Libra: Despite Claims, Facebook Has Yet To Contact Swiss Data Protection Authority

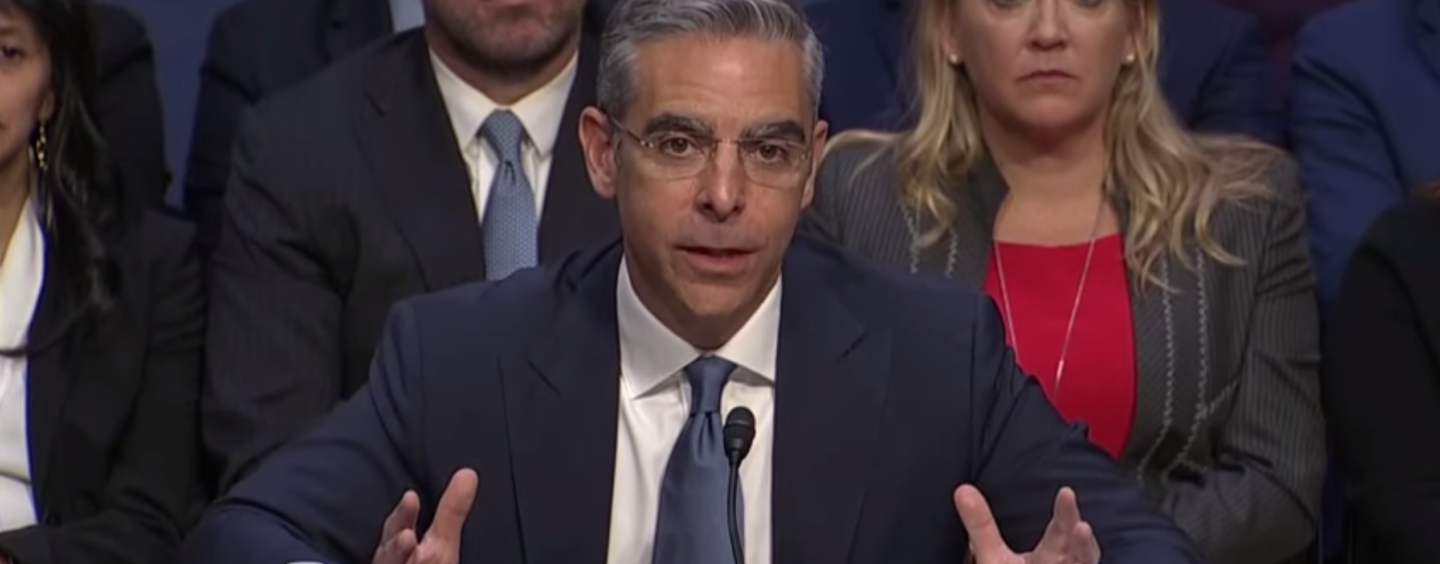

by Fintechnews Switzerland July 24, 2019During a hearing in the US Senate, David Marcus, the head of Facebook’s digital currency project Libra, said that Swiss authorities will be overseeing data and privacy protections for its Libra cryptocurrency. But a spokesperson for the Federal Data Protection and Information Commissioner (FDPIC) told CNBC on July 16 that the Swiss agency has not yet been contacted by the company.

In his testimony before the US Senate Banking Committee, Marcus said that “for the purposes of data and privacy protections, the Swiss FDPIC will be the Libra Association’s privacy regulator.”

However, Hugo Wyler, head of communication at the FDPIC, told the media outlet that “until today, we have not been contacted by the promoters of Libra.”

“We have taken note of the statements made by David Marcus, chief of Libra, on our potential role as data protection supervisory authority in the Libra context,” Wyler said.

“We expect Facebook or its promoters to provide us with concrete information when the time comes. Only then will we be able to examine the extent to which our legal advisory and supervisory competence is given. In any case, we are following the development of the project in the public debate.”

US Senate hearing

Marcus said in his testimony that while FDPIC would handle data privacy issues, the Swiss Financial Markets Supervisory Authority (FINMA) would be the main financial regulator of Libra. FINMA confirmed to CNBC it has been in contact with initiators of Libra.

Marcus said the association also intends to register with the US Treasury Department’s Financial Crimes Enforcement Network (FinCEN) as a money services business.

The Libra Association was established in Geneva in May. The organization is responsible for managing a pool of government-issued currencies, including the US dollar, British pound, euro and Japanese yen, that underpins the value of the Libra stablecoin. Founding members of the Libra Association include Visa, Mastercard, PayPal, Uber, Spotify and Vodafone.

Facebook has also registered a company in Geneva called Libra Networks. With Facebook Global Holdings as stakeholder, Libra Networks is responsible for providing financial and technology services, and developing related hardware and software.

The Libra project has been met with skepticism from regulators around the world. French Finance Minister Bruno Le Maire has cited concerns over privacy, money laundering and terrorism finance issues. Markus Ferber, a German member of the European Parliament, has said that Facebook, with more than 2 billion users, could become a “shadow bank,” adding that regulators should be on high alert.

At the US Senate hearing, Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell said they had “serious concerns” about Libra related to money laundering, financial stability and regulation.

Senate Banking Committee Chairman Mike Crapo said he was concerned about the company’s “massive reach and influence” and the vast amount of personal information it keeps.

Senators also questioned Marcus about the series of scandals faced by Facebook in recent years. These include the company’s agreement earlier this month to pay a US$5 billion fine by the Federal Trade Commission for breaking a 2012 Consent Decree to protect the privacy of its users, as well as its role in spreading fake news reports during President Donald Trump’s 2016 campaign.

Ohio Senator Sherrod Brown said Facebook “has demonstrated through scandal after scandal that it doesn’t deserve our trust. It should be treated just as the profit-seeking corporation that it is, just like any other company.”

He said, Zuckerberg and his entourage had “proven over and over that they don’t understand governing or accountability; they’re not running a government, they’re running a for-profit laboratory.”

Featured image: David Marcus, the head of Facebook’s digital currency project Libra, at a hearing in the US Senate on July 16, 2019.