Along with being one of the most efficiently regulated and supervised financial centers in the world, Switzerland is trying to emerge as a fintech hub.

Swiss Finance Startups, but also Swiss Fintech, are only a few of the numerous initiatives that seek to foster fintech innovation by supporting the local startup scene.

According to non-profit organization Swiss Fintech, there are close to 150 fintech startups that seek to reinvent how we pay, invest, lend and save.

In this extensive list, we’ve picked 10 of what we believe are the most promising startups. Here it goes:

Knip

Knip is a curated finance startup that helps users manage their insurances in a single app. The app provides users with a bi-annual review of their finances.

Founded in 2013, Knip has been experiencing rapid growth and has recently launched services in Germany. Recently Knip was named the 6th best Swiss Startup.

Cash Sentinel

Cash Sentinel is an online payment service dedicated to buying and selling used vehicles without the need of manipulating cash.

The service allows real-time, in-person money transfers of up to 100,000 CHF and works with any mobile phone, including non-smartphones. It is also fully integrated on the Swiss marketplace AutoScout24.

Its key benefit is that users can send large amount through its mobile payment service, while being charged a low fee only when the transaction is confirmed. CashSentinel was recently named the 2nd best Swiss Fintech Startups

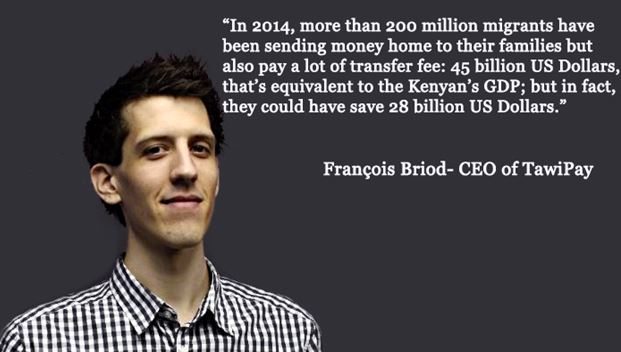

Tawipay

Tawipay is an online platform that allows users to find and compare money transfer services.

This comparison website seeks to provide transparency and empower migrants with clear and complete information to help them find the best money transmitter service for their needs. Tawipay was awared with the first price on the first Swiss Fintech Pitch.

Advanon

Led by former Google interns, Advanon is an online platform that makes the financing of small and medium businesses easier and more flexible. The platform allows selling invoices in a less frictional manner than what factoring companies offer.

Founded earlier this year, the startup has recently closed its first round of financing. The round counted among its participants award-winning investor Daniel Gutenberg, who joined both personally and through the Venture Incubator Fund.

milliPay

milliPay is a micropayment system that allows users to pay with a single click, across the web and on any device.

Founded in 2011, milliPay can be used by services to charge minimal amounts on a pay-as-you-go basis. Its innovative cryptographic protocol helps processing payment transactions extremely secure and efficient.

Crowdhouse

Crowdhouse is Switzerland’s first property crowdfunding portal. On the platform, users can start investing starting from 25,000 CHF and become co-owners.

The company seeks to democratize real estate ownership and make everyone a “happy landlord.” Crowdhouse was awarded with the 2nd place on the Swiss Fintech Pitch.

DealMarket

Zurich-based DealMarket provides users with an online platform for fundraising and deal flow management.

Launched in mid-2011, DealMarket currently serves some 60,000 recurring users from 154 countries. Over 3,000 deals and service providers have been promoted or listed so far. Global leading banks, including UBS, have been using DealMarket’s deal flow management tools.

Numbrs

Numbrs, a product of CentralWay, is a mobile app that provides worldwide access to users’ bank accounts from any place and in any time. The platform also enables users to manage these accounts and conduct transactions.

The application supports all major banks and is compatible with iOS iPhone and iPod Touch.

Headquartered in Zurich, the startup has raised a total of US$11.5 millions in two funding rounds.

Ethereum

Ethereum is not a company but a platform developed by Switzerland-based non-profit organization the Ethereum Foundation.

This ‘crypto 2.0’ project consists in a decentralized platform that runs smart contracts: applications that run exactly as programmed without any risk of downtime, censorship, fraud or third-party interference.

Simply put, Ethereum aims to decentralize pretty much anything on the Internet. Ethereum is widely known for being the fourth most well-funded crowdfunding project, raising more than US$18 million.

Monetas

Monetas is a software company founded by Johann Gevers. The Monetas platform is an advanced crypto-transaction technology that uses a cryptographically secured digital notary to enable all kinds of financial and legal transactions, public or private, worldwide.

With the Monetas platform, institutions, individuals and businesses can easily conduct transactions with all types of trade instruments, including all national and digital currencies. Seamless integration with Distributed Ledger and Blockchain Technologies ensures the platform is future-proofed.