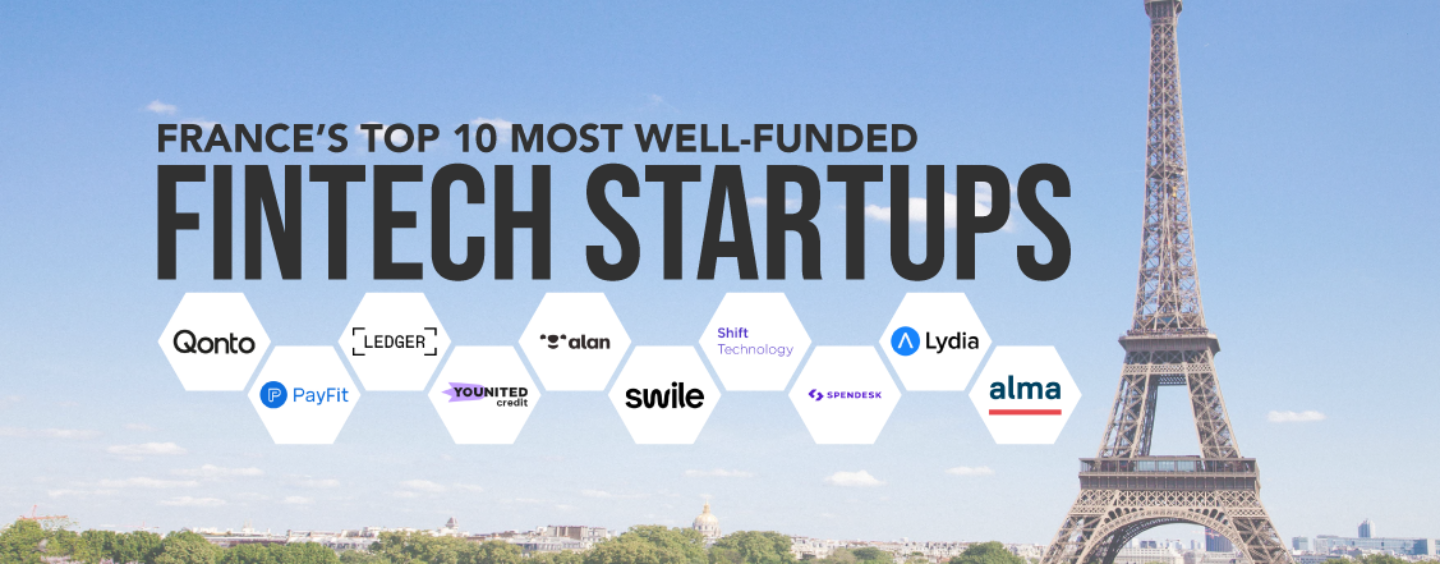

2021 was a blockbuster year for France’s fintech startups, which raised a record of EUR 2.2 billion on the back of booming demand for digital financial services.

Data from industry trade group France Fintech and French investment bank Bpifrance show that France now has a burgeoning fintech sector that employs some 30,000 people.

In 2021, more than 150 new fintech startups were founded, showcasing the sector’s dynamism, with insurtech, financing, micro-savings and impact finance emerging as the hottest segments.

Booming funding activity in 2021 brought valuations to new heights and turned five French fintech startups into unicorns, data from CB Insights show. The momentum is continuing this year with a number of large funding rounds announced in Q1 2022 and already two startup joining the unicorn club.

To get a sense of France’s up-and-coming fintech leaders, we take a look today at the top ten most well-funded private fintech companies.

Qonto – US$703 million

Founded in 2017, Qonto is a business finance solution provider serving freelancers, startups and small and medium-sized enterprises (SMEs). The company allows them to open a digital bank account in just a few minutes, get accompanying payment cards and make transfers seamlessly and conveniently. The solution also comes with an array of financial tools and capabilities that include accounting, bookkeeping and spend management.

Qonto serves more than 220,000 clients in France, Germany, Italy and Spain, and has been listed by the French government in the Next40 club, a group comprising the 40 most promising scale-ups in France with the potential to become global tech leaders.

Qonto has raised a total of EUR 622 million (US$703 million), its latest round being a EUR 486 million (US$552 million) Series D in January 2022, and is valued US$5 billion, according to CB Insights.

PayFit – US$496 million

Founded in 2015, PayFit provides cloud-based payroll management and human resources (HR) management solutions for businesses. PayFit’s features and capabilities include wage management, expense reporting, employee management, leave management, workflow management, onboarding and organizational management.

PayFit strives to support the digital transformation of HR through a reliable software-as-a-service (SaaS) solution that enables a superior user experience. The company claims to serve over 6,000 customers in France, Germany, Spain and the UK, and has raised EUR 433 million in funding (US$496 million). Its latest round was a EUR 254 million Series E (US$289 million) in January. PayFit is valued EUR 1.8 billion (US$2.1 billion).

Like Qonto, PayFit is part of France’s Next40 list.

Ledger – US$466 million

Founded in 2014, Ledger is the all-in-one cryptocurrency management solution serving retail and institutional clients in 200 countries. Ledger’s products include the world’s most popular hardware wallets, the Ledger Nano series, a user friendly and secure cryptocurrency management and exchange platform, called Ledger Live, and a digital assets security solution for financial institutions, called Ledger Enterprise Solutions.

A market leader in cryptocurrency hardware wallets with more than three million devices sold, Ledger claims its products now secure an estimated 15% of all cryptocurrency assets globally, and counts over 1.5 million monthly users on Ledger Live.

Ledger has raised a total of US$466 million in funding, its latest round being a US$380 million Series C fundraising in June 2021. The company was last valued at US$1.5 billion. Ledger is another Next40 scale-up.

Younited – US$400 million

Founded in 2009, Younited, formerly known as Pret d’Union, is a regulated credit institution in the European Union (EU) specializing in consumer loan. The company focuses on integrating instant credit into the customer journey.

Younited allows professional qualified investors to finance transparent and competitive consumer loans. Borrowers, on the other hand, can ask for an instant loan of up to EUR 50,000 for a duration of up to 84 months. In 2019, the company expanded to business-to-business (B2B), offering banks, insurance companies, telcos, e-commerce retails and tech companies with banking-as-a-service (BaaS) solutions to provide their own customers with instant digital credit and payment options like buy now, pay later (BNPL).

The company claims it serves one million customers in France, Germany, Italy, Spain and Portugal, and expects to reach its EUR 5 billion gross merchandise value (GMV) milestone this year.

Younited has raised over EUR 323 million (US$400 million) in funding. The company is also amongst of France’s Next40.

Alan – US$360 million

Founded in 2016, Alan is a healthcare super-app offering personalized information, proactive care, care delivery and post-care services, as well as health insurance coverages.

Alan distributes its own health insurance plans to companies of all sizes as well as independent professionals. Its long-term goal is to become the go-to healthcare services and insurance platform in Europe and beyond, by prioritizing improved customer experiences and transparent pricing and policies.

The company claims to cover 270,000 members for more than 14,000 businesses, including WeWork, Deliveroo, JustEat, Vitaliance and Big Mamma, representing over EUR 140 million in annualized revenue.

It has raised about US$360 million in funding so far, according to CB Insights, its latest round being a EUR 185 million (US$220 million) Series D at a US$1.68 billion valuation. It’s also part of the Next40 list.

Swile – US$333 million

Founded in 2016, Swile, formerly known as Lunchr, is the developer of an employee benefits platform. Employees get a Swile Card and an accompanying mobile app designed to offer meal vouchers, gift vouchers and mobility benefits, as well as a group order functionality and capabilities such as reimbursements between colleagues, bill sharing, instant messaging and event organization.

Swile claims 750,000 employees use its services daily. The company serves SMEs and large firms including supermarket chain Carrefour, healthtech startup Doctolib, telco Free, and advertising multinational JCDecaux. It claims a 13% share in the corporate benefits market.

Swile has raised US$333 million in funding, its latest round being a US$200 million fundraising in October 2021. The company is valued US$1 billion, according to CB Insights, and is part of the Next40 list.

Shift Technology – US$320 million

Founded in 2014, Shift Technology delivers artificial intelligence (AI)-native decision automation and optimization solutions built specifically for the global insurance industry.

Addressing several critical processes across the insurance policy lifecycle, the Shift Insurance Suite helps insurers achieve faster, more accurate claims and policy resolutions. It features underwriting fraud detection, investigation tools, and cloud-based end-to-end claim processing and filing solutions.

Shift Technology claims it has analyzed nearly two billion insurance claims to date, and is serving more than 100 customers in 25 different countries.

Shift Technology has raised US$320 million in funding, its latest round being a US$220 million Series D in May 2021. The company is valued at US$1 billion, and is part of the Next40 list.

Spendesk – US$300 million

Founded in 2016, Spendesk aims to change the way companies manage their payments by offering a full-fledged corporate spending solution.

The solution is designed to save time and money across the entire spending process with 100% visibility and built-in automation. The central dashboard allows businesses to track budgets, receipts, and expense approvals for European companies. The solution

Spendesk claims to serve “thousands of companies across Europe and the US” including startups and established brands, such as Algolia, Soundcloud, Curve, Doctolib, Gousto, Raisin, Sezane, Wefox.

Spendesk has raised US$300 million in funding, its latest round being a US$100 million Series C fundraising. The company is valued US$1.5 billion, according to CB Insights, and it’s part of the Next40 club.

Lydia – US$260 million

Launched in 2013, Lydia is the developer of a full mobile banking app. The app provides customers with services to manage their financial life, giving them access to current and shared accounts, remunerated savings accounts, loans, instant bank transfers, mobile payments and investment.

Lydia claims its mobile app is used by more than 5 million users, and a third of France’s 18-35 year old adults. Lydia strives to become Europe’s first super-app and become the primary account for 10 million users within the next three years.

The company has raised US$260 million in funding, its latest round being a US$100 million Series C in December 2021. The startup is valued at US$1 billion, according to CB Insights, and is a member of the Next40 club.

Alma Finance – US$233 million

Founded in 2017, Alma is BNPL provider. The company offers a platform for retailers to provide their customers with instalment payments, allowing them to increase conversion rates and basket sizes. Users can manage sales via the dashboard, including payments, accounting exports, data analysis, and more.

Alma claims it serves more than 6,000 brands including upmarket department store chains Galeries Lafayette and Printemps, as well as Mauboussin, Samsonite and Lancel, and processes over EUR 1 billion worth of transactions annually.

Alma is now looking to expand to the Netherlands, Luxembourg, Portugal, Ireland, and Austria. The company raised EUR 115 million (US$131 million) in equity funding in February, bringing its total funding to EUR 210 million, according to a Reuters report. Like the rest of the list, Alma is part of the Next40 list.