Swiss Banks And Swiss Fintechs Are Undergoing A Serious Customer Trust Issue

by Fintechnews Switzerland May 19, 2017Swiss banks and financial institutions are facing many challenges as new, tech-focused entrants are trying to disrupt their businesses. Customer behavior and expectations have changed dramatically and trust in the financial services market is on an all-time low, an issue that needs to be overcome rapidly for both incumbents and startups, according to a new report by consulting firm EY.

Building trust digitally has become a priority in the financial services industry, notably in Switzerland where financial services customers are among the most digitalized customers when compared to other countries.

Fintech startups are radically transforming the industry’s business and marketing practices. These companies integrate digital media and technology to make services and interactions more transparent, simple and convenient, and address previously unmet needs of customers.

Fintech startups excel in digital customer experiences, but at the same time, are challenging an industry that typically relies on building customer relationship through personal face-to-face interactions between the customer and an advisor.

EY, which interviewed 12 experts and senior managers representing both incumbent and startup companies, reported its findings in a paper called “Is trust powered by a heartbeat or a beep?” in which the firm shares recommendations for fintechs and banks to build trust in an increasingly digitalized environment.

EY, which interviewed 12 experts and senior managers representing both incumbent and startup companies, reported its findings in a paper called “Is trust powered by a heartbeat or a beep?” in which the firm shares recommendations for fintechs and banks to build trust in an increasingly digitalized environment.

Insights gained from these interviews, in addition to the results of a qualitative survey with over 400 Swiss citizens, were used to formulate recommendations on how trust can be built through digital interactions.

For incumbents, the report says that although these firms have a competitive advantage, this advantage can be reduced by startups that are following a “hybrid strategy” which combines personal and digital interaction in different phases of the customer process.

It recommends banks to expand their digital presence to meet customer expectations and consider carefully where to reduce personally contact if necessary. Furthermore, a convenient deployment of new technologies and elaborated digital interactions are needed to keep up with startup companies.

For new entrants and tech-focused startups, the report claims that the lack of existing trust is an undeniable constraint that needs to be overcome. Trust-building measures should be put in place in digital interactions in order to compensate the lack of personal contact. Also, personal elements in the customer interaction can contribute to reduce their strategic disadvantage.

Partnering with Fintech Startups

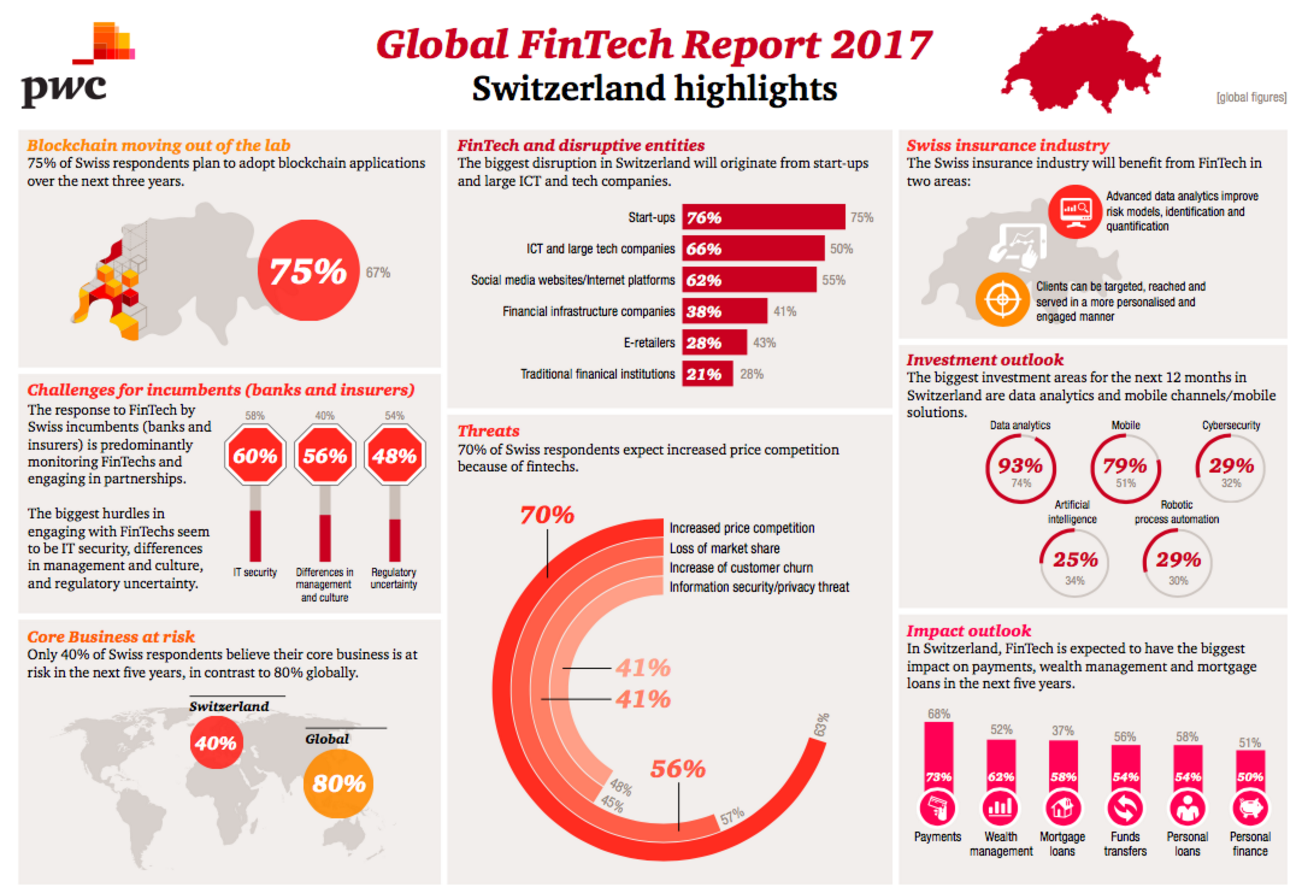

In Switzerland, 70% of the bankers are expecting price competition because of fintechs and 56% predict a loss of market share, according to PwC’s Global Fintech Report 2017.

The response to fintech by Swiss incumbents is predominantly monitoring fintechs and engaging in partnerships. However, banks named the biggest hurdles in engaging with fintechs as IT security, differences in management and cultures, and regulatory uncertainties.

Despite the challenges, 82% of Swiss respondents plan to increase partnerships over the next three to five plans.

“In Switzerland, we have a relatively small, fragmented market, with intense competition and high barriers to entry. The perceived threat by fintechs is comparatively less dramatic than in other markets,” said Daniel Diemers, Partner Financial Services PwC Strategy and Switzerland.

“The focus here is more on wealth management, an area that sees disruption today as less imminent than retail banking or payments. However, the trends will clearly disrupt all areas of financial services in the coming 5-10 years, including Swiss private banking and wealth management.”

Swiss respondents named payments (73%), wealth management (62%), mortgage loans (58%), and funds transfers (54%) as the four areas that will be the most impacted by fintech.

The report says that the Swiss financial services industry can benefit from fintech innovation in a number of areas. Advanced data analytics can improve risk models, identification and quantification. Financial technology also enables firms and banks to target, reach and service clients in a more personalized and engaged manner.

Featured image: Handshake by pikcha, via Shutterstock.com.