Fintech public listings reached a new high in Q2 2021 with 19 venture capital-backed fintech companies announcing public exits that quarter. Companies like Coinbase, Alkami, Flywire, dLocal and Marqeta went the initial public offering (IPO) route while others, including Grab, Better.com, Dave and Acorns, opted for a merger with a special purpose acquisition company (SPAC), according to a CB Insights’ latest State of Fintech industry report.

SPACs have become an increasingly popular path for fintechs to enter public markets. In Q1 2021, 17 blank-check companies announced plans to merge with fintech firms, according to data from fintech-focused investment bank Financial Technology Partners (FT Partners), surpassing the whole year 2020 during which 15 SPACs merged with fintech companies.

So far this year, about 5 SPAC mergers involving fintech companies have been completed, according to data from Spactrack.net, including Opportunity Financial, Alight, Payoneer, Katapult and BTRS, but more deals are in the works.

These include Grab’s landmark US$40 billion merger deal with blank-check Altimeter Growth scheduled for Q4 2021, Israeli brokerage firm eToro’s US$10.4 billion deal with Fintech Acquisition V, savings and investing app Acorns’ US$2.2 billion merger with Pioneer Merger, and financial-connectivity firm Pico’s US$1.8 billion merger with FTAC Athena Acquisition.

Q2 2021 also saw a number of high-profile public listings, including Coinbase, the first crypto company to go public and Marqeta, a US paytech company serving customers like Uber. More followed suit during the month of July, including acclaimed cross-border money transfer specialist Wise (formerly TransferWise), and commission-free stock brokerage pioneer Robinhood.

Other blockbuster direct listings and IPOs are expected for the second half of the year, including India’s fintech leaders Paytm, Mobikwik and Policybazaar and US neobank Chime, In the US, digital payments processor Stripe has reportedly taken the first steps towards a stock market debut by hiring a law firm to help with preparations, sources told Reuters in July. Stripe, a 11 year old company, is the world’s most valuable private fintech firm, worth US$95 billion.

2021, a blockbuster year for fintech funding

With more than US$30 billion raised across 657 deals, Q2 2021 was the largest funding quarter recorded by CB Insights, surpassing Q1 2021’s previous record of US$23 billion.

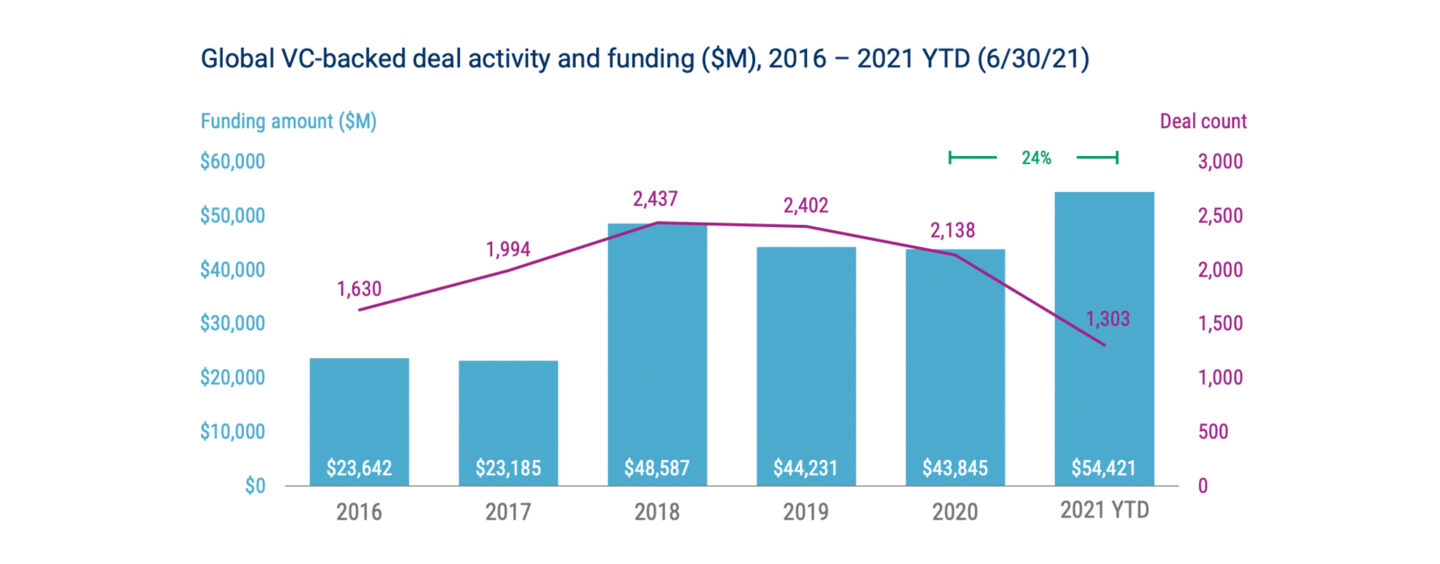

This brings the total amount of funding raised so far this year to US$54 billion, already exceeding total funding in 2020 by 24% and paving the way for a blockbuster year.

Global VC-backed deal activity and funding ($M), 2016 – 2021 YTD (6/30/21), State of Fintech Q2’21 Report, CB Insights

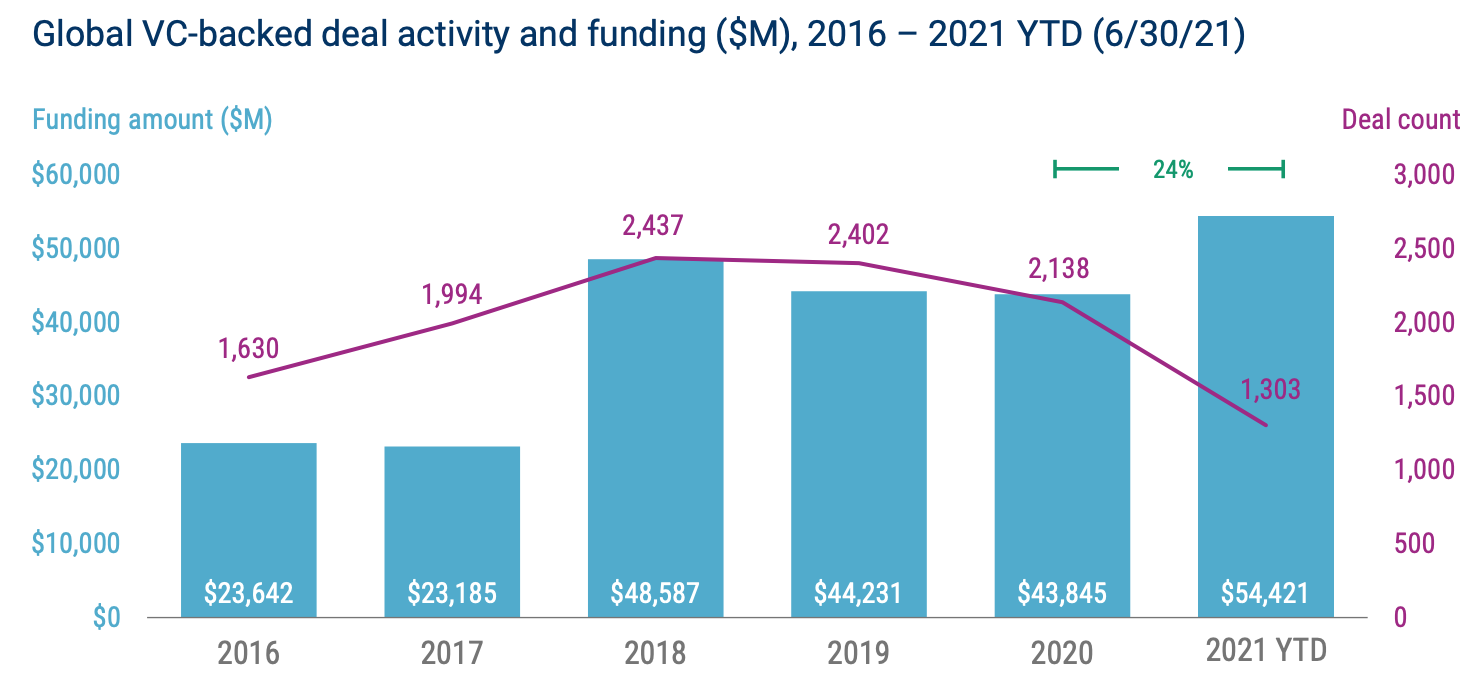

Mega-rounds worth US$100 million and over drove Q2 2021’s fintech funding boom. A record of 88 mega-rounds were announced that quarter, accounting for 70% of total fintech funding for that period.

Global VC-backed fintech mega-round deals and % of total funding, Q2’18 – Q2’21, State of Fintech Q2’21 Report, CB Insights

Europe-based fintech companies attracted most of the quarter’s largest deals. Germany’s commission-free broker Trade Republic scored US$900 million, the biggest fintech funding round in Q2 2021, followed by Dutch paytech startup Mollie (US$800 billion). Germany’s Wefox secured US$650 million, Q2 2021’s fourth largest round, while Swedish buy now pay later (BNPL) leader Klarna closed US$639 million, the fifth largest one.

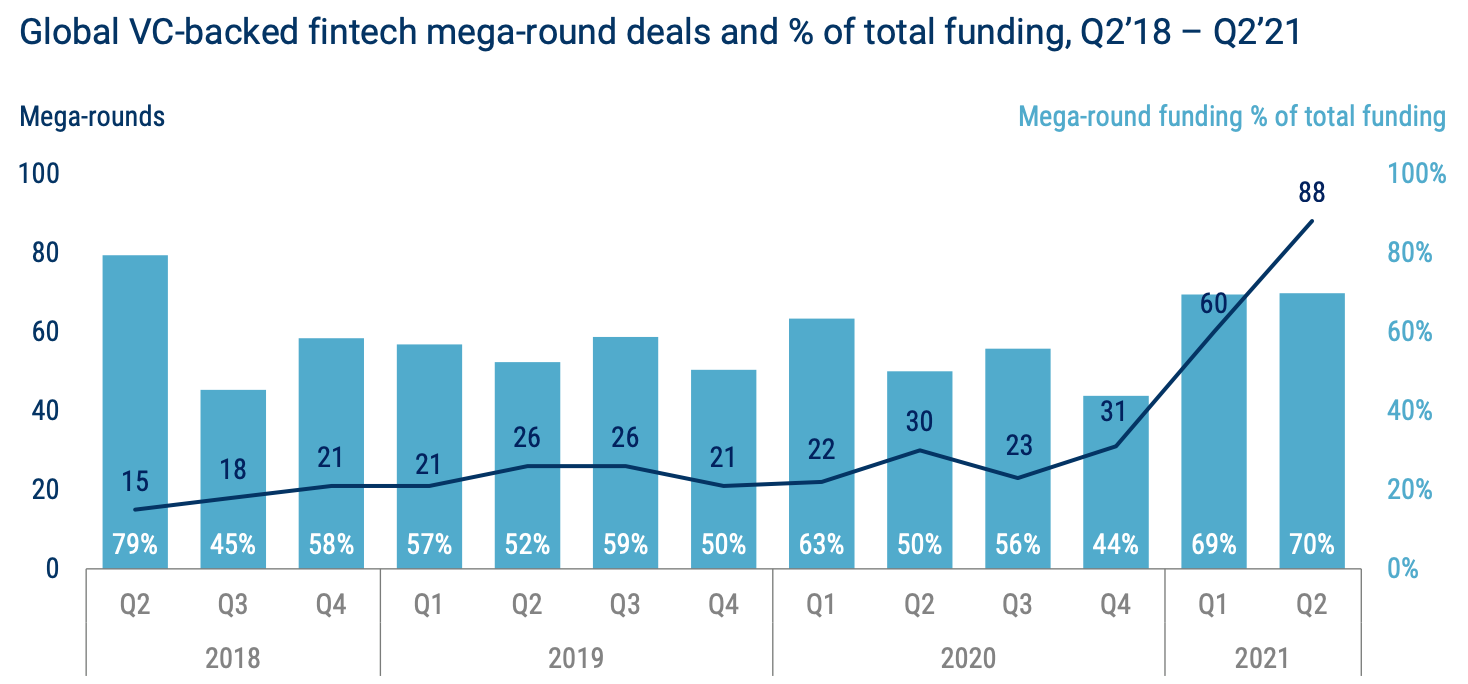

South America is another region highlighted in the CB Insights report where funding soared 153% quarter-on-quarter, while deal count surged 52%. Since 2016, funding to Latin America (LatAm) fintech companies has grown at a 57% compound annual growth rate (CAGR), showcasing investors’ appetite for the red-hot market.

As of June 28, US$4.2 billion had been raised this year, nearly twice as much as 2020’s total funding. Paytech startups scooped the largest sums including EBANX (US$430 million), a Brazilian startup offering cross-border payment processing across LatAm, Clip (US$250 million), a Mexican business payments and risk management system provider, and CloudWalk (US$190 million), an open payment platform from Brazil.

Funding to Latin America fintech companies since 2016, State of Fintech Q2’21 Report, CB Insights

In Q2 2021, funding grew in nearly all fintech sectors though open banking, in particular, gained momentum. Several large deals going towards companies like Plaid (US$425 million), TrueLayer (US$70 million), and Belvo (US$43 million) were closed. The quarter also saw the announcement that Visa would be acquiring Tink, an open banking platform last valued US$2.2 billion.

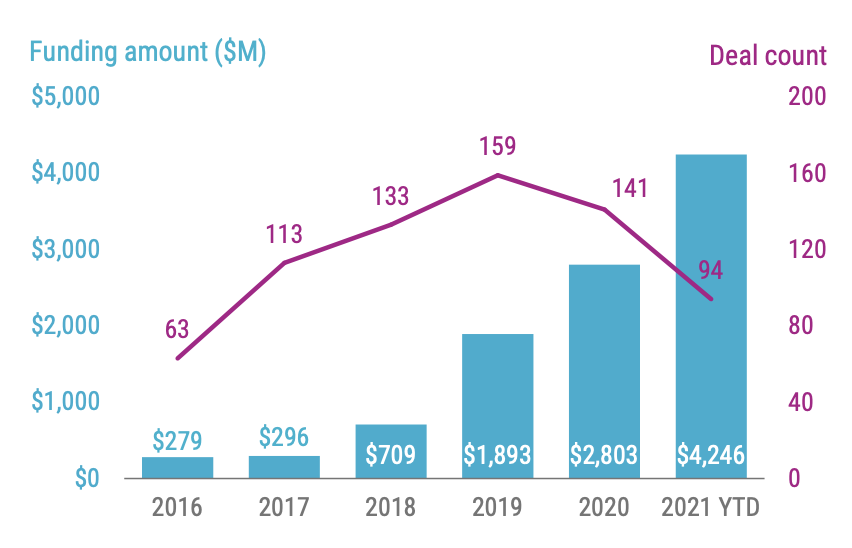

Blockchain was another hot topic, with funding hitting a new record high of US$4.3 million in Q2 2021. Top deals included Circle’s US$440 million round, Ledger’s US$380 million round and Paxos’ US$300 million round.

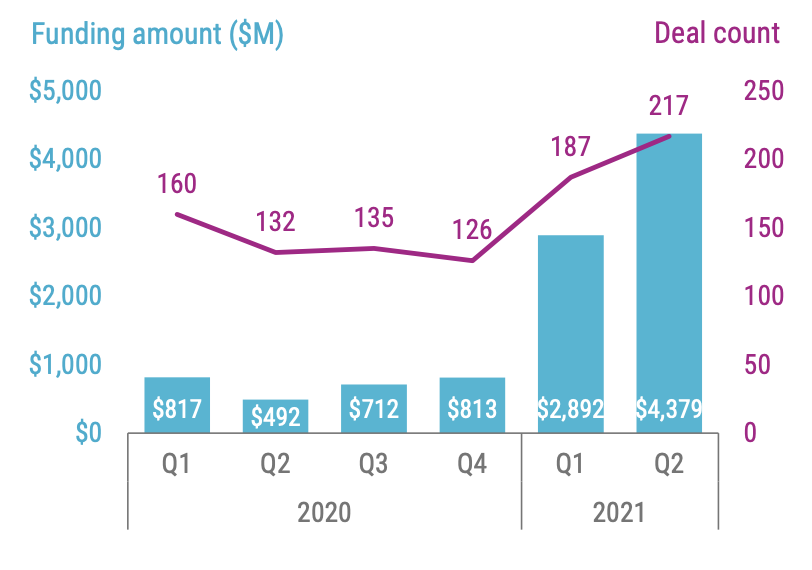

Blockchain funding between Q1 2020 and Q2 2021, State of Fintech Q2’21 Report, CB Insights