A report indicates that more than 70% of Americans struggle financially. At the same time, these same households pay roughly $175 billion annually in fees and interest for financial products and services, yet most of such instances don’t improve their financial situation.

While the situation in Switzerland is better with only one fifth of households struggling financially, the fees structures are not drastically different. There’s some observable lessons that Swiss Fintech companies can learn from this study

Fintech solutions that could help them might already exist in the market, yet consumers that were surveyed in this report reveals that they mistrust fintech solutions.

According to the report, revenue models are foundational to establishing and retaining trust in consumers—nothing erodes trust in a financial service company more than lack of product and cost transparency.

This is because the same research reveals that the most popular revenue model is to charge consumers directly.

Fintech Monetisation Models

How to monetise fintech? That’s a question that you’ll find budding entrepreneurs asking themselves

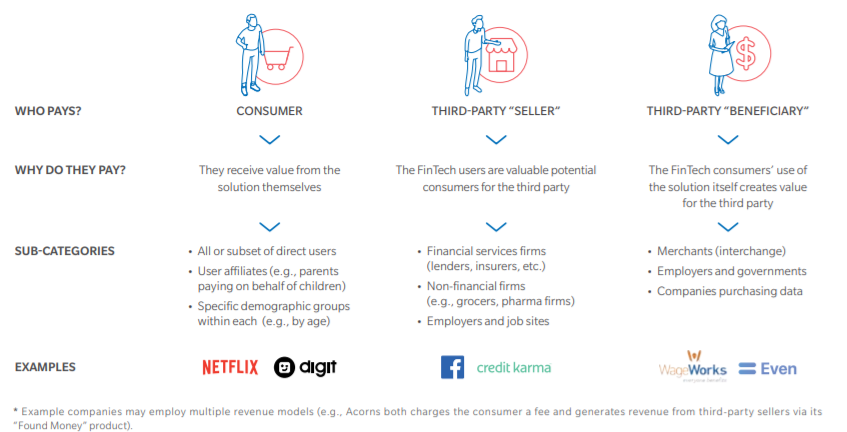

Of course, there are an infinite amount of ways to monetise one’s fintech platform, but Omidyar Network discovered that these are the three basic ways that fintech players monetises:

Consumers: the obvious choice and the most straightforward monetisation model.

Third-party sellers: they usually pay for advertising and referrals on the fintech platform.

Third-party beneficiaries: They themselves gain value when consumers use the financial health tool—like money, or more indirect value like employee wellness, reducing turnover or promotes productivity.

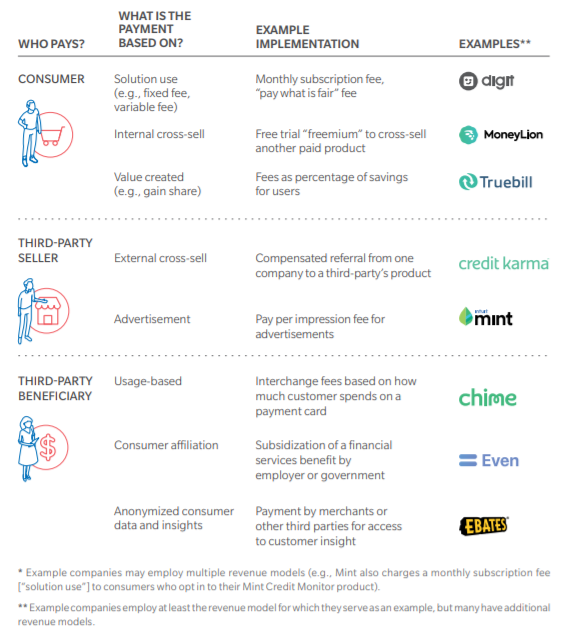

How Payments Should Be Structured

In addition to who forks out the cash, fintech players also need to figure out how the payments should be structured. Out of all the fintech companies observed, the report lists the following as the categories that most payment types fall into:

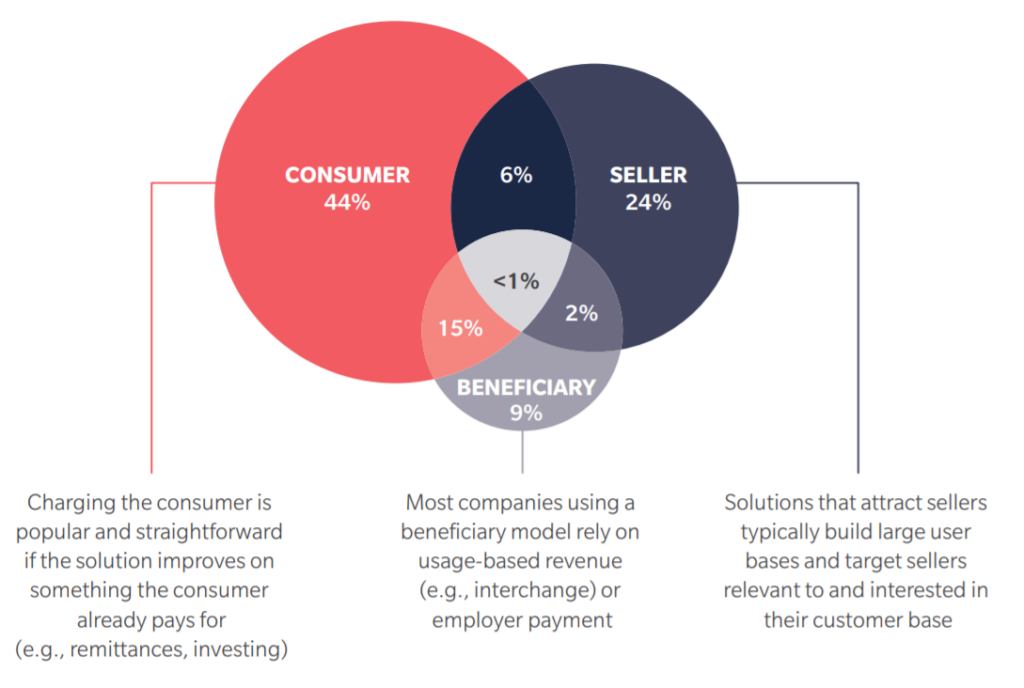

To date, consumer pay approaches are by far the most commonly used revenue model, with 65% of fintechs reviewed using this approach. Third-party seller models (33% percent) and third-party beneficiary models (26%) are also used by a notable minority of startups.

Most fintechs start from a single revenue source early on, but they diversify over time. Three-quarters of financial health solutions in the market though, today, rely on a single source of material revenue.

Companies with multiple material sources of revenue have raised twice as much funding from investors, though they also tend to be slightly older startups.

Experts and entrepreneurs pointed to a simple explanation for this trend: Building a revenue model is hard work. It takes trial and error, executive focus, and incremental effort outside of product design. Most entrepreneurs narrow the aperture and choose a single payer source to focus on first.

Usually, as fintechs mature, they have more resources to add new features and complex solutions, which diversifies their revenue models. Therefore, it is often strategic for fintechs to not only determine which revenue model works best for them at this juncture, but what revenue streams could become viable over time.

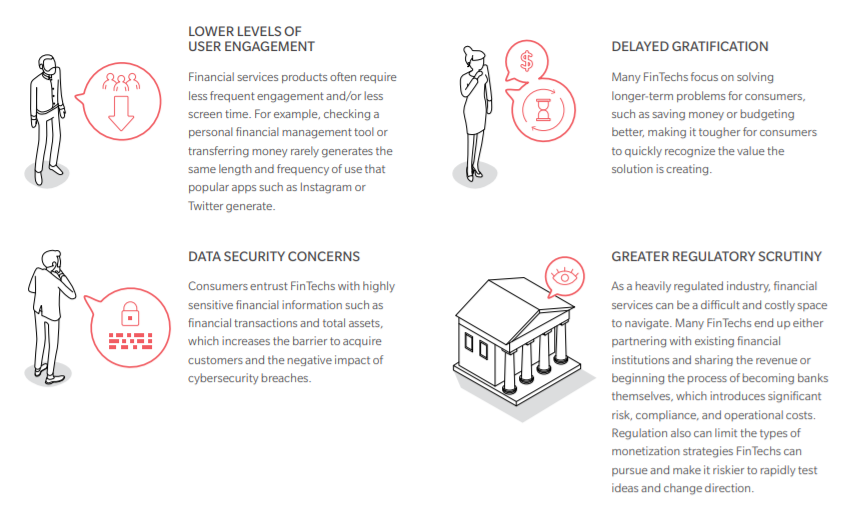

Rampant Mistrust Among Consumers

Since most fintechs do use the directly charging consumers method,be it directly to the public or sellers, monetisation strategies could affect consumers’ perceptions in a profound way. The right one could make them feel like their financial providers are looking out for their best interests, whereas hidden fees and excessive rates could leave them feeling taken advantage of.

Some of the key concerns that users have pointed out regarding mistrusting fintech are:

How to directly tackle user mistrust

In this report, Omidyar Network and Oliver Wyman investigate current revenue practices among financial health entrepreneurs, highlighting trends from data collected from surveys with 350 fintechs, 11 case studies from firms in the space, as well as advice from founders and investors collected during interviews and workshops with more than 50 entrepreneurs and sector leaders, and focus groups and digital diaries with dozens of consumers across income ranges and geographies.

The research distills approaches on how to embed commitment to financial health into the company’s core strategy and how to mitigate the risks of its revenue model to customers.

The idea is to inspire entrepreneurs serving the mass market and provide them with a framework that opens up the possibility of doing well by doing good.

The full report on how to monetise fintech and more can be downloaded here.