Free Stock Trading App Robinhood Joins Fintech Unicorn Club as 23rd Member

by Fintechnews Switzerland May 1, 2017Robinhood, a popular app for trading stocks without fees, has raised US$110 million in a Series C funding round led by DST Global, the Russian firm led by billionaire Yuri Milner. The round gives Robinhood a valuation of US$1.3 billion. The startup joins 22 other fintech unicorns that are valued at US$1 billion or more.

Founded in 2013, Robinhood operates a mobile app that allows customers to buy and sell stock on US exchanges commission-free. Robinhood also offers a premium plan called Robinhood Gold which starts at US$10 per month and comes with a number of advanced features and services including extended hours trading, interest-free margin trading, and faster deposits.

Founded in 2013, Robinhood operates a mobile app that allows customers to buy and sell stock on US exchanges commission-free. Robinhood also offers a premium plan called Robinhood Gold which starts at US$10 per month and comes with a number of advanced features and services including extended hours trading, interest-free margin trading, and faster deposits.

The company said that the Robinhood Gold signups are surging 17% month over month. Robinhood claims it has about two million users and US$50 billion in transaction volume.

The company’s mission is to democratize access to financial markets by making it easier for young adults to get started with investing. As of January 2015, the company claimed that 80% of its customers belonged to the Millennial demographic with an average customer age of 26.

“We’re not going away. Free trading is here to stay,” said Baiju Bhatt, Robinhood’s co-founder and co-CEO, as quoted by Inc. “We’re never going to charge you for trading. We’re never going to start jacking up the account minimums.”

“We’ve literally taken half a billion dollars out of the financial system and given it back to the American consumer. That’s something that we’re really proud of.”

By crossing the US$1 billion valuation mark, Robinhood joins the world’s 20+ fintech unicorn club. Bhatt said he hopes the company will go public in the next three to five years.

23 fintech unicorns

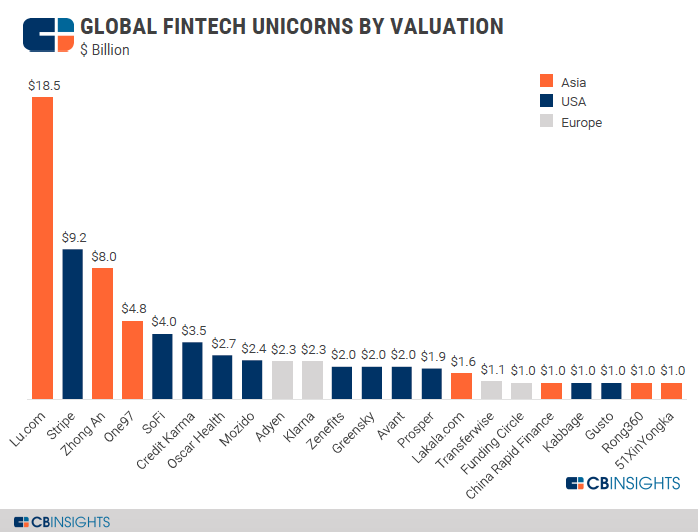

According to CB Insights, there are currently 23 fintech unicorns globally that have an aggregate value of over US$75 billion.

Global Fintech Unicorns by Valuation, The Global Fintech Report Q1 2017, CB Insights

The US counts 12 of the 22 companies. These include Stripe, an online payments startup valued at US$9.2 billion, SoFi, an online personal finance company that provides student loan refinancing, mortgages and personal loans valued at US$4 billion, Credit Karma, a company offering a free credit and financial management platform valued at US$3.5 billion, as well as Oscar Health, Mozido, and Zenefits.

Asia counts seven, six of which are in China. These include are Lufax, a peer-to-peer lending platform from China valued at US$18.5 billion, Zhong An, China’s first complete online insurance company valued at US$8 billion, and One97, a mobile Internet company from India and the owner of online payments provider Paytm valued at US$4.8 billion.

China is also home to the financial affiliates of Alibaba and JD Finance, valued at US$75 billion and US$7.1 billion, respectively.

Europe counts the least number of fintech unicorns with four companies. They are Adyen, a multichannel payment company from the Netherlands, and Klarna, a Swedish e-commerce payment company, both valued at US$2.3 billion, as well as international money transfer startup TransferWise, valued at US$1.1 billion, and peer-to-peer lending marketplace Funding Circle, valued at US$1 billion.

Featured image: Unicorn via Pixabay.