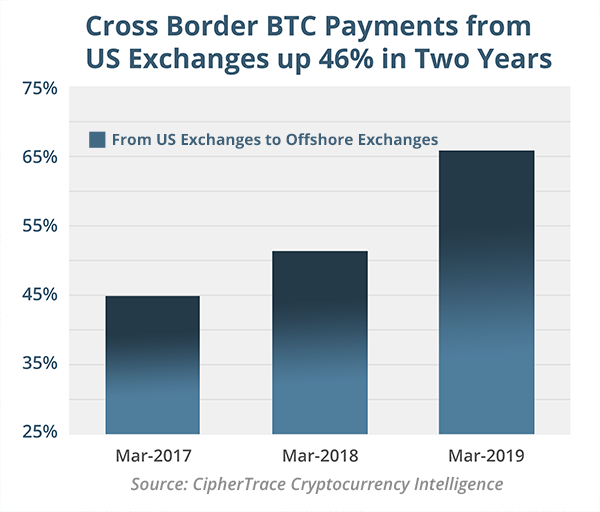

The CipherTrace research also found that cross-border transactions from US cryptocurrency exchanges to offshore exchanges were on the rise, recording an increase from 45% from the twelve months ending Q1 2017 to 66% in the twelve months ending Q1 2019. This reveals “a major hole in the current cryptocurrency regulatory fabric with respect to cross-border payments,” the report says.

Via CipherTrace Q1 2019 Cryptocurrency Anti-Money Laundering Report

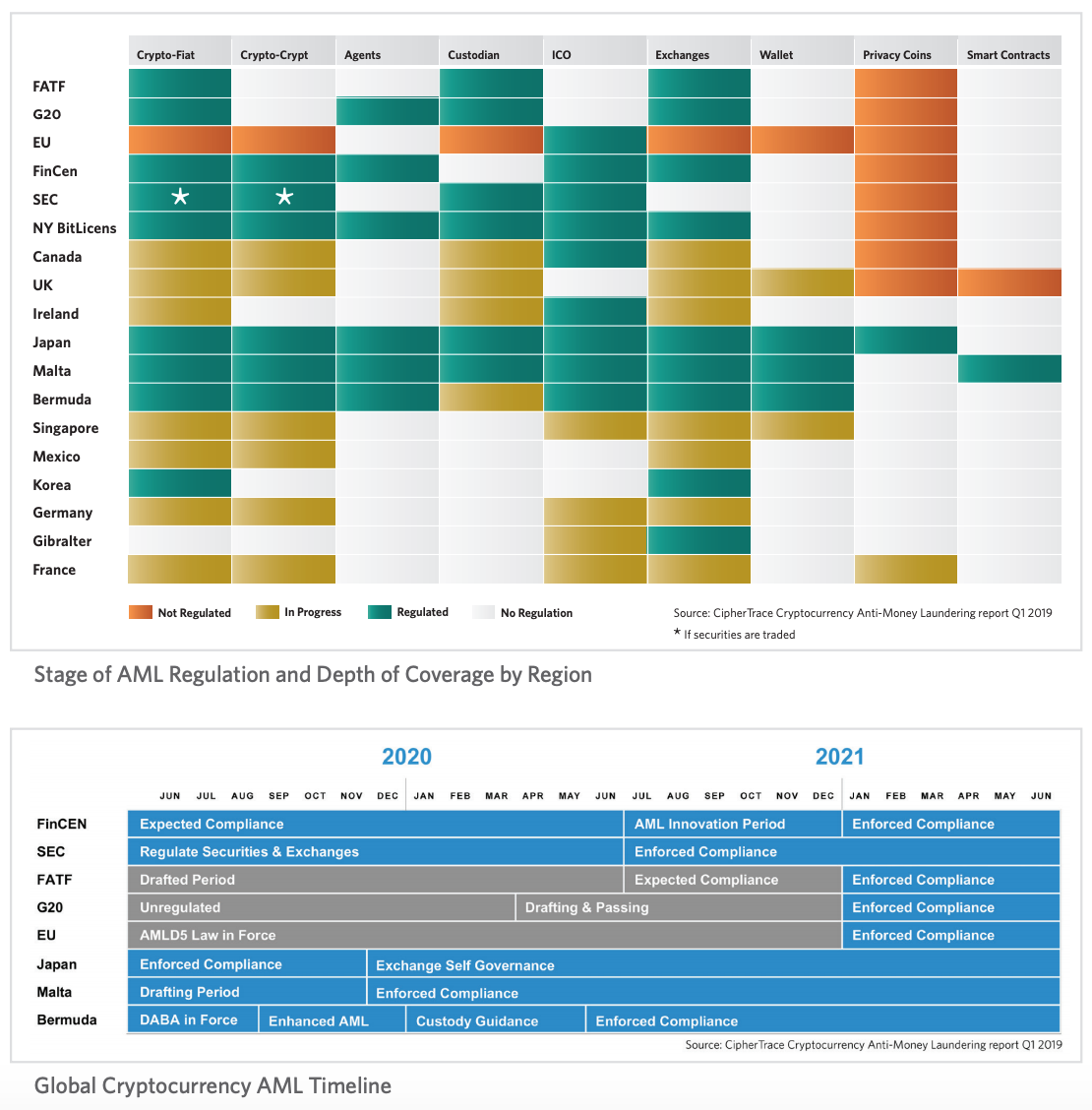

But a wave of new cryptocurrency regulations is coming soon across the world, including anti-money laundering (AML) and counter-terror financing (CTF) regulations, it says, and as of April 2019, 17 countries in addition to the European Union had at least some regulation or standard-setting bodies dealing with cryptocurrencies.

In 2018, the EU adopted the Fifth Anti-Money Laundering Directive (5MLD5), which increased the scope of the EU’s regulatory perimeter to include cryptocurrency exchanges as well as those that provide custodian wallet services.

In Canada, in light of the collapse of QuadrigaCX, regulators are considering putting in place rules for cryptocurrency exchanges in the country. Additionally, regulators around the world are also beginning to consider bans on privacy-centric and anonymous cryptocurrencies.

The French government has recommended a ban on anonymous altcoins, and the UK and Mexico drafted new regulations in Q1, which are waiting for comments and approval.

Via CipherTrace Q1 2019 Cryptocurrency Anti-Money Laundering Report

The research also found that crypto crime has considerably evolved from being largely dominated by external exchange hacks to now an increasing number of cases involving insiders’ jobs, extortionists and scammers who are attempting a more diverse range of crimes.

For instance, the report notes the case of kidnappers in Norway who demanded a EUR 9million euros ransom in Monero, a privacy coin, for a billionaire’s wife.

“This shift suggests that security against external hackers at exchanges is maturing under the pressure from regulators and customers to take necessary measures to prevent losses,” the report says.