Digital Asset Data and Infrastructure Sector Poised for Further Maturation and Growth

by Fintechnews Switzerland June 4, 2020Healthy competition and institutionalization of the industry, combined with COVID-19 related pressures on funding, will lead to further maturation of the digital asset data and infrastructure sector, with M&A deals expected to multiply in the near future, according to a new report by The Block.

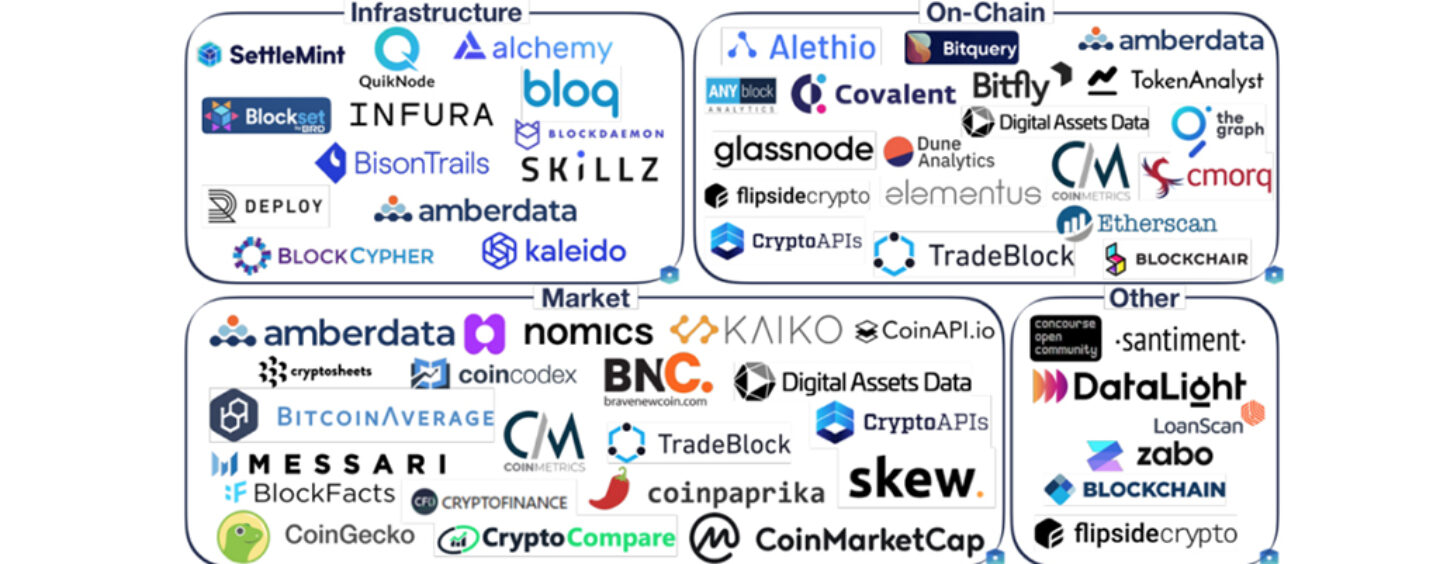

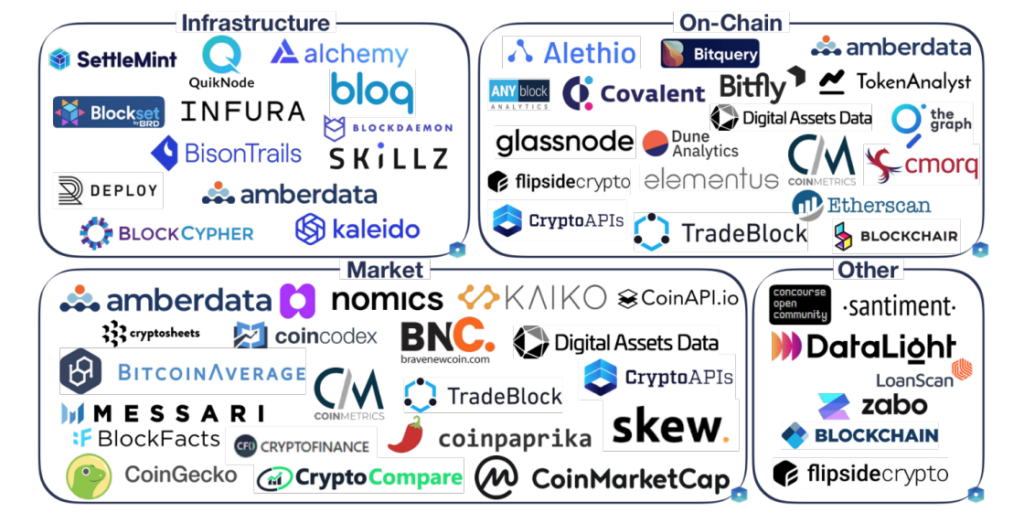

In research paper titled The State of the Digital Asset Data and Infrastructure Landscape, The Block looks at the digital asset data and infrastructure sector by analyzing a sample 51 firms in the sector and interviewing 35 participants.

Industry sample, Source: The State of the Digital Asset Data and Infrastructure Landscape, The Block, April 2020

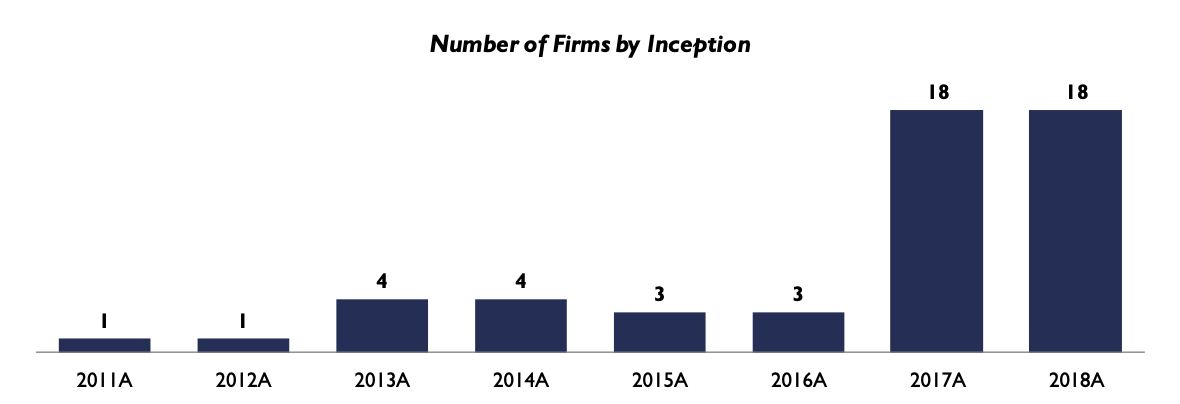

According to the study, more than half of the surveyed companies were launched in either 2017 or 2018. These years coincide with the crypto bubble of 2017 as well as with the entrance of institutional firms including the International Continental Exchange (ICE), CME Group and Fidelity, in the space, the research notes.

Number of firms by inception, Source: The State of the Digital Asset Data and Infrastructure Landscape, The Block, April 2020

46% of these companies are headquartered in the US, followed by the European Union (EU) (22%), and the UK (13%). According to the report, this showcases that these companies strategically chose to set up shop at locations that host major financial and business hubs to get easy access to clients such as institutional investors, digital asset businesses, and developers.

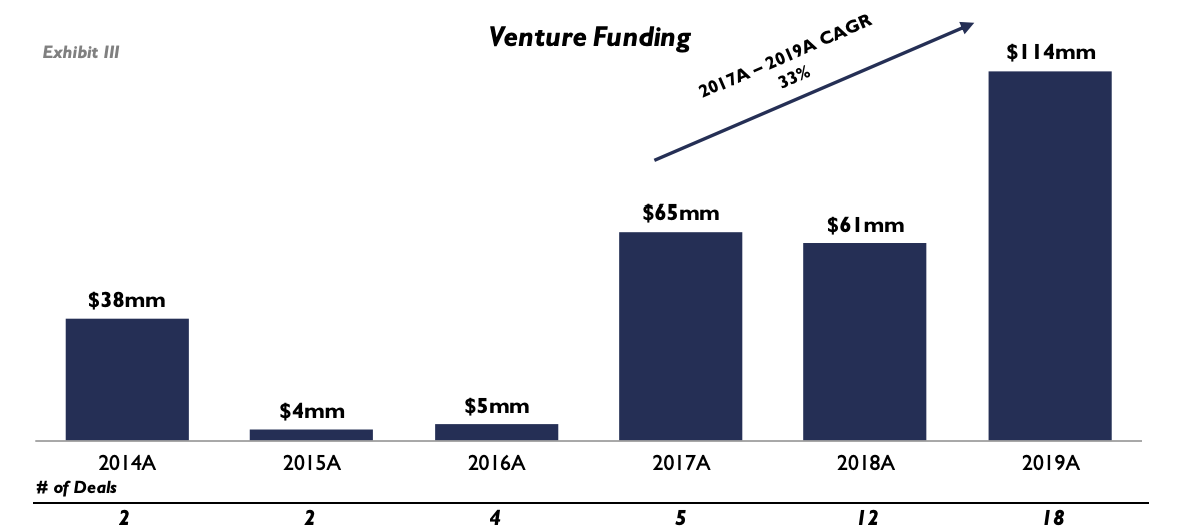

Venture funding and acquisitions

From 2014 to 2019, companies in the digital asset data and infrastructure sector raised over US$286 million in venture funding through 44 deals, implying that sector is still nascent. These numbers are relatively small when compared with the broader blockchain and digital assets industry which saw US$16.2 billion raised in venture funding across 2,775 deals over the same time frame, the report notes.

Venture funding activity however started surging in 2017, with the sector recording a 1,183% year-on-year increase by the end of 2017. Between 2017 and 2019, the digital asset data and infrastructure space saw a remarkable 33% compound annual growth rate (CAGR), the report says.

Venture funding into digital asset data and infrastructure companies, Source: The State of the Digital Asset Data and Infrastructure Landscape, The Block, April 2020

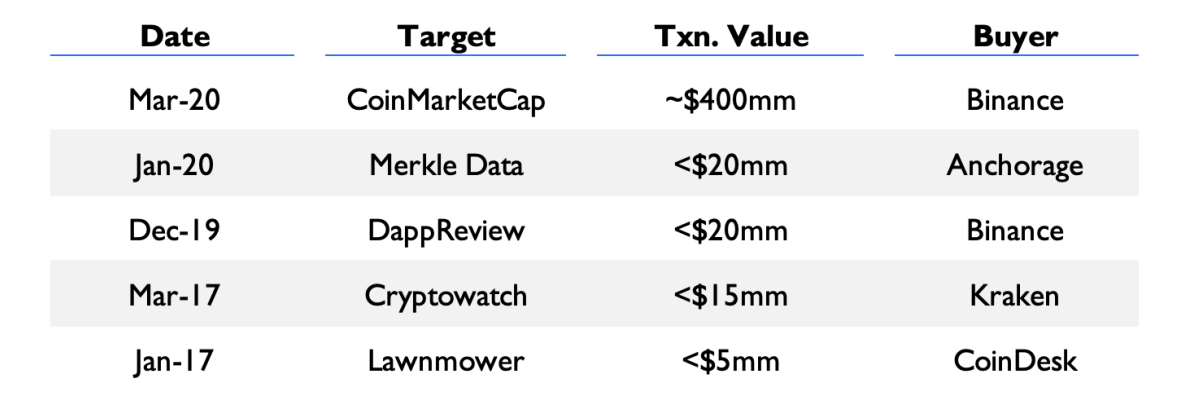

2017 also saw the industry’s first acquisitions take place, it notes. For example, digital asset exchange Kraken acquired charting and trading data platform Cryptowatch in March, and blockchain media leader CoinDesk purchased market data and investment tool Lawnmower in January.

But it’s actually in 2020 that the digital asset data and infrastructure sector saw its first major acquisition with Binance, the world’s largest cryptocurrency exchange by market volume, purchasing popular digital asset data site CoinMarketCap for a reported US$400 million.

Selected acquisitions in the digital asset data and infrastructure sector, Source: The State of the Digital Asset Data and Infrastructure Landscape, The Block, April 2020

For the research, The Block segmented the 51 companies it studied into three main verticals: infrastructure providers, which offer blockchain node infrastructure services and developer tools (e.g. Alchemy and Infura); on-chain metrics providers, which offer services that change raw and unorganized public blockchain data into user-friendly and digestible data (e.g. Etherscan and TradeBlock); and market data providers serving retail customers and/or enterprises (e.g. Kaiko and CryptoCompare).

Among the trends to watch out for, the report notes that the institutionalization of the digital asset space, a trend that began in 2019, will further push demand for enterprise-quality market data.

In the retail space, the growth of futures and options markets will force market data providers to fully integrate derivatives data and become more sophisticated. Diversified revenues will continue to grow in popularity, the report says, and more retail-facing providers will explore serving an enterprise clientele as well.