Customers Unsatisfied With Current Banking On-Boarding Processes

by Fintechnews Switzerland April 4, 2016Consumers are unsatisfied with current banking on-boarding processes, which they claim are frustrating and time consuming. Banks need to listen to consumer demands and become truly digital to resist the competition and increase revenues and user base, according to a new report by Signicat.

The report, entitled ‘The battle to on-board’, analyzes results of a survey conducted by Red Briks for Signicat on over 2,000 UK-based consumers to explore experiences of applying for financial products with traditional banks. Findings suggest that banks fail to address the pain caused by current on-boarding processes and show that banks are clearly out of alignment with consumer expectations.

The report, entitled ‘The battle to on-board’, analyzes results of a survey conducted by Red Briks for Signicat on over 2,000 UK-based consumers to explore experiences of applying for financial products with traditional banks. Findings suggest that banks fail to address the pain caused by current on-boarding processes and show that banks are clearly out of alignment with consumer expectations.

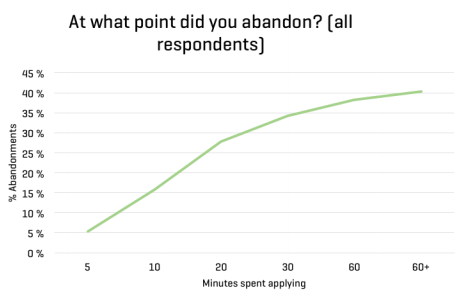

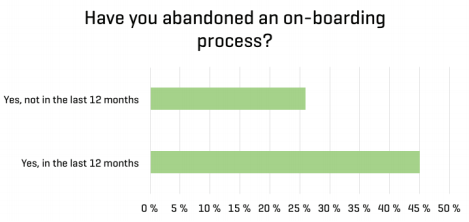

Overall, customer frustration with on-boarding process is high and this is leading to increasing levels of abandonment and lost custom for banks. 40% of consumers said they have abandoned bank applications with more than one third (39%) of these abandonments due to the length of time taken to enroll, and 34% were due to needing too much personal information.

The on-boarding time was judged too long with an average of 18.45 minutes.

The report also suggests that financial services is the sector that has the highest abandonment rates when it comes to client on-boarding, and the trend is on the increase, the report says.

Consumers demand 100% online processes

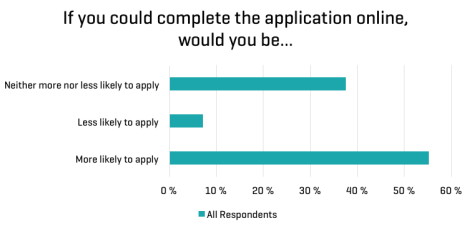

Consumers want to move to digital and want to be able to verify their identity online with 55% of consumers stating they would be more likely to apply for a financial product if the process was 100% online. The figure rises to 64% in those with negative experiences of applying.

Additionally, 52% of respondents said they would buy additional services if paper-based identity paper was not needed.

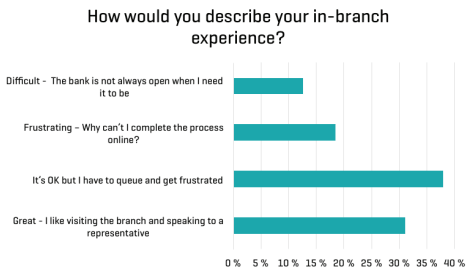

Simultaneously, customers are clearly unsatisfied with in-branch experience with 68% saying they were unhappy with how branches operate and 56% expressing frustration.

“Understanding where and why consumers are abandoning and what steps they can take to accelerate the on-boarding process, bank can protect and grow market share, increase revenues and boost customer satisfaction,” the report says. “Traditional banks need to change if they are to withstand the challenge from start-up banks and to win the battle for the consumer.”

It concludes:

“To date, banks have been focusing on providing both new products and a digital service to customers, but this will be for nothing if consumers are abandoning the on-boarding process before they are exposed to new systems and products. If banks fail to address the pain caused by the on-boarding process, customers, revenue, reputation and eventually market position will be sacrificed.”

The Signicat report comes amid a recent ruling by the Swiss Financial Market Supervisory Authority (FINMA) that aimed at facilitating client identification. The new circular allows financial services providers to on-board clients by means of online and video transmission, putting these means of identification on the level of in-person identification.

The move, the authority says, is to reduce obstacles faced by fintech companies and other new entrants that primarily operate through digital channels.

Read Signicat’s ‘The battle to on-board’ report: https://www.signicat.com/on-boarding-report/

Featured image: Frustrated man by altanaka, via Shutterstock.

4 Comments so far

Jump into a conversationThe numbers say it all…thanks for the instructive perspective.

The main reasons why a fully digital onboarding process is paramount evolve around a few key factors: being client centric, offering simple solutions, providing instant gratification while avoiding cognitive dissonance plus unlocking efficiencies for one of the core processes of the bank.

Clients increasingly have liquid expectations, ie, expect the same level of service excellence when onboarding with a bank as with any other service.

For more thoughts and details on why a digital process is the only alternative: http://bit.ly/1YcrXku

To resist competition and increase revenues and user base, the report recommends that banks listen to consumer demands and become truly digital. This means streamlining on-boarding processes and offering a more user-friendly and efficient experience for customers.

It seems that customer frustration with on-boarding process is high and this is leading to increasing levels of abandonment and lost custom for banks.

I am impressed. You are truly well informed and very intelligent. You wrote something that people could understand and made the subject intriguing for everyone.