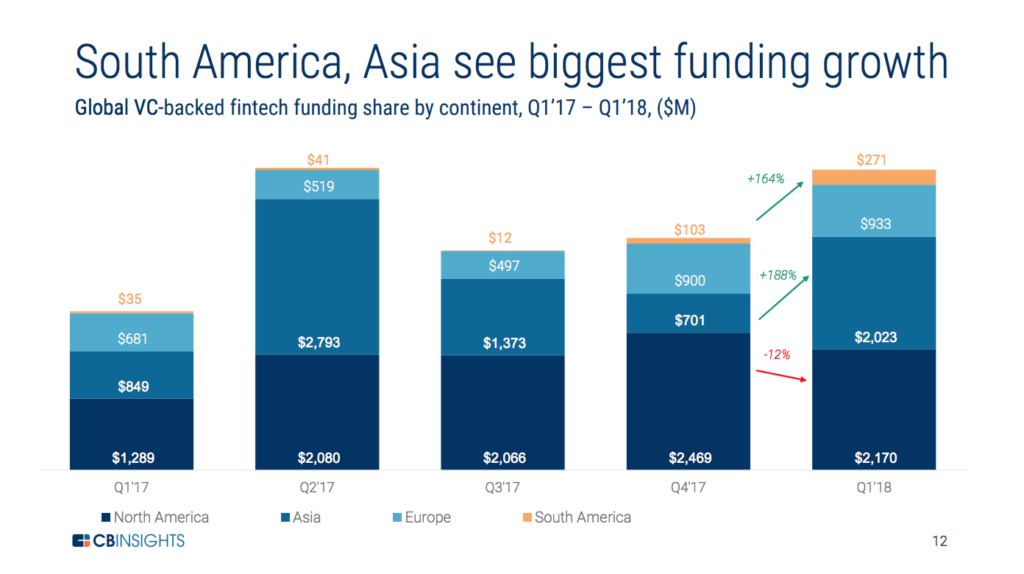

Asia is witnessing a strong increase in fintech investment as overseas investors search for opportunities in emerging markets and as western banks look to bolster their presence in the region.

In the first quarter of 2018, investment into fintech companies in the region surged on the back of a quartet of US$100 million+ mega-round deals. The region saw more than US$2 billion being pumped into its fintech startups, nearly as much as North America during the same period, according to CB Insights.

The rapid growth of fintech funding in Asia can be partly explained by the increasing number of western investors turning their attention to emerging markets as fintech markets across the US and Europe become saturated with companies and capital, according to Michael Lints, venture partner at Singapore-based VC Golden Gate Ventures.

Furthermore, the enticing mix of booming middle-class populations and rocketing smartphone adoption offer the greatest opportunity for returns in fintech investments.

Several foreign banks and financial institutions have begun tapping into the Asian fintech industry for both investment and collaboration opportunities. Many of them are looking at fintech companies as potential partners that will help better serve their Asia-based clients through innovative solutions and become more efficient.

Swiss banks tap Asian market

One particular Swiss bank that’s been active in the Asian fintech ecosystem is UBS. The bank began setting up innovation labs around the world in 2014 and today has facilities in locations that include Zurich, London and Singapore. The UBS Centre for Design Thinking and Innovation in Singapore focuses on creating new innovative and user-centric products to meet the bank’s wealth management clients in Asia-Pacific and globally. The bank launched a digital hub in Hong Kong in late-2017 to link tech startups with its high-net-worth clients.

One particular Swiss bank that’s been active in the Asian fintech ecosystem is UBS. The bank began setting up innovation labs around the world in 2014 and today has facilities in locations that include Zurich, London and Singapore. The UBS Centre for Design Thinking and Innovation in Singapore focuses on creating new innovative and user-centric products to meet the bank’s wealth management clients in Asia-Pacific and globally. The bank launched a digital hub in Hong Kong in late-2017 to link tech startups with its high-net-worth clients.

UBS has also turned to tech companies and startups to look for innovative and disruptive ideas to bolster its wealth management services. In Hong Kong, the bank has partnered with Hong Kong X-Tech Startup Platform to find new innovations and uncover real world business opportunities. In Singapore, it is collaborating with homegrown fintech startup FinChat Technology to develop an offering that allows secured social chat communication between clients and their advisors in Asia-Pacific.

Another Swiss bank that’s been active in Asia is Zurich-based Credit Suisse. In 2017, the bank entered into a partnership with Singapore fintech firm Canopy, formerly Mesitis. Canopy specializes in wealth management technology, and has developed an account aggregation and analytics platform for financial institutions, wealth management professionals, and high net worth individuals.

Another Swiss bank that’s been active in Asia is Zurich-based Credit Suisse. In 2017, the bank entered into a partnership with Singapore fintech firm Canopy, formerly Mesitis. Canopy specializes in wealth management technology, and has developed an account aggregation and analytics platform for financial institutions, wealth management professionals, and high net worth individuals.

The partnership was aimed at providing Credit Suisse’s clients access to Canopy’s solution by integrating it into the bank’s digital private banking platform.

Later that year, Credit Suisse participated in Canopy’s US$3.4 million funding round alongside Hong Kong’s Lionrock Capital. The collaboration has allowed Credit Suisse to improve its digital offering in Asia, while ensured both the capital and support for Canopy’s expansion into key wealth markets including Zurich and Hong Kong.

Asian fintech startups eye expansion

Canopy is not the only Asian startup looking to expand overseas. 8 Securities, a stock trading and wealth management startup with offices in Hong Kong and Japan, recently raised US$25 million from Japan’s Nomura Asset Management to launch new digital wealth management services and expand into new geographics.

Bambu, a B2B robo-advisory services provider from Singapore, opened a new office in London in April. The company said the move was part of “Bambu’s long-term growth strategy to offer our services and expertise on a global scale.” Bambu is an alumnus of Switzerland’s Fintech Fusion.

Better Trade Off is another fintech startup in Asia that Switzerland should be watch for. The startup won the DIAmond Award 2018 in May which recognizes the most innovative ventures in the insurtech industry. Better Trade Off has developed a financial planning solution called Aardviser.

Featured image: Tokyo, Japan, by Sean Pavone, via Shutterstock.com.