German Banks Ramp Up Fintech Startup Investment; Commerzbank Leads In Deals

by Fintechnews Switzerland May 11, 2018German banks and financial institutions are ramping up fintech investment with Commerzbank, the fourth largest bank by total assets, emerging as the most active bank in terms of number of fintech deals.

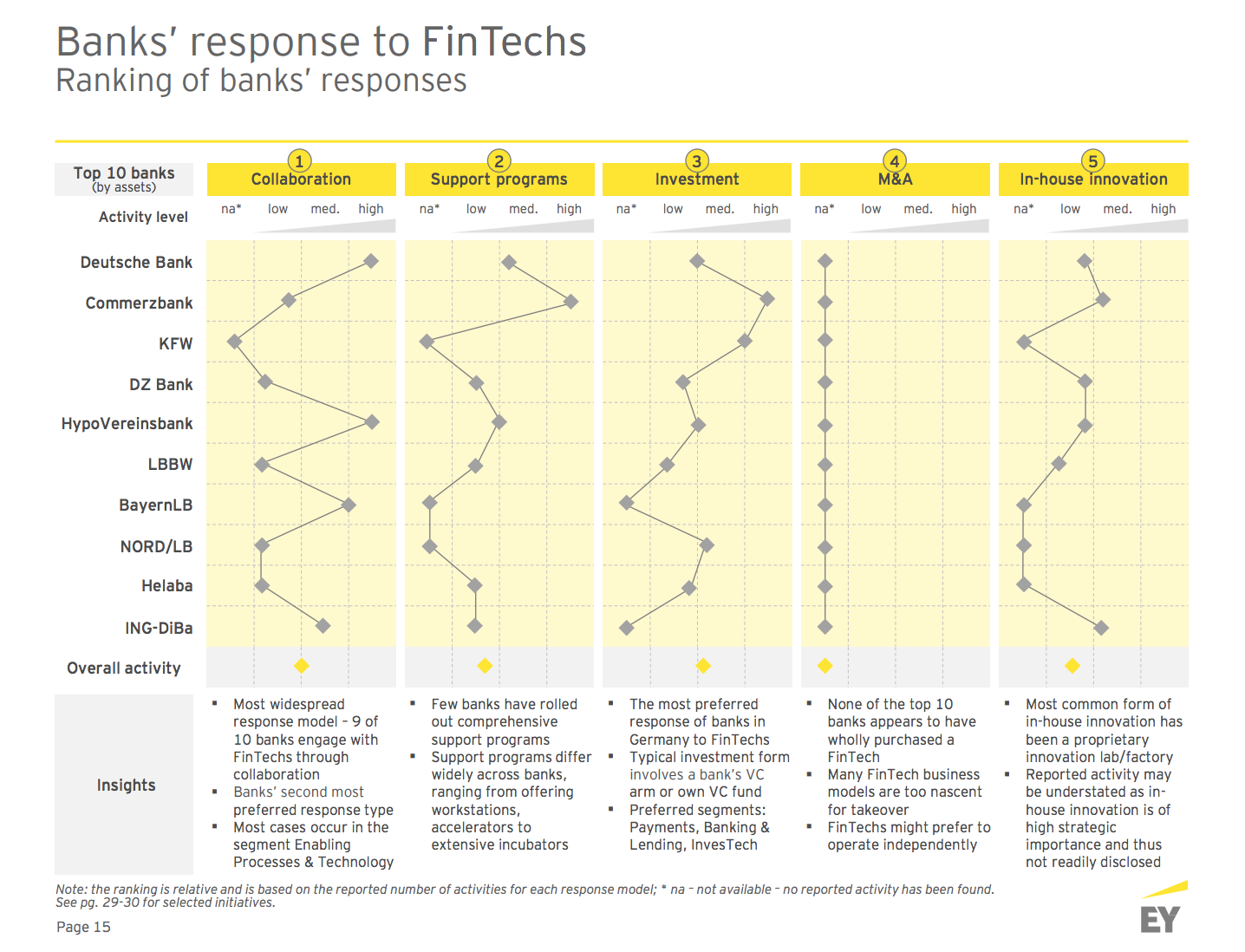

Germany’s top 10 largest banks are pursuing a multi-response approach in dealing with the rise fintech. However, investment and collaboration remain by far the most preferred response models based on the number of reported cases.

Germany Fintech Landscape, September 2017, EY

Within collaborations, the country’s top 10 banks are most active in engaging with fintech companies that enable them to digitalize their service offering. Several banks have also launched or are co-supporting various development programs for fintech.

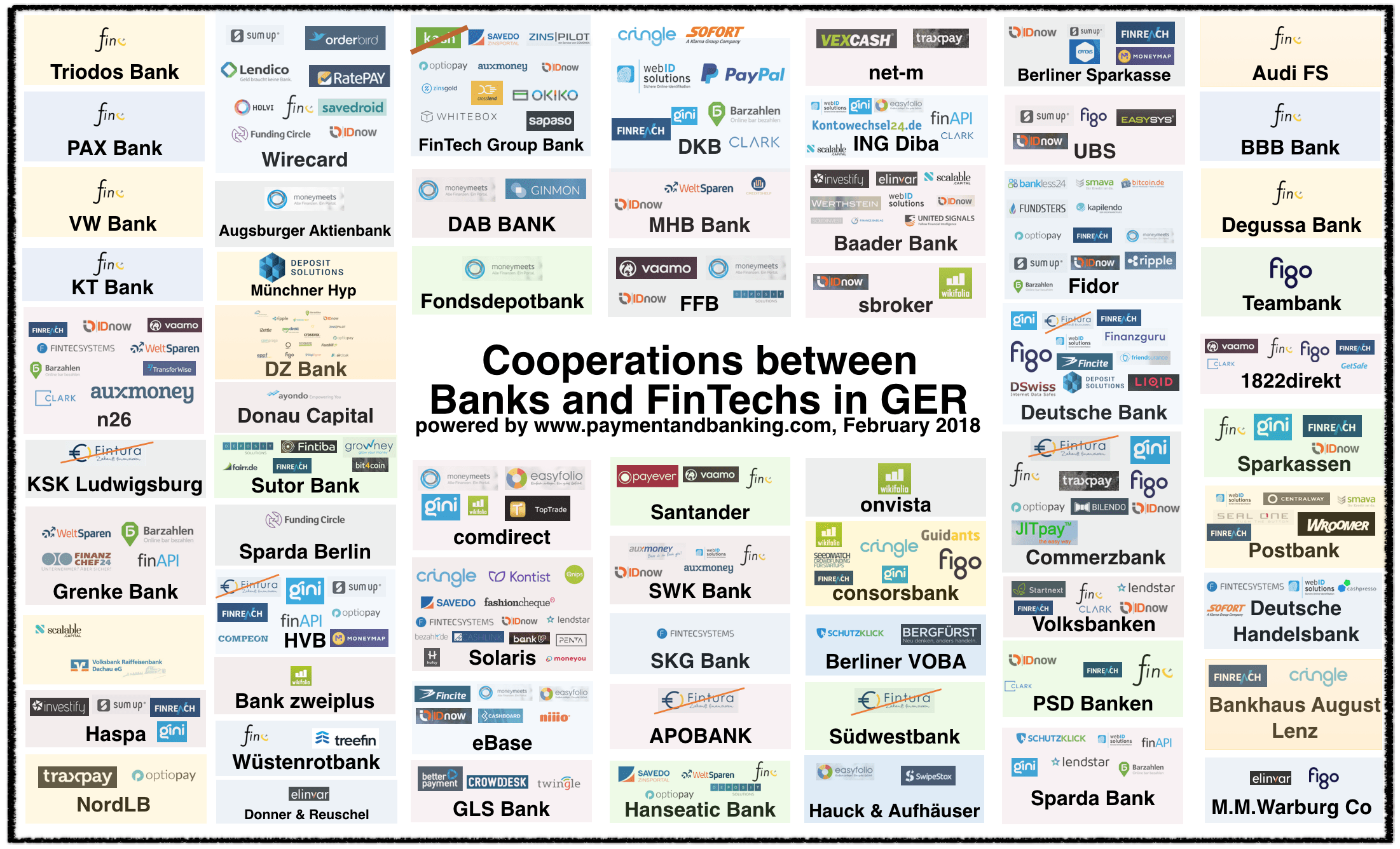

Cooperations between banks and fintechs in Germany, https://paymentandbanking.com/

Commerzbank leads the pack

According to a research by Finanz-szene.de, Commerzbank is by far the most active bank among Germany’s top 10 largest financial institutions in terms of fintech deals. Commerzbank is currently involved in 27 fintech startups. By comparison, the other 9 of Germany’s top banks combine just 20 holdings.

For some of these startups, Commerzbank is holding double-digit percentage of ownership, including Bilendo (12.9%), Gini (13.4%) and GetSafe (13%).

Bilendo is a B2B software-as-a-service (SaaS) provider that focuses on optimizing the liquidity of companies, and automatizing the entire dunning process. Bilendo’s service starts directly after the invoicing, imports all relevant data via an interface or recognition system, matches incoming payments of business accounts with outgoing invoices, sends out required documents such as reminder or dunning letters via e-mail or by post, and informs about current statuses through valuable reports.

Gini is a startup that provides a SaaS solution for extracting content from documents, and GetSafe is an insurtech startup that provides a platform of innovative, data-driven insurance products that users can subscribe to on demand.

Fintech companies in which Commerzbank holds minor shares include European brokerage company eToro, payment startup Marqeta, social payment platform PayKey, and digital commerce platform provider OmnyWay, among others.

In terms of fintech deals, Commerzbank is followed by Deutsche Bank with eight startups, namely TrustBills, WeTrade, R3, Acadia Soft, Vermietet.ed, Dwins, Neptune Networks and USC; and NordLB with seven startups, namely Entrafin, NDGIT, Tradico, Liqid, Cashpresso, SMACC, and Optiopay.

The other seven largest banks in Germany has been involved more or less in the fintech space. The Hypo-Vereinsbank has not disclosed any of its fintech investment but according to Finanz-szene.de, only holds shares in two startups, Finleap and MoneyMap. Similarly, DZ Bank too has invested in two startups, Trust Bills and architrave.

ING Diba has not invested in any fintech company, but the bank did recently acquire Berlin lending marketplace Lendico.

BayernLB has reportedly not invested in any fintech startup but has however partnered with several players through its online subsidiary DKB.

LBBW has so far been almost exclusively focused on in-house digitalization initiatives, such as its recent blockchain project for financial transactions with Daimler.

Hessische Landesbank (Helaba) has not been directly involved in any fintech companies so far, but recently established Helaba Digital, an investment company set up to invest in Internet companies.

Germany’s fintech ecosystem

Overall, the German fintech ecosystem remains on a healthy development path with deal flow growing, the average deal size increasing and investment volumes continuing to expand, according to EY.

In 1H’ 2017, fintech companies in Germany raised EUR 307 million with top deals that include Kreditech at EUR 110 million, Scalable Capital at EUR 30 million, and Raisin at EUR 30 million as well.

Germany’s fintech startup ecosystem now counts over 300 companies, many of which are focusing on B2B enabling processes and technology services, payments, and wealthtech.