Acebanker: Making Wealth Management Accessible and Comprehensible to Ordinary People

by Fintechnews Switzerland February 18, 2016Singaporean startup Acebanker offers a mobile app that aims to democratize private banking and make wealth management services accessible and comprehensible to ordinary people.

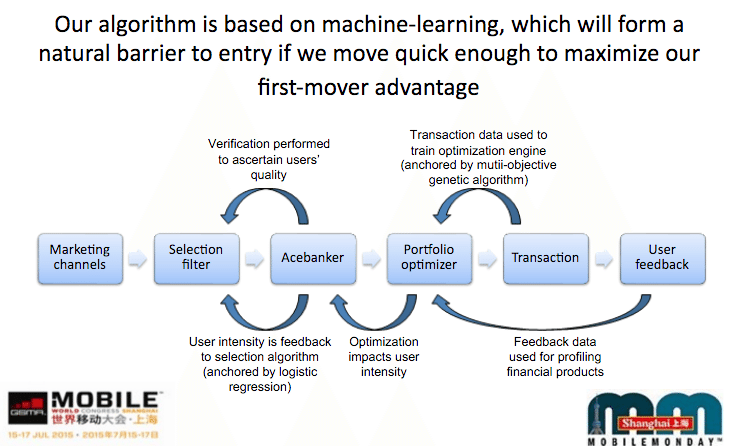

Underneath, there is an algorithmic-based wealth manager with machine-learning capabilities that uses real-world market data to provide independent wealth management advice to individuals based on their demographic profiles, risk tolerances and financial goals.

Underneath, there is an algorithmic-based wealth manager with machine-learning capabilities that uses real-world market data to provide independent wealth management advice to individuals based on their demographic profiles, risk tolerances and financial goals.

Confused? Here’s how it works: you signup and fill a risk profile survey; the machine-learning algorithm then calculates the “best-fit” portfolio based on the financial attributes of each product in Acebanker’s database, as well as other non-financial attributes; finally, you get to pick whether you want to buy the recommended products or build your portfolio on your own. Acebanker helps you keep track of your entire portfolio and sends you important alerts. The tech constantly scans the market for open data and study clients’ investment patterns in order to stay relevant.

Acebanker infographic (http://slideplayer.com/slide/9459931/)

Banks can choose to directly embed Acebanker’s core algorithm into the back-end of their online banking platform and let the technology works behind the scene. Or they can have a customized version of Acebanker in terms of modules, which are used as “plugins” to the client-facing online/mobile interface. Both ways will allow banks’ clients to directly access Acebanker’s automated wealth management solution.

The bionic option on the other hand, allows client advisors to keep track and manage all their clients’ portfolio in one place, allowing them to provide more value-added services to more of their clients, while delegating much of the computational-intensive portfolio management activities to Acebanker.

In addition to being customizable and personalizable, Acebanker provides in-depth analytics and insights by tracking, capturing and crunching a huge amount of data. Another feature that Acebanker provides users with is a data visualization module, which allows banks’ clients to easily find out their current wealth management status. Acebanker currently offer over 300 data visualization toolkits for banks to choose from.

Acebanker is a product of Koolla Pte. Ltd., a startup incorporated in Singapore with a second office in Shanghai and a research lab in Geneva.

The company is led by Chuang Shin Wee, a serial entrepreneur who had won a number of awards. Shin Wee Chuang was named in 2013 one of the Top 50 Business Innovators in China.

The startup is currently working on a number of internal projects in addition to collaborations with major international banks. These partnerships with financial institutions are mainly aimed at understanding the digital behaviors of the Asian consumers. One of these initiatives was a 6-month field study on the investment patterns of Chinese consumers on mobile devices.

Acebank is one of the ten startups to be selected to join the inaugural class of Fintech Fusion, Switzerland’s first fintech accelerator program.

The company is looking to raise between US$1-2 million in capital to scale the business.

Featured image credit: pexels

2 Comments so far

Jump into a conversation