Germany, Austria and Switzerland, also referred to as the DACH region, have been proponents of fintech in Europe from the beginning, an early support that has enabled the region to establish one of the world’s most vibrant and dynamic fintech ecosystems.

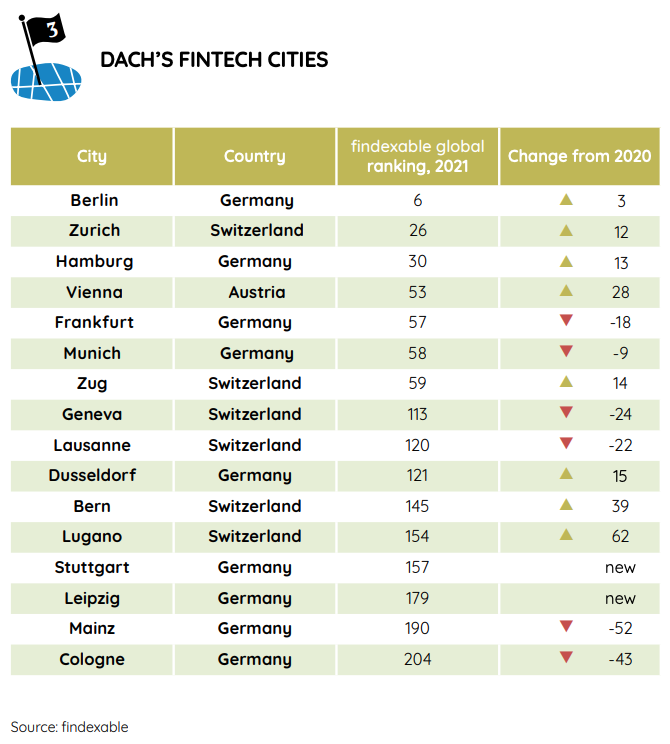

In 2021, fintech research and analytics firm Findexable named Switzerland the fifth biggest fintech hub in the world, and Germany, the 9th largest. The 2021 Global Fintech Ranking, which considered a location’s density of fintech companies and accelerators, payments ecosystems and the ease of doing business, also placed Berlin, Zurich and Hamburg among the world’s top 30 most prominent fintech cities in the world, ahead of locations including Seoul, Paris, Dubai and Shenzhen.

DACH’s fintech cities, Source: Findexable/Mambu, Aug 2022

According to a separate August 2022 by Finexable in partnership with German software-as-a-service (SaaS) cloud banking platform Mambu, the growth of DACH’s fintech industry has been enabled by the region’s advanced technical infrastructure, strong human capital and longstanding banking and asset management industries, which have provide both sources of capital and huge client bases and problems to solve.

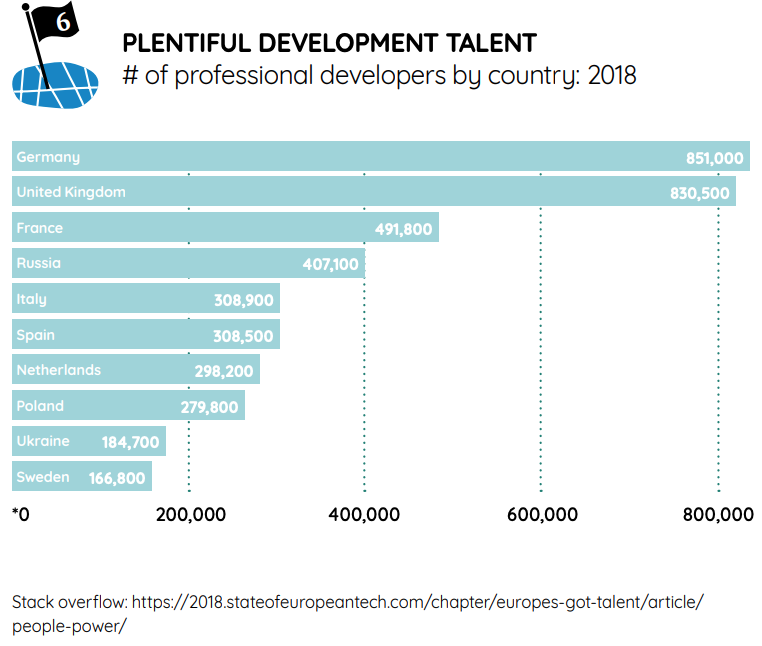

DACH countries account for just 13% of Europe’s population, but a fifth of its software developers, the report says. Germany, meanwhile, accounts for twice as many patent applications a year than any other European country.

Number of professional developers by country, 2018, Source: Findexable/Mambu, Aug 2022

In 2022, DACH’s fintech ecosystem continued to grow and mature, on the back of increased consumer adoption, solid fintech funding activity and growing interest from strategic investors. This year, industry stakeholders and observers are expecting more innovations in burgeoning domains like climate/green fintech, an uptick in merger and acquisition (M&A) transactions, as well as increased demand for embedded finance solutions.

Fintech funding activity remains strong

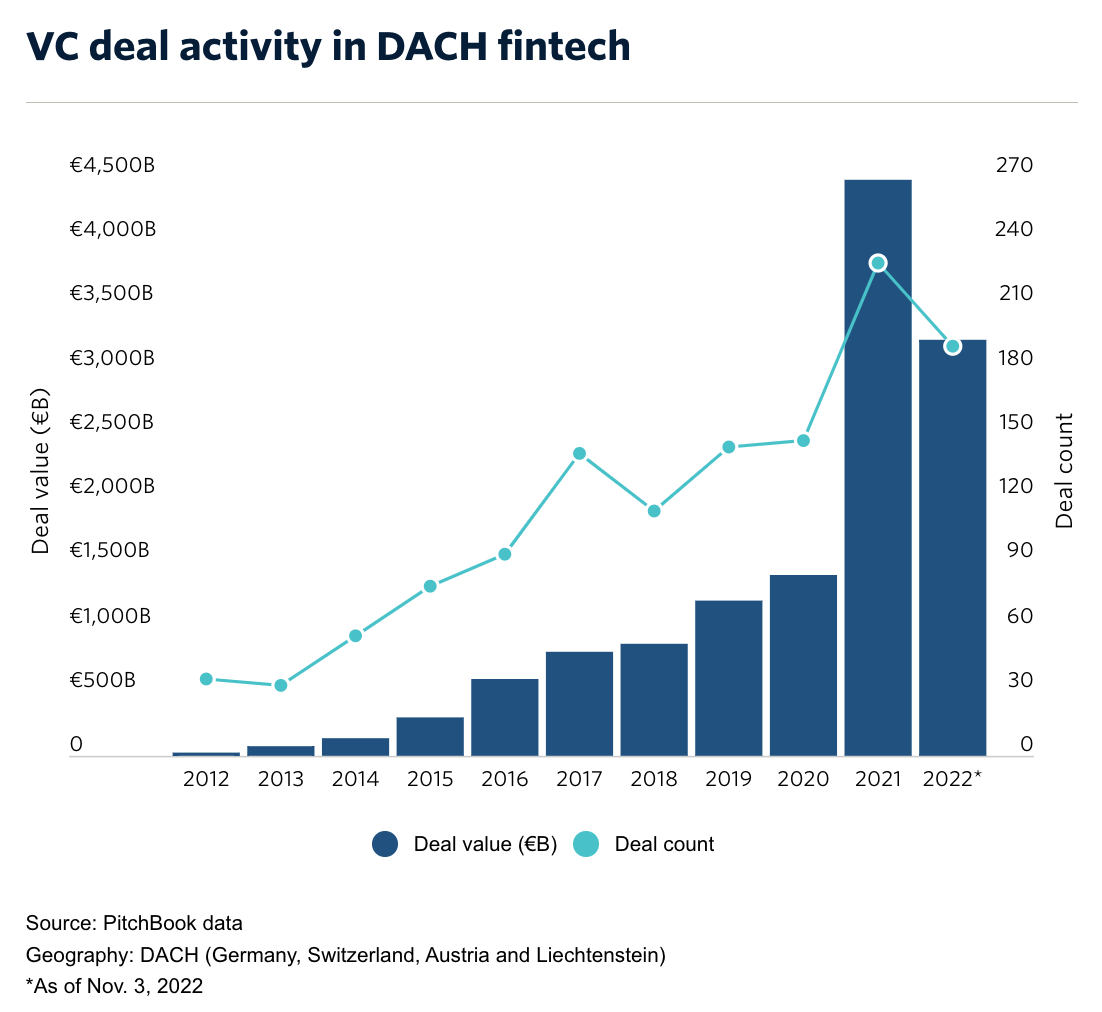

Despite a pullback in VC dealmaking, fintech funding in the DACH region remained strong in 2022, registering is second-best year to date, data from Pitchbook show.

As of November 2022, a total of 191 deals worth EUR 3.2 billion had been completed in the sector across Germany, Switzerland, Austria and Liechtenstein.

The figures fell short of 2021, which saw 230 rounds totaling EUR 4.5 billion, but nevertheless made fintech one of the region’s most active verticals for VC dealmaking by accounting for 9.2% of overall deal value and 7.5% of the region’s total number of rounds.

VC deal activity in DACH fintech, Source: Pitchbook, Nov 2022

Soaring fintech funding activity in DACH over the past years has pushed valuations to new heights. Currently, the region is home to eight fintech unicorns and all of them reached a US$1 billion and plus valuation within the past three years, data from CB Insights show.

Taxfix, Berlin’s digital tax accounting, is the latest company to join the club after securing a US$220 million Series D in April 2022 at a US$1 billion valuation.

DACH’s other fintech unicorns are German digital bank N26 (US$9.23 billion valuation), insurtech firm WeFox (US$4.5 billion), digital wealth manager Scalable Capital (US$1.4 billion), Berlin-based BaaS platform Solarisbank (US$1.65 billion), German neobroker Trade Republic (US$5.4 billion valuation), Swiss bitcoin vault Numbrs (US$1 billion), and Austria crypto exchange BitPanda (US$4.11 billion), data from CB Insights show.

Growing appetite for fintech investments

In 2022, strategic investors in the DACH region started accelerating their involvement in fintech and bolder in their investments and acquisitions, a trend that’s set to carry on in 2023, according to a September 2022 report by PwC.

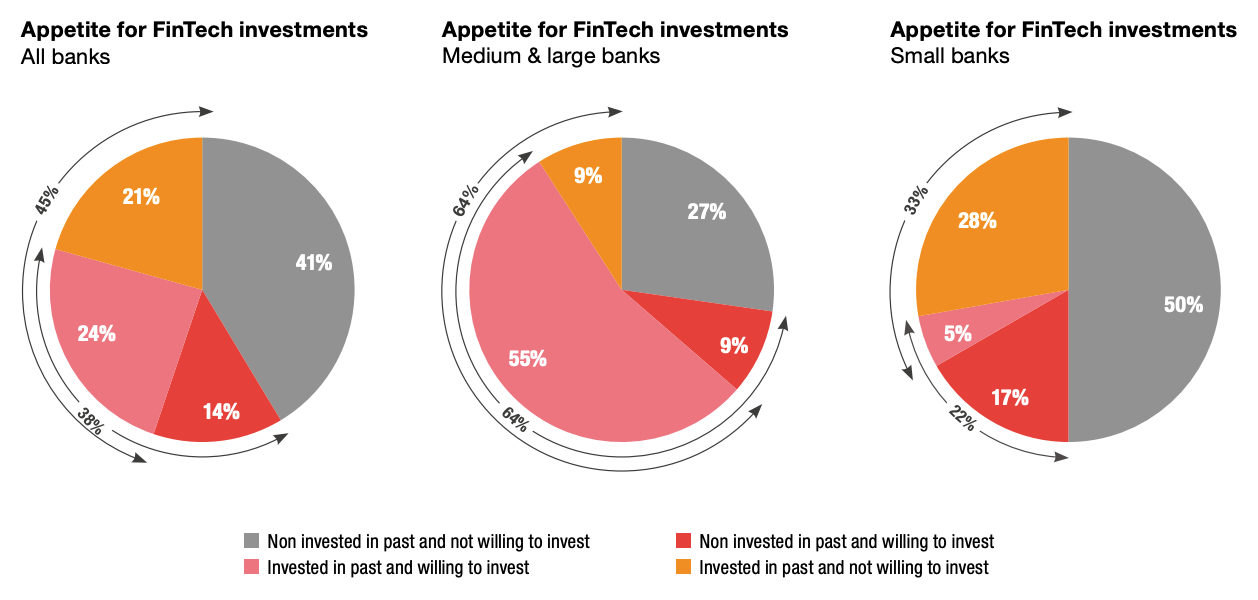

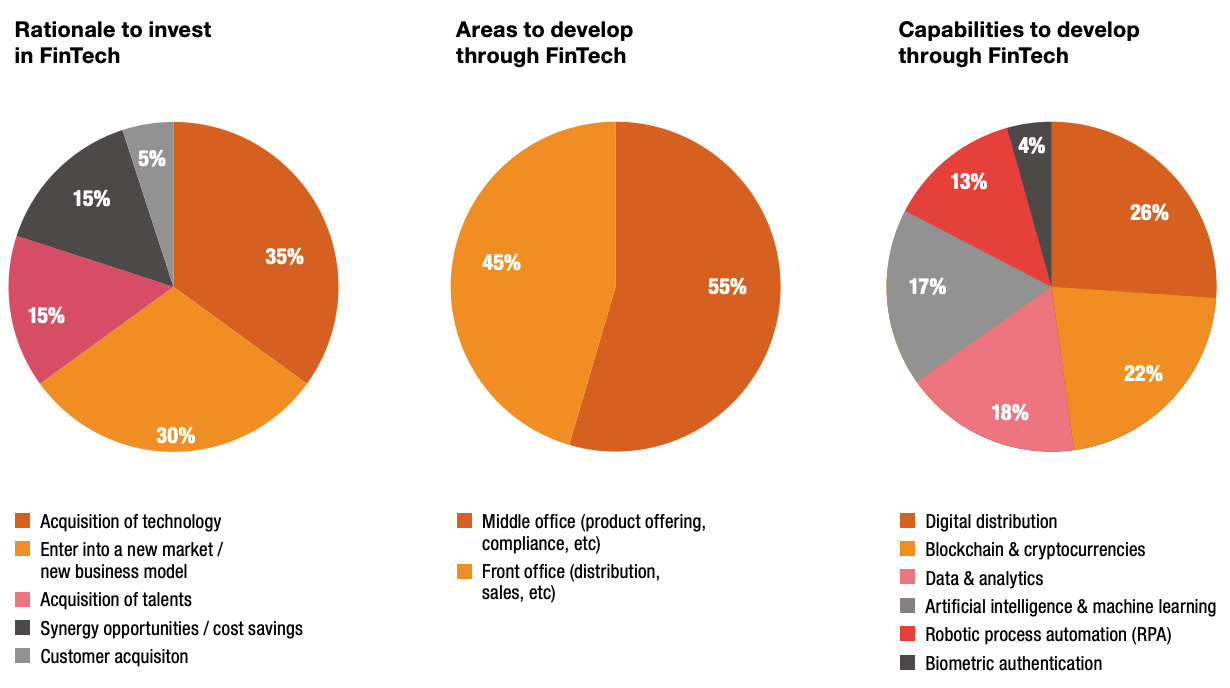

A survey conducted as part of the report, found that, of the 30 bank executives interviewed, 45% of respondents in Switzerland and Liechtenstein had already invested in fintech. Moving forward, 38% of respondents indicated that they intended to invest in fintech over the next two years, showcasing the banking sector’s increasing appetite for fintech investments.

Appetite for fintech investments in the Swiss and Liechtenstein banking landscape, Source: PwC, 2022

For most banks, the main reasons they invested in a fintech company was to gain access to new technology (35%) or enter new market and business model (30%). Digital distribution (26%), blockchain and cryptocurrencies (22%) and data analytics (18%) were cited as the top capabilities they sought to develop through fintech investments.

Wealthtech and blockchain/crypto – two sectors that are capital-light and which promise high margins – were identified as the most attractive fintech verticals to invest in. Insurtech, lending and payments/billing were named as the least interesting vertical options.

Why do banks invest in fintech, Source: PwC, 2022

More market consolidation in 2023

Looking at fintech funding trends observed in DACH last year, PwC expects an ongoing or even improved deal flow in the course of 2023. The consultancy also predicts an uptick in M&A transactions, a sentiment that’s shared by Yusuf Ozdalga, partner at QED Investors.

“I think all fintech sectors will see M&A activity increase: payments, wealth management, lending, and neobanks, just to name a few,” Ozdalga told Sifted in a statement.

“The dynamics driving M&A apply broadly — and while there are nuances across subsectors, the overarching theme of M&A will be a constant.”

Nick Sando, principal at Octopus Ventures, noted that the BaaS vertical, in particular, was primed for consolidation in 2023.

“2021 saw a great deal of funding into the BaaS category,” Sando told the media outlet.

“Many of the BaaS providers have customer bases heavily skewed towards very early-stage fintech companies, some of which will likely continue to find it difficult to operate and raise in 2023. This will likely lead to increased customer churn and revenue per customer falling for some of the BaaS providers.”

The rise of green fintech

In 2022, funding to climate fintech companies reached a new high, totaling US$2.9 billion in VC raised by companies in the sector, data from CommerzVentures, the corporate venture capital (CVC) arm of Commerzbank in Germany, show. The sum represents more than double what was secured in 2021 (US$1.2 billion) and showcases accelerating investor appetite for the nascent sector.

In 2023, the momentum is set to carry on as new use cases and subsectors like biodiversity and natural capital emerge and gain traction, Paul Morgenthaler, managing partner at CommerzVentures, told Sifted in a recent interview.

“In addition to the climate crisis, we have a biodiversity crisis,” Morgenthaler said.

“We are seeing a lot of interesting new approaches for investing in natural capital and preserving biodiversity, and we expect some very successful companies to emerge in that space over time.”

These companies are tackling the “biodiversity crisis” and are introducing “new approaches for investing in natural capital and preserving biodiversity,” similarly to what startups in the carbon offsetting space have been doing with carbon credits, he said.

All in all, Morgenthaler expects the whole climate fintech sector to perform well in 2023, a sentiment that was echoed by Manuel Silva Martinez, general partner at Mouro Capital, who told the media outlet that 2023 could very well be “the breakthrough year” for climate fintech.

“Up until now, we have been somewhat underwhelmed by this space … Perhaps 2023 is the year we’ll start seeing real businesses being built at the crossover of financial services and sustainability,” he said.

“So, less about analytics and environmental, social and governance (ESG) data reporting, and more about how sustainability is embedding into people’s lifestyles, from consumption to real estate or mobility.”

Crypto sector under regulatory scrutiny

The crypto industry faced a tough year 2022 amid a market meltdown and company collapses. For Magda Posluszny, senior associate at Lakestar, 2023 could mark the end of an era of unregulated crypto markets.

“What comes next is increased regulatory scrutiny, acceleration of regulatory frameworks across the world and growing demand for compliance solutions across the traditional finance and crypto sectors,” she told Sifted in a statement.

DACH is home to some of the world’s most dynamic crypto and blockchain ecosystems. In Switzerland, the canton of Zug has earned the nickname Crypto Valley for the high number of blockchain-based fintech companies based in the area. Separately, the Swiss city of Lugano unveiled last year plans to develop new infrastructure to adopt cryptocurrencies and allow residents to use crypto for everyday spending.

Germany, meanwhile, is considered one of the world’s pioneers in blockchain technology adoption. This early support has enabled the nation to become the largest blockchain hub in the whole European Union (EU). The EU Blockchain Observatory and Forum, a European Commission initiative to accelerate blockchain innovation and adoption, estimates that Germany is currently home to more than 340 blockchain solution providers and startups, surpassing Estonia with 200+ but behind the UK with 1,000+. The country also has one of the largest pools of blockchain talent in the EU with 4,600 professionals.

In Austria, though the blockchain scene is much smaller than the ones in Germany and Switzerland, the industry has grown considerably over the past years and has minted its first unicorn startup.

Local crypto exchange Bitpanda reached a US$1.2 billion valuation in 2021 after raising a US$170 million round. Th round came on the back of an impressive growth spurt, with the company reporting the same revenue in the first two months of 2021 as in the whole of 2020. Bitpanda, which claims four million users, is the country’s first and only fintech unicorn startup.

In Austria, blockchain and digital currencies have also sparked the interest of the government, which unveiled earlier this year a research project to learn more about tokenization and central bank digital currencies (CBDC).

Digital payments on the rise

Though cash has long been the preferred method of payment in the DACH region, digital transactions are catching up fast, a trend that was accelerated by the COVID-19 pandemic.

In June 2019, overall contactless adoption in DACH was at just 40%. This figure rose quickly to 71% by June 2020 and by June 2021 more than three quarters of cashless transactions in Germany, Austria and Switzerland were contactless, according to data published by Nets Group, a leading paytech firm from Denmark.

As of September 2021, the average contactless rate was 77% in Germany, 82% in Austria and 80% in Switzerland.

“The pandemic has significantly accelerated a steadily growing trend in the DACH region,” said Robert Hoffmann, CEO of Nets Merchant Services.

“It was inevitable that Germany, Austria and Switzerland would ultimately achieve high levels of contactless payment adoption, but without this catalyst, it would have taken years to reach where it is today. An increasing number of merchants here are now offering and actively encouraging tap-and-go, which is becoming the norm for consumers.”

The 2022 Finexable and Mambu report noted that the rise of e-commerce in DACH has fueled usage of digital payments, and most particularly, digital wallets, open invoicing, and buy now, pay later (BNPL) arrangements.

Interest in embedded finance on the rise

In 2023, embedded finance will continue to gain further momentum, Jennifer Heathfield-Lee, head of partnerships of ClearBank, said in a statement to Mambu. This growth will be driven by rising demand from non-financial companies looking to tap new revenue streams and increase customer engagement, as well as fintech companies looking for alternatives to BaaS.

“Fintech companies are increasingly reliant on their BaaS providers to speed up time to market, boost revenues, and meet compliance demands,” Heathfield-Lee said. “However, as fintech companies scale and look to offer more complex services, many BaaS providers are struggling to keep up with this demand. This is resulting in lost revenues, significant resource requirements, rising costs, and at worst intervention from the regulator.

“Because of these issues, we’re seeing an appetite from across Europe for embedded banking as it’s more than just licensing, it’s the ability to create fit-for-purpose, targeted services supported by an API-enabled technology infrastructure in full compliance with regulatory requirements.”

Fintech DACH Trend Webinar- Replay