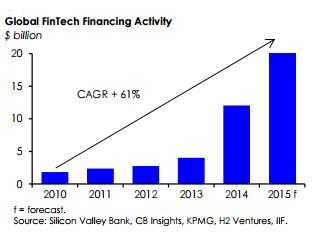

Just a few years ago, no one would have predicted mobile and social media would play a big role in money management. Smartphone penetration is reaching a critical adoption level, and the technology provides new methods for conducting day-to-day financial activities. Considering how established financial players are rather slow in adoption new technologies, FinTech startups have a major advance in the mobile field.

Spreading the word on new exchange trading strategies and financial solutions takes place all across social media. In fact, several financial platforms (such as Etoro) can connect to existing social media services such as Facebook and LinkedIn. Contrary to popular belief, discussions on money management are taking place on a regular basis all over the world.

When it comes to alternative investments, the market is getting very competitive. Some services connect professional portfolio managers with mailing list subscribers, whereas others use trading algorithms on a mass market scale. But there are other noticeable trends as well, such as peer-to-peer lending and equity crowdfunding,

When it comes to alternative investments, the market is getting very competitive. Some services connect professional portfolio managers with mailing list subscribers, whereas others use trading algorithms on a mass market scale. But there are other noticeable trends as well, such as peer-to-peer lending and equity crowdfunding,

There is no denying that money management is benefitting tremendously from technological innovation, as it becomes easier for consumers to conduct financial operations. Combining financial planners with technology will provide the middle class with a plethora of money management advice, in exchange for modest fees.

Not all of these efforts are focused on the consumer side though, as retail investors stand to benefit from a disruption in money management as well. Whether they want to access products that were previously unattainable to them, or make use of high-level trading strategies, the world is their oyster right now.

Embracing these new forms of technology, and catering towards emerging trends, will be key for the success of disrupting money management as a whole. Consumers have expressed their desire for a more digital experience when it comes to finance, and FinTech startups are providing them exactly that. Companies who can make proper use of all of the big data at their disposal will come out on top as a major player in the financial industry.

Source: IIF Study, Modernizing Money Management How Technology is Transforming Asset and Wealth Management

1 Comment so far

Jump into a conversationThe “Alternative methods” fields will be made accessible in the middle of 2020, as originally anticipated, rather than at a later date. In the interest of privacy, the “Alternative procedures” fields and the biller’s organizational structure will be printed.