Swiss Marketplace Lending Volume Surged 42.5% to CHF 15.4 Billion in 2020

by Fintechnews Switzerland July 26, 2021In 2020, the total volume of new debt capital brokered through online platform in Switzerland grew 42.5% to CHF 15.4 billion.

This represents a 183% increase from 2017 during which total volume of marketplace lending in Switzerland totaled CHF 5.4 billion, and indicates that marketplace lending is increasing moving into the mainstream, found a new research paper by the Lucerne University of Applied Sciences and Arts, the Swiss Marketplace Lending Association (SMLA) and the TMF Group.

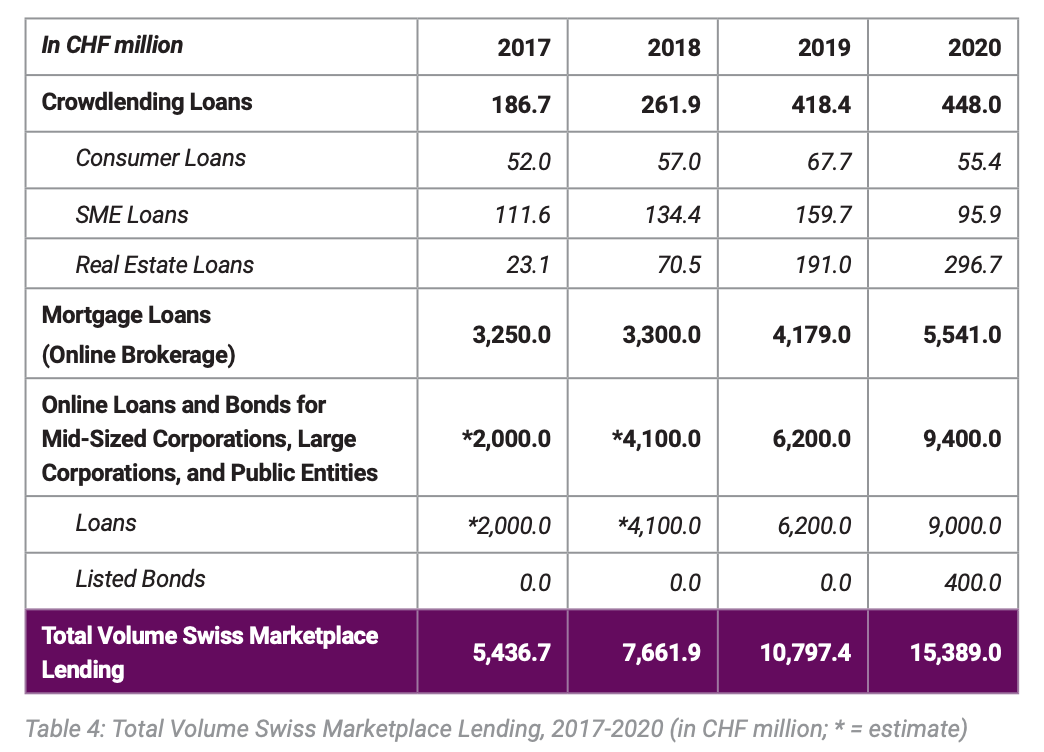

Total Volume Swiss Marketplace Lending, 2017-2020 (in CHF million; * = estimate), Source: Marketplace Lending Report Switzerland 2021, Lucerne University of Applied Sciences and Arts, Swiss Marketplace Lending Association (SMLA) and TMF Group

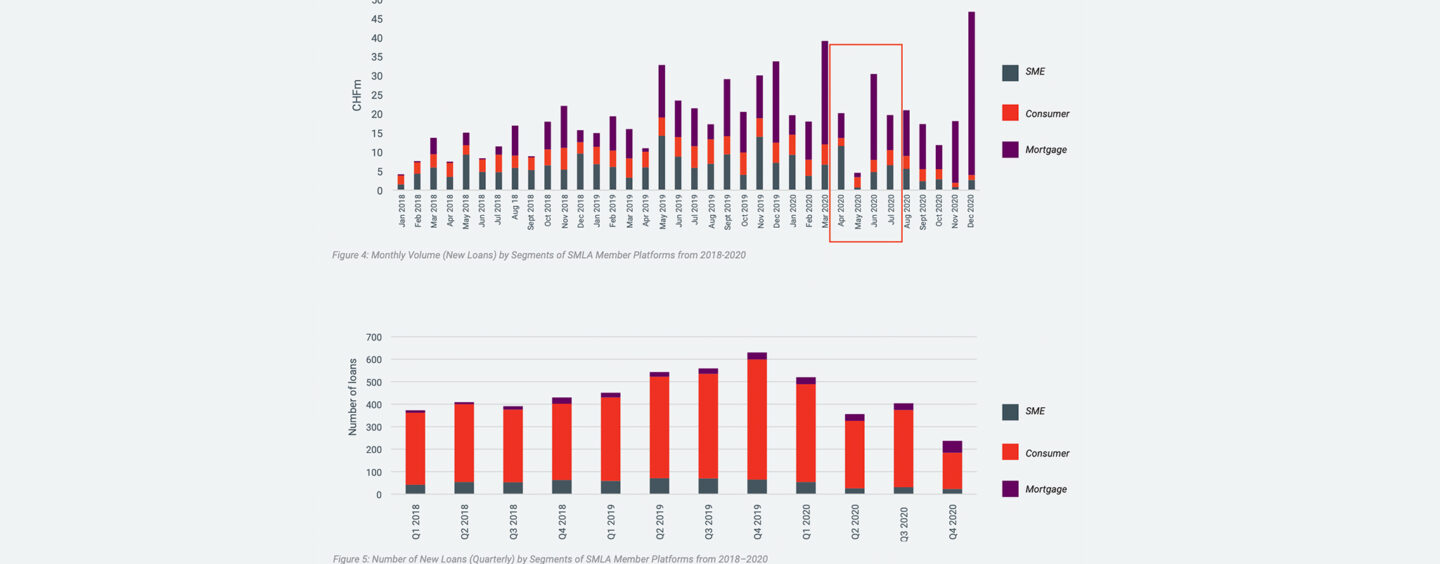

Breaking down the different segments composing marketplace lending, data show that while consumer loans and small and medium-sized enterprises (SME) loans volumes stalled between 2017 and 2020, real estate crowdlending, online loans for mid-sized and large corporations, and public entities, and online mortgage loans drove the whole sector’s growth, with volumes soaring 1,184%, 350% and 70%, respectively.

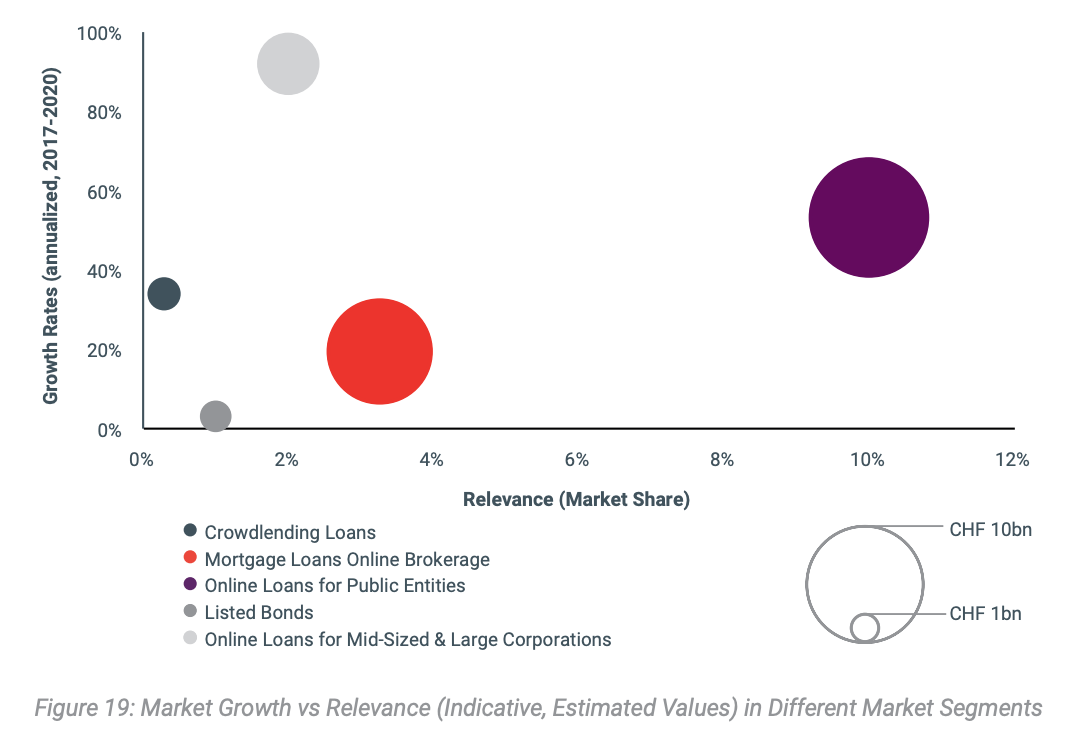

2020 numbers show that online loans for mid-sized and large corporations and public entities took the lion’s share, making up for more than 58% of the year’s total marketplace lending volume.

Three market participants are active in the segment – Loanboox, Cosmofunding (owned by Bank Vontobel), and Valyo (owned by Raiffeisen Schweiz) – and they now hold an estimated 10% market share, the report says.

Market Growth vs Relevance (Indicative, Estimated Values) in Different Market Segments, Source: Marketplace Lending Report Switzerland 2021, Lucerne University of Applied Sciences and Arts, Swiss Marketplace Lending Association (SMLA) and TMF Group

These figures coincide with the fact that public entities, including municipalities, cities and cantons, have embraced online lending at a faster pace than other segments.

A separate 2020 study by the Lucerne University of Applied Sciences and Arts focused on municipalities found that about 15% of the surveyed municipalities used platforms for financing purposes in 2019. While banks remained public entities’ most important financial partners, their market share is decreasing, sliding 11% compared to the 2016 study, the research found.

After online loans for mid-sized and large corporations and public entities, online mortgage loans had the second strongest growth rates of about 20% annually and a market share of about 3%. In 2020, volumes jumped to CHF 9 billion, growing 45% from 2019.

Six different brokerage platforms currently operate in the space: UBS Atrium and key4 by UBS, both owned by UBS; Valuu, run by PostFinance; and HypoPlus, Hypotheke and MoneyPark, three independent players.

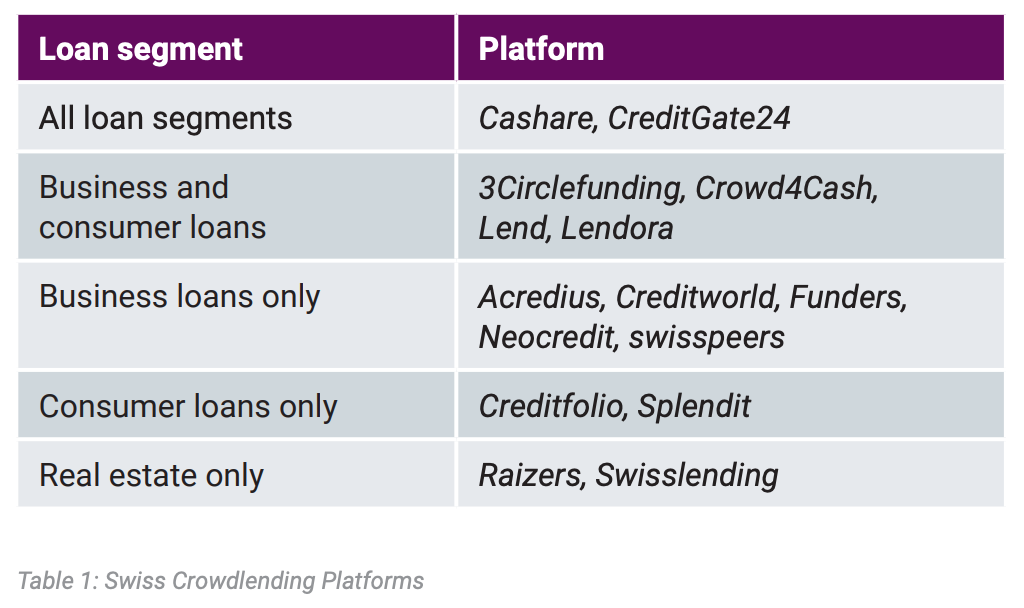

At the end of 2020, a total of 15 platforms in Switzerland were active in the crowdlending segment.

Swiss crowdlending platforms as of December 2020, Source: Marketplace Lending Report Switzerland 2021, Lucerne University of Applied Sciences and Arts, Swiss Marketplace Lending Association (SMLA) and TMF Group

Though significant growth has been witnessed since 2018, the Swiss crowdlending space remains relatively small, especially when compared to the UK and the US, the report says.

Moving forward, the authors expect a rebound in the SME lending market, which took a halt due to the Swiss government’s loan program. In 2021 and onward, growth rates are set to accelerate, the report says, especially considering that many SMEs have grown accustomed to digital tools amid COVID-19, and could potentially be more open to digital lending solutions.

Despite already strong growth, the momentum of online mortgages is projected to continue with growth rates estimated at around 30% per year during the next two to three years. With a market share of just 3%, the space is poised to take off considerably. In comparison, in Germany, 40% of mortgages are concluded or extended via online platforms. In the Netherlands and the UK, the figures are as high as 65% and 70%, respectively.