European Parliament Releases Study on Competition Issues in Fintech

by Fintechnews Switzerland July 31, 2018The European Parliament (EP) has published a new study on the competition challenges arisen from the increasing number of fintech services provided by newcomer startups, traditional financial institutions and Big Tech companies.

According to the paper, factors such as network effects derived from the use of online platforms, access to customer data, standardization, interoperability and the use of algorithms could potentially result in anticompetitive behaviors.

Competition Issues in the Area of Financial Technology (Fintech)

The study, titled Competition Issues in the Area of Financial Technology (Fintech) and provided by Policy Department A at the request of the European Parliament Committee on Economic and Monetary Affairs (ECON), analyzes these factors and their impact both in the fintech ecosystem and in the services categories.

It stresses that due to the fact that fintech platforms are not as regulated as incumbent financial trading platforms, challenges arisen from the generation of network effects that create barriers to entry. For instance, a multi-sided network effect can enable a large platform to be protected from competition from smaller platforms with fewer participants.

Interoperability is a potential critical anticompetitive factor related to platforms as an active pursuit of non-interoperability can act as a deterrence if access to the market is difficult or costly.

Standardization also plays a relevant role in the field of competition between fintech providers as it may result in an oligopoly where providers agree on features of the service to split the market between them. But on the other hand, if standardization lowers entry costs, and prices, and/or allows firms to compete on more core parts of the service, then it has a positive effect.

Access to data may become another competition issue in the fintech ecosystem. Control over unique data troves, can result in, for example, exclusionary conduct when not allowing competitors to access data, the conclusion of exclusive contracts that foreclose competition, and the tying and bundling of services.

In particular, the paper highlights specific competition issues for each fintech category:

Banking: Banking platform markets are primarily multi-home and do not have a high intensity of use, so potential anti-competitive factors might not have a real impact on competition at this stage.

Payments, transfers and forex: Relevant concerns include access to critical assets such as data and mobile near field communication (NFC) chips, and the use of an incumbency position gained offline to engage in exclusionary conduct towards competitors.

Digital currencies: The most relevant concerns are the presence of network effects, and the standardization of distributed ledger technology (DLT) and other technical protocols. Private or public consortia agreements in relation to technical standards may affect the market entry or have an impact on current costs.

Wealth and asset management: The potential competition challenges in this area involve the fee policies of different service providers, the blurring of boundaries between different types of services including information, advisory, and management, and the implications of the use of algorithms.

Personal finance management: Competition issues regarding digital Personal Finance management (PFM) services arise mainly in the field of customer data access.

Insurance: Access to customers’ data and the impact of algorithms on pricing strategies are the main factors that can lead to anticompetitive practices.

Enabling technologies and infrastructures: There are no specific competition concerns in technologies such as DLTs, artificial intelligence (AI) and data analytics, apart from the common ones that are standardization, network effects, and access data.

Fintech in Europe

Fintech services offer many benefits to European consumers including cost reduction, efficiency improvements, better adaption to customers’ preferences, greater transparency and increased financial inclusion.

In Europe in particular, fintech services provide cross-border financial services between member states and extend financing and investment alternatives to European businesses and households, thus contributing to the achievement of some of the most relevant European Union objectives.

These include, for instance, the Digital Single Market, a policy that covers digital marketing, e-commerce and telecommunications announced in 2015, the Consumers Financial Services Action Plan, which seeks to harness the potential of digitalization and fintech to improve consumer access to financial services across the EU, and the Capital Markets Union, an action plan of the European Commission to mobilize capital in Europe by achieving a true single market for capital.

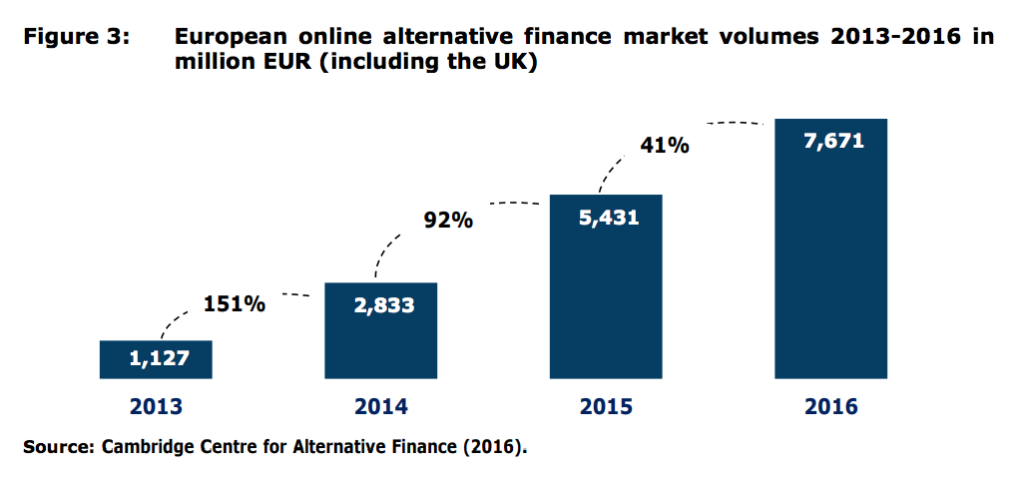

A segment of fintech that has grown rapidly in the past years in Europe is alternative finance. As of 2016, the total volume of online alternative finance in the EU reached EUR 7.67 billion, according to Cambridge Centre for Alternative Finance, or 41% higher than in 2015.

The UK is the largest market, representing approximately 73% of the total European volume. Following the UK, the countries with the greatest volumes of online alternative finance in Europe are France, Germany, the Netherlands, Finland and Spain.

Featured image via Competition Issues In The Area Of Financial Technology (fintech), by Policy Department A, at the request of the ECON Committee, European Parliament