New Report Highlights Switzerland’s Rapidly Growing Fintech Sector

by Fintechnews Switzerland December 7, 2018On the European fintech and blockchain scene, Switzerland is quickly catching up with the UK, the region’s leader, leaving Germany, France and Spain well far behind, according to the Swiss Startup Radar report by online news platform Startupticker in partnership with HEC Lausanne, the University of Lausanne.

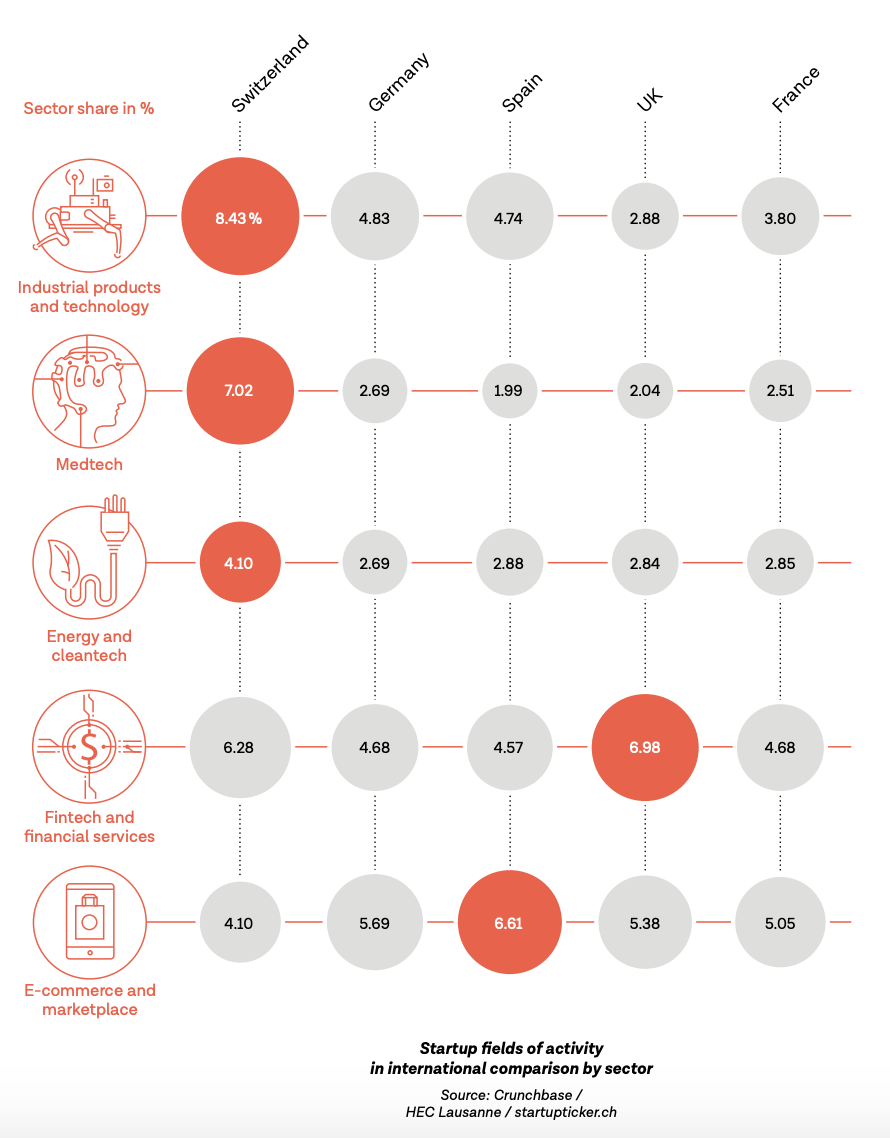

Fintech, which currently represents 6.28% of the Swiss startup ecosystem, has been rapidly growing in the past years.

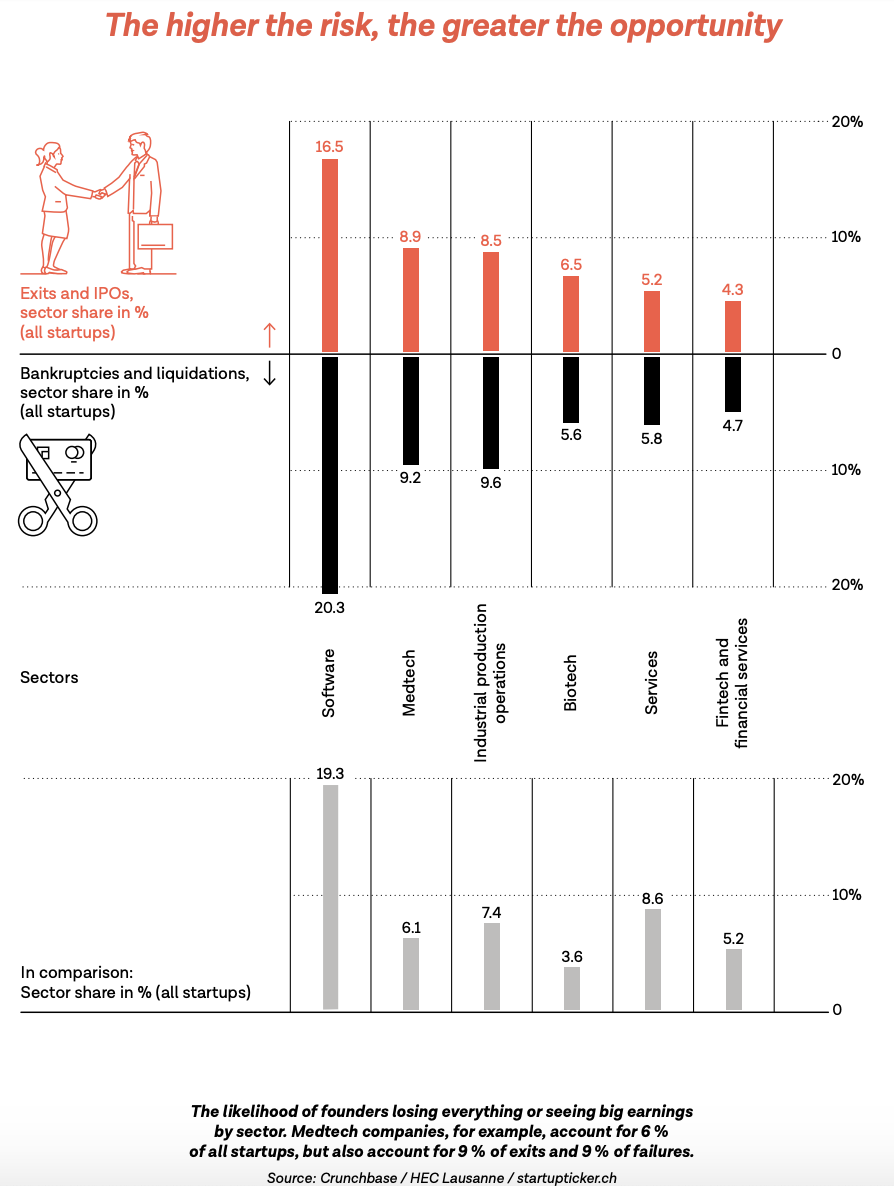

The inaugural Swiss Startup Radar report, a study based on an evaluation of 4,000 datasets, estimates that fintech and financial services companies account for about 4% of the Swiss startup sector’s exits and initial public offerings (IPOs), and 4.7% of bankruptcies and liquidations.

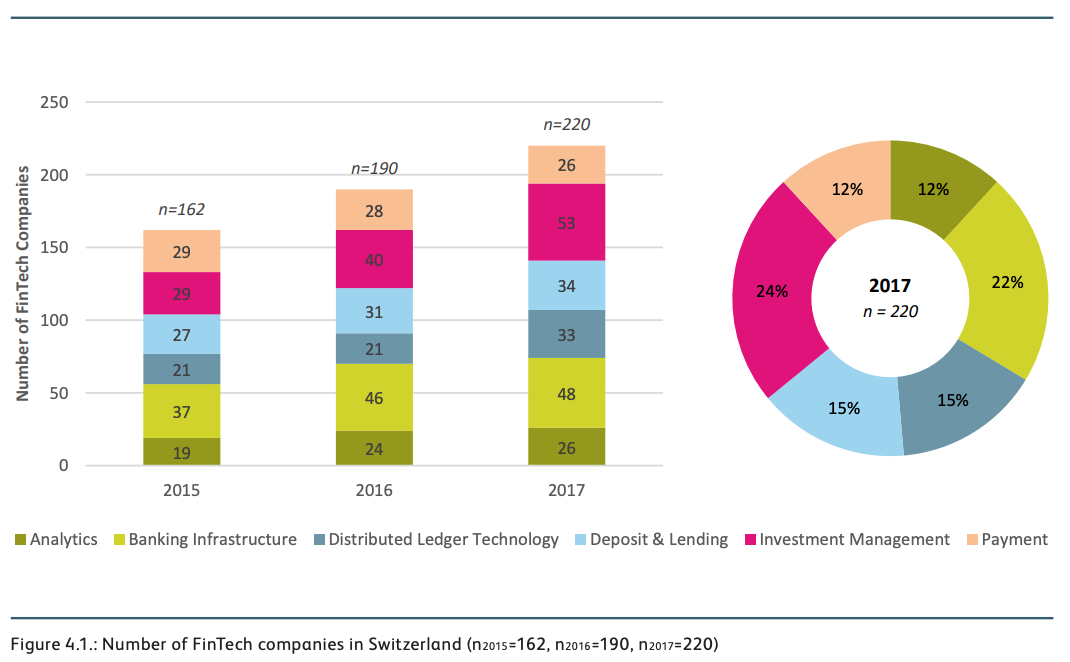

According to the separate IFZ Fintech Study 2018 released earlier this year, there were 220 fintech companies in Switzerland at the end of 2017, 24% of which operating in the investment management segment, followed by banking infrastructure at 22%, then distributed ledger technology and blockchain, and deposit and lending, both segments at 15%.

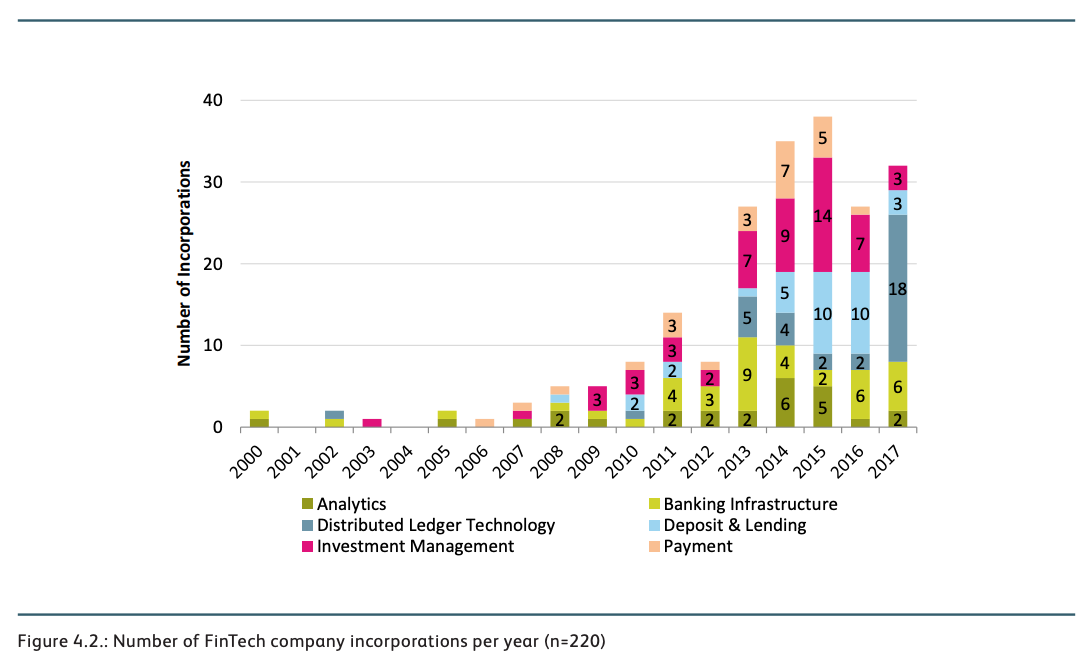

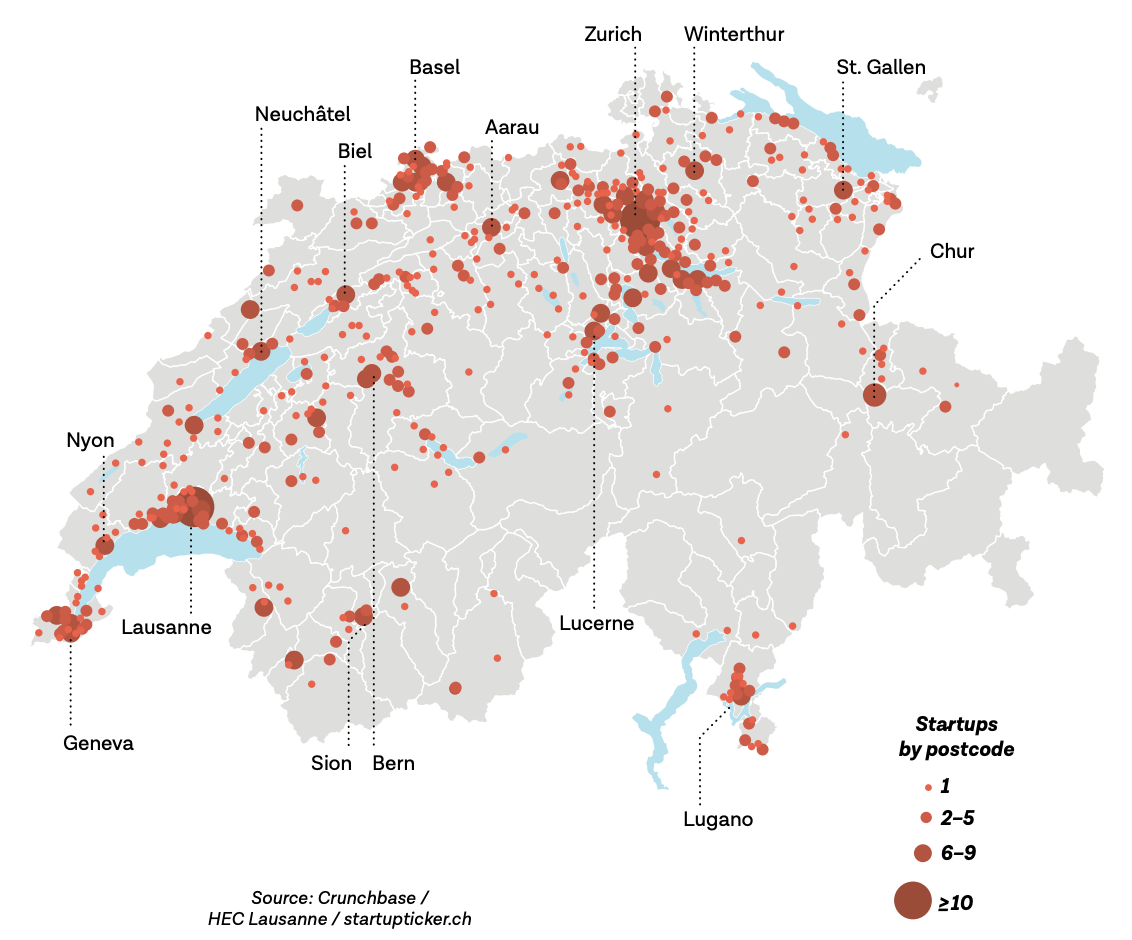

32 new fintech startups were incorporated in 2017 with more than half offering blockchain related services. The majority of these companies were founded in Zug, also known as Crypto Valley for the high concentration of blockchain startups located in the city.

The trend reflects Switzerland’s ambition to become a pioneer in blockchain and crypto technologies with not only financial institutions rapidly adopting the technology but also governments.

In June, Zug conducted Switzerland’s first municipal blockchain-based vote. The vote trial utilized the city’s digital ID system which was first set up in November 2017 and was deemed a success. In contrast to other e-voting systems, the voting process Zug did not take place via a single central server, but was distributed using blockchain technology to make the voting process “safer and less susceptible to unnoticed manipulation.”

The city also hosts several renowned blockchain projects and startups including the Ethereum Foundation, Xapo, Lykke, iProtus and ConsenSys.

300 new startups each year

While fintech has witnessed significant developments, it still falls behind other much more popular segments including software, which comprises enterprise software, information technology, Internet, SaaS and web development, representing 14.43% of Switzerland’s startups, industrial products and technologies representing 8.43%, services representing 8.13% and medtech representing 7.02%.

Thanks to the organizations and initiatives from politics, management, business and society engaged in promoting entrepreneurship and innovation, the Swiss startup ecosystem has been thriving, the report notes.

About 300 startups are founded in Switzerland every year, four times more than 15 years ago. The canton of Zurich accounts for just under a third of companies and canton Vaud for about 15 %. There are also centers in Geneva (7 %), Zug (5 %) and both Basel cantons (together 9 %).

Among the key factors contributing to Switzerland’s rapidly growing startup ecosystem are the country’s large talent pool and its very high quality education system, including staff training.

Among the key factors contributing to Switzerland’s rapidly growing startup ecosystem are the country’s large talent pool and its very high quality education system, including staff training.

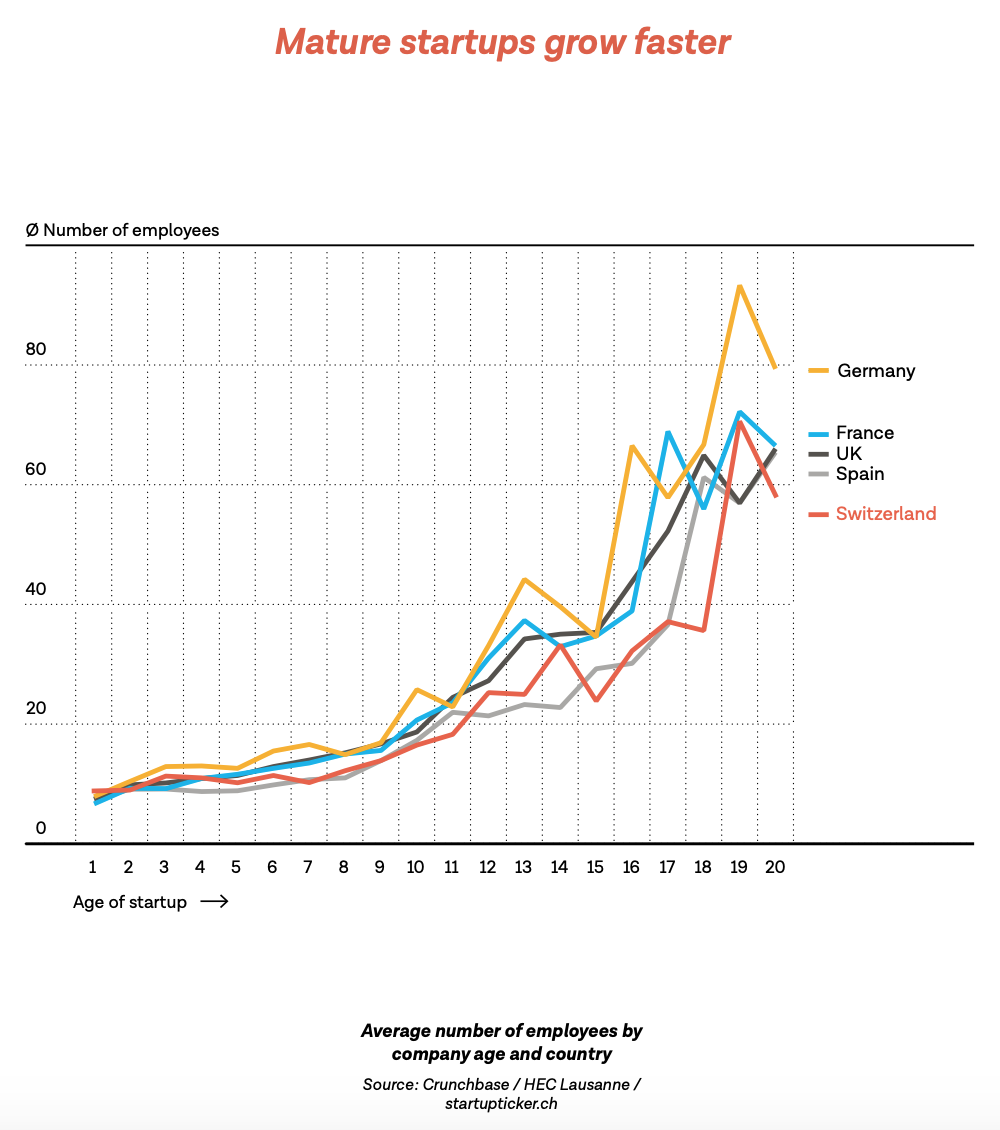

However, the report notes that startups are growing more slowly in Switzerland than in other European countries. “One reason may be the development of complex products that take longer with slower job growth than, for example, building a typical Internet startup,” it argues. “Another reason is that Swiss companies focus on their core skills right from the start and outsource many activities to suppliers.”

Featured image: Flag-map of Switzerland, Wikipedia