Virtual Debit/Credit Cards Take Off Amid Rising Theft, Digital Shift

by Fintechnews Switzerland October 19, 2021Around the world, virtual debit and credit cards are on the rise, a trend brought about by COVID-19. In Switzerland, neobanks, incumbents and card issuers are waking up to the shift, launching new products to address evolving customer demand and expectations.

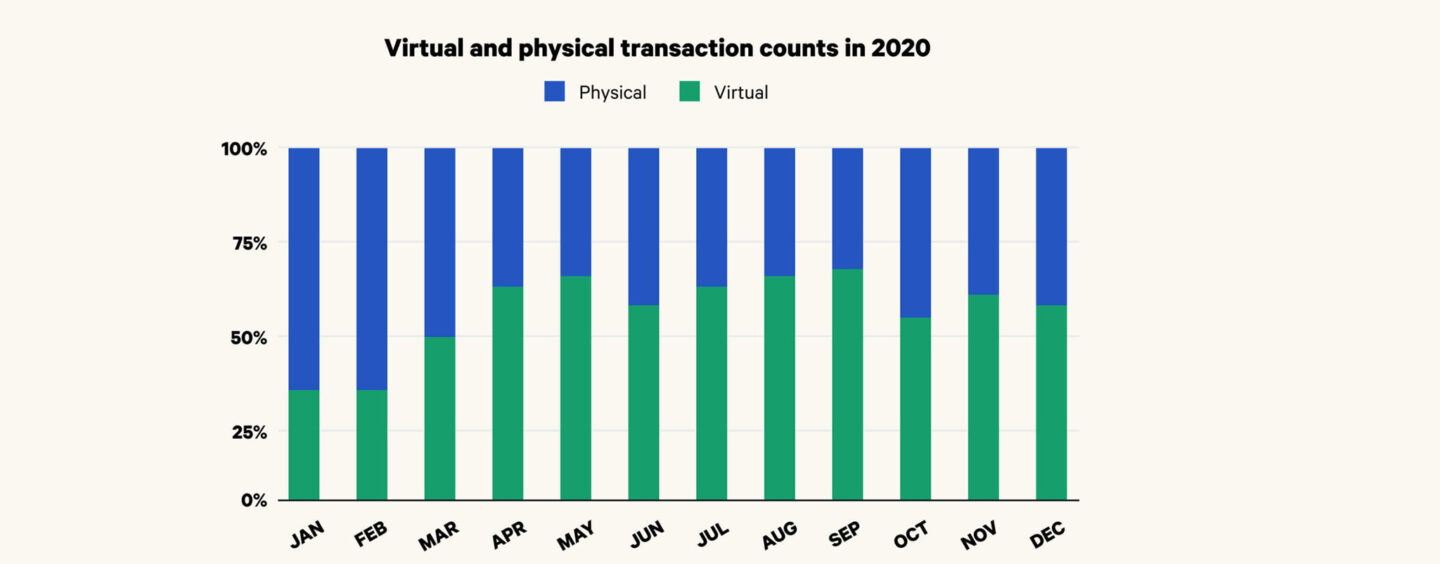

At the start of 2020, physical cards were still favored for the majority of transactions but since the pandemic, usage of virtual cards started picking up alongside digital payments. Data from US expense management and business budgeting software Divvy show that virtual card transactions climbed to make up more than 50% of business card transactions in March 2020, up from less than 40% in January and February.

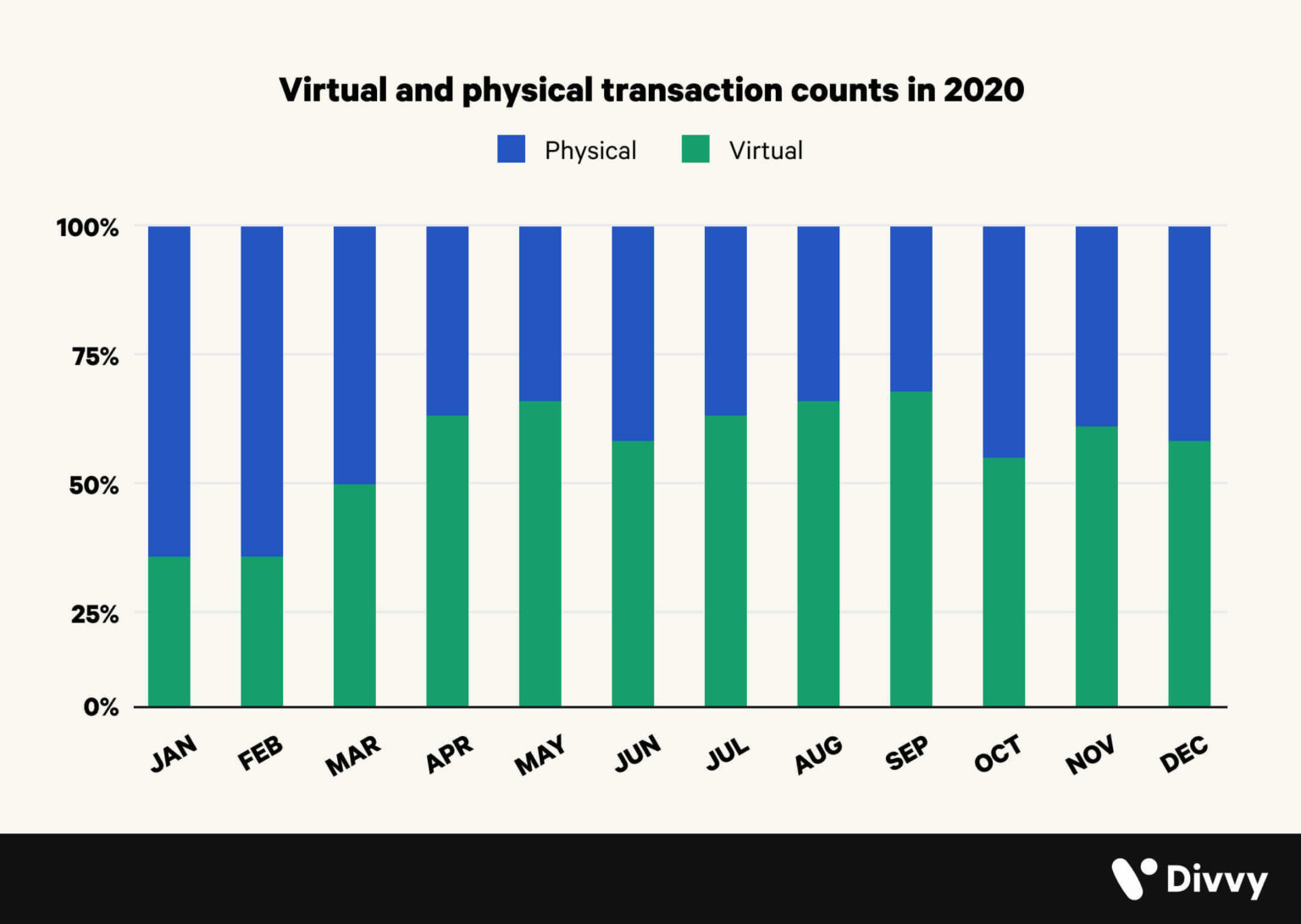

In 2020, out of the total number of Divvy cards issued, 93% of these were virtual cards, showcasing how businesses have been quick to embrace them.

Virtual and physical transaction counts in 2020, Source: Divvy, March 2021

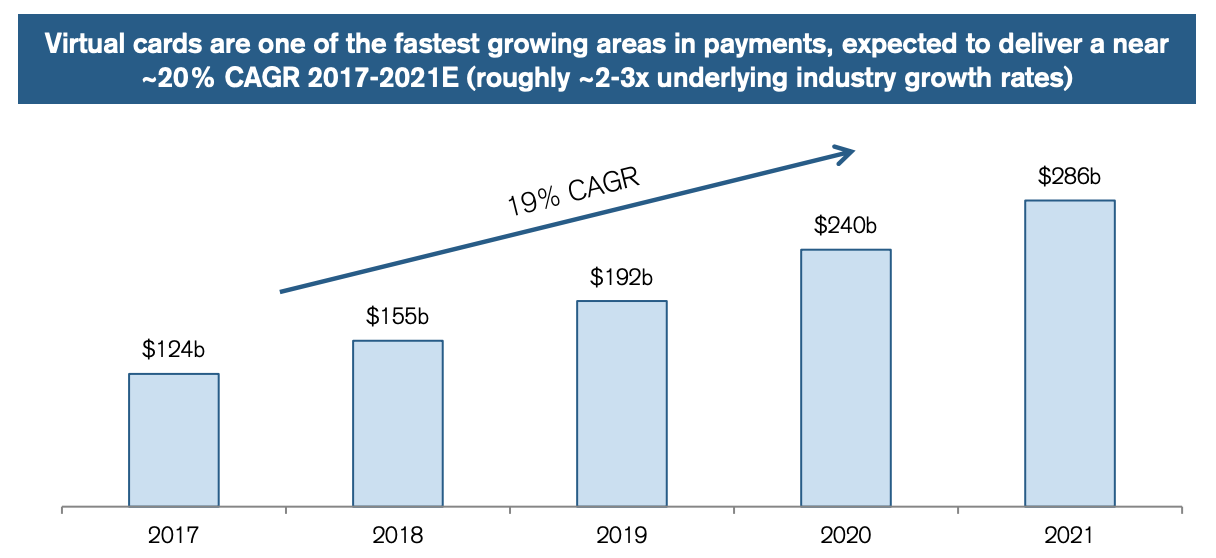

Credit Suisse forecasts virtual card payments to reach US$286 billion in volume in 2021, rising at a compound annual growth rate (CAGR) of 19% between 2017 and 2020.

Virtual card payments growth, Source: Credit Suisse, January 2021

Booming credit card theft has been a driving force for growth in the virtual credit card market. In 2019, payment card fraud losses reached US$28.65 billion worldwide, according to a Nilson Report data. Experts warn that credit card fraud will only increase in the years to come amid the economic downturn, with losses estimated to rise to US$34.66 billion in 2022.

What virtual cards are and how they work

Virtual debit and credit cards are digital alternatives to physical bank cards. But instead of existing physically, they only exist digitally. They are stored in digital wallets and used typically through a mobile banking app.

Using a virtual card is similar to using a real credit card. Payments at point-of-sale (POS) terminals in physical stores are done using the virtual card in combination with a mobile payment platform like Apple Pay or Google Pay.

For online payments and card-not-present (CNP) transactions, users simply need to enter the card number, expiry date, and verification code as they would with a physical, conventional credit card.

Virtual cards have a number of benefits, including increased security since the card cannot be physically stolen, easy cancellation as users can freeze and delete their virtual card on demand through their mobile app, as well as seamless management and spend limit which can be set and modified conveniently through the app. Also, some providers offer the ability to create temporary virtual cards for one-time use with a set budget, an expiration date or a spending limit.

Virtual cards are typically linked to a digital platform that features personal finance management tools and instant notifications, providing greater visibility and control. It can also include personalized security features such as fingerprint ID and PIN verification.

Another important advantage is that virtual cards are available almost immediately after the account is opened, and customers don’t need to wait to receive their physical card to start making payments.

Limited options and the list is growing

In Switzerland, virtual card options are still limited but growing in number. Out of the six service providers serving the Swiss retail market, five are digital banks and neobanking platforms, according to information compiled by local online comparison platform Moneyland.ch.

N26, a digital bank from Germany, Revolut, a neobank from the UK, Wise, a UK-based cross-border payments specialist, Yapeal, a Swiss app-based banking platform, and Swiss Bankers, a provider of card-based and account-independent peer-to-peer (P2P) money transfer services, all provide their customers with virtual cards.

Wise customers can have access to as many as three digital cards on their account, while Revolut customers can add up to five standard virtual cards, in addition to unlimited disposable cards which can only be used for one transaction.

UBS is currently the only bank in Switzerland to provide a virtual credit card, an offering it launched in November 2020.

Virtual business credit cards also exist, and are issued by Cornercard and Swisscard.