How the Financial Industry Will Look Like in 2030: Swiss Fintech Innovations

by Fintechnews Switzerland February 14, 2020Industry trade group Swiss Fintech Innovations (SFTI) has released a discussion paper exploring how the financial and banking services industry will likely look like in 2030.

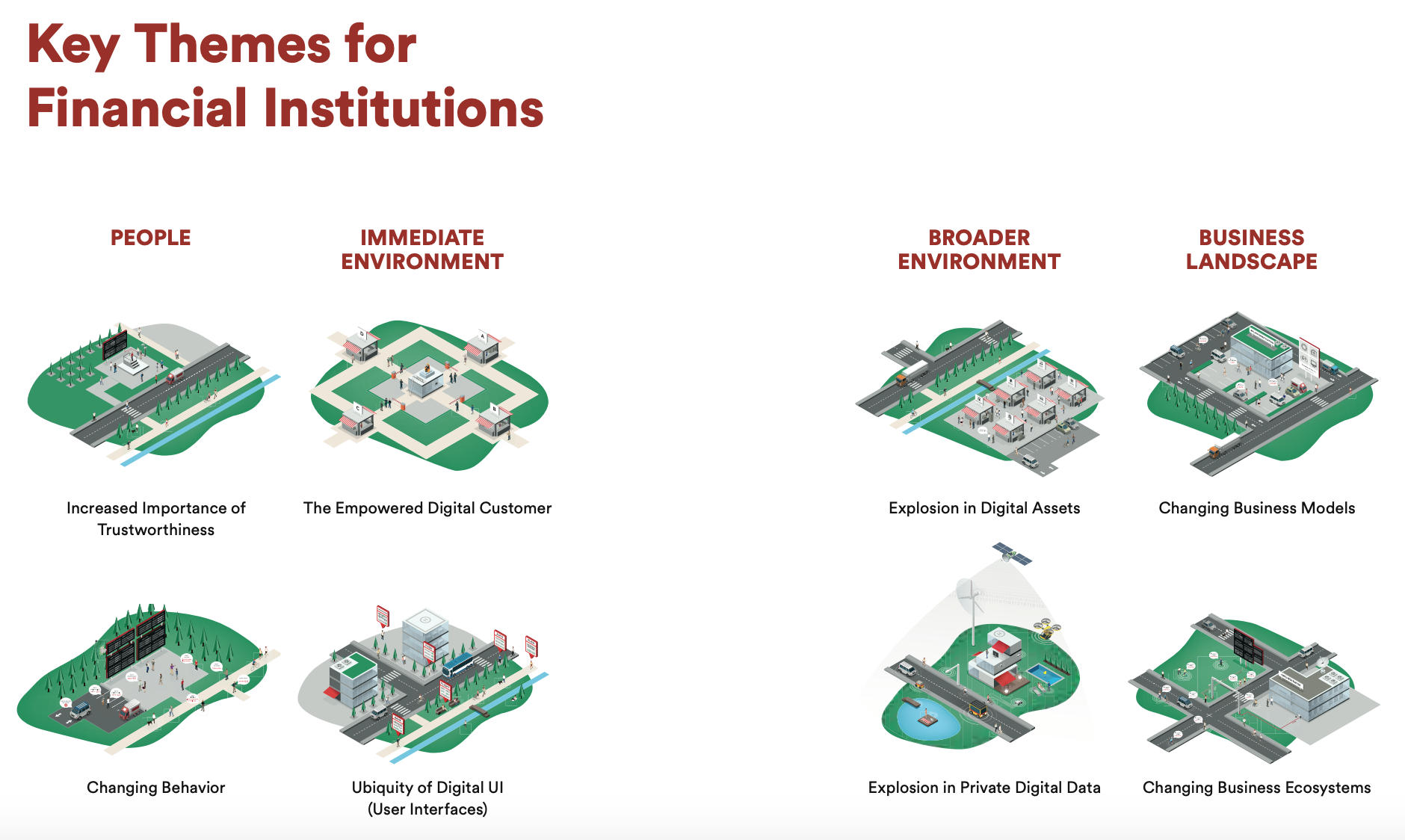

The paper, produced by members of SFTI representing the likes of Swisscom, SIX, Zürcher Kantonalbank, Raiffeisen Switzerland, and Banque Cantonale Vaudoise, sheds light on key themes that are shaping the financial industry in the future, including the increased importance of trustworthiness, changing consumer behavior, and changing business models.

“A bright hybrid world”

Image: Virtual reality, Pixabay

Among the six future scenarios the paper presents, it delves into one that’s the most probable and which it refers to as the “bright hybrid world.” In this scenario, repeated tasks are fully automated with the help of automation and artificial intelligence (AI), augmented and virtual reality are ubiquitous, and decentralized architectures and solutions are common.

Additionally, there is an established application programming interface (API)-economy, distributed ledgers are used in cases where no trusted party can be identified, and the reliance on cloud infrastructure has increased dramatically.

The financial sector in 2030

Key themes for financial institutions, Future of Financial Institutions View 2030, Swiss Fintech Innovations, August 2018

According to the paper, in 2030, people will greatly value security, privacy and transparency, and will demand to have full control of access and usage of their personal data. Consumers will be far less trusting than they were in the past, implying that trustworthiness will become an increasingly important criterion in consumers’ decision-making.

This focus on trustworthiness will impact all players in the financial sector, and will push customers to shift their trust from traditionally reliable institutions to partners that not only guarantee control of one’s personal data, but also enable and empower them.

In this scenario, also, more and more aspects of people’s lives will take place in part or completely in the digital sphere, and customers will no longer accept that one single player has access to all their data, locking them into a single ecosphere of services, applications, and user interfaces (IUs).

These changes in consumer expectations will be reflected by changes in legislation, requiring not only data mobility but also interoperability between the different digital applications, the paper says.

A major focus will be put on understanding customers more comprehensively in order to develop tailored advisory recommendations and products. As finance becomes more and more integrated into customers’ lives, the role of financial institutions will eventually evolve from that of a financial advisor to that of a trusted life coach who is discreetly available whenever needed.

In this environment, financial institutions will have to develop the capabilities to embed their services into the customer’s journey and build up a consistent and clear ecosystem strategy with reliable partnerships.

“Explosion in digital assets”

The paper also predicts the “explosion in digital assets” in 2030 with all real-world assets, tangible and intangible, being digitized and registered on digital ledgers. The rights to these assets will be tradeable and exchangeable within interconnected and interoperable systems.

There will also an explosion in native digital assets, including cryptocurrencies, virtual in-game objects, data produced by sensors, and digital definition/descriptions of assets, and the rights to these assets will also be digitally represented. This will lead to an explosion in number and variety of rights to assets, the report says.

Featured image credit: Unsplash