5 Trends That Wealth Managers Need to Keep Their Eyes On Right Now

by Fintechnews Switzerland August 12, 2019The wealth management industry is facing disruptive challenges, including increased adoption of new technologies like artificial intelligence (AI) and analytics, the entry of bigtechs, and pressure of fee structures.

As the wealth industry evolves, wealth management firms must reinvent themselves and take advantages of cutting-edge technologies to enhance customer experience and provide greater personalization, according to reports by BCG and Capgemini.

In two separate research papers, the companies explore the future of wealth management and draws out recommendations for the industry. Here are 5 key takeaways from BCG’s Global Wealth 2019: Reigniting Radical Growth, and Capgemini’s World Wealth Report (WWP) 2019.

Wealth Clients are Not Satisfied with Digital Offerings

While overall satisfaction toward wealth management firms are still at a healthy level, wealth clients’ expectations are increasingly shifting to expect their wealth management providers to offer seamless, convenient digital experiences, and current solutions aren’t enough.

Source: Capgemini’s World Wealth Report (WWP) 2019.

According to the WWR 2019 Global High Net Worth (HNW) Insights Survey, fewer than 50% of HNW clients are satisfied with mobile and online platforms. HNW individuals are demanding more digital interaction across accessing portfolio information (nearly 88%), executing transactions (87%) and obtaining advice/service from wealth managers (84%).

According to the reports, many firms still lag behind in employing digital tools and capabilities and in acquiring the speed, agility, and mindset to develop them. That deficit has a negative impact on the client experience, leaving value on the table and increasing the cost to serve clients.

The Need to Increase Investment into Product Innovation

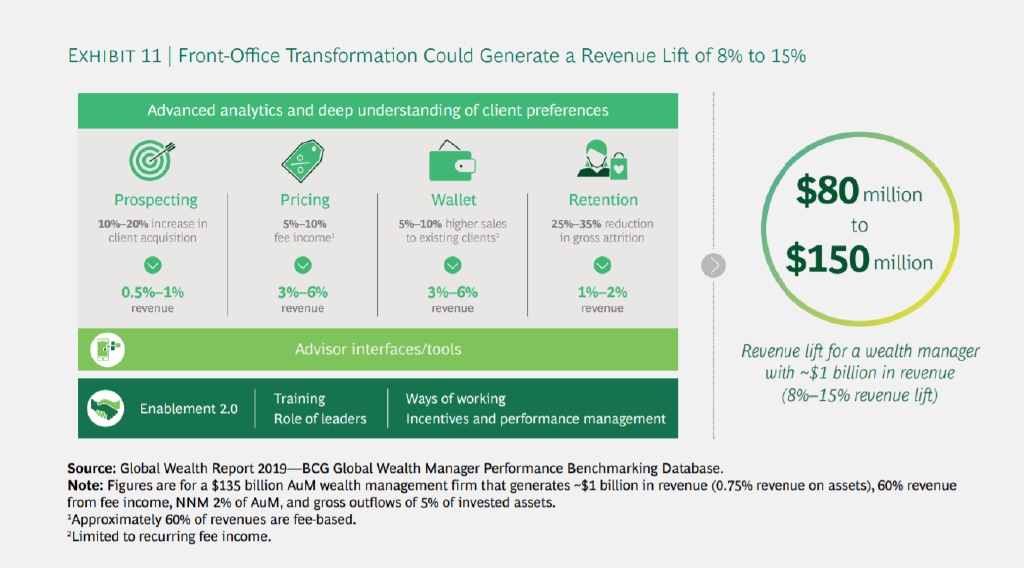

In order for wealth management firms to extend their reach, enhance client relationships and differentiate their offering, they must invest in product innovation, advanced analytics, and a robust set of digital tools and platforms. BCG’s report indicates by investing in front office transformation wealth managers can lift top-line performance by 8% to 15%

Source: BCG’s Global Wealth 2019: Reigniting Radical Growth

In the WWR 2019 Global HNW Insights Survey, wealth managers indicated substantial gaps in what they expect and what is being delivered by their firms in terms of capabilities and identified levers.

Many wealth managers feel they are forced to work using siloed legacy systems that don’t allow a seamless and simplified process experience. The lack of an integrated firmwide portal/solution may exacerbate this significant gap.

Bigtechs are The Biggest Threat to the Industry

Source: BCG’s Global Wealth 2019: Reigniting Radical Growth

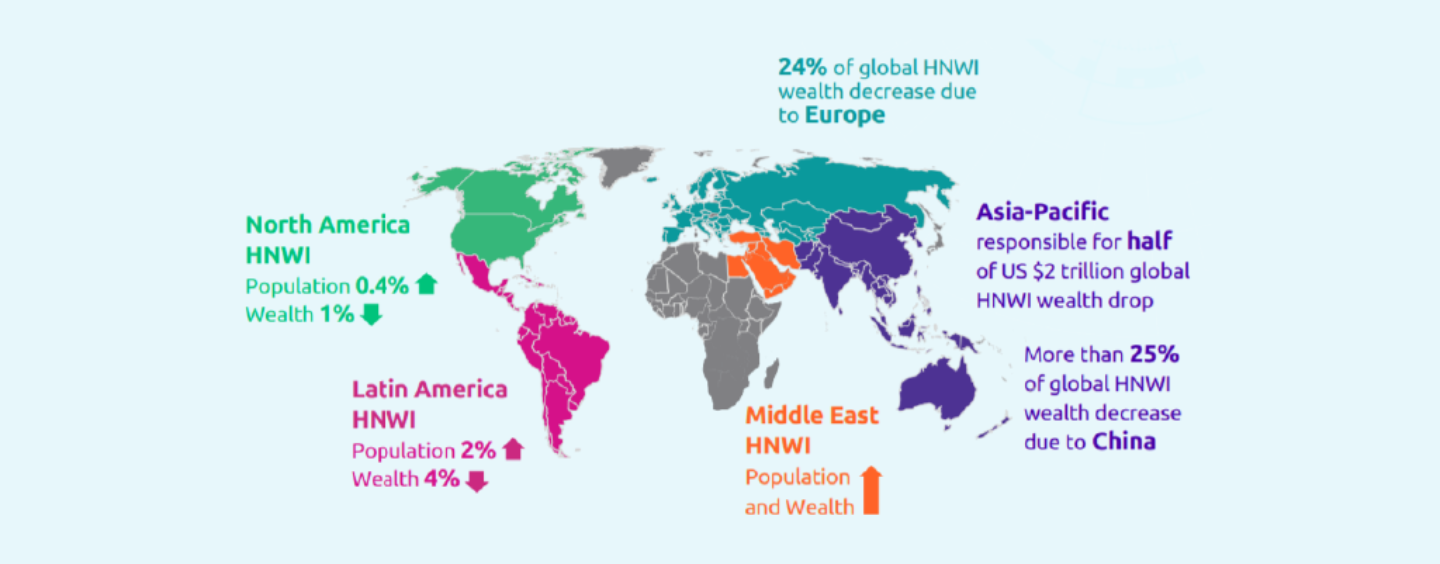

While there are many players eyeing for the same piece of pie, bigtechs such as Amazon, Google, Alibaba, Apple and Facebook, are expected to be one of the greatest industry disruptors due to their digital capabilities.

In the past years, bigtechs have entered the broader financial services industry, beginning with payments and then moving into areas such as loans and insurance.

In 2005, Apple founded Braeburn Capital, its own asset management company. Despite being dedicated to the management of Apple’s cash reserves, it is a first step in building asset management capabilities.

In 2017, Tencent invested US$360 million in China International Capital Corporation, one of the leading banking firms in China. Last year, the Chinese tech giant was granted a license to sell mutual funds to WeChat’s one billion users. The platform is already used by fund houses to sell their products.

Ant Financial’s wealth management arm claimed in 2018 that its user base surged to 622 million users with assets under management in the tune of US$345 billion.

Incumbents must watch out for these.

Personalization as the main differentiator

In this evolving wealth management landscape, personalization will be a key area for differentiation.

Across the industry today, clients are already being offered personalized experiences. However, only close to 40% of surveyed HNWIs said they were satisfied with personalized offerings from their wealth management firms. The figure is even smaller for younger HNWIs as only 33% of under-40 HNWIs reported satisfaction compared to 41% of older counterparts (aged above 60).

Source: BCG’s Global Wealth 2019: Reigniting Radical Growth

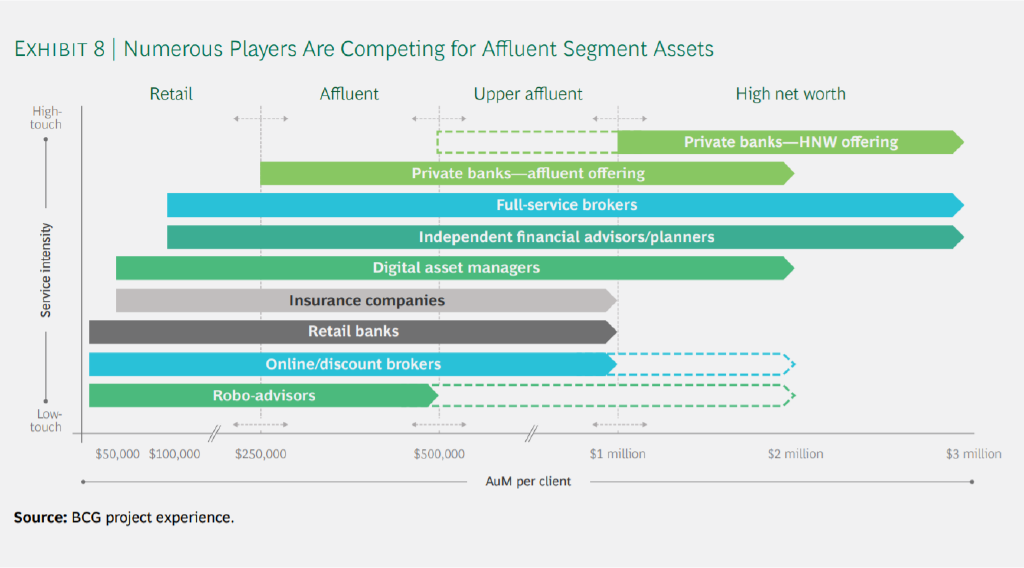

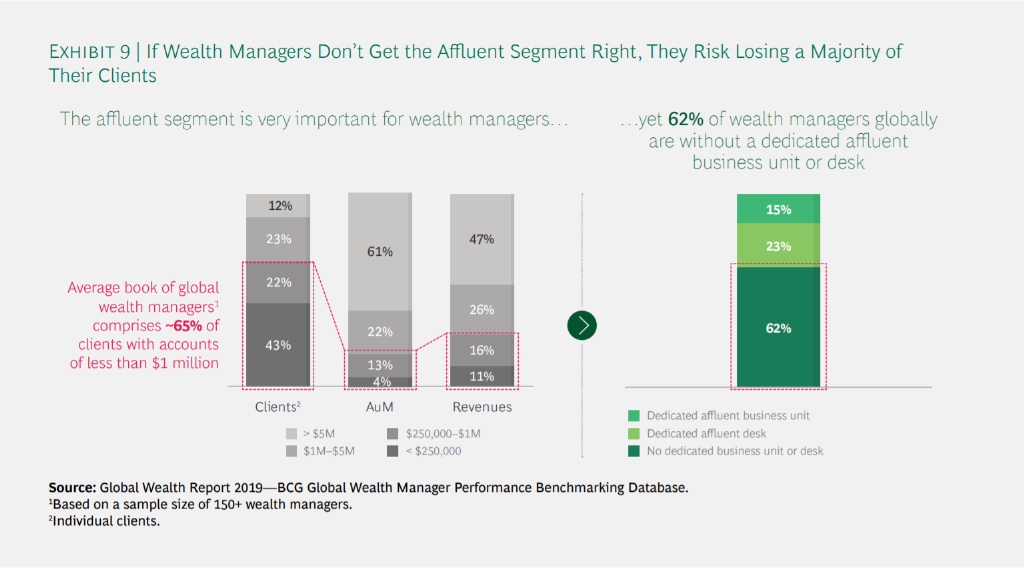

The reports also indicate that if firms dont step up their game they stand to lose out on their most important segment, the affluent

BCG advises wealth management firms to prioritize investments in analytics, personalization at scale, data harmonization, management, and storage, to give advisors the tools they need to deliver suitable tailored service.

Artificial intelligence: a game-changer

Adoption of emerging technologies such as AI, digital analytics, and intelligent automation, will be critical to enhance wealth manager efficiency and bolster clients’ service experience.

In particular, firm executives and wealth managers are unanimous on the fact that AI is a key game-changer.

However, only 5% of surveyed firms for the WWP 2019 said they had implemented AI strategies across all core areas. More should be done in this area.

Source: Capgemini’s World Wealth Report (WWP) 2019.