Deutsche Bank recommends robo-advisors for financial inclusivity. It also suggests that it complement traditional financial advisory, instead of replacing it altogether, in a bid to target underserved consumers.

Deutsche Bank’s August 10 issue of its EU Monitor research report titled Robo-advice – a true innovation in asset management notes that hybrid services that combine features of both robo-advice and traditional financial advice could benefit asset and wealtj managers. This is despite robo-advisors possibly posing as a challenge to traditional financial advisory services, thanks to its user-friendliness, automated processes, low-cost portfolio management and solid performance, said the report.

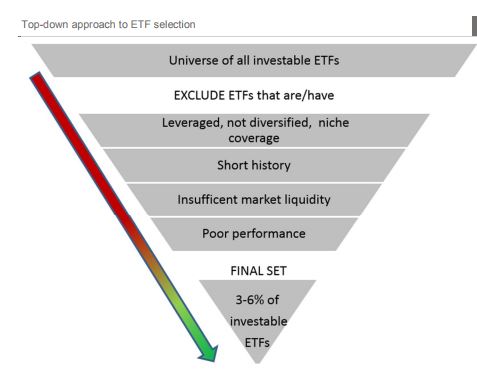

Robo-advisors create client portfolios using algorithms based on mean-variance optimisation. In addition, they automatically rebalance portfolios to maintain targeted asset allocations and provide tax-efficient solutions through tax-loss harvesting. Too-frequent rebalancing or tax-loss-harvesting, however, can be detrimental to long-term investment goals, said the report’s author Orçun Kaya.

Millennials were among the first robo-advisory clients. Recently, wealthier and more educated clients in their 40s and 50s also seem to have been entrusting robo-advisors with part of their portfolios. The markets, however, is becoming more competitive for robo-advisory startups, and there will be consolidation by asset management firms or banks in coming years, wrote Kaya.Still, robo-advisors’ performance needs to be tested over a longer period.

“If robo-advisors and their regulators can guarantee a high degree of accuracy and suitability for clients, robo-advice has great potential to complement, rather than displace, traditional financial advisors in the future,” said Kaya.

Robo-advisory’s rising popularity

Robo-advisory’s rising popularity

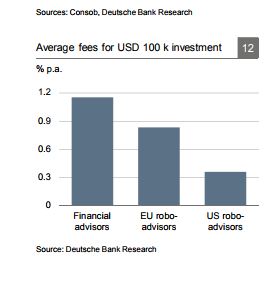

Robo-advisors are more affordable for retail investors due to their lower fees. For example, financial advisors’ average annual fees are typically around 1 per cent for managing a portfolio of up to US$100,000, wrote the report. For a similar portfolio, US robo-advisors charge around 0.4 per cent on average with a range between 0.15 per cent and 0.67 per cent.

But the right mix of robo-advisory and traditional financial advisory is crucial to wealth managers’ future. For one, robo-advisors tend to be more conservative with their investments to reduce investment risk.

“To be specific, they usually have a policy of entering the market 30 minutes after it opens and to leave it before it closes. Moreover, some robo-advisors suspend trading for a few hours before and after market-moving events such as central bank announcements about interest rates,”

“These are precautionary measures designed to reduce the algorithm’s potential overreaction to market movements that could otherwise lead to unnecessary losses for clients,” said Kaya.

With its more conservative approach and its affordability, robo-advisors could suit less wealthy and less financially savvy consumers, argues Kaya. Yet, critics point out that robo-advisors perform well only in bullish market conditions, and have not proven its ability to outlast volatility in the markets.

“All in all, robo-advisors will not be a substitute for financial education, but will complement financial planning. A likely precondition for this is that robo-advisors guarantee a high degree of accuracy, suitability and consistency to satisfy clients’ goals. This, on the other hand, requires sufficient regulation and supervision,”

How to safeguard investors who use robo-advisors

Deutsche Bank emphasises that robo-advisors must be transparent in terms of costs, potential risks and limitations of their services. They have a duty to fully and fairly disclose all information so that clients can clearly understand their investment practices and potential conflicts of interest. Such information should be easily accessible and understandable.

Secondly, robo-advisors need to explain how they handle operational and market risk both in normal times and in distressed market conditions. Investors must be informed about operational aspects of their services, i.e. regarding the assumptions and limitations of the optimisation algorithm for portfolio allocation and rebalancing.

Thirdly, robo-advisors should ensure that their recommendations and strategies are suitable for their clients. Suitability should be based on the client’s financial situation and investment objectives. For this, robo-advisors depend on the information provided by clients in online questionnaires.

Last but not least, cybersecurity and the protection of sensitive customer information is a very important issue when it comes to automated online advice. Thus, robo-advisors must establish controls to protect client data and to maintain the public website or the client’s log-in functionality, the report concluded.