10 Trends in Retail Banking to Watch Out for in 2020 and Beyond

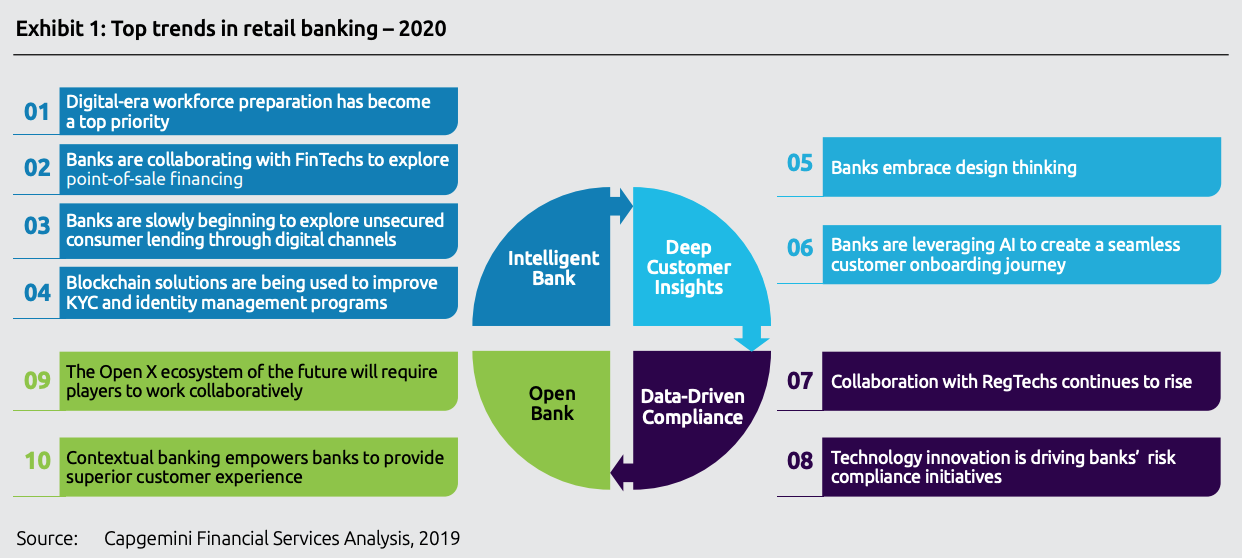

by Fintechnews Switzerland February 13, 2020The banking industry is undergoing fundamental changes driven by advancements in technology, the emergence of the so-called Open X ecosystem, and the entrance of bigtechs into the scene, according to a report by Capgemini.

The consulting firm released in November 2019 a paper exploring what it believes to be the top ten trends in retail banking to watch out for in 2020 and beyond. These trends are emerging on the back of the rise of artificial intelligence (AI), machine learning (ML), blockchain and other cutting-edge technologies, as well as changing customer expectations.

Top 10 trends in retail banking

Top trends in retail banking – 2020, Capgemini, November 2019

According to Capgemini, these trends are:

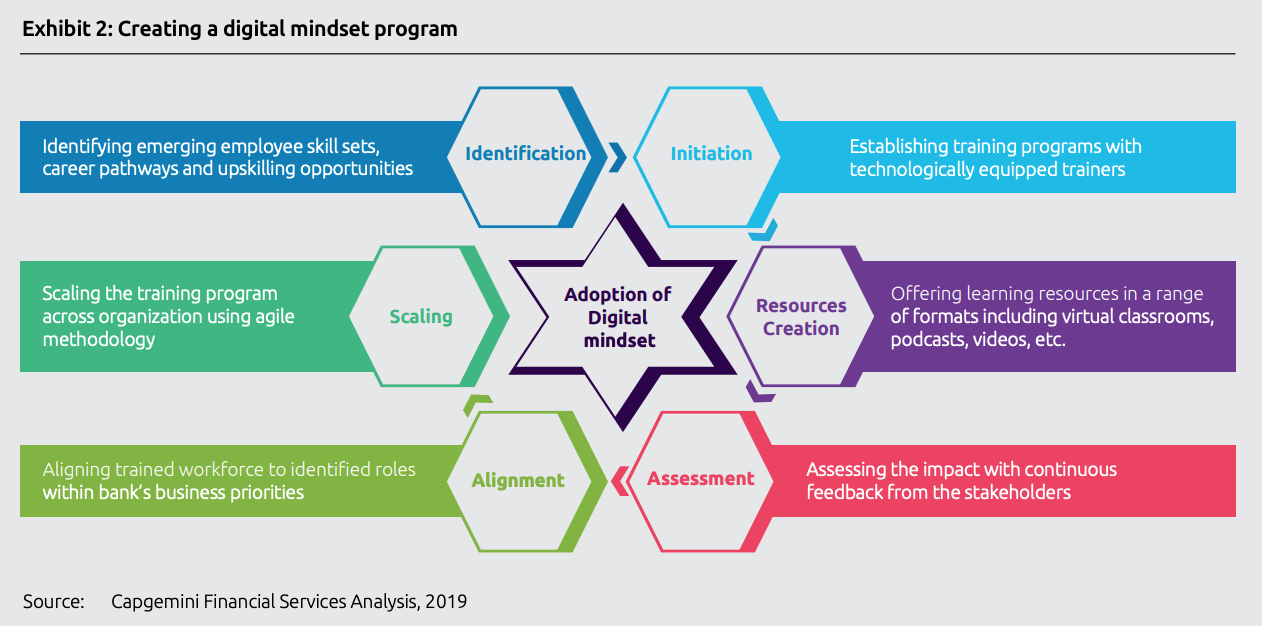

Equipping employees with digital competencies: Banks are investing in developing workforce skills in emerging technologies and creating upskilling opportunities with internal career mobility.

For example, JP Morgan announced last year a five-year US$350 million global investment to develop and pilot innovative new education and training programs aligned with high-demand digital and technical skills.

Creating a digital mindset program, Top trends in retail banking – 2020, Capgemini, November 2019

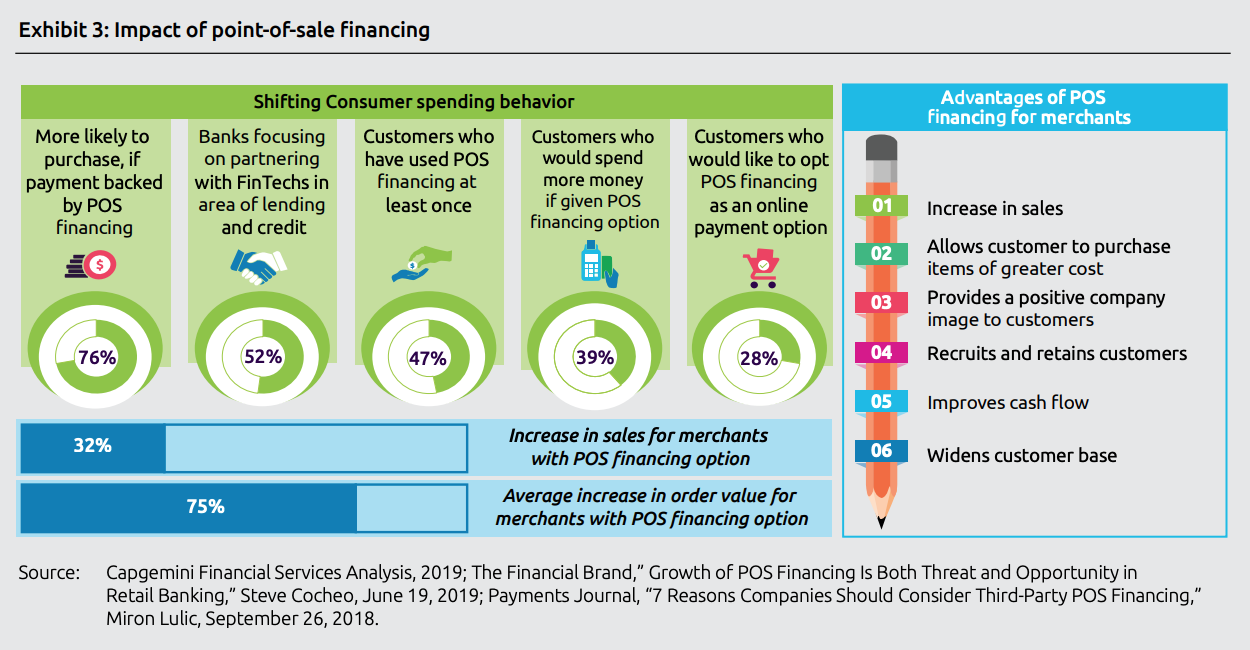

Banks explore point-of-sale (POS) financing with fintechs: Banks are teaming up with fintechs to move into the POS financing market. POS financing is when a merchant offers their customers a financial solution at the point of purchase in order to assist them in buying the product or service.

Fintech company Affirm, in partnership with Cross River Bank, partnered with Walmart last year to offer POS financing online.

Impact of point-of-sale financing, Top trends in retail banking – 2020, Capgemini, November 2019

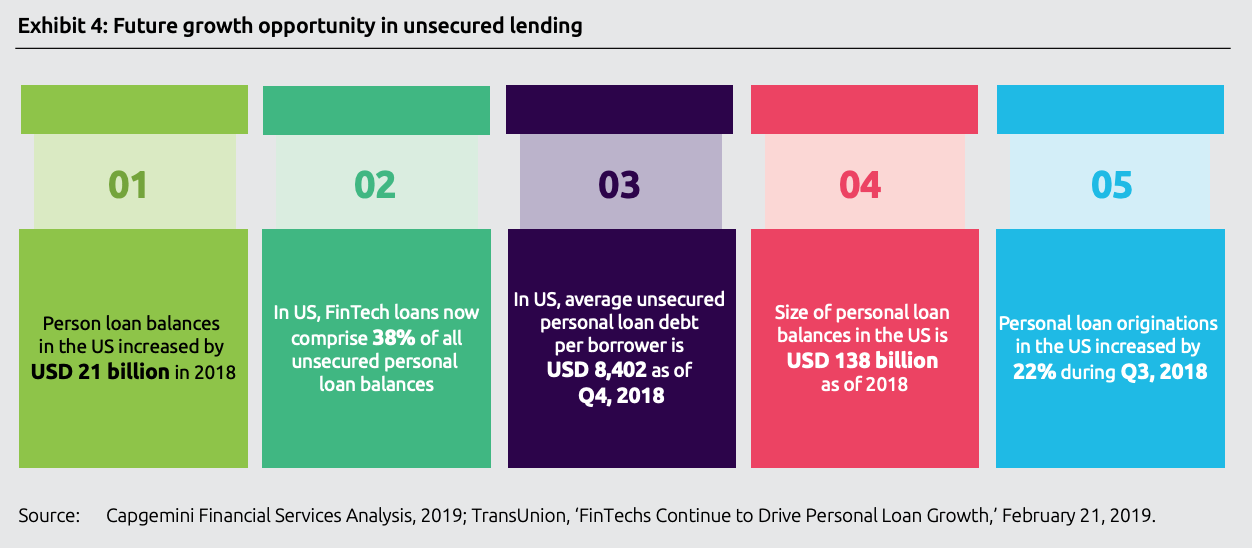

Banks explore unsecured consumer lending through digital channels: The unsecured consumer lending business has become a fast-moving marketplace and major banks have begun extending their lending services in collaboration with digital tech platforms.

HSBC began using Avant’s digital lending platform Amount in 2018 to process and lend to consumer digitally.

Future growth opportunity in unsecured lending, Top trends in retail banking – 2020, Capgemini, November 2019

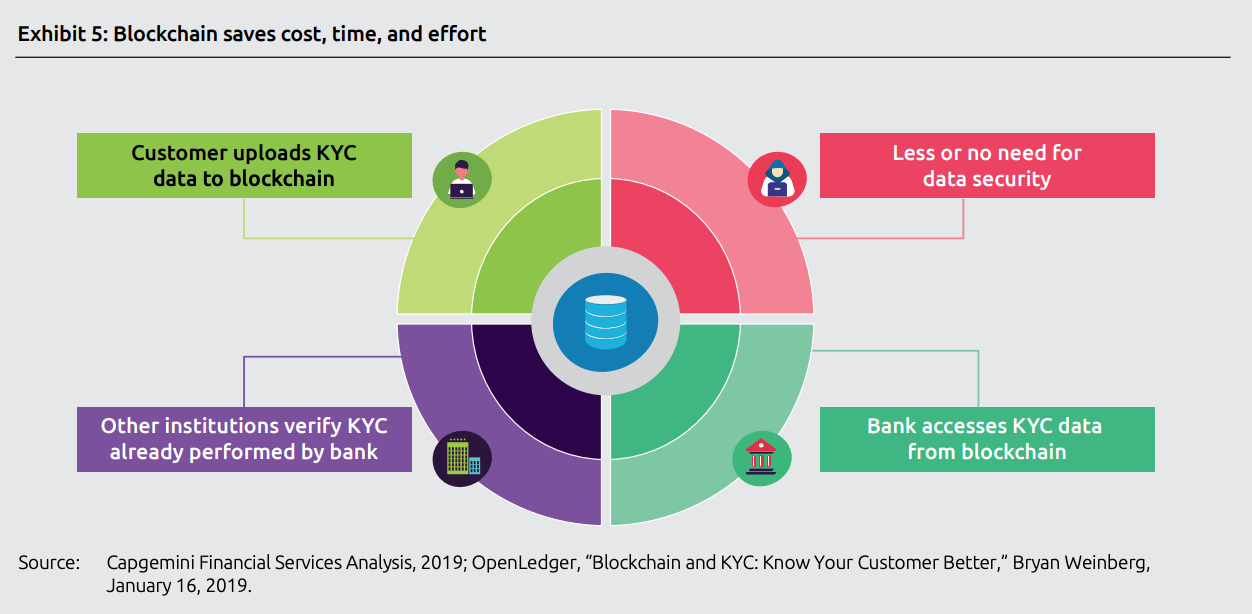

Banks are leveraging blockchain to improve know-your-customer (KYC) and identity management: Banks are looking at blockchain technology to streamline KYC and identity management solutions and manage regulatory requirements more effectively.

Several consortia have been established to study and implement blockchain for KYC. OCBC Bank, HSBC and Mitsubishi UFJ Financial Group (MUFG), for example, successfully completed a proof-of-concept for a KYC blockchain in 2017.

Blockchain saves cost, time and effort, Top trends in retail banking – 2020, Capgemini, November 2019

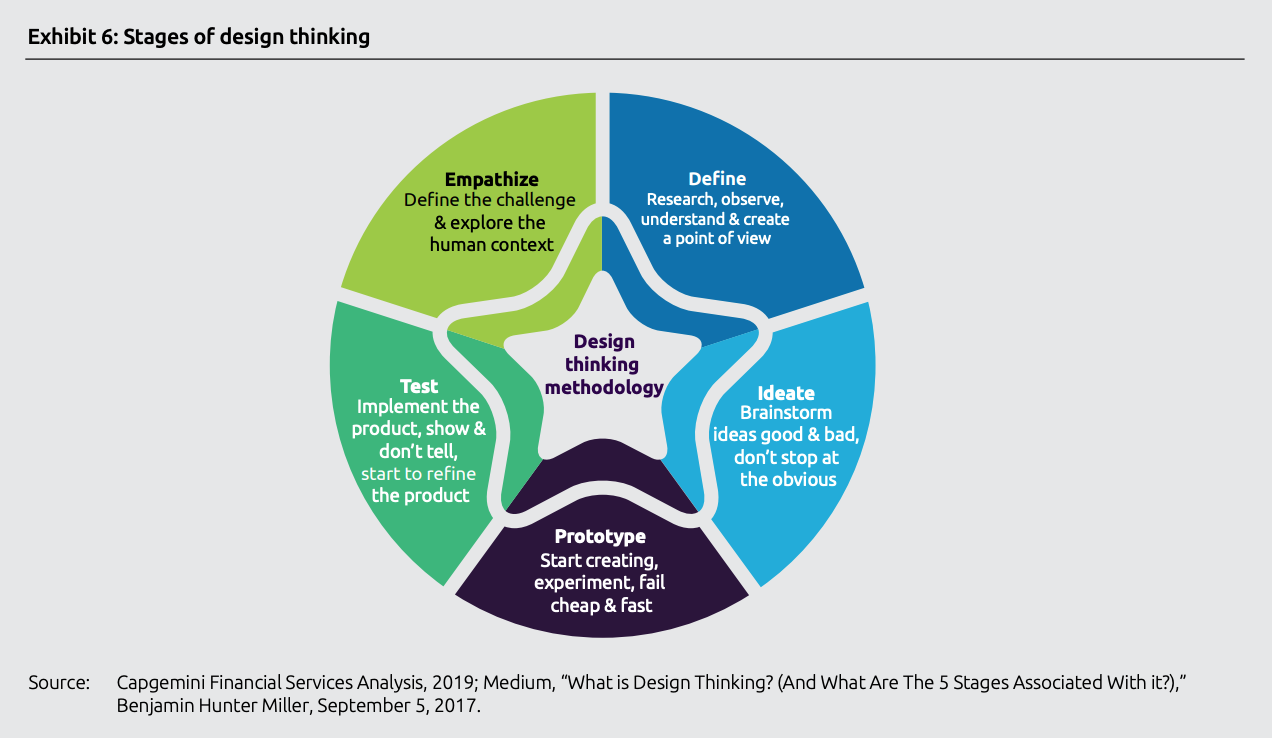

Banks embrace design thinking: Banks are organizing workshops to gain first-hand insight into customer needs and expectations, and are creating product prototypes to match the digital experiences customers seek.

Australia’s Bankwest, for example, has conducted design-thinking customer workshops to create a seamless loan application process for small and medium-sized enterprise (SME) customers, the report says.

Stages of design thinking, Top trends in retail banking – 2020, Capgemini, November 2019

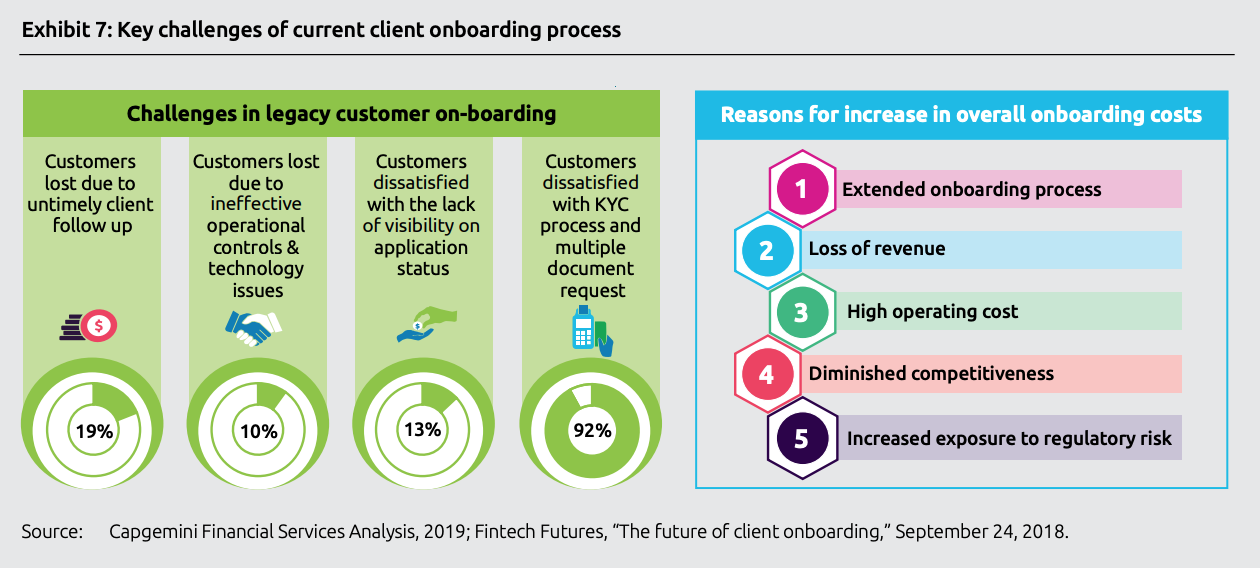

Leveraging AI to create a seamless customer onboarding journey: Banks are investing in AI through natural language processing (NLP), biometrics, optical character recognition (OCR), and more, with the goal to provide superior customer experience and improving the onboarding process.

Standard Bank South Africa has been using Workfusion’s AI-backed automation cloud solution to reduce customer onboarding time from 20 days to just five minutes, and Royal Bank of Canada launched last year an AI-backed, personalized budget solution.

Key challenges of current client onboarding process, Top trends in retail banking – 2020, Capgemini, November 2019

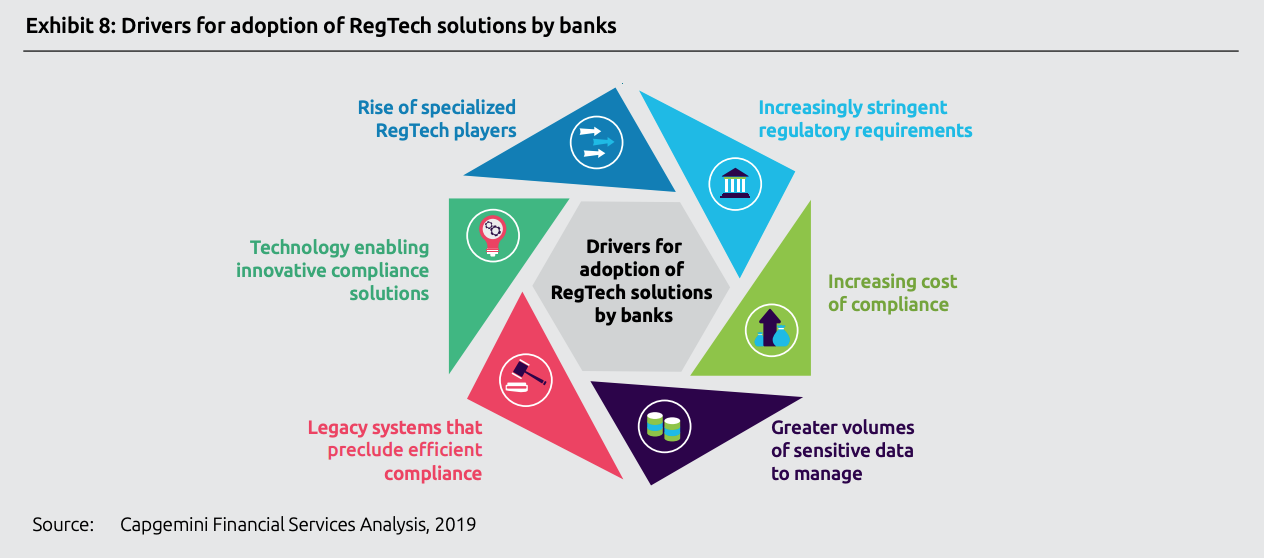

Collaboration with regtechs continues to rise: Financial institutions are engaging with regtech firms and outsourcing their compliance functionality to test and deploy regulatory solutions faster.

ING Bank and the Commonwealth Bank of Australia (CBA) have been using Ascent’s regtech solution to automatically generate audit report and help them manage their compliance activities.

Drivers for adoption of regtech solutions by banks, Top trends in retail banking – 2020, Capgemini, November 2019

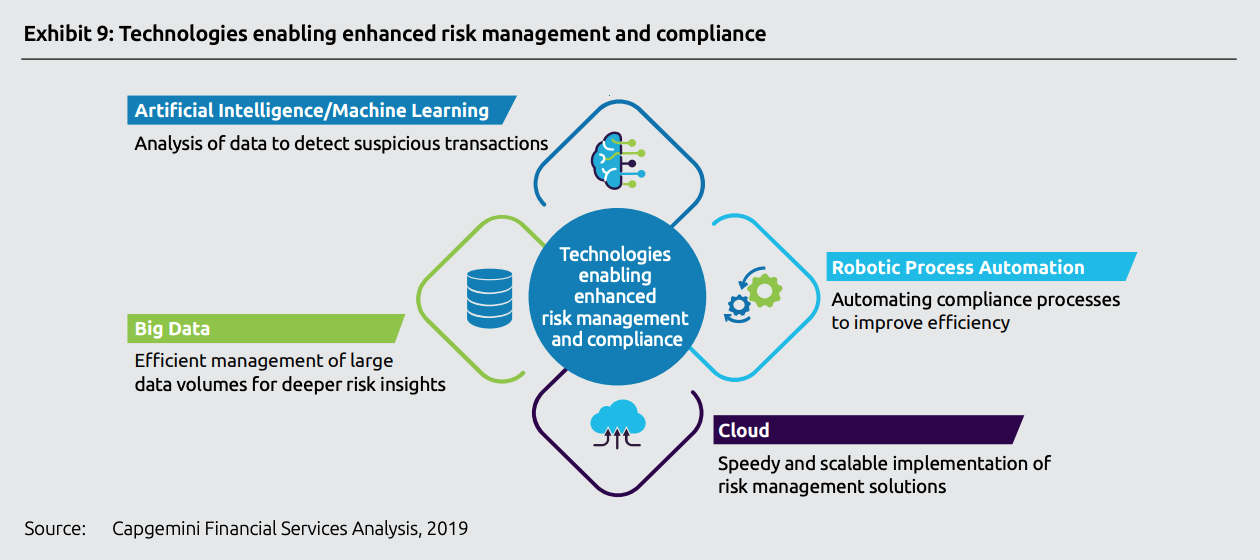

Banks embrace technology for risk-compliance initiatives: Banks are embracing the potential use of technologies including AI and ML, big data, cloud and robotic processing, to meet regulatory requirements, automate compliance processes, improve operational efficiency, fight cyber-attacks, and more.

The People’s Bank of China, for example, is using AI, big data and cloud computing to improve its ability to identify, prevent and decrease cross-market and cross-sector financial risks.

Technologies enabling enhanced risk management and compliance, Top trends in retail banking – 2020, Capgemini, November 2019

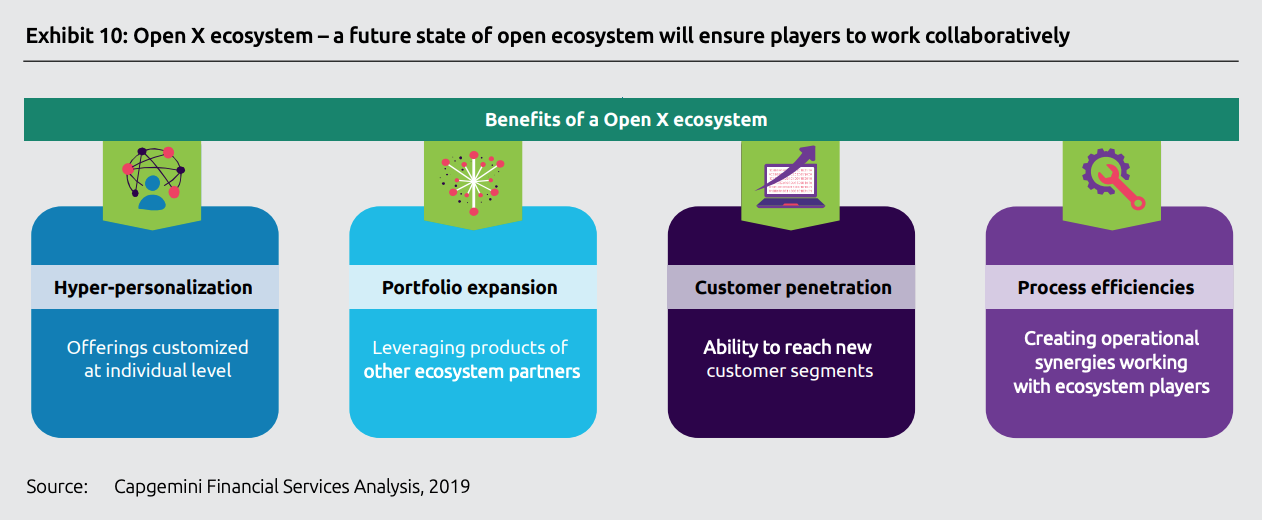

Open X will require players to work collaboratively: The industry is transitioning to service rebundling and shifting towards the so-called Open X ecosystem. Within this new ecosystem, banks will provide personalized products and services by extensively leveraging data, and will have to collaborate with other ecosystem partners to garner relevant information.

Banks are already capitalizing on the shared marketplace and have launched several initiatives. HSBC for example offers an app called Connected Money which lets customers view their accounts at up to 21 different banks in one place.

Open X ecosystem – a future state of open ecosystem will ensure players to work collaboratively, Top trends in retail banking – 2020, Capgemini, November 2019

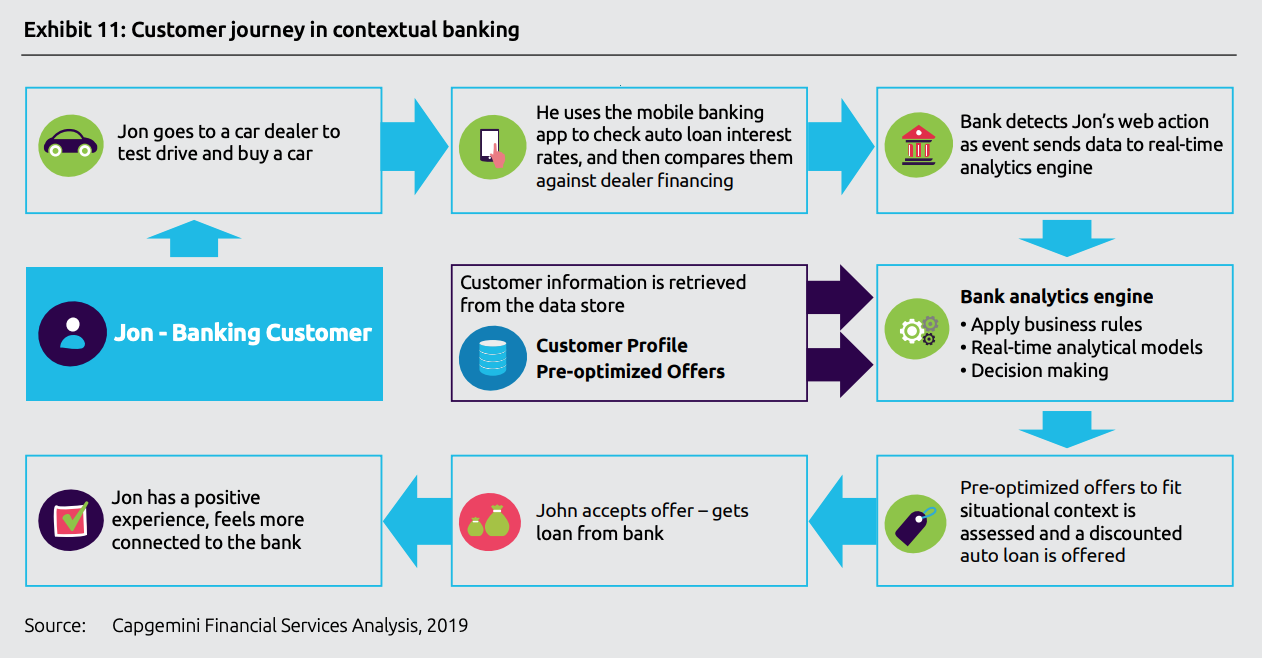

Offering superior customer experience through contextual banking: Banks are leveraging cutting-edge technologies to offer a contextual banking experience and offer customers the right products at the right place and time.

The CBA launched in mid-2019 its CommBank App 4.0 update which offers personalization tailored to individual customer needs. In Singapore, OCBC has embedded Clinc’s conversational AI in its mobile app to provide customers with voice-enabled instant access to their financial information.

Customer journey in contextual banking, Top trends in retail banking – 2020, Capgemini, November 2019

Featured image credit:freepik