Swiss Fintech Study 2022: Fintech Sector Rebounds After 2021 Decline

by Fintechnews Switzerland March 21, 2023After a market slump in 2021, the Swiss fintech industry rebounded in 2022, with the number of companies operating in the sector rising, investment increasing, and banking incumbents stepping up their digitalization game, a new report by the Lucerne University of Applied Sciences and Arts’ Institute of Financial Services Zug (IFZ) says.

The annual IFZ Fintech Study, released earlier this month, presents the current state and advancements in the Swiss fintech sector, examining trends and sharing predictions for the year ahead.

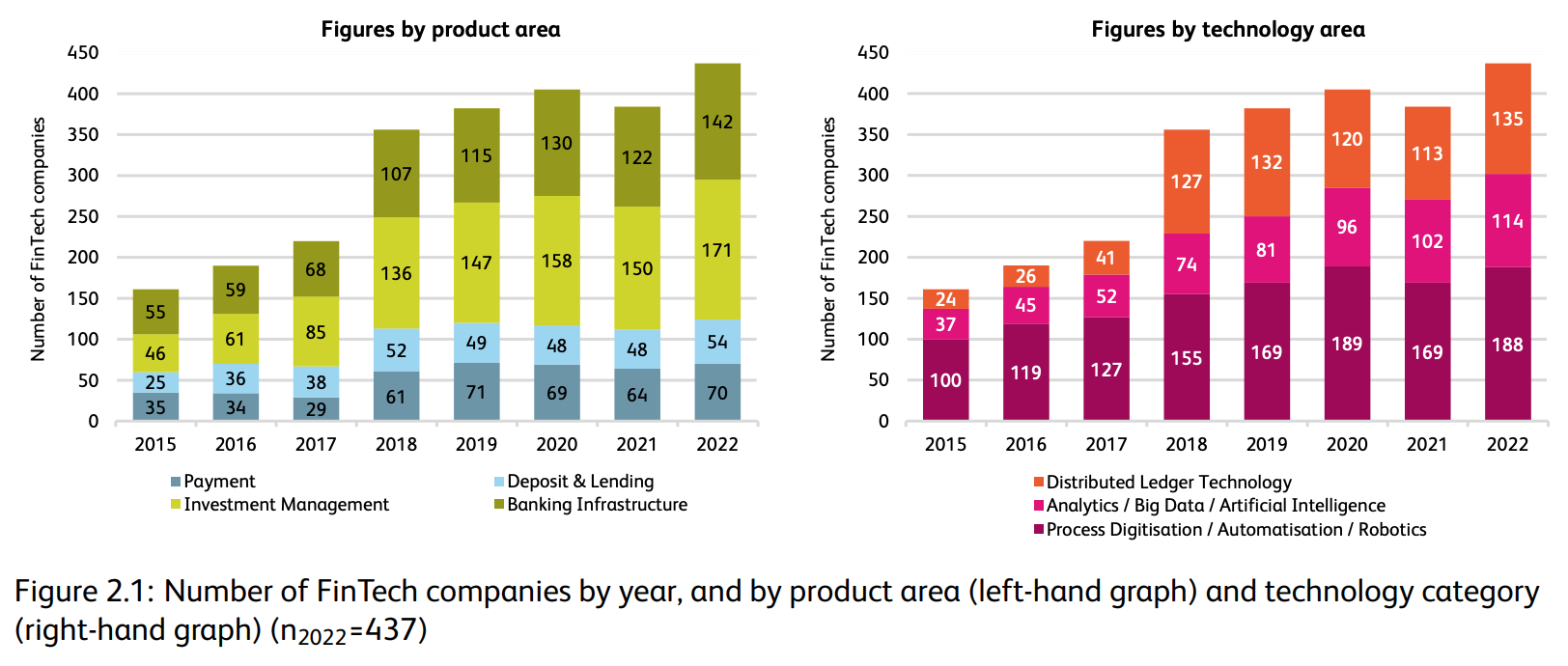

Results from the research show that the Swiss fintech sector grew considerably in 2022, rising from 384 active companies at the end of 2021 to 437 fintech companies a year later. The number – a new all-time high – represents a growth of 14% in the number of fintech companies active in the country year-over-year (YoY).

A breakdown by product area shows that the growth in 2022 was led by an increase in fintech companies operating in the segments of investment management, which added 21 companies (+14% YoY), as well as banking infrastructure, which added 20 companies (+16.4% YoY). These two categories have historically been Switzerland’s most developed fintech segments.

A breakdown by technology area shows that distributed ledger technology (DLT) saw the biggest growth in 2022, adding 22 companies (+19.5%).

Number of fintech companies by year, and by product area and technology category, Source: IFZ Fintech Study 2023, Institute of Financial Services Zug (IFZ), March 2023

Fintech investment remains strong

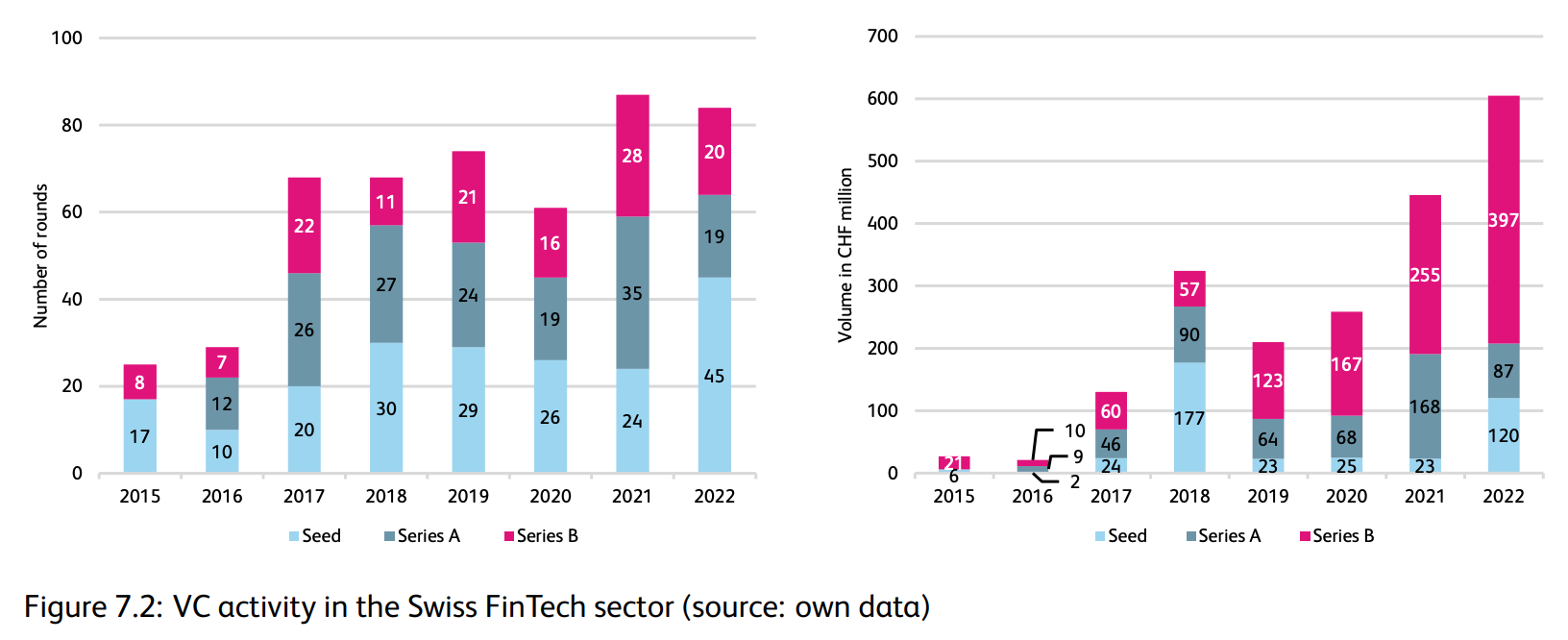

Despite the global downward trend, fintech funding activity in Switzerland remained strong in 2022. Against all odds, Swiss fintech companies secured a new record of CHF 605 million last year, up 36 YoY.

The growth of fintech funding in 2022 was driven by early-stage startups and seed rounds, which totaled CHF 120 million through 45 deals. 2022 was also marked by a mega-round of CHF 100 million and up. The deal, which was secured in January, was conducted by SEBA Bank and involved a CHF 110 million Series C.

VC activity in the Swiss fintech sector, Source: IFZ Fintech Study 2023, Institute of Financial Services Zug (IFZ), March 2023

Despite rising fintech funding, access to financing remains a hurdle

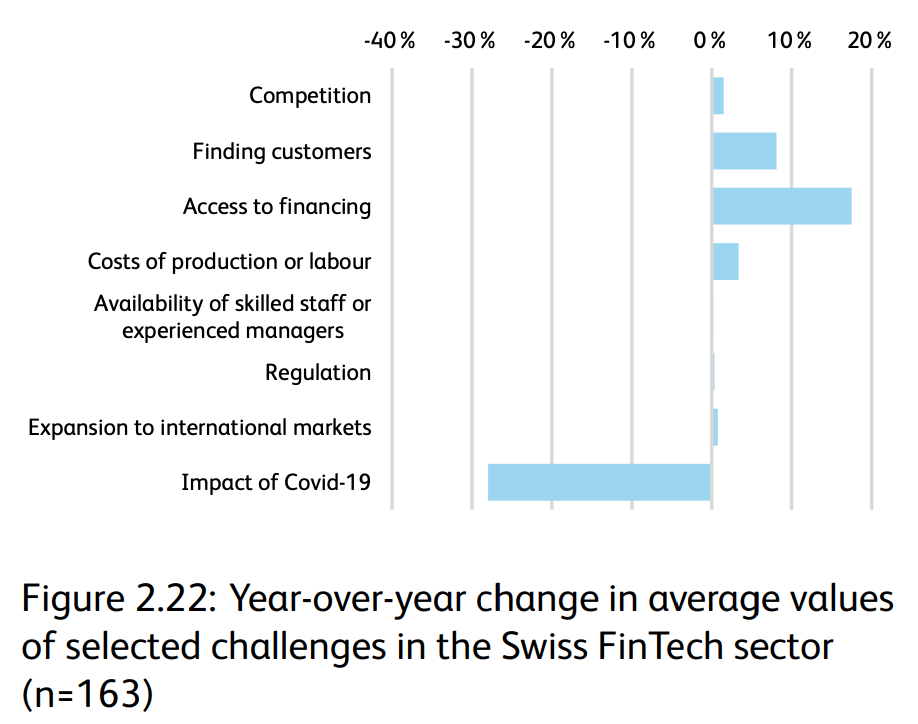

Although data show that Switzerland largely escaped the global funding downward trend, access to financial resources for fintech companies was perceived to be more difficult last year than the previous, results of a survey conducted as part of the study show.

The survey, which polled more than 160 fintech companies, found that the biggest YoY changes were recorded in access to financing, which increased the most in urgency (+17%), followed by the challenge related to finding customers (+8).

At the other end of the spectrum, the impact of COVID-19 recorded the largest decrease in urgency (-28%).

Year-over-year change in average values of selected challenges in the Swiss fintech sector, Source: IFZ Fintech Study 2023, Institute of Financial Services Zug (IFZ), March 2023

Swiss banks ramps up digital efforts

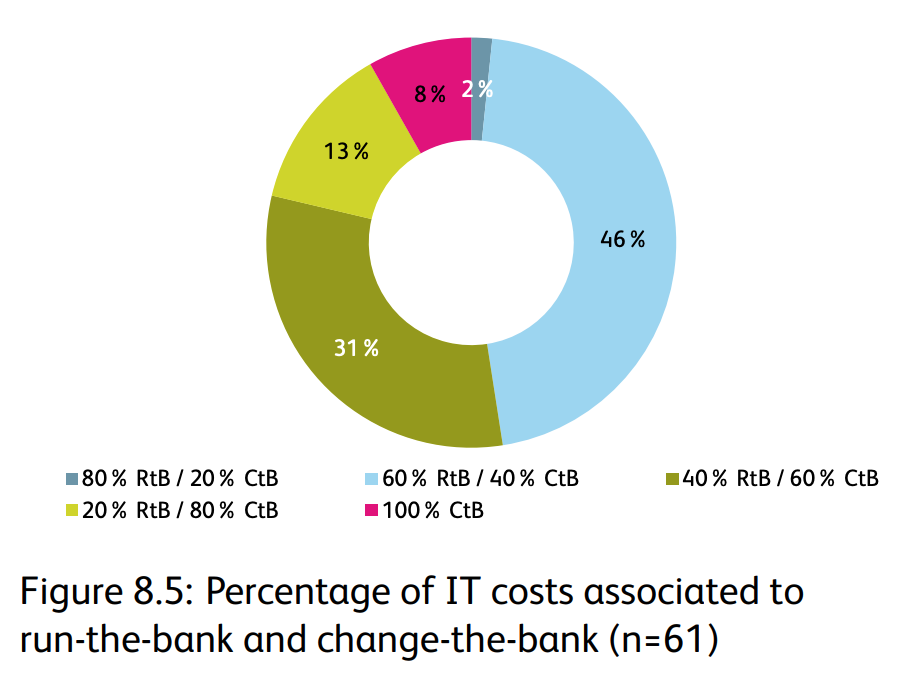

Another survey conducted as part of the study, which polled 61 Swiss banks, found that financial institutions increased their information technology (IT)-related resources in 2022.

These resources are now being increasingly invested in transforming the banking business, including the digitalization of business processes, and less in the pure maintenance of day-to-day business, results show.

In particular, 52% of Swiss banks said they invest a majority of their IT costs in “change-the-bank” activities, while 48% invest the majority in “run-the-bank”. These findings indicate increasing innovation in the banking sector, the report says.

Percentage of IT costs associated to run-the-bank and change-the-bank, Source: IFZ Fintech Study 2023, Institute of Financial Services Zug (IFZ), March 2023

Sustainable fintech gains traction

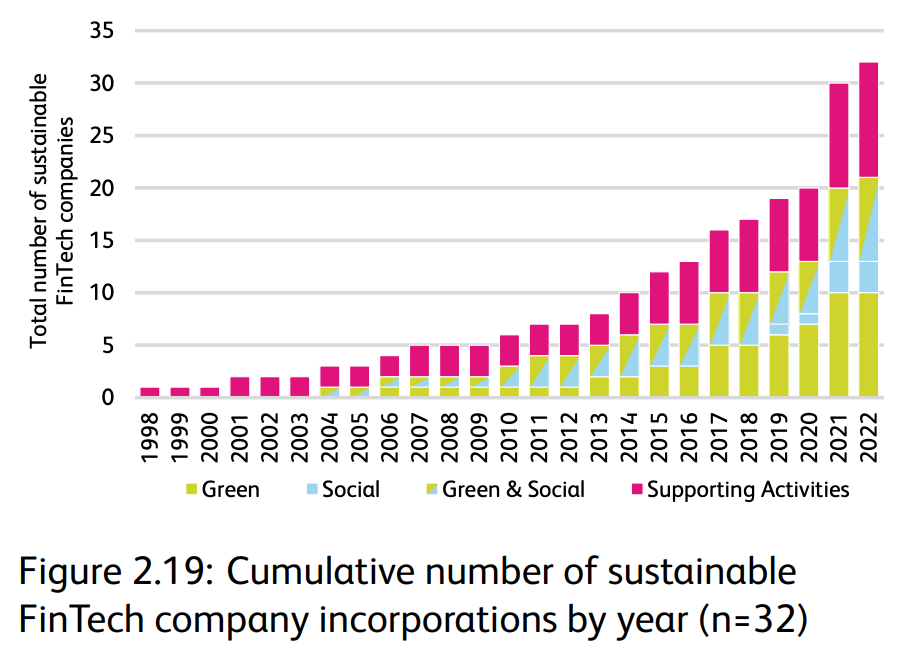

Another trend highlighted in the report is the rise of sustainable fintech. These companies aim to contribute to sustainable development by providing innovative products, services, and processes in the financial industry.

The study identified 32 Swiss-based sustainable fintech companies as of the end of 2022, implying that 7.3% of the country’s fintech companies are falling into the category. The figure represents a larger market share than the previous year during which sustainable fintech companies accounted for just 4.4% of the total industry.

As sustainable fintech continues to grow and evolve, new business models and opportunities are expected to emerge in the near future, the report says.

Cumulative number of sustainable fintech company incorporations by year, Source: IFZ Fintech Study 2023, Institute of Financial Services Zug (IFZ), March 2023

Crypto trading volumes dip

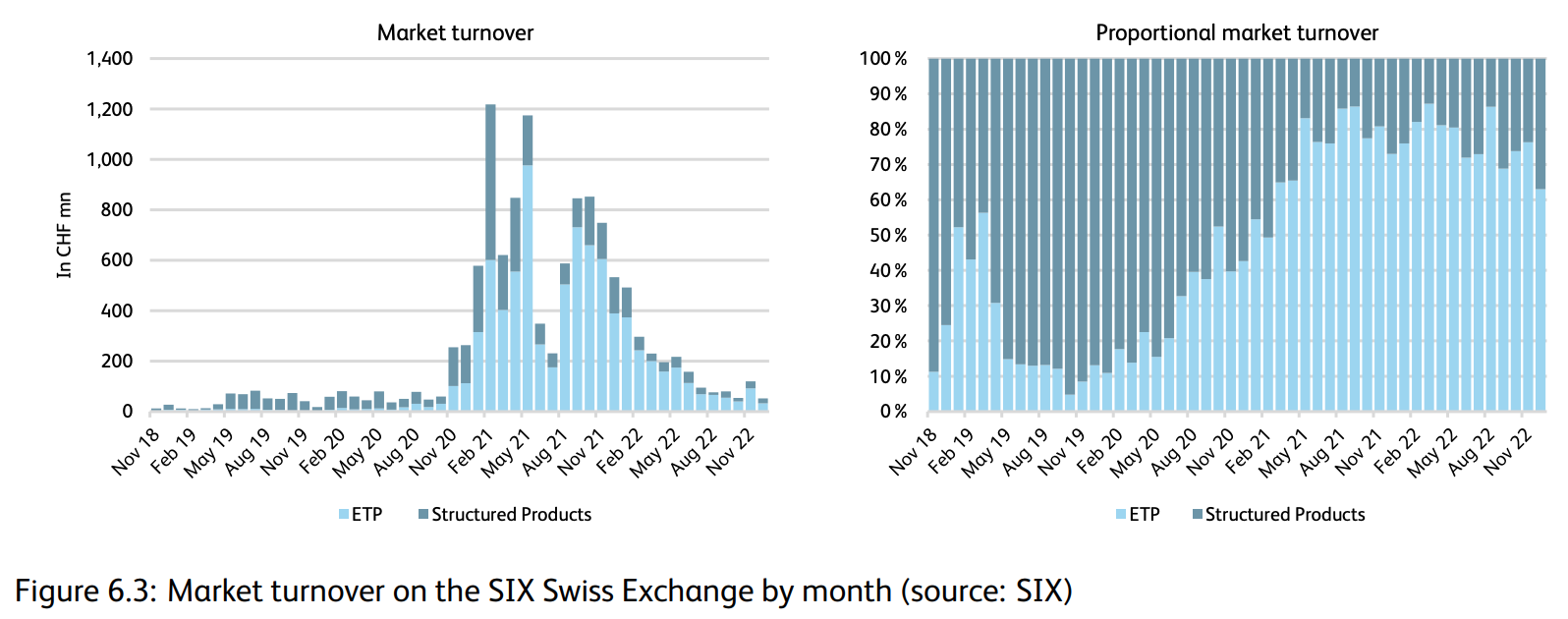

2022 was a turbulent year for the cryptocurrency market, which saw total market capitalization loose two third of its value.

This so-called prolonged “crypto winter” has impacted trading activity, especially indirect products on crypto. In 2022, the total monthly trading volumes of indirect investment products in Switzerland, including exchange-traded products (ETPs) and open end funds, decreased significantly.

As of December 2022, the total market turnover was CHF 52 million. Compared with the highest figure of over CHF 1.2 billion in February 2021, this represents a decline of 96%. Total annual trading volume reached CHF 2.1 billion, down 76% from 2021 with CHF 8.6 million.

Market turnover on the SIX Swiss Exchange by month, Source: IFZ Fintech Study 2023, Institute of Financial Services Zug (IFZ), March 2023

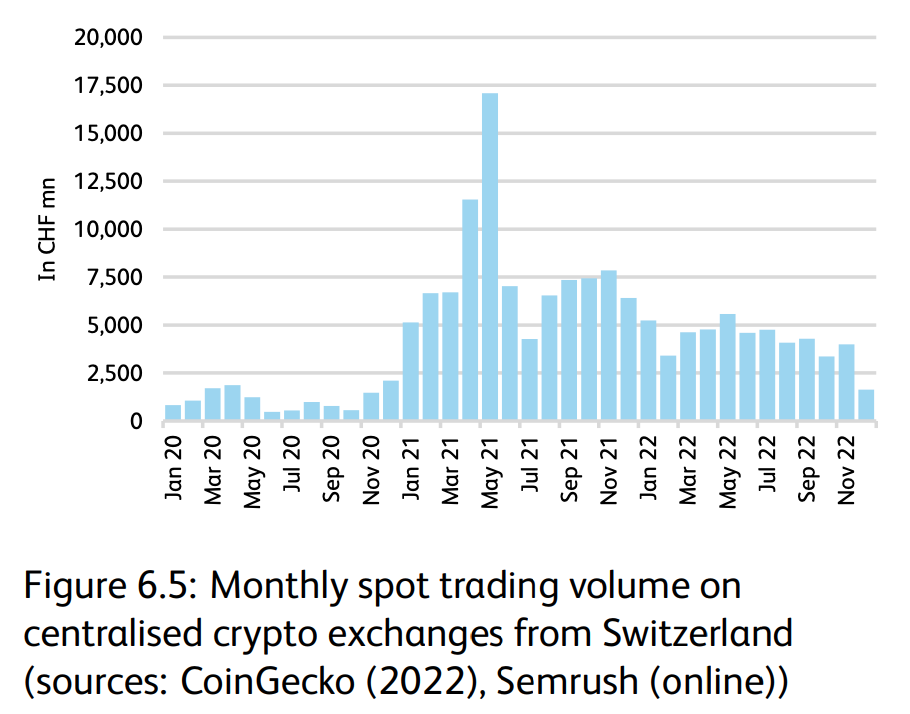

Direct investments in crypto, notably through centralized exchanges, also declined considerably in 2022.

In December, centralized exchanges cleared CHF 1.6 billion in spot trading, a figure that is about ten times smaller than the record month of May 2021, when they cleared about CHF 17.1 billion.

Monthly spot trading volume on centralized crypto exchanges from Switzerland, Source: IFZ Fintech Study 2023, Institute of Financial Services Zug (IFZ), March 2023

Featured image credit: Edited from Freepik