In the financial services industry, banks, insurers, asset managers and fintech companies are increasing the speed at which they deploy artificial intelligence (AI)-enabled applications, confident that AI will help them assess risk more accurately, enable operational efficiencies, and reduce costs, results from a new study by American tech firm Nvidia show.

The 2023 State of AI in Financial Services report, released on February 02, 2023, draws on a survey of nearly 500 global financial services professionals that sought to understand AI trends in the sector, as well as the opportunities perceived and challenges faced by the industry.

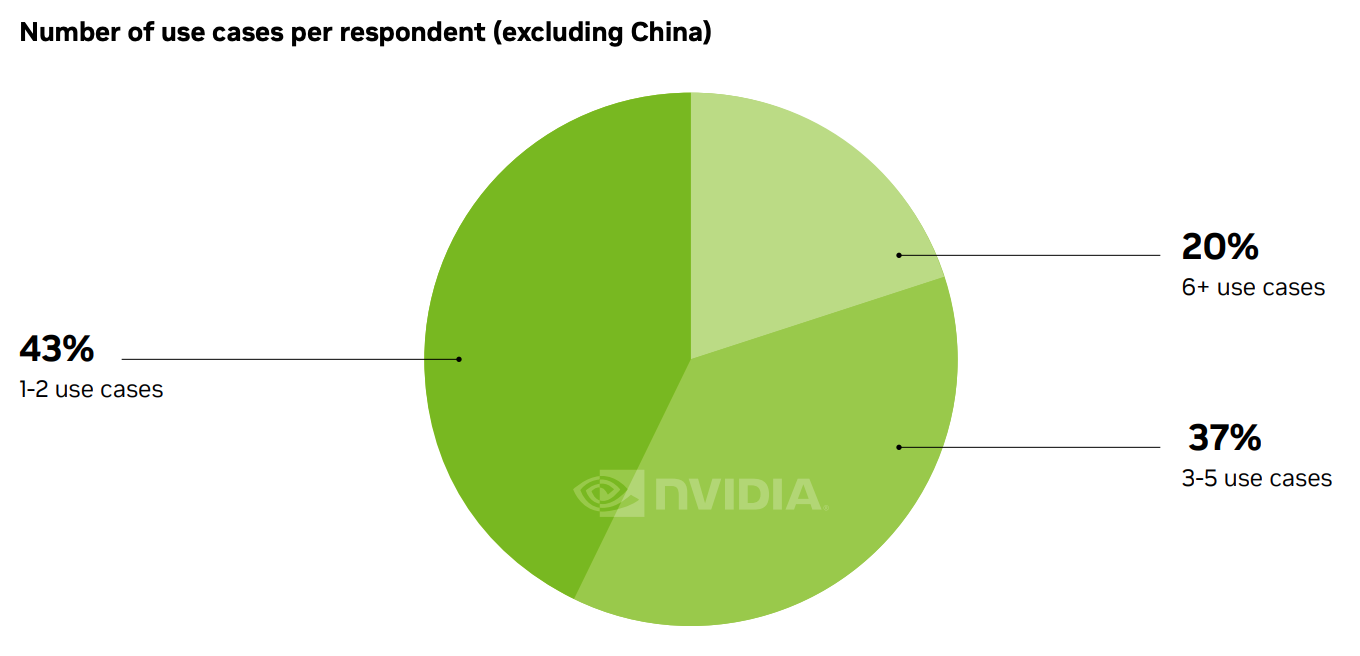

Results from the study show that the adoption of AI in the finance sector is accelerating at a fast pace, with over half of the respondents indicating having deployed three or more of the 21 different AI-enabled use cases analyzed by the survey. A fifth of respondents said they had six or more use cases in market.

Number of use cases per respondent (excluding China), Source: State of AI in Financial Services, Nvidia, Feb 2023

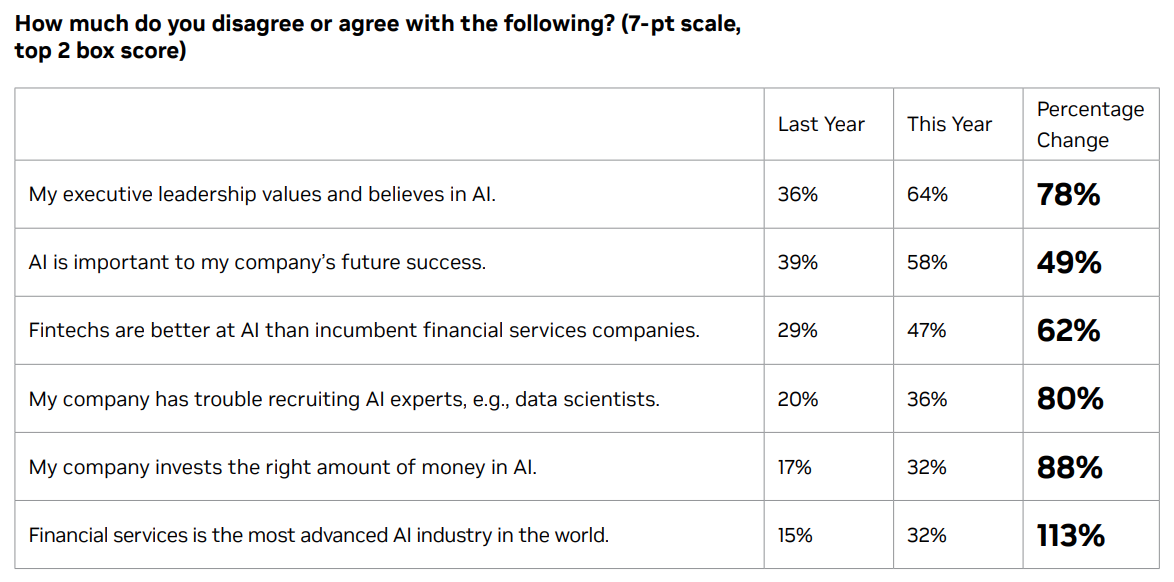

Accelerated adoption of AI in the sector comes on the back of increased awareness of the imperative among executive leadership teams. This year, 64% of respondents agreed that their executive leadership “values and believes in AI”, a figure which represents an increase of 78% year-over-year (YoY). More respondents also indicated that their leadership view AI as an important factor to their company’s future success, a proportion which stands at 58% this year, compared with 39% in 2022.

How much do you disagree or agree with the following?, Source: State of AI in Financial Services, Nvidia, Feb 2023

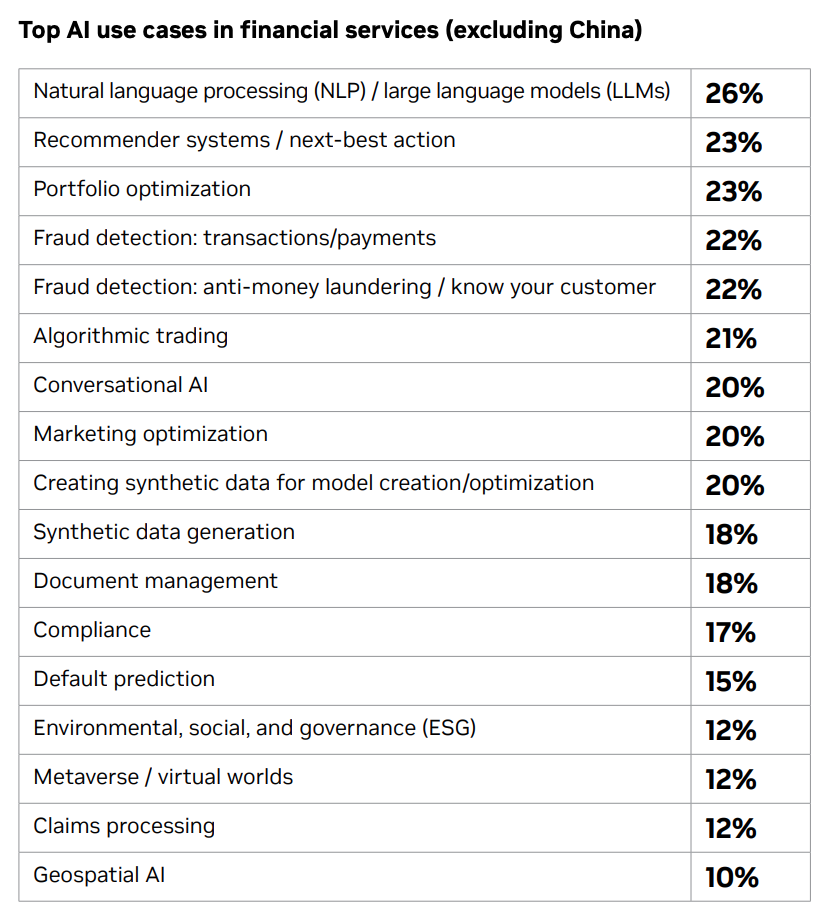

Top AI use cases

Findings also show that finance professionals are now applying AI in a wide range of use cases, with ten of the 21 use cases studied being utilized by over 20% of the respondents’ companies.

These applications are natural language processing (NLP) and large language models (LLMs) (26%), recommender systems and next-best action (23%), portfolio optimization (23%), fraud detection in transactions and payments (22%), fraud detection for anti-money laundering and know-your-customer (AML/KYC) (22%), algorithmic trading (21%), conversational AI (20%), marketing optimization (20%) and creating synthetic data for model creation/optimization (20%).

Interestingly, 12% of respondents said their company have deployed AI-enabled applications for use cases relating to the metaverse and virtual worlds with aspirations to explore opportunities relating to employee training, new employee onboarding, retail branch simulation and insurance risk evaluations.

Top AI use cases in financial services (excluding China), Source: State of AI in Financial Services, Nvidia, Feb 2023

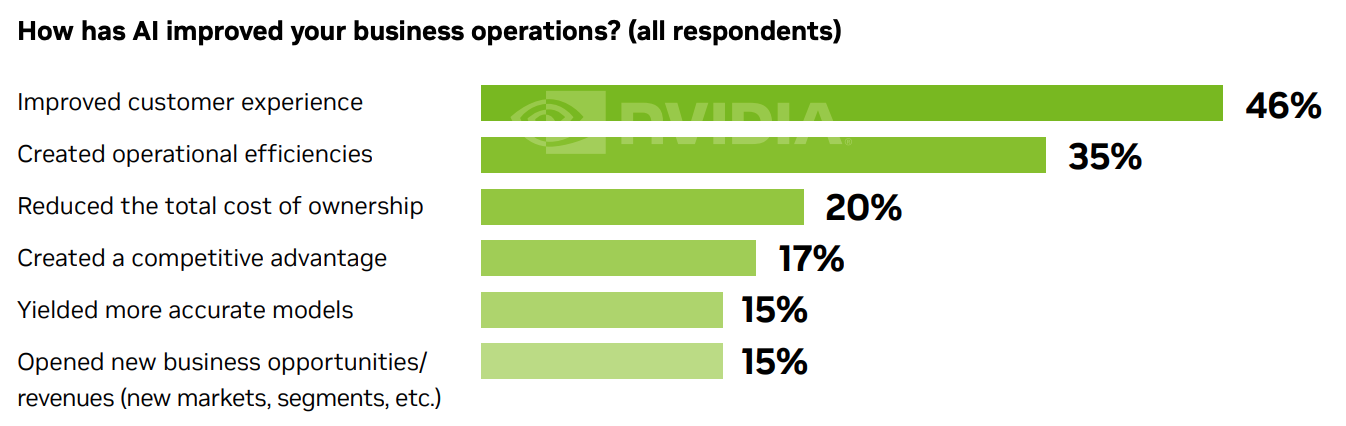

Companies that have deployed AI applications into production said the technology has brought them real benefits, including improved productivity and cost savings. In fact, 35% of respondents said these applications have created operational efficiencies, and 20% said they have reduced the total cost of ownership. When asked about how much their companies saved, 36% indicated AI-enabled applications have helped decrease annual costs by more than 10%.

Investing in AI have also brought benefits that extend beyond financial impact, the survey found, including improved customer experiences, new business opportunities, and more accurate models.

How has AI improved your business operations?, Source: State of AI in Financial Services, Nvidia, Feb 2023

AI is already widespread in Switzerland

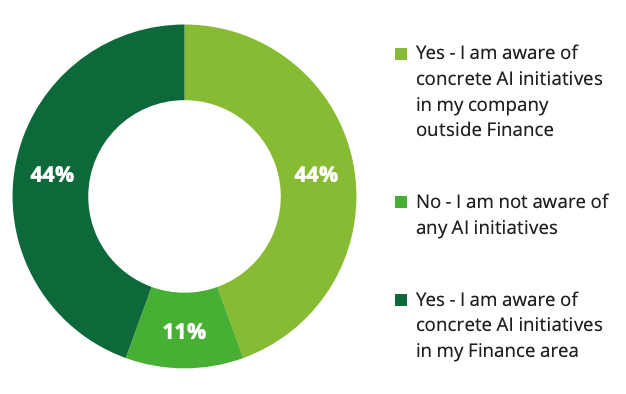

Results of the Nvidia survey are consistent with those found by other similar studies. A new report by consultancy Deloitte, which focused on the Swiss market, shares findings from a survey of companies in various industries, including consumer, financial services and life sciences, and found that AI is now widespread in the country. Almost 90% of the Swiss executives surveyed stated that they are aware of AI initiatives in their company with almost half of these being in the finance function.

Are you aware of ongoing or completed AI initiatives/projects in your company?, Source: Finance Innovation Survey 2023, Deloitte, 2023

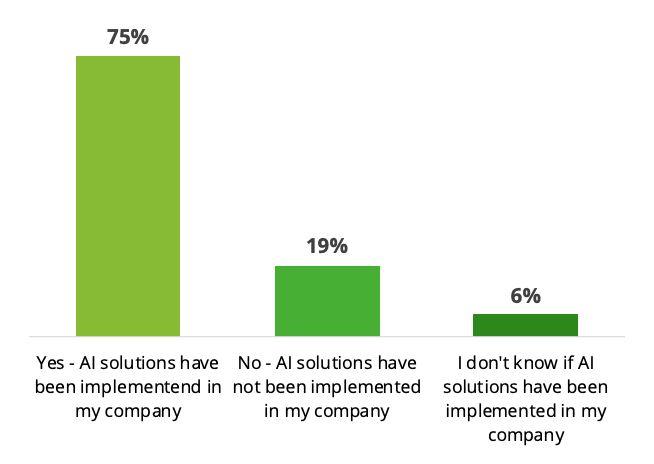

The deployment of AI solutions is also well underway, with 75% of respondents indicating that AI solutions are being implemented.

Has any AI solution already been implemented in your company?, Source: Finance Innovation Survey 2023, Deloitte, 2023

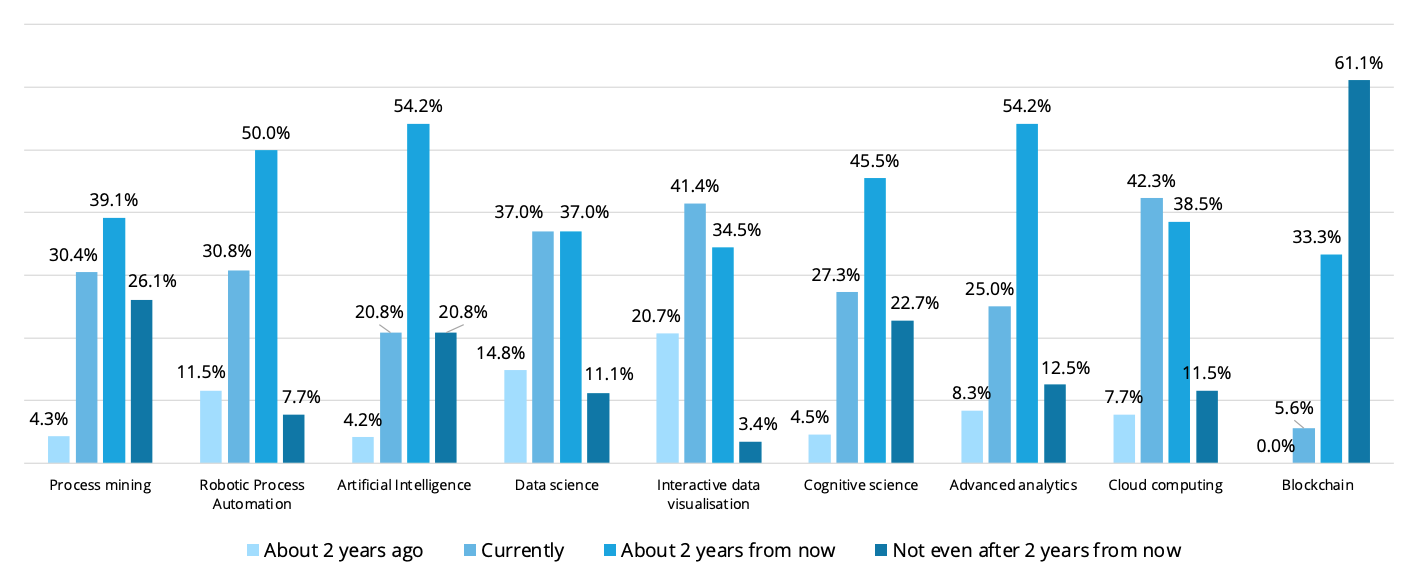

The study, which also looked at the adoption of other technologies, found that cloud computing (42.3%), interactive data visualization (41.4%) and data science (37%) are currently the most used digital technologies in the finance sector. These technologies are set to still be leaders in the next two years, though particularly large gains are also expected in AI, advanced analytics and robotic process automation (RPA).

In general, which of the following technologies have you used in your finance organisation 2 years ago, or use today or expect to use in 2 years’ time?, Source: Finance Innovation Survey 2023, Deloitte, 2023

The rise of generative AI

AI has been a hot topic of discussion in the business community since the release of AI-powered chatbot ChatGPT in November 2021. The tool, which became the fastest-growing consumer app in history when it surged past the 100 million monthly active users mark in January 2023, is praised by industry experts for its ability to accurately answer questions, mimic human language and complete a wide range of tasks.

ChatGPT sparked a frenzy in the tech community and prompted most industry leaders to ramp up AI development. In fintech, a number of industry stakeholders are already speculating on the potential of generative AI – the form of AI which ChatGPT relies on that’s capable of creating new content, including text, audio and images – in the sector.

Sarah Hinkfuss, a partner at Bain Capital Ventures, authored a recent article that provides a deep dive into the subject, arguing that the most impactful usage of generative AI will be as tools built into desired products or software workflows.

Prominent examples include auto-generated personal loan offers with custom messaging based on contextual information about a particular customer; auto-generated insurance application forms based on data and information provided in previous applications submitted; AI-powered chatbots for 24/7 customer service and support; as well as forecasting and risk identification.

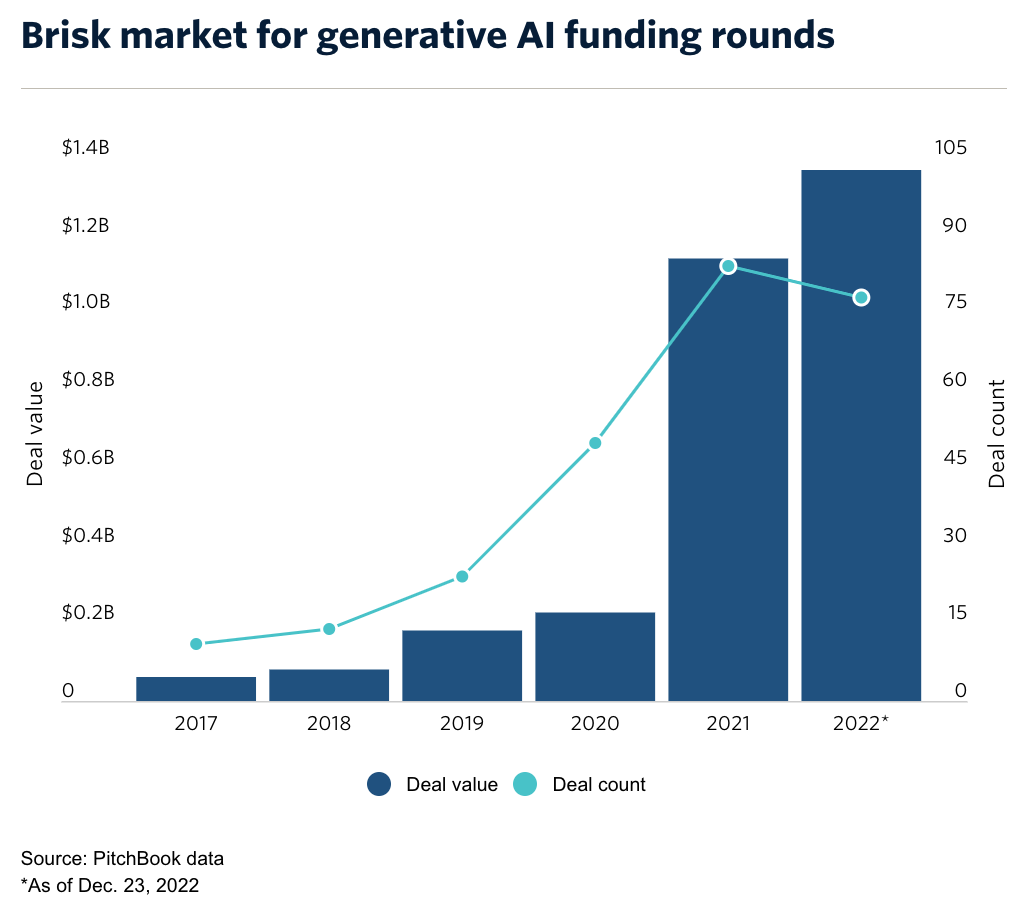

Venture capital (VC) investment in generative AI increased nearly 500% between 2020 and 2022 to US$1.37 billion, data from Pitchbook show. The VC funding frenzy is expected to carry on this year, with already a number of notable deals being announced in Q1 2023. Anthropic, an AI company that’s testing a rival to ChatGPT called Claude, received a US$400 million investment from Google in February; Cohere, another competing generative AI startup, is reportedly in talks to raise hundreds of millions of dollars in funding; and OpenAI, the research lab behind ChatGPT, inked a US$10 billion deal with Microsoft in January.

Generative AI funding rounds, Source: Pitchbook, Dec 2022

Though the generative AI space remains nascent, business analytics platform and global database CB Insights has identified more than 250 companies in the sector.

OpenAI is currently the biggest player with a US$29 billion valuation, followed by Hugging Face (US$2 billion), Lightricks (US$1.8 billion), Jasper (US$1.5 billion), Glean (US$1 billion), and Stability AI (US$1 billion).

Featured image credit: edited from Freepik