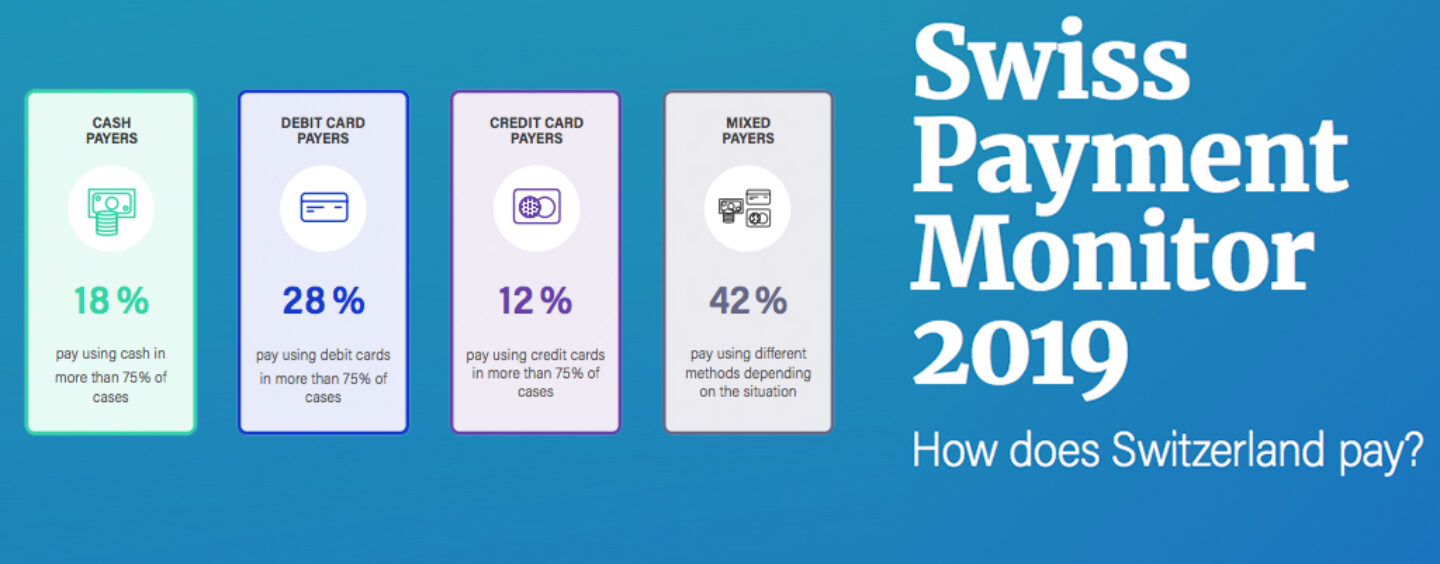

According to the latest Swiss Payment Monitor by ZHAW and the University of St. Gallen, new payment methods such as contactless and mobile are enjoying a surge in popularity. Nevertheless, the Swiss still have more confidence in traditional payment methods – for now.

As in the previous year, the debit card (Maestro, PostFinance Card, V PAY) remains the preferred payment method of Swiss consumers.

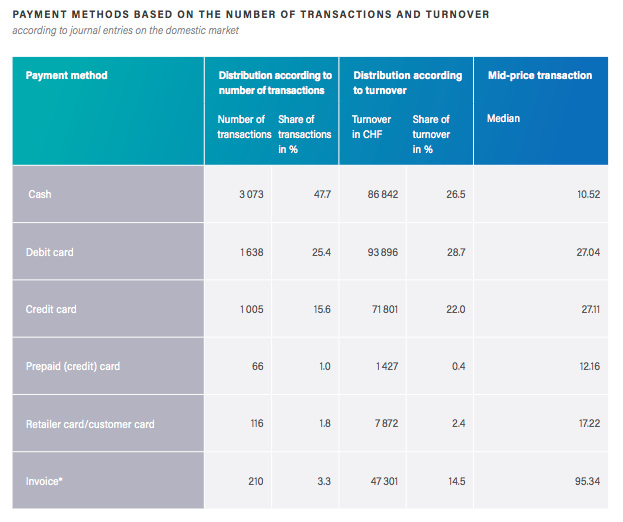

This was the conclusion of the Swiss Payment Monitor, conducted for the second time by the ZHAW School of Management and Law and the University of St. Gallen. Cash payments still outnumber card transactions in Switzerland. However, measured in terms of value, the debit card accounts for 29% of total spend, putting it ahead of cash (27%), credit card (22%) and mobile payment (just under 2%).

The debit card is also seen as faster and more convenient, attractive and modern than cash, according to the representative study conducted in 2018 among 1,000 people between the ages of 18 and 65 in all three main geographic regions of Switzerland.

The debit card is also seen as faster and more convenient, attractive and modern than cash, according to the representative study conducted in 2018 among 1,000 people between the ages of 18 and 65 in all three main geographic regions of Switzerland.

Tobias Trütsch, payment expert and Head of Economics at the University of St. Gallen, believes that the debit card’s popularity is largely down to the introduction of ‘contactless’, which is preferred by younger consumers in particular. Based on the respondents’ answers, more than 50% already make contactless payments using their debit card. The debit card therefore accounts for the same proportion of contactless payments as the credit card.

Mobile payments on the rise

The Swiss population is making increasing use of mobile payment alongside traditional means of payment. More than 90% of people are now familiar with the method. ‘Nevertheless,’ says ZHAW payment expert Bettina Gehring, ‘there is no general understanding among the public of what mobile payment actually is.’

The term is most widely associated with making payments in apps via an integrated payment function (‘in-app’ payments), or with using a mobile phone to make payments at the point of sale in a physical store or on the internet in an online shop. Compared to 2018, there has been a shift in the perception of mobile payments as local payments (at POS) towards remote payments (e.g. in online shops).

Due to various security concerns, newer payment methods such as contactless or mobile tend to be perceived more negatively than the traditional payment methods of cash, debit card and credit card. However, based on the respondents’ answers, this perception appears to be gradually changing. Mobile is currently the least popular form of payment at stationary points of sale, where it is criticised as being ‘unnecessary’, ‘slow’ and ‘unreliable’. Non-users of these payment methods tend to have a

considerably worse view of them than users do.

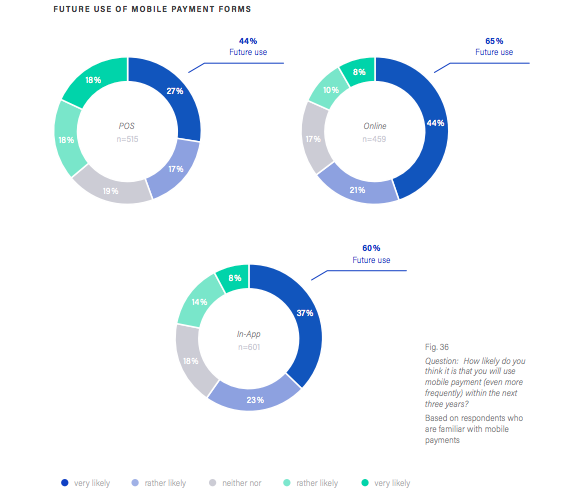

Contactless and mobile payment methods have potential

The potential of these newer payment methods is nowhere near exhausted. For example, three in five respondents could imagine using contactless payment within the next three years or using it more frequently. This intention is even higher for mobile payment. The highest potential (65%) is attributed to making mobile payments on the internet, closely followed by in-app solutions (60%).

How quickly and to what extent payment behaviour will develop in the coming years is difficult to predict at present. However, it is becoming increasingly clear that cash will gradually be replaced by cashless payments in the future.

How quickly and to what extent payment behaviour will develop in the coming years is difficult to predict at present. However, it is becoming increasingly clear that cash will gradually be replaced by cashless payments in the future.