Challenger Banks Market is the Hottest Fintech Vertical in Europe

by Fintechnews Switzerland March 10, 2017Challenger banks have raised more venture capital than any other fintech vertical in Europe. So far, over US$500 million has been invested into EU digital banks, according to a new report by Frontline Ventures.

Titled “Challenger Banks in Europe: Challenge Accepted,” the report says that incumbents have paved the way for challengers through “persistently low customer satisfaction.”

Challenger banks are smaller retail banks set up with the intention of competing for business with large, long-established national banks. They use fast on-boarding, pain point marketing, performance marketing, and network effects to on-board new customer at one fourth of the cost of traditional banks.

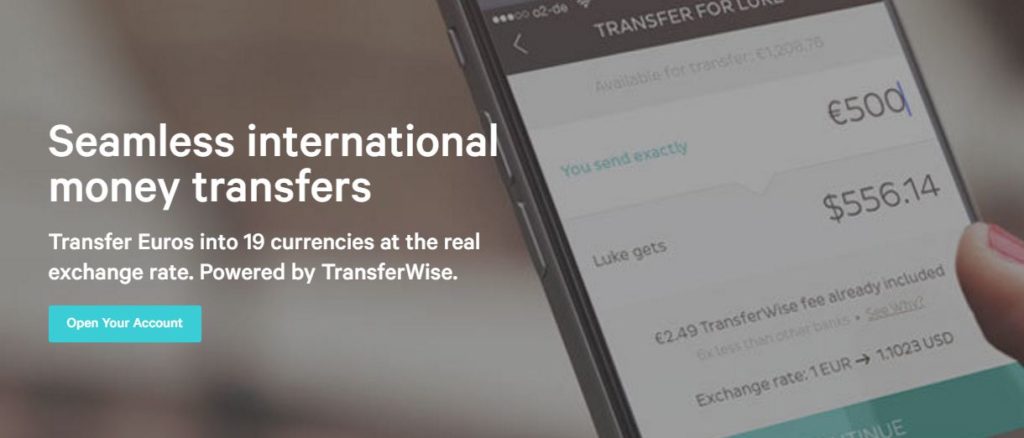

These players are digitally-focused and operates through a simple business model that provides them a cost advantage. They often partner with other businesses to further their expansion and are pursuing a marketplace model. One relevant example is German challenger bank N26 which partnered with Vaamo to provide customers with asset management as well as TransferWise for currency transfer.

These players are digitally-focused and operates through a simple business model that provides them a cost advantage. They often partner with other businesses to further their expansion and are pursuing a marketplace model. One relevant example is German challenger bank N26 which partnered with Vaamo to provide customers with asset management as well as TransferWise for currency transfer.

One of their main advantages is their lower fees. For instance, Metro Bank, N26, Monzo and Revolut all offer free foreign purchase, while HSBC, Barclays, RBS and Lloyds Bank charges up to 2.99%.

One of their main advantages is their lower fees. For instance, Metro Bank, N26, Monzo and Revolut all offer free foreign purchase, while HSBC, Barclays, RBS and Lloyds Bank charges up to 2.99%.

In Europe, challenger bank lending assets grow 30% YoY, and the performance of some of the region’s top players demonstrates the rapid growth of the industry. Notably, Metro Bank serves some 700,000 customers and grows 40% p.a. Shawbrook lent to 60,000 SMEs and consumers £1.6 billion in 2015. Virgin Money has over 2.8 million customers and was valued at £1.25 billion when it IPOed in 2014.

The rise of challenger banks was enabled by new regulations in Europe that make it easier than ever to start a bank. Moreover, the PSD2 ruling in 2018 is expected to further shift power toward digital players.

In response to the trend, incumbents have started making strategic acquisitions and investments. BBVA in particular has acquired US-based Simple for US$117 million, as well as Finish Holvi. The bank also owns the majority of UK-based Atom Bank. Meanwhile, Santander has decided to further improve its offerings and focus on creating a better digital experience.

Among the notable players in Europe, Atom Bank was granted a banking license in 2015 and has raised US$300 million in funding so far; Monese, which received US$16 million in venture capital, has over 55,000 users; and N26 serves over 200,000 customers and was granted a German banking license last year.

Others include Fidor Bank, a subsidiary of a high-profile German digital bank. The bank is consumer-oriented and relies heavily on social media. It uses its own in-house developed technology. Fidor began operating in the UK in September 2016 and has recently been acquired by BPCE, France’s second largest banking group.

London-based Babb is creating a bank based on blockchain technology. The company is currently regulated as an approved payment institutions by the UK’s Financial Conduct Authority but is in the process of applying for a full banking license.

In the light of the current state of industry, Frontline Ventures predicts the emergence of more “horizontal” banks which will target specific customer segment such as immigrants, or freelancers. 2017 should also see incumbents investing into improving their mobile apps, as well as more challenger banks emerging in continental Europe.

Allied Market Research forecasts that the global market will grow at a CAGR of 50.6% during the period 2017 – 2020. Most particularly, the neo and challenger banks market in China is anticipated to witness the fastest growth driven by the country’s large pool of underbanked consumers and the surge in online and mobile banking users.

Featured image by Frontlines Ventures