FinTech – Financial Technology – refers to the use of new technologies in Financial Services. Leveraging analytics, data management and disruptive digital functions are just some of the main drivers. FinTech Startups are agile – release cycles differ from 2-3 per week, compared with 2 to 3 per year by banks. Can we really talk about the same level playing field?

First: What is FinTech? For European FinTech Startups it is about creating new efficiency, cost-effectiveness and innovative tailored financial services solutions, mostly at the FrontEnd. In Asia and Africa FinTech means even more to open the door for the unbanked and underbanked communities.

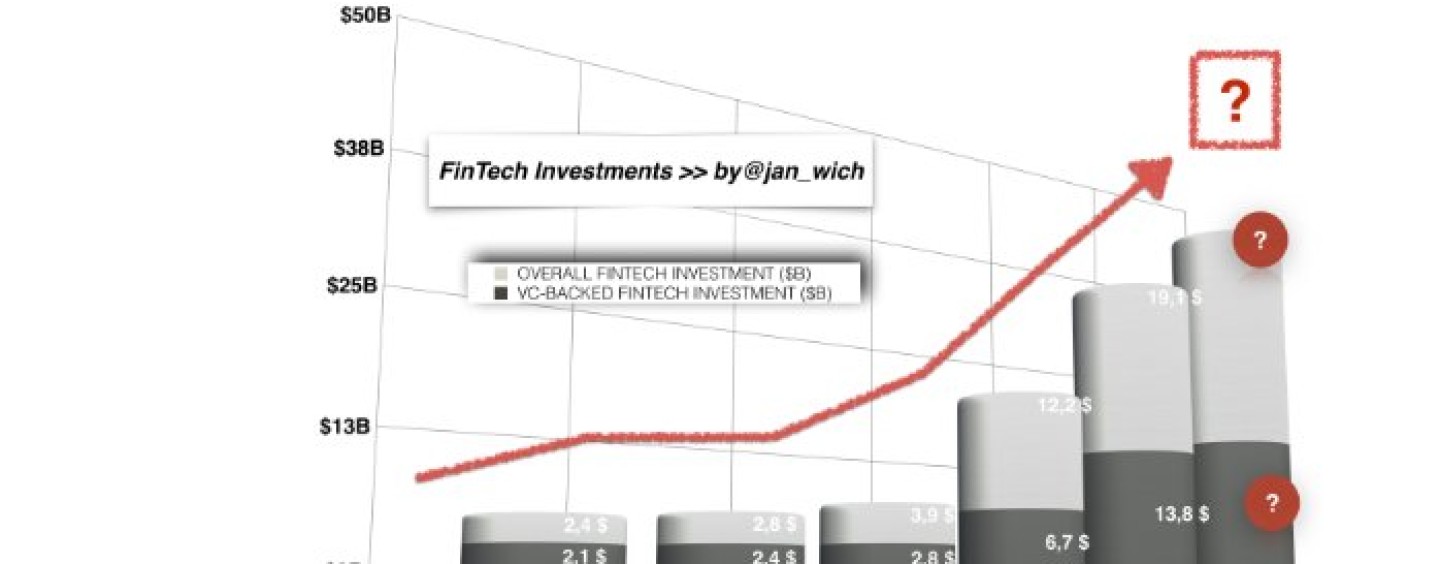

FinTech is hot. Venture Capital funding doubled in 2015 by 103 percent, compared to 2014 – over US$13.8 billion have been invested across 653 deals in FinTech startups globally by Venture Capital, regarding a Report by CB Insights and KPMG. The total investment hit US$19,1 billion in 2015.

Second: FinTech Startups are forcing banks to knock down silos, rethink established processes, implement new technology-driven solutions: disruptive digital approaches are born, new FrontEnd solutions, always customer focused, but what is currently really paving the wave for market disruption in Europe and banks? Regulation.

Third: Regulation as enabler for financial service companies to start their own innovation? The little brother of FinTech:

Regulation Technology >> RegTech

RegTech is facing the back- and middle-end of banks by understanding and managing their risks. Everyone knows, Regulation is not sexy, it is always treated as a must for financial institution, but:

Regulation is not only a challenge, it is the chance for financial institutions to take the wave of innovation!

We all know, the level of regulation is still increasing and is having a significant impact on the operational business model of financial institutions. Banks have to modernize their IT core systems, accelerating the digital transformation and regulation at the same time. Investments in employees, IT-Infrastructure and setting up new processes is capital intensive.

Innovation: RegTech is coming at this cross-boarder with innovative reporting approaches, based on big data – this is not new at all, but bringing together this combination, using the data and creating more value for financial service institutions is new. Data at first, followed by compliance approaches. Compliance is focussing on legal and governance aspects. But what kind of challenges are banks facing in terms of regulation today?

- Regulatory is non-negotiable

>authorities can shut down the business or impose substantial fines - Disruptive Technologies

>Blockchain is unlikely anything else in traditional banking, hence difficulties exist of creating regulations - Globalization

>different countries, different regulation

Is this a new level playing field for RegTech Start-ups? RegTech Solutions are ranging from simple digitization of paper based tasks to predictive analytics of employee fraud. Compliance starts demanding realtime analysis instead of information after the fact: predictive analysis of employee compliance, business compliance and financial are just some fields to focus on.

Onboarding processes, fraud prevention, analytics and monitoring solutions could also be of further interest. RegTech encompasses a broader field with additional themes – in my second blog I will give you an overview.

Final: So whats my guess? We need a shift in mindset from competition to collaboration – as Einstein said: „The measure of intelligence is the constantly ability to change.“

The party has just started. Welcome RegTech.

Article first appeared on Linkedin Pulse, Featured picture source – linkedin.com