Fintech Switzerland Startup of The Month: Veezoo, Data Exploration And Visualization

by Fintechnews Switzerland October 3, 2016Zurich-based Veezoo is one of the startups that are being incubated by SIX’s Fintech Incubator F10. The company has developed a platform that allows users to research, explore and visualize data, with an aim to “make complex information easy to understand.”

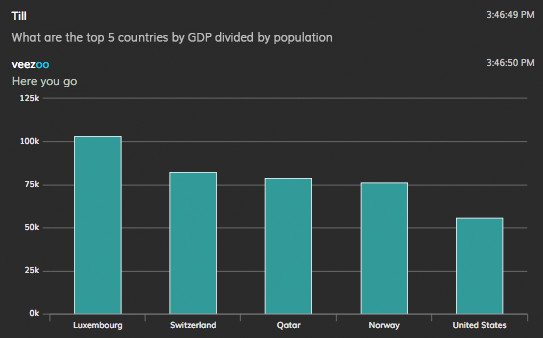

Veezoo, which leverages Artificial Intelligence (AI) and its own Natural Language Processing technology, works on a question-and-answer concept.

Veezoo, which leverages Artificial Intelligence (AI) and its own Natural Language Processing technology, works on a question-and-answer concept.

The solution is quite simple, intuitive and straight-forward: first, the user asks a question in natural language about the data he would be to get through a Google-like interface. Veezoo then looks for the best data visualization to answer the question interactively.

Image via http://www.veezoo.com/

The purpose of Veezoo is to provide a visualization that gives “the optimal trade-off between displayed information and simplicity” and which answers a user’s question in the most objective way.

It aims at providing clients and users with a more efficient alternative to the highly complex tools currently available in the market which often require experienced people to both explore the data and find the optimal way to visualize relevant information out of them.

The solution seeks to help businesses, notably banks, retailers, telecom companies and consulting firms, as well as governments make better decisions by allowing them to integrate Veezoo into their data infrastructure.

Year 2015 saw 397 AI venture financing deals totaling US$2.3 billion, according to CB Insights.

Image credit: agsandrew / Shutterstock

AI is the theory and development of computer systems that can perform tasks which typically require human intelligence such as visual perception, speech recognition, decision-making, and translation between languages. AI can be used to analyze data produced by the Internet-of-Things, social media and other sources to provide active learning analytics.

AI has several applications in sectors and functions that are data-rich, notably healthtech, marketing and sales, business analysis and financial services.

In the fintech sector, AI has been used in several ways: robo-advisors such as Wealthfront are using AI to track account activity; others like Sentient Technologies, are using AI to analyze data and improve investment strategies; while the Royal Bank of Scotland has developed an AI solution that answers customer’s queries.

London-based Almax Analytics uses AI and Big Data to offer a “first to market” solution for traders and asset managers building and executing on strategies across all asset classes.

Almax Analytics extracts information from ad-hoc news and filings and processes this information automatically. It aims at solving the problem of information overload with actionable insights by putting the content of news into context and by running deep analysis across the entire network of affected companies.

According to John Superson, CEO of SUMO Capital and a beta customer of Almax:

“It is simply not feasible for humans to read and absorb the sheer quantity of news available. This is a real and painful problem for asset managers and one that is impossible to manage in real time with the current systems. The analytics output of the Almax Analytics platform is highly valuable as it helps to generate alpha and manage risk and improves trading with efficient intelligence and data gathering.”

Watch Veezoo’s intro video:

Featured image by ESB Professional, via Shutterstock.com.