WealthInitiative Launches Online Platform to Enhance Wealth Managers’ Value Proposition for Real Estate, Art and Passion Investing

by Fintechnews Switzerland February 10, 2016WealthInitiative a Zurich-based fintech startup, has announced the release of its online platform and marketplace that aims to empower wealth managers with a more efficient tool to monitor and manage real estate, art and passion investments.

The WealthInitiative platform, launched today, aims to provide wealth managers and top tier wealth institutions with a competitive edge by allowing them to share a network of deals on behalf of their clients in the fields of real estate, art and passion investments.

“A basic example would be where you have on one side a client based in Geneva who would like to sell his apartment in London and on the other side a client sitting in Singapore who is looking to buy a similar apartment in London. Instead of them going through many intermediaries and real estate agencies to facilitate the deal, the transaction could be easily executed through the platform by connecting the buyer and the seller.”

– WealthInitiative, via F6S

The platform can be used internally, by allowing wealth managers to explore synergies among their clients, propose a panel of offering in key strategic areas, and enable a deeper understanding of client wealth; and externally, by allowing actors to share deals with other selected private banks, and members of WealthInitiative’s community.

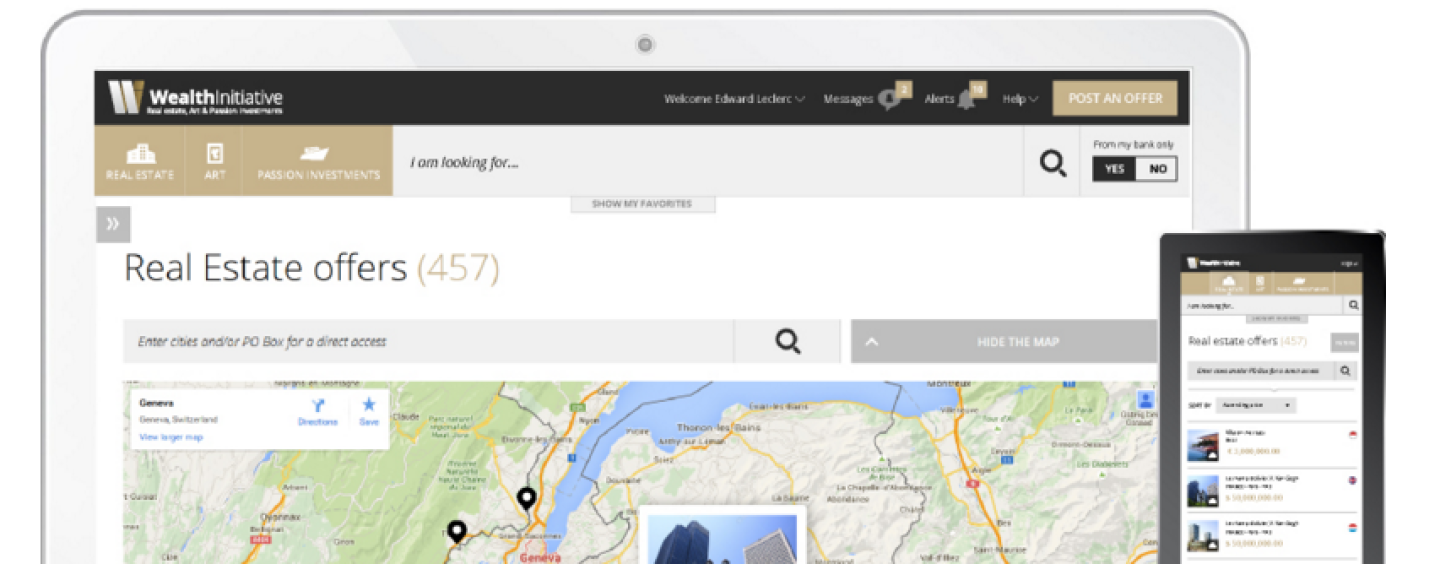

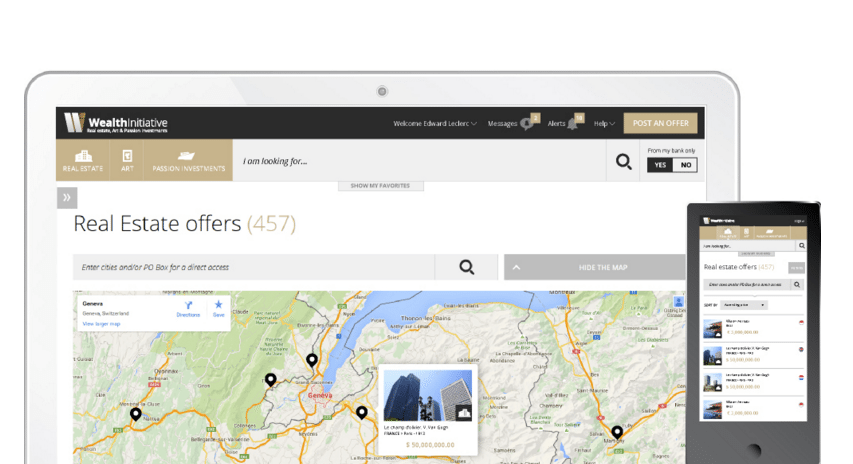

WealthInitiative provides professionals with an intuitive interface and cutting edge functionalities, allowing them to reduce transaction costs by cutting out intermediaries, while providing enhanced confidentiality and a more efficient way for these professionals to meet their clients’ needs.

Users can explore all available deals in the fields of real estate, art and passion investments and they can easily and securely conduct trades on their personal dashboard as well as manage their portfolio.

The platform is currently available as a cloud-based solution or can be hosted on banks’ IT infrastructure. However, the company plans to add more functionalities in the near future, including the ability for various wealth management institutions to securely reach out and connect with each other, multiplying transaction flow, and creating additional opportunities for their clients.

All about WealthInitiative

WealthInitiative unveiled in a release that it was currently working on integrating blockchain technology to provide a transparent track record of provenance and ownership details of any asset traded on the platform.

Founded in 2015 by Swiss investment advisor and art investment expert Douglas Azar, WealthInitiative builds solutions targeted at wealth management institutions, asset management firms and family offices.

“I strongly believe that creating synergies among clients is the next growth driver for wealth management institutions,” Azar said in a statement.

“Throughout my experience in private banking and art investment research, I kept on wondering about the lack of tools that would allow private banks to better exploit this untapped potential. WealthInitiative was born out of a desire to fill this gap.”

Watch WealthInitiative’s promo video:

More Information about WealthInitiative can be found also here

4 Comments so far

Jump into a conversationIch denke, dass diese WealthInitiative-Plattform das Potenzial hat, die Arbeitsweise von Vermögensverwaltern wirklich zu verändern. Die Möglichkeit, alle Anlagemöglichkeiten und Geschäfte an einem zentralen Ort zu finden, wäre für Vermögensverwalter wertvoll und zeitsparend. Ich kann mir nur vorstellen, wie viel Zeit die Vermögensverwalter mit der Suche nach den richtigen Anlagen und Möglichkeiten für ihre Kunden verbringen, sodass eine Plattform, die diesen Prozess rationalisiert und sie mit den relevanten Angeboten verbindet, ein Geschenk des Himmels sein muss.

Die Idee eines sicheren Netzwerks, das es Vermögensverwaltern ermöglicht, sich untereinander auszutauschen und im Namen ihrer Kunden Angebote zu unterbreiten, ist ziemlich revolutionär. Ich bin sicher, dass es derzeit viele verpasste Gelegenheiten gibt, bei denen die Bedürfnisse eines Kunden perfekt mit den Vermögenswerten eines anderen Kunden übereinstimmen, die Vermögensverwalter sich dessen aber nicht bewusst sind. Diese Plattform könnte diese versteckten Synergien aufdecken und allen mehr Geld einbringen!

Die Angular-Entwickler waren maßgeblich am Aufbau dieser Plattformen beteiligt. Sie setzten das Angular-Framework geschickt ein, um eine effiziente und skalierbare Plattform zu schaffen, die es Vermögensverwaltern ermöglicht, die Investitionen ihrer Kunden in Immobilien, Kunst und Leidenschaft zu überwachen und zu verwalten: https://andersenlab.de/find-developers/angular

The game features a clean and minimalistic design, placing the focus squarely on the music. The simplicity of Heardle’s interface enhances the gaming experience, letting players dive into the challenge without distraction

Spot on, passive real estate is key. “Mailbox money” as they call it. Some operations pay out quarterly, others at the end upon maturity.