Swiss Regulator Meets With Crypto Industry To Clarify ICO Guidelines

by Fintechnews Switzerland March 29, 2018The Swiss Financial Market Supervisory Authority (FINMA) is holding a series of roundtable discussions across Switzerland to present and clarify its recently released ICO guidelines. The regulator said the purpose is to provide first-hand information to market participants interested in conducting ICOs in the country, and facilitate a direct exchange between stakeholders and FINMA.

Among other topics, FINMA will present its assessment of ICOs under the guidelines, the categorization of tokens, and how ICOs are potentially impacted by financial market regulation.

Two first roundtables were held on March 14 in Zug and March 21 in Geneva. The last roundtable will take place in Lugano on April 10 at the USI University. These are being organized in cooperation with the non-profit industry association Crypto Valley Association.

Switzerland has been pushing for fintech innovation with FINMA playing a key role in the country’s journey into becoming a global fintech leader. The regulator has been introducing new rulings favorable to financial innovation and fintech development, amending the Swiss Federal Banking Ordinance in 2017 to ease the regulatory framework for providers of fintech products, launching a regulatory sandbox for startups to test innovative products, and offering a tailor-made fintech license.

ICO Switzerland Guidelines

As ICOs started becoming a world phenomenon last year, FINMA began investigating the practice and issued a first guidance in September 2017, stating that while it didn’t specifically regulate ICOs, depending on how an ICO was structured, some parts of the procedure might be covered by existing regulations.

FINMA also said it was investigating several ICOs and cryptocurrency projects for possible breaches of Swiss law.

The ICO guidelines published last month are intended to complement the 2017 release and set out how the regulator is looking to treat enquiries from ICO organizers.

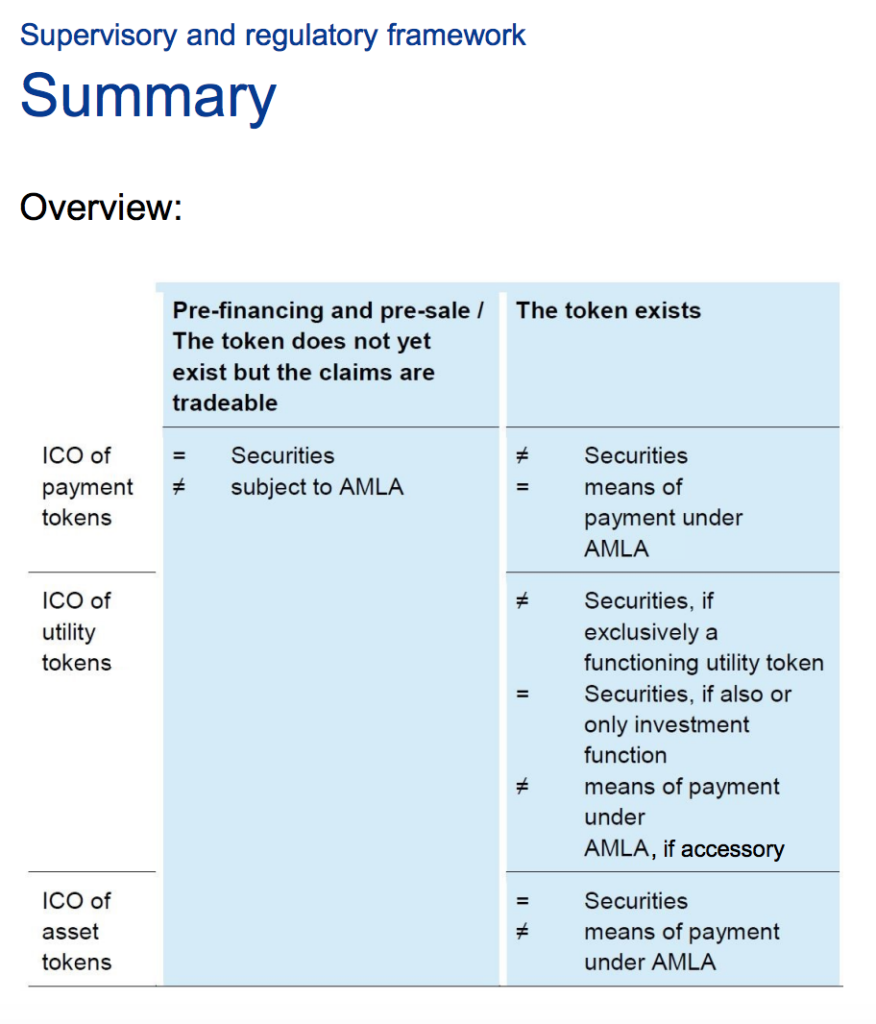

In assessing ICOs, FINMA said it will focus on the economic function and purpose of the tokens issued. The key factors taken into consideration are the underlying purpose of the tokens and whether they are already tradable or transferable.

FINMA categorizes tokens into three types, but hybrid forms are also possible:

Payment tokens: These are intended to be used as a means of payment for acquiring good or services or as a means of money or value transfer. Payment tokens give rise to no claims on the issuer. For payment ICOs, FINMA will require compliance with anti-money laundering regulations (AMLA).

Utility tokens: These provide access digitally to an application or service by means of a blockchain-based infrastructure at the point of issue. If a utility token functions solely or partially as an investment in economic terms, FINMA will treat such tokens as securities in the same way as asset tokens.

Asset tokens: These represent assets such as debt, equity or other claim on the issuer, whether that’s a share in future company earnings or capital flows. Asset tokens are analogous to equities, bonds or derivatives, and are regarded as securities. This means that there are securities law requirements for trading in such tokens, as well as civil law requirements.

FINMA Roundtable on ICOs Presentation, March 2018

The Blockchain/ICO working group was established earlier this year by the State Secretariat for International Financial Matters (SIF) to review the legal framework and identify any potential need for action.

The work is being carried out in a steering committee consisting of the head of the SIF State Secretariat, Jörg Gasser, the director of the Federal Office of Justice (FOJ), Martin Dumermuth, and FINMA’s Branson. The committee will work closely with the sector and will report to the Federal Council by the end of the year.

In a recent interview with Swissinfo.ch, Gasser noted the need for appropriate regulation in order for the blockchain and broader fintech industry to thrive in Switzerland.

“If we put the right framework conditions into place, we will be able in the long term to attract innovative companies, which will create jobs and pay taxes,” Gasser said.

“Our goal is to ensure that Switzerland keeps a competitive edge in blockchain technologies in general without compromising the integrity of the Swiss financial sector.”