4 Key Findings About Millennials’ Financial Investment Habits

by Fintechnews Switzerland September 12, 2016Becoming the majority of the global work force, millennials are considered the future investor generation. With the unique characteristics of being digitally active, conscious and demanding, they are setting new expectations for the investment market.

There will be a huge opportunity for financial providers who understand the millennial customer segment. Selma Finance has summed up 4 key things about the attitudes and expectations of the new generation of investors in their recent research in Switzerland and Finland, 2016.

1. They don’t trust banks

Banks are perceived as a safe place to keep money but their advice and products are not trusted. 23/25 people who took part in the survey share a belief that very often bank advisors would suggest products that do not fit their profile, are too pricey and include hidden costs.

The skeptical millennial investors would rather take an active role in selecting financial products rather than listening to banking service providers. They continuously cross-check decisions and require high transparency in prices and in product selection, either through Google searches or getting advice from family, friends and financial blogs.

2. Personal values & beliefs guide their investment decisions

The research found a high need for personalized investments based on personal beliefs, values and motives from the millennials.

“Sustainability is important for me. I’m particularly interested in supporting endeavours related to education.” – Zora, 33, Project Manager, Switzerland

Today’s young adults are known for their profound beliefs and values guiding their decisions, even if it means less profit. This behaviour can be explained by the following 3 main reasons:

– Personal values & beliefs are unconditionally important. Being conscious of sustainability, millennial investors are nearly twice as likely to invest in companies or funds that target specific social or environmental outcomes. – Goldman Sachs, 2015

– Relying on their own professional knowledge, opinions and self-education, millennials want to invest in areas they know about and feel confident with.

– Specific topics are chosen in order to make an informed bet.

3. They demand high quality internet banking services

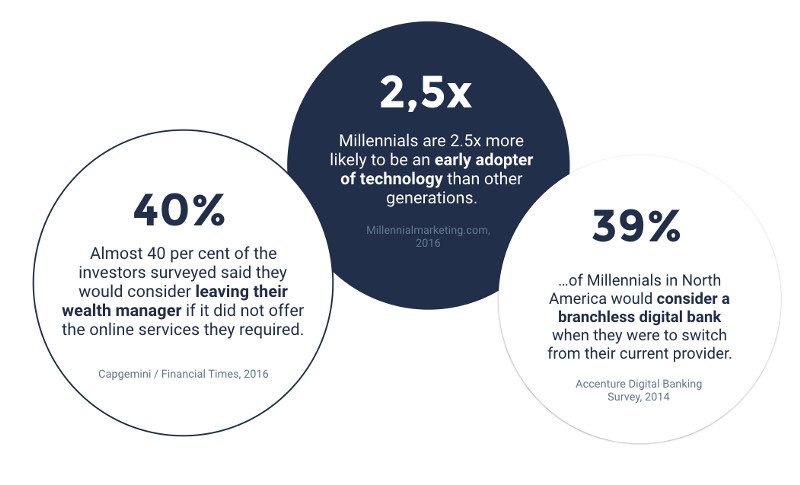

Almost 40% of the investors would consider leaving their wealth manager if it did not offer the online services they required. — Capgemini / Financial Times, 2016

Growing up with digital services, mobile apps and online media, millennial investors are setting high standards for their online financial services. More than the previous generation, they demand convenience through a simpler and direct user experience. For many, the quality of internet banking is the number one reason to switch financial service providers.

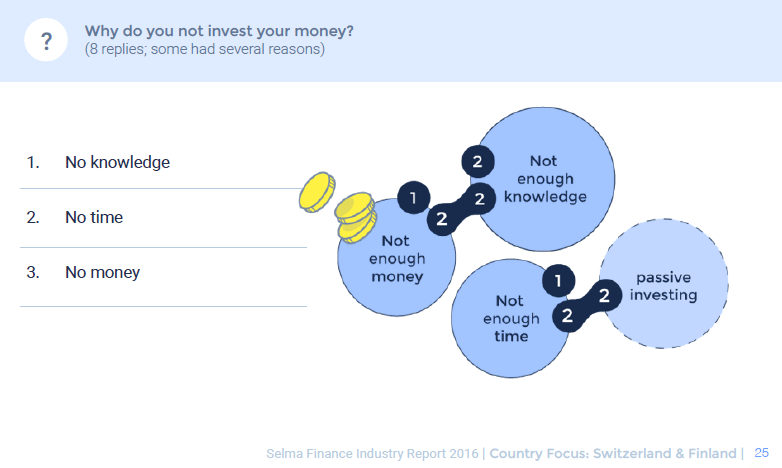

4. Lack of time and know-how are common obstacles

Lack of financial knowledge and the fact that investing “intimidates” them are major reasons not to invest — CIBC, 2015

For some of the interviewees in the survey, not having the right financial knowledge to make good decisions is one of the reasons why they don’t invest. Lack of time to follow financial markets is another key obstacle. This is why transparent financial products and less scattered, trustworthy sources of information would be some of the best selling points for financial service providers to consider if they want to attract more millennial customers.

Download the full report: “Millennials’ Financial Investment Habits” by Selma Finance here

Featured Image: Goldman Sachs