Amazon is attacking the financial services industry, but rather than building the next-generation bank, the American e-commerce giant is focusing on building financial services that support its core strategic goal of increasing participation in the Amazon ecosystem, according to a report by CB Insights.

Amazon has built and launched tools and services mostly focused on payments, cash deposits and lending. These services aim at increasing the number of merchants and customers in its ecosystem by enabling them to sell and buy more, and reducing any buying/selling friction.

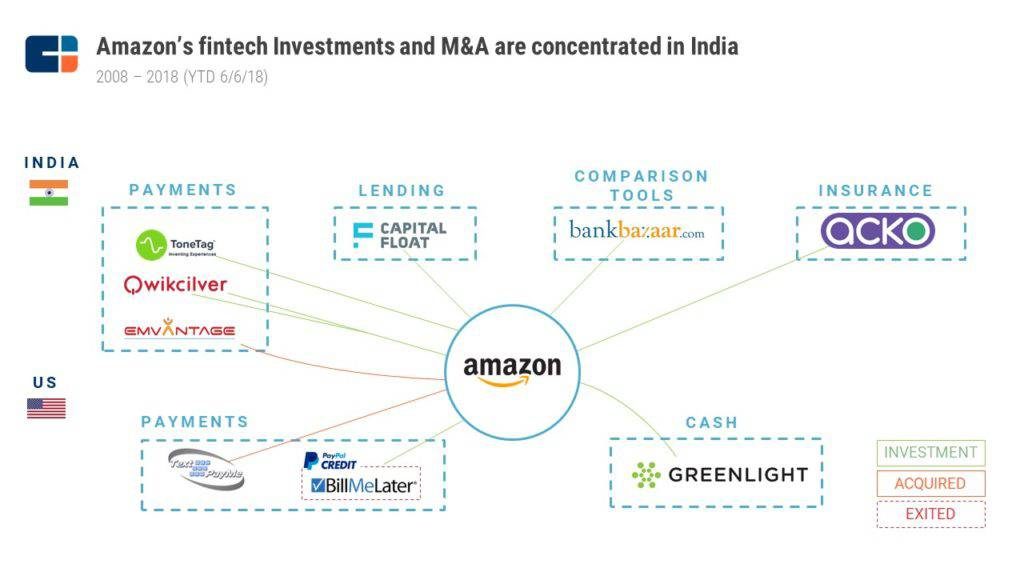

In parallel, Amazon has made several fintech investments, mostly focused on international markets, including India and Mexico, where partners can help serve Amazon’s core strategic goal.

Amazon currently has 310 million active customer accounts, 100 million Prime customers, and 5 million sellers, a considerable ecosystem. The company is forecast to grow revenue by 18.19% over the next 3 years. The firm currently has 12 marketplaces: USA, UK, Germany, France, Canada, Japan, India, Italy, Spain, Mexico, Brazil, and China. Amazon Australia and Singapore are launching soon.

“Amazon is not building a bank by the traditional definition,” said Lindsay Davis, tech industry analyst at CB Insights.

“Amazon is building financial services products to increase participation in the Amazon ecosystem. Amazon is building a bank for Amazon, and that may be even more compelling than launching a traditional deposit-holding bank.”

And according to CB Insights, the potential of the so-called “bank of Amazon” should have traditional incumbents worried.

Amazon’s financial services strategy

Amazon Pay

Amazon has aggressively invested in payments infrastructure and services over the last few years. Its flagship product, Amazon Pay, functions as a digital wallet for customers and a payments network for both online and brick-and-mortar merchants and shoppers. Amazon Pay had 33 million customers in 170 countries, as of 2016.

But Amazon has been experimenting with payments functionalities for over a decade, starting with the acquisition of peer-to-peer mobile service TextPayMe in 2006, and an investment into Bill Me Later and the launch of Amazon Pay, both in 2007. Webpay was relaunched as Amazon Webpay in 2011 but failed to gain user traction and was eventually terminated in 2014.

But before being a success, the firm has had missteps with Amazon Pay, including Amazon Local Register, a card reader for SMEs launched in August 2014, which it shut down in October 2015.

In reference to failed payments projects, Patrick Gauthier, an ex-PayPal employee now vice-president of Amazon Pay, said:

“What people never realize or truly understand about Amazon is that part of the recipe for success is daring to try things you have no idea whether will succeed or not, and if you think that you have a notion of how to succeed … you try again.”

Moving forward, the future of Amazon’s payment strategy will likely be centered on biometric and contactless payments. A new technology called Just Walk Out is being piloted within its Amazon Go grocery store. The technology uses computer vision, sensor fusion and advanced machine learning to enable a frictionless payments experience. Amazon is still only in beta with this technology.

Amazon Cash

Launched in April 2017, Amazon Cash allows customers to deposit cash, without a fee, to a digital account by showing a bar code at a partner brick-and-mortar retailer. The program aims to bridge the gap between online commerce using debit or credit cards as payment, and offline commerce that relies on “cash on delivery” options like cash and gift cards. It is targeted at underbanked and unbanked populations.

Another demographic Amazon wants to tap into is the younger generations. The firm launched Amazon Allowance in mid-2015, which enables kids, with parental consent, to set up their own Amazon accounts and make purchases. Parents can allocate recurring funds to their child’s account and get the added control of overseeing what their kids purchase.

Additionally, Amazon’s Alexa Fund is an investor in Greenlight Financial, an alternative debit card issuer aimed at young consumers. With the card, parents can manage spending limits and allocate funds for their children through a mobile app.

Lending

Amazon Lending initially launched in 2011 to help small businesses finance and sell more goods on Amazon. Since then, Amazon has expanded Lending to the UK, Japan, and India. From launch in 2011 to June 2017, Amazon reported it issued US$3 billion across 20,000 businesses in the US, Japan, and the UK.

In consumer lending, Amazon has been iterating with partner cards for Prime and non-Prime customers. The Amazon Prime Store Card, for instance, was launched in 2015 with partner Synchrony Bank, and was Amazon’s first card exclusively for Prime customers, offering unlimited 5% cash back on Amazon purchases. The Amazon Visa Credit Card, with partner Visa, offers non-Prime customers 3% cash back on Amazon purchases, 2% cash back at gas stations, restaurants, and drugstores, and 1% cash back on everything else.

Moving forward…

But besides payments, cash deposits, and lending, evidences suggest that Amazon is looking to further expand across the financial services ecosystem, including:

Checking accounts: Amazon is reportedly in talks with several banks to develop a product similar to a checking account, which would be pushed primarily through Amazon Cash. Amazon has also patented methods for linking bank account information and for prepaid cards as early as 2004.

Insurance: Amazon has not formally launched an insurance business but has been exploring the topic notably through Amazon Protect, a white-label service launched in April 2016 in the UK. Amazon Protect provides accidental and theft insurance on various consumer goods. Claims are underwritten through a partnership with The Warranty Group’s London General Insurance Company. Amazon Protect has since expanded to other EU countries including Spain, Italy, Germany, and France.

Emerging markets

Amazon is aggressively entering emerging markets where rapid mobile Internet adoption, a lack of legacy infrastructure, and a growing middle class, are offering huge opportunities for the e-commerce giant.

In India, Amazon has verbally committed to investing US$7 billion and has already launched several initiatives that coincide with its financial services strategy.

Amazon’s first entry point in India was in payments in October 2014. In early 2016, it acquired Emvantage Payments, which was quickly integrated into Amazon Pay and relaunched as a digital wallet later that year.

Similarly, Amazon integrated the services of Qwikcilver, a prepaid gift card company, after investing in it in 2015. It can now be used as a form of payment on Amazon’s India marketplace.

Earlier this year, Amazon made an investment into contactless payments hardware and software provider ToneTag. The ToneTag platform was integrated into Amazon Pay, expanding Amazon’s reach to ToneTag’s reported 50 million customers and 25,000 retail pods in India. The partnership also expanded Amazon Pay in India to offline commerce.

In January 2018, Amazon Pay rolled out the Doorstep feature, a cash pickup service that allows customers to load money into their Amazon Pay digital wallet using cash.

In lending, one of Amazon’s first equity investments in 2018 was Capital Float, an Indian platform that provides working capital finance to SMEs. The company also partnered with the Bank of Baroda to provide micro loans to Amazon’s e-sellers and help them expand their operations and finance inventory during seasonal spikes.

In June, Amazon launched a marketplace for lenders and sellers to obtain a competitive loan. Called Seller Lending Network, the platform has already onboarded several lenders. Another option these sellers could use for short term financing is title loans.

In the insurance business, Amazon invested into India insurtech startup Acko. The firm has reportedly covered 10 million ride-hailing trips, and news suggest the two may partner to roll out a product insurance program similar to Amazon Protect in the UK.

In Mexico, Amazon’s financial services push began in 2017. Since then, it has launched Amazon Prime, Amazon Cash, and Amazon Cash debit cards in Mexico.

In March 2018, the company introduced a debit card with partner Grupo Financiero Banorte, a Mexican bank, called Amazon Recargable (Rechargeable). Like Amazon Cash, customers can deposit cash on the debit card at convenience stores across the country.

Featured image via Freepik