All-In-One Nudipay: Mobile Payments and Loyalty Points With ‘The Barest of Fees’

by Fintechnews Switzerland October 26, 2015Online payment startup Nudipay wants to “redefine how we use money for everyday living.” And to do so, it has developed its very own ecosystem in which consumers can make online and mobile payments easily without risking their personal financial information, while providing merchants with low-cost day-to-day payments solutions and free marketing tools.

Nudipay’s payment solution addresses some of the pain points with mobile payment adoption that lots of players, including Apple Pay, Google Wallet or PayPal, haven’t overcome, according to Les Toft, CEO and Co-Founder of Nudipay.

“Everyone is talking about how mobile payments are the future. But despite the marketing hype, it is just not happening,” Toft argues.

He continued:

“Why? According to Forbes, 87% of small businesses are plain rejecting mobile payments all together, and the reason is, they’re just too expensive. And no one is going to use mobile payments is no one is accepting it.”

Notably, these costs include purchasing new equipment and terminals for merchants who want to accept mobile payment apps such as Apple Pay or Google Wallet, which are both relying on NFC technology.

Nudipay doesn’t require merchants to buy any additional equipment as they can use it on any laptop, computer, tablet, smartphone or mobile phone.

Merchants pay a flat 15 cents fee per transaction regardless of the size. For consumers, Nudipay is entirely free.

Additionally, players that are tackling the mobile payment industry typically haven’t considered the importance of loyalty programs and rewards, as well as the fact that NOT everyone owns a smartphone.

To address all of these issues, Nudipay is relying on four technologies:

- ‘Geo’ displays in a map all merchants accepting Nudipay close to where the user is located. Merchants can have their own information detail card for free and users can choose to call them or pay them through the app. Users can search merchants by using keywords as well.

- ‘Loyalty’ is a free customer loyalty program. Users tap on a black button named ‘MyVips’ to collect points and get in-store discounts. Consumers get a monthly email with updates and specials from their linked stores.

- ‘Tag’ is a super fast payment feature that allows users to pay by ‘tagging’ a merchant’s pad at cashier or staff’s Mini Tags. Currently, Tag is only available for Android devices, as Apple hasn’t released the technology yet, Toft said.

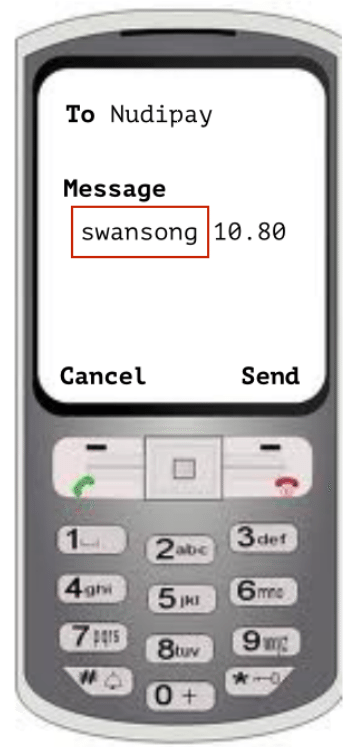

- ‘SMS’ allows users that don’t have a smartphone or mobile Internet to pay by sending the name of a merchant and the amount of money to be sent. Nudipay processes the payment and sends the consumer and the merchant a confirmation SMS.

“Not everyone has a smartphone,” Toft argues. “Google and Apple have no interest in these customers. In the USA and Europe, that’s about 660 million customers that are completely ignored by these companies, customers who still buy stuff.”

On a global scale, that amounts to 4.1 billion people who don’t own a smartphone, against 2.7 billion who do have one. And Nudipay wants to tap into both markets aggressively. The startup plans to expand to more than 98 countries in a 60-month period.

Another work it has on the way which the company is still testing, is called NudipayMT. NudipayMT is a remittance feature that would allow multi-currency global money transfers.

Watch Les Toft, CEO and Co-Founder of Nudipay present his startup:

Cover image credit: ‘Tag’ by Nudipay using a Mini Tag, Nudipay.com.

1 Comment so far

Jump into a conversationReally great information. Not only does it add a variety of knowledge, it also brings value to readers.