Regtech 2.0 Enters New Growth Phase As Sector Moves From Niche To Mainstream

by Fintechnews Switzerland February 23, 2018Regtech is entering a new phase of development and adoption as the sector evolves from niche to mainstream, according to new study by Burnmark and Alvarez & Marsal.

The report, titled Regtech 2.0, focuses on the emerging trends in regtech and explores the sector landscape from the perspectives of startups, regulators and banks. It has been compiled using interviews of industry participants.

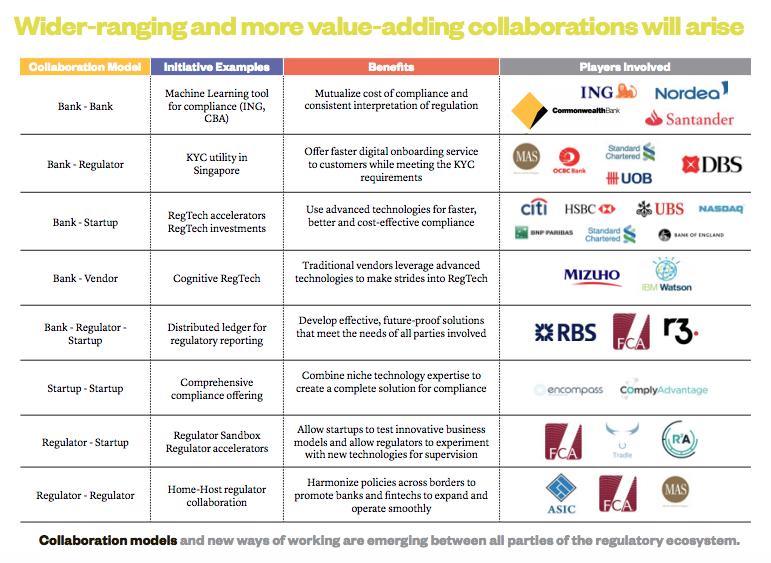

According to the study, more collaboration between regtech firms and banks as well as regulators are expected to take place in the years to come as the sector transitions into a new phase of growth.

“Implementation success in ‘Regtech 2.0’ will come from nurturing wider-ranging and value-added collaborations across all parties,” the report says.

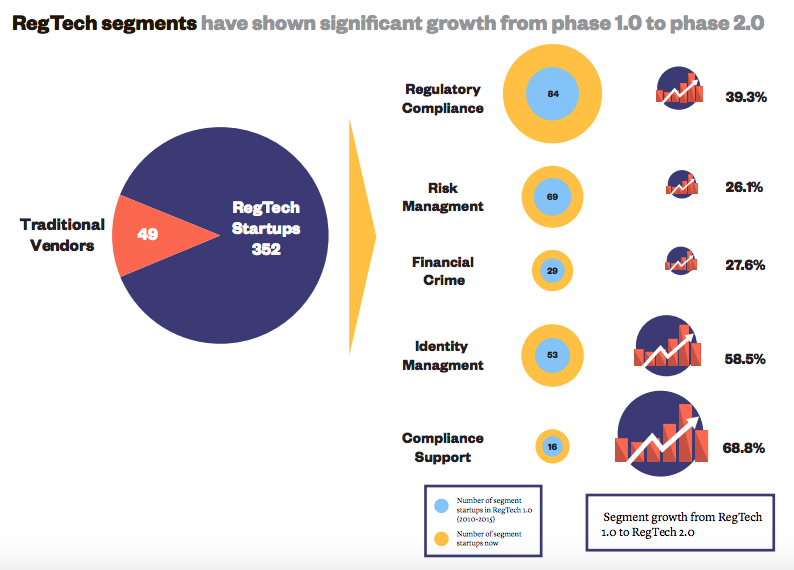

Among the 352 regtech startups studied, 84 companies were specialized in regulatory compliance, making it the most crowded segment, followed by risk management with 69 companies, and identity management with 53 companies. While compliance support was the less populous with only 16 companies, the segment is expected to experience the biggest growth in the years to come.

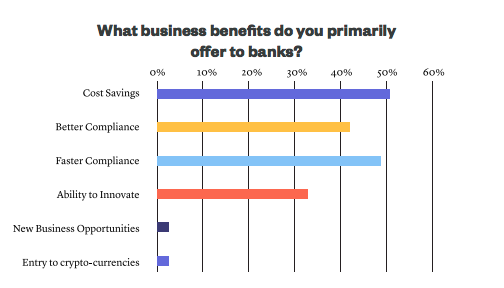

These startups cited the main appeals of using their services as cost savings as well as better and faster compliance.

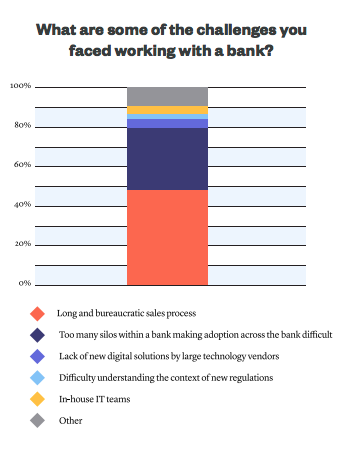

Some of the early regtech firms have already worked with 10+ banks but mostly in a proof-of-concept deployment model, the survey found. Entrepreneurs cited the main challenges when working with a financial institution were the long and bureaucratic sales process as well as the many silos within a bank.

“It is very easy to criticize traditional banks but you have to appreciate just how large these organizations are, the pressures they are under and the many facets of regulation they have to deal with,” US-based regtech firm Kompli-Global, said during its interview. “However, key to a successful working relationship with regtechs will be appreciating that your regtech solution is almost certainly only addressing a single piece of the complex compliance pie. The challenge for many of these institutions is knitting all of these solutions together.”

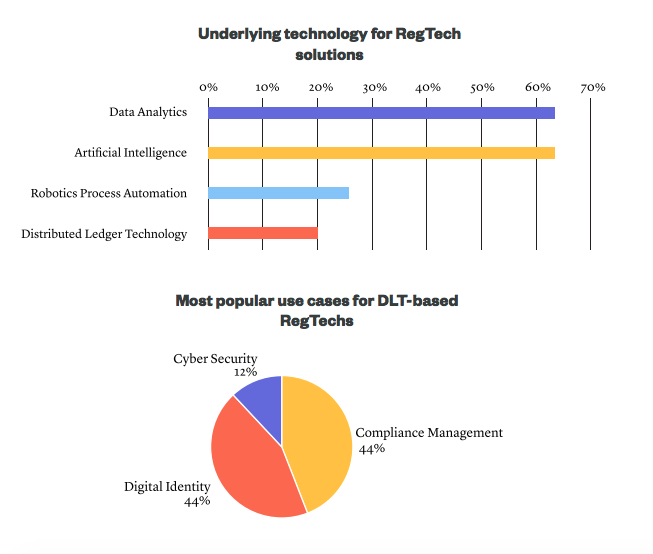

Almost all respondents said the underlying technology for their regtech solutions was related to data analytics, whether that was for KYC, onboarding, fraud, crime or reporting. The study also found a wide adoption of technologies supporting artificial intelligence (AI). Distributed ledger technology on the other hand was far less involved in their solutions.

Rise of “suptech”

The new phase of growth will also see the emergence of a new breed of “suptech” startups that will work alongside regulators in meeting challenges. Suptech, or technology for supervision, refers to regtech solutions deployed by regulators.

“In Regtech 2.0, regulators, especially in the regions with fintech hubs, will become significant users of regtech themselves (unlike in Phase 1.0 where direct involvement with regtechs was minimal except via accelerators) to keep up with the supervision challenges,” the report says.

“Suptech, the emerging segment of regtech, can enable regulators to take a data-driven approach to supervisory process and shift from a retrospective to a forward-looking approach.”

The Monetary Authority of Singapore (MAS) defines the concept as “essentially the other side of the same coin – applying technology to enhance the way MAS carries out its financial supervision functions.” The term was reportedly coined at the Singapore Fintech Festival in November 2017.

At the event, MAS managing director Ravi Menon, detailed the authority’s own suptech efforts and goals: first, ensure that all regulatory reporting can be achieved machine-to-machine with structured; second, eliminate duplication within their structured data collections.

“We have set a goal: all data requests from MAS will eventually be in machine-readable templates,” Menon said. “The requested data will flow seamlessly from financial institutions’ databases to our forms and ultimately to the supervisory dashboards of MAS officers.”

He continued:

“A major source of pain for financial institutions is regulators requesting the same data more than once under different data collection exercises […] By taking a more cohesive approach to data, MAS will aim to achieve zero duplication in our data requests to financial institutions.”