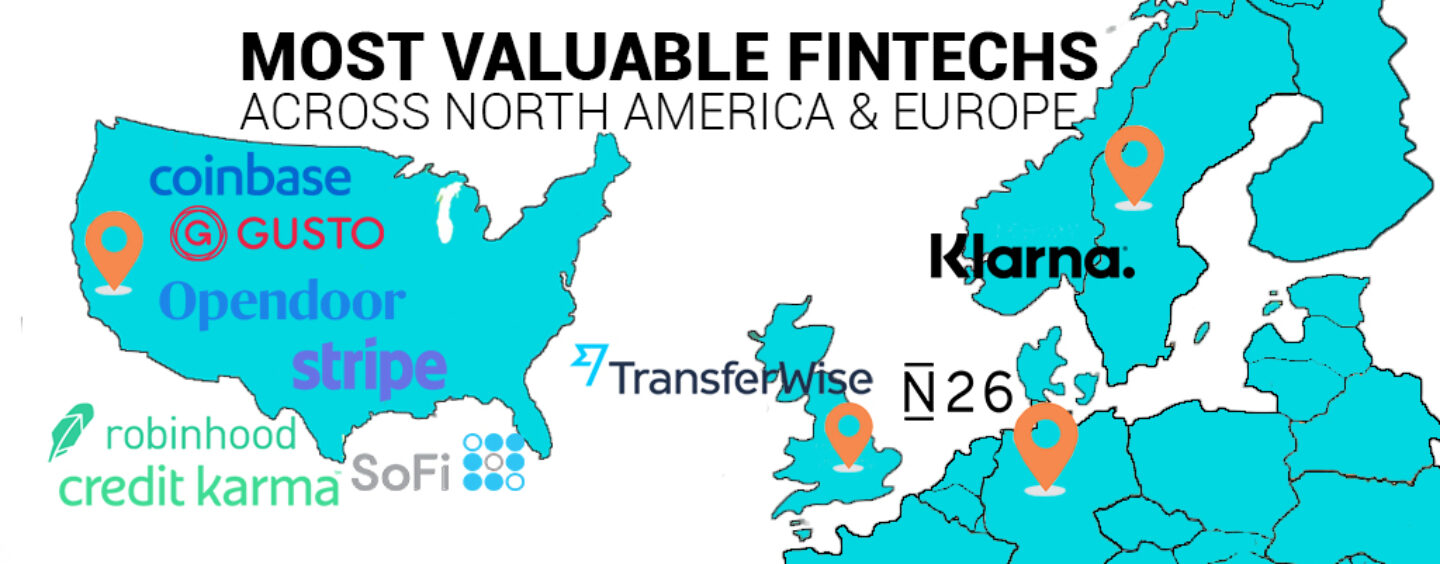

Top 10 Most Valuable Fintechs Across North America and Europe

by Fintechnews Switzerland August 14, 2019PitchBook, a software-as-a-service company that delivers data, research and technology covering the private capital markets, has released its list of the ten most valuable fintech startups in North America and Europe.

These tackle a broad range of areas including cryptocurrencies, payments, credit, investment and trading.

Among the ten fintech startups, PitchBook notes two main trends: the removal of traditional banking fees such as Credit Karma’s free credit and financial management platform, and Robinhood’s commission-free trading platform, as well as the elimination of geographical limitations and complex processes in traditional credit and money services like Opendoor’s instant home buying service.

The following are the ten most valuable fintech companies in North America and Europe, according to PitchBook data.

1.Stripe

Valuation: US$22.5B

Founded: 2011

Headquarters: San Francisco

Description: Stripe is the developer of an online payment platform designed to integrate electronic payments and enable secure transactions. The company’s software allows individuals and businesses to make and receive payments over the Internet. It provides the technical, fraud prevention, and banking infrastructure required to operate online payment systems.

Investors: Base Partners, DST Global, Proioxis Ventures, Sherpalo Ventures, Tiger Global Management.

2.Coinbase

Valuation: US$8.1B

Founded: 2012

Headquarters: San Francisco

Description: Coinbase is a digital currency exchange that brokers exchanges of Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic, and Litecoin with fiat currencies in approximately 32 countries, and bitcoin transactions and storage in 190 countries worldwide.

Coinbase has two core products: the Coinbase Pro professional trading platform, and a user-facing retail broker of Bitcoin, Bitcoin Cash, Ether, Ethereum Classic, and Litecoin for fiat currency. The company also offers an API for developers and merchants to build applications and accept payments in digital currencies.

Investors: 1Confirmation, A.Capital Ventures, Eudaimonia Capital, Government of Singapore Investment Corporation (GIC), Hard Yaka.

3.Robinhood

Valuation: US$7.6B

Founded: 2013

Headquarters: Melon Park

Description: Robinhood is the developer of an investment platform that offers commission-free trading in stocks, ETFs, options and cryptocurrencies, as well as margins. The firm is a FINRA-approved broker-dealer, registered with the US Securities and Exchange Commission and is a member of the Securities Investor Protection Corporation.

Investors: Amplo (Spring), Arrive, CapitalG, Hard Yaka, ICONIQ Capital.

4.Klarna

Valuation: US$5.5B

Founded: 2005

Headquarters: Stockholm

Description: Klarna Bank AB, commonly referred to as Klarna, is a Swedish bank that provides online financial services such as payment solutions for online storefronts, direct payments, post purchase payments and more. The company’s core service is to assume stores’ claims for payments and handle customer payments, thus eliminating the risk for seller and buyer.

The company currently plans to expand payment presence in the US.

Investors: BlackRock, Commonwealth Bank of Australia, Dragoneer Investment Group, Första AP-fonden, HMI Capital.

5.Social Finance (SoFi)

Valuation: US$4.8B

Founded: 2011

Headquarters: San Francisco

Description: Social Finance, commonly known as SoFi, is an online personal finance company that provides student loan refinancing. The company’s platform includes online banking, personal, mortgage and wealth management, enabling students to get lower interest rates based on their career experience, monthly income, financial history and education.

Investors: Manhattan Venture Partners, Next Ventures, Qatar Investment Authority, G Squared, New Ground Ventures.

6.Credit Karma

![]()

Valuation: US$4B

Founded: 2007

Headquarters: San Francisco

Description: Credit Karma is a multinational personal finance company, best known as a free credit and financial management platform. Credit Karma provides free credit scores and credit reports from credit bureaus TransUnion and Equifax, alongside daily credit monitoring from TransUnion. It also provides credit tools, free tax preparation, monitoring of unclaimed property databases, a tool to identify and dispute credit report errors, as well as an account aggregation service called Yodlee.

Investors: Silver Lake Management, W Capital Partners, Valinor Management, Viking Global Investors, CapitalG.

7.Opendoor

Valuation: US$3.8B

Founded: 2014

Headquarters: San Francisco

Description: Opendoor operates an online real estate marketplace aimed at simplifying home buying and selling. The marketplace helps sellers receive an offer without listing or showing their home, and buyers to browse for homes on sale and instantly unlock them using the company’s application, enabling customers to buy and sell properties in a hassle free way.

Investors: Hawk Equity, Lennar, Silicon Valley Bank, SoftBank Investment Advisers, Andreessen Horowitz.

8.Gusto

Valuation: US$3.8B

Founded: 2011

Headquarters: San Francisco

Description: Gusto, formerly ZenPayroll, is a company that provides a cloud-based payroll, benefits, and human resource management software for businesses based in the US. Gusto handles payments to employees and contractors and also handles electronically the paperwork necessary to help client companies comply with tax, labor, and immigration laws.

Separately, Gusto offers employee health insurance, dental insurance, and vision insurance enrollment and administration. In addition, the company provides other employee-benefit and related products through third parties, including 401K and workers’ compensation insurance.

Investors: Fidelity Management & Research, Generation Investment Management, AME Cloud ventures, Cross Creek, Dragoneer Investment Group.

9.N26

Valuation: US$3.5B

Founded: 2013

Headquarters: Berlin

Description: N26, formerly known as Number 26, is a German direct bank that offers its services throughout most of the Eurozone and in the UK. The company provides a free basic current account and a debit MasterCard card to all its customers, as well as a Maestro card for their customers in certain markets. Additionally, customers can request overdraft and investment products. It also offers premium accounts which offer additional features for a monthly fee.

N26 counts more than 3.5 million customers.

Investors: Government of Singapore Investment Corporation (GIC), Insight Partners, Allianz X, Greyhound Capital, Tencent Holdings.

10. Transferwise

Valuation: US$3.5B

Founded: 2011

Headquarters: London

Description: TransferWise is an online money transfer service supporting more than 750 currency routes across the world including GBP, USD, EUR, AUD and CAD. The company also provides multi-currency accounts. In 2018 TransferWise’s customer-base reached 4 million who collectively transfer around US$4 billion per month.

Investors: BlackRock, Lead Edge Capital, Lone Pine Capital, Vitruvian Partners, Gebrüder Mende.