Yukka Lab, a Berlin-headquartered fintech startup, has launched a new product called Yukka News and Trend Lab that provides investors and traders with an organized and efficient way to view financial news in real-time and gain critical market insights.

Yukka News and Trend Lab is a web-based application designed to provide asset managers and financial advisors with a comprehensive overview of the topics and trends observed in the professional financial news, allowing for interpretation of complex contexts and relations between markets, companies and its stakeholders. The platform aims to provide financial professionals with an information advantage at a considerably smaller expenditure of time.

Yukka News and Trend Lab uses the company’s text analysis technology which automatically detects, interprets and evaluates news content in English and German in real time. The company claims the Yukka Lab engine can process up to three news stories per second each, up to 200,000 professional news from 20,000 sources, financial media and pro-feeds a day.

Yukka Lab currently counts among its partners established news agencies including dpa-AFX, The Guardian, Dow Jones Newswire, Nasdaq GlobeNewswire, Business Wire, awp and others.

More specifically, Yukka News and Trend Lab consists of two elements:

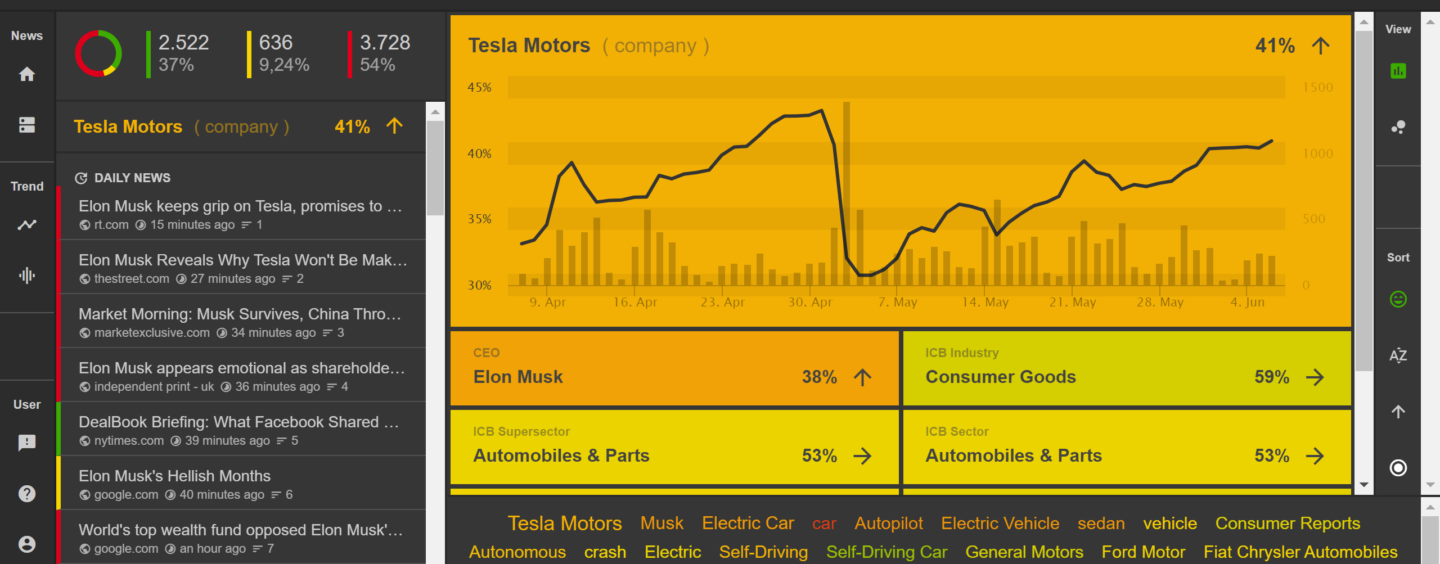

- The News Lab, which focuses on the presentation of market events, stakeholders and interrelationships, including the sentiments.

- The Trend Lab, which develops trends indicators and trading signals on the basis of self-developed financial models from the sentiments.

The platform includes several features such as:

- The Yukka News Boards with aggregated news flow of all relevant market drivers, including positive, neutral or negative sentiments for indices, sectors and shares;

- The Yukka News Networks which allows for the visualization of the interrelationships of events, trends, companies and stakeholders;

- Multiple search and filter options for periods, languages, sources, etc.;

- My Portfolio, a personalized user interface to create watchlists and alerts; and

- Early warning system for trends and trend shifts at stock markets.

Yukka Lab is charging EUR 299 per month for News Lab, EUR 439 per month for Trend Lab, and EUR 549, for both, News and Trend Lab.

Founded in 2014, Yukka Lab specializes in augmented language intelligence and context-based text analysis for the financial services industry. Yukka Lab’s tools are available as SaaS and via APIs and although its technology is currently being used in the financial markets, Yukka Lab seeks to apply it beyond the field as well.

Yukka Lab has a client list that includes Consors Bank, UBS, and Belvoir Capital AG. The first Yukka Lab sentiment based fund, the Sentiment SICAV – Europe 600, went live over a year ago. Today, it manages EUR 20,5 million in assets and was able to yield a 9.61% return in 2017, Yukka Lab claims.

Yukka Lab is one of the many startups that have emerged in the past years to bring innovative solutions and approaches that leverage artificial intelligence (AI) to the financial market.

Quandl, for instance, is a platform for financial, economic, and alternative data serving investment professionals. Quandl’s platform is used by over 250,000 people, including analysts from the world’s top hedge funds, asset managers and investment banks.

Kavout is an AI-driven investment platform built for investors of all levels. Kavout uses AI, machine learning and big data to provide investors with better insights to make smarter decisions.