Facebook has registered as an electronic money provider in Spain as the firm seeks to expands its peer-to-peer payments functionalities over Messenger to Europe.

Facebook Payments International Limited (FBPIL) was added to the Bank of Spain’s register of e-money entities on December 30, 2016, and follows a license granted by the Central Bank of Ireland.

In October, the Central Bank of Ireland granted a license to FBPIL pertaining to e-money issuing and payment services provision and includes credit transfer, payment transactions and money remittance.

The Irish license applies throughout all 27 EU member states, with the firm only needing to notify the respective central banks to validate the authorization.

Confirming the approval of the European license, Facebook wrote in an email to TechCrunch:

“The license enables us to roll out products like charitable donations on Facebook or peer-to-peer payments via Messenger in Europe, as we have in the U.S. The license authorizes FBPIL to issue donations from Facebook users to charities registered in the European Economic Area (EEA) only; and peer-to-peer payments, within the EEA.”

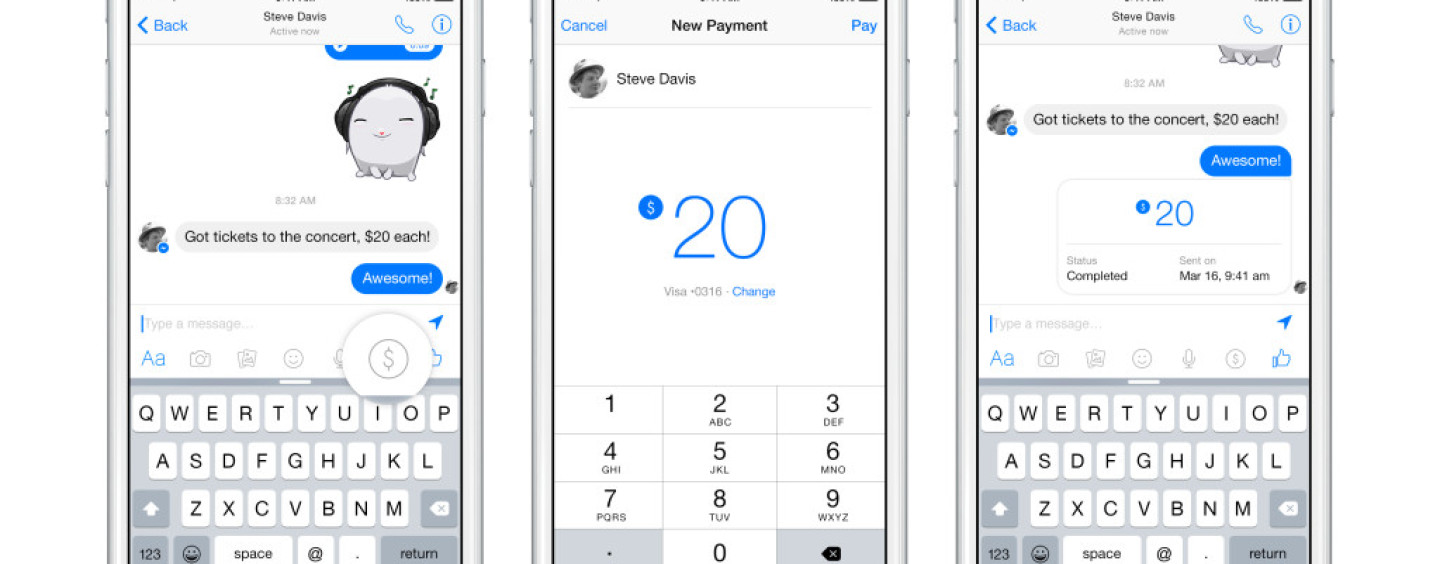

In March 2015, Facebook announced a new feature on Messenger allowing users to send and receive money over the messaging app.

The payments feature lets you connect your Visa or MasterCard debit card and tap a “$” button to send friends money on iOS, Android, and desktop with zero fees.

But Facebook has bigger plans for Messenger, which it wants to turn into a marketplace and add a number of functionalities including in-store payments, according to the Information.

David Marcus, VP for Messenger products, confirmed this information in late-2016, adding that the company was already working with some payment providers, such as PayPal, Visa, MasterCard, American Express and Stripe, for some time, in order to operate their resources.

Speaking at TechCrunch Disrupt SF 2016 in September 2016, Marcus said that Messenger bots can accept payments natively without sending users to an external website.

The credit card information people already have stored in Facebook or Messenger can be used to instantly make purchases in bots that are part of the new closed beta the developers can apply for.

The move is part of the firm’s broader push to keep its 1.3 billion global users inside its ecosystem.

“Today, we’re also rolling out a new way for businesses to sell products and services in Messenger,” Seth Rosenberg, product manager at Facebook, wrote in a blog announcement on September 12, 2016.

“Payments can now be integrated into messages, making it easy for customers to shop and purchase without leaving the app. Messages with payments utilize industry-leading controls and financial information is protected with bank-level encryption. As of today, payments will be available for select developers in beta … We expect to roll out this capability more broadly by the end of the year.”

Featured image via Facebook.