Since its release in November 2022, artificial intelligence (AI)-powered chatbot ChatGPT has garnered much excitement in the technology industry, praised by industry observers and experts for its ability to accurately answer questions, mimic human language and complete a wide range of tasks, from creating software to formulating business ideas.

Developed by American AI research laboratory OpenAI, ChatGPT is a chatbot that’s able to articular answers across many domains of knowledge, handle complex queries, debug computer programs, compose music, write poetry, and much more.

ChatGPT leverages Generative Pre-trained Transformer 3 (GPT-3), a language model trained on large Internet datasets. GPT-3 is aimed at natural language answering of questions, but it can also translate between languages and coherently generate improvised text.

With 175 billion parameters, GPT-3’s language model is said to be one of the largest language processing AI models to date, making it better than any prior model for producing human-like text.

In the banking and fintech sector, applications for GPT-3 are wide-ranging, encompassing chatbots for customer inquiries, document processing and report generation, personalized financial advice, financial forecasting and fraud detection, to name a few.

Customer support and inquiries

GPT-3 can be integrated into virtual assistants to provide 24/7 customer support and respond to a customer’ financial inquiry in a prompt manner, whether that’s an account balance inquiry, or getting an update on a loan status.

The technology can also be used to facilitate the work of support staff, by, for instance, classifying tickets based on their content and then, getting them appropriately assigned, or by summarizing inquiries, helping thus agents quickly understand the issue and provide an appropriate response in a swift manner.

Document processing

Because GPT-3 is able to automatically extract information from documents and text, the technology can be used to generate financial reports and summaries, ultimately reducing time and effort in manual data analysis and processing.

The technology is able to analyze large amounts of financial data, identify patterns and extract critical insights, making it a powerful tool for use cases such as financial forecasting and investment analysis.

Personalized financial advice

Advisors can use GPT-3 to provide their customers with personalized financial advice. The technology can be used to generate custom-made financial plans and investment strategies based on a user’s goals, risk tolerance and financial situation. It can also identify spending patterns and offer suggestions for budget optimization.

Using GPT-3 for personalized financial advice would imply integrating the technology with a financial management platform, providing it thus with the necessary customer financial data to formulate relevant recommendations.

Loan processing

In loan processing, GPT-3 can make the underwriting process more efficient by automatically analyzing and assessing a borrower’s financial situation, credit history and income.

The technology can also help improve credit decisioning by reducing the risk of human error, identifying risk factors that would be otherwise overlooked, and automatically flagging potential risks.

Fraud detection

Banks can also use GPT-3 for fraud detection. Organizations can use historical fraud and transaction data to train GPT-3 to recognize anomalies in transaction patterns, detect fraudulent activity and flag anomalies.

The technology can assist in the detection and prevention of fraud by generating alerts and reports, and by notifying relevant personnel of potential fraud.

GPT-3 creator OpenAI is ranked by AI researchers as one of the top three AI labs worldwide. The company received earlier this month a multiyear, multibillion-dollar investment from Microsoft, a deal which marked the third phase of the partnership between the two companies and which followed previous investments from the tech giant in 2019 and 2021.

OpenAI’s AI chatbot ChatGPT went viral shortly after its release on November 30, 2022, surpassing one million users in just five days.

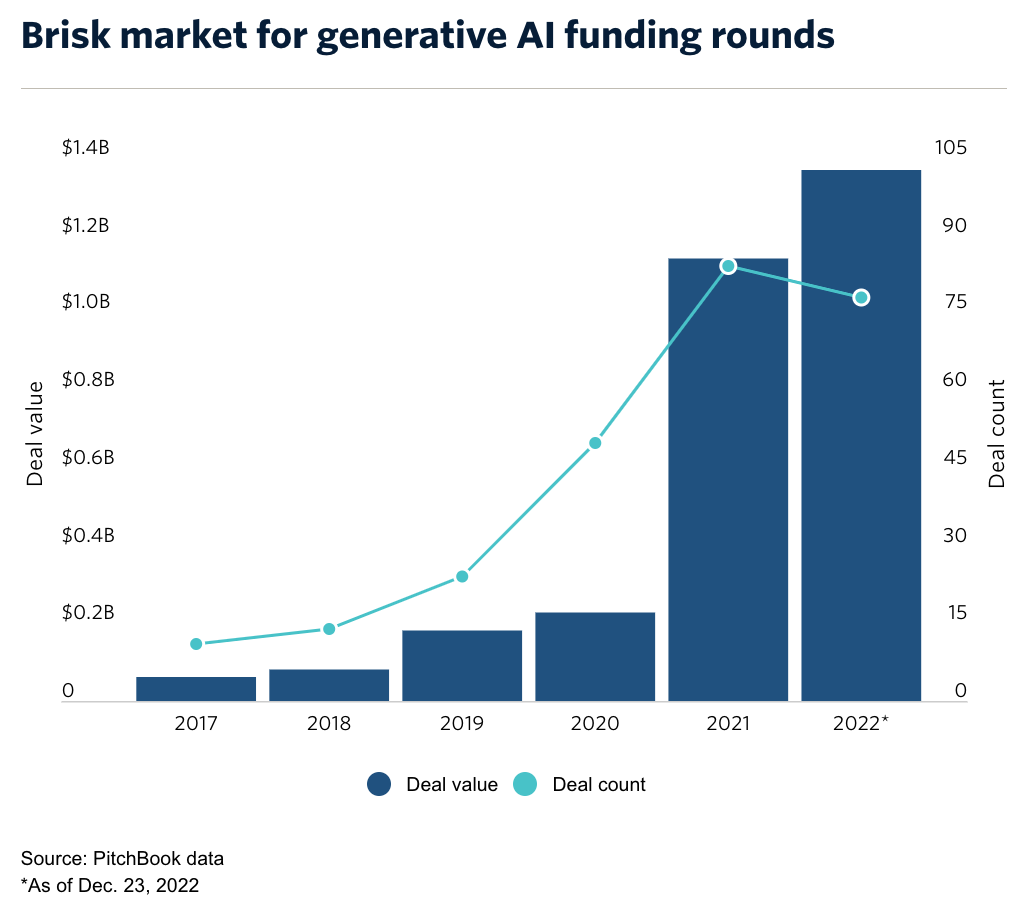

Venture capital investment in generative AI, or algorithms that can be used to create original content, increased nearly 500% between 2020 and 2022 to US$1.37 billion, data from Pitchbook show.

Generative AI funding rounds, Source: Pitchbook, Dec 2022

Featured image credit: freepik