Neobanks are on the rise in Switzerland. Every tenth person has already used these new online banking solutions, as the latest Swiss Payment Monitor shows. At the same time, the eradication of cash is not an option for the majority of the population.

One-tenth of Swiss residents have already used new online banking solutions provided by neobanks at least once. They are particularly common among males as well as younger and more educated people with higher incomes. In total, around two out of five people in this country are familiar with at least one of the better-known neobanks.

This is confirmed by the Swiss Payment Monitor – conducted for the third year running by the ZHAW School of Management and Law and the University of St. Gallen. More than 1,200 subjects throughout Switzerland were questioned for this survey at the end of 2019.

Used for Payments Abroad

Three-quarters of neobank users take advantage of these exclusively online banking services in addition to having a traditional banking service provider.

Tobias Trütsch

“At present, neobanks function primarily as niche products, especially for making payments when traveling abroad,”

explains Tobias Trütsch, payment economist at the University of St. Gallen.

Only around 10% of neobank users have canceled the services of a conventional provider in favor of these new digital-only services and another 10% intend to do so.

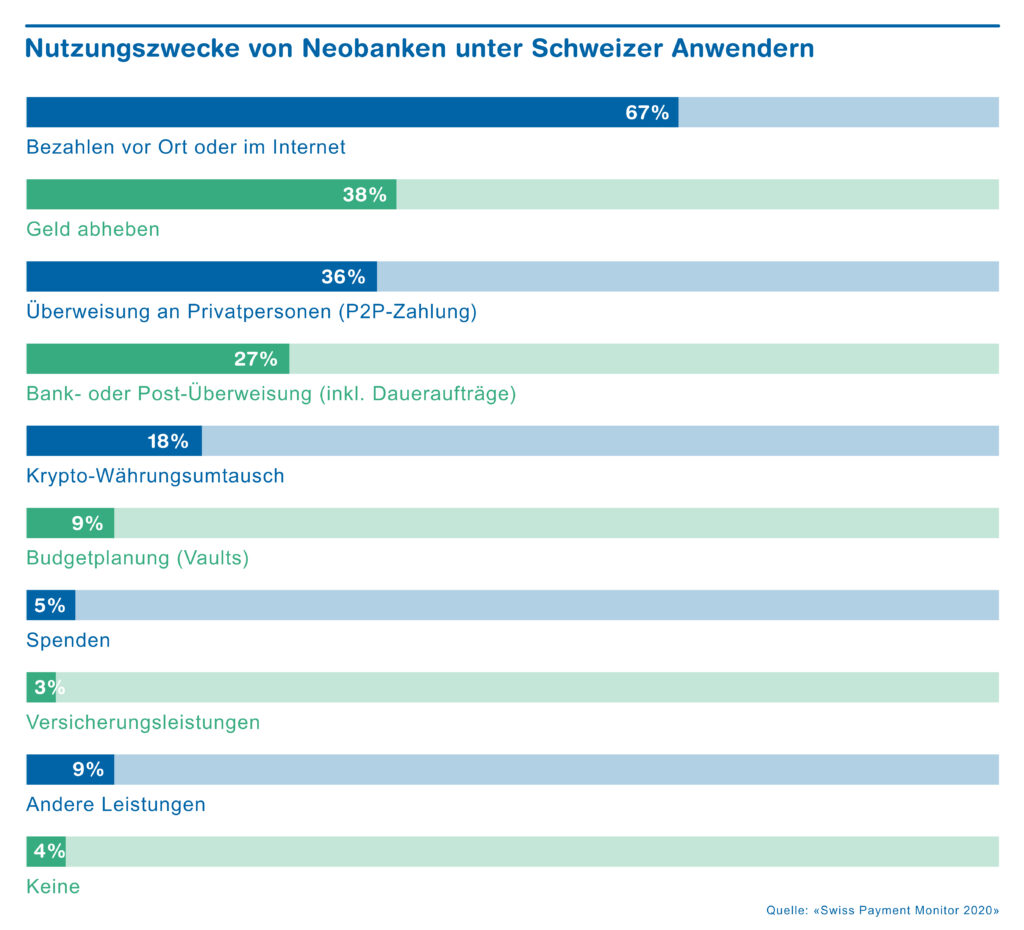

The main reasons for the popularity of neobanks are their practical and straightforward handling and competitive fee structure, particularly the favorable foreign exchange rates. The best-known neobank businesses in Switzerland are Revolut (26% awareness share) and Zak (16%). Revolut is most frequently used (7% usage share) together with Transferwise, a UK provider (3%). In terms of security perception, however, Swiss neobanks Zak and Neon lead the field.

No to the Cashless Society

Despite new digital solutions, the eradication of cash as a means of payment is not an option for around three-quarters of those surveyed, and half reject the idea altogether.

Sandro Graf

“This is a highly emotive topic for many people,”

says ZHAW payment expert Sandro Graf. Only about one-fifth are entirely in favor of a cashless Switzerland.

“The main arguments against the abolition of cash, in the view of the respondents, are the loss of the value of money, a lack of control over personal finances, dependence on technology, and various security concerns such as cyber attacks or technical breakdowns,”

explains Graf.

Other factors include the loss of anonymity, fears of monitoring by the state or financial institutions, and less flexibility regarding means of payment.

Freedom of Choice is Important

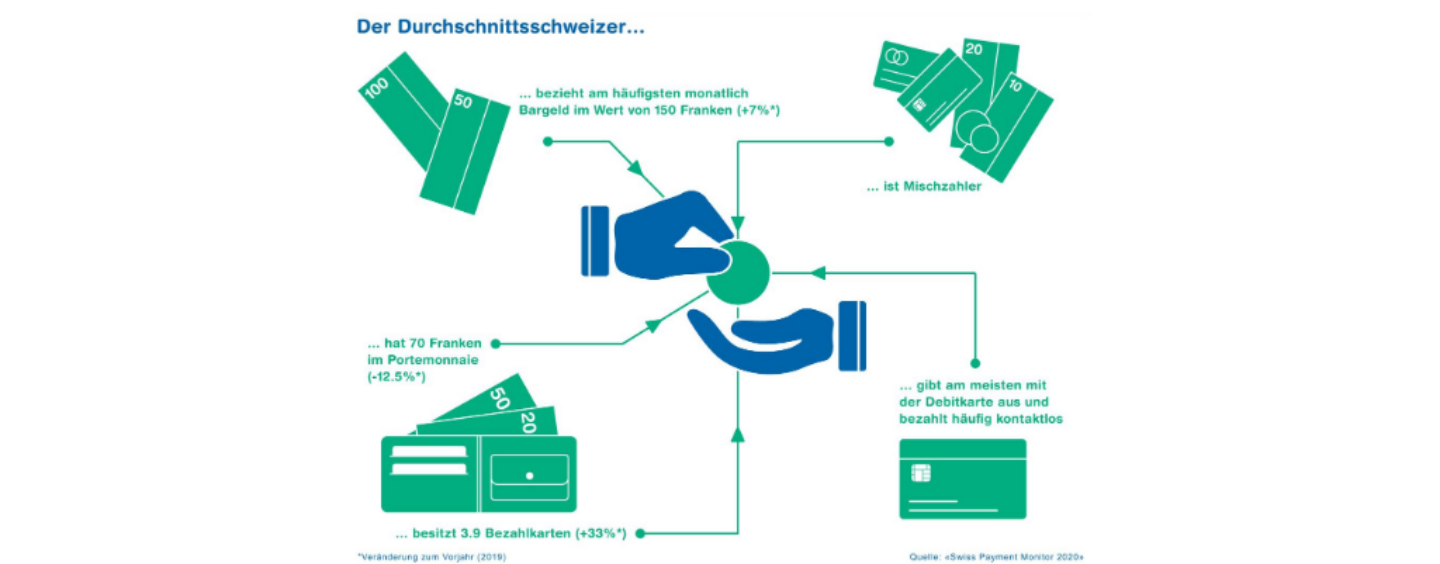

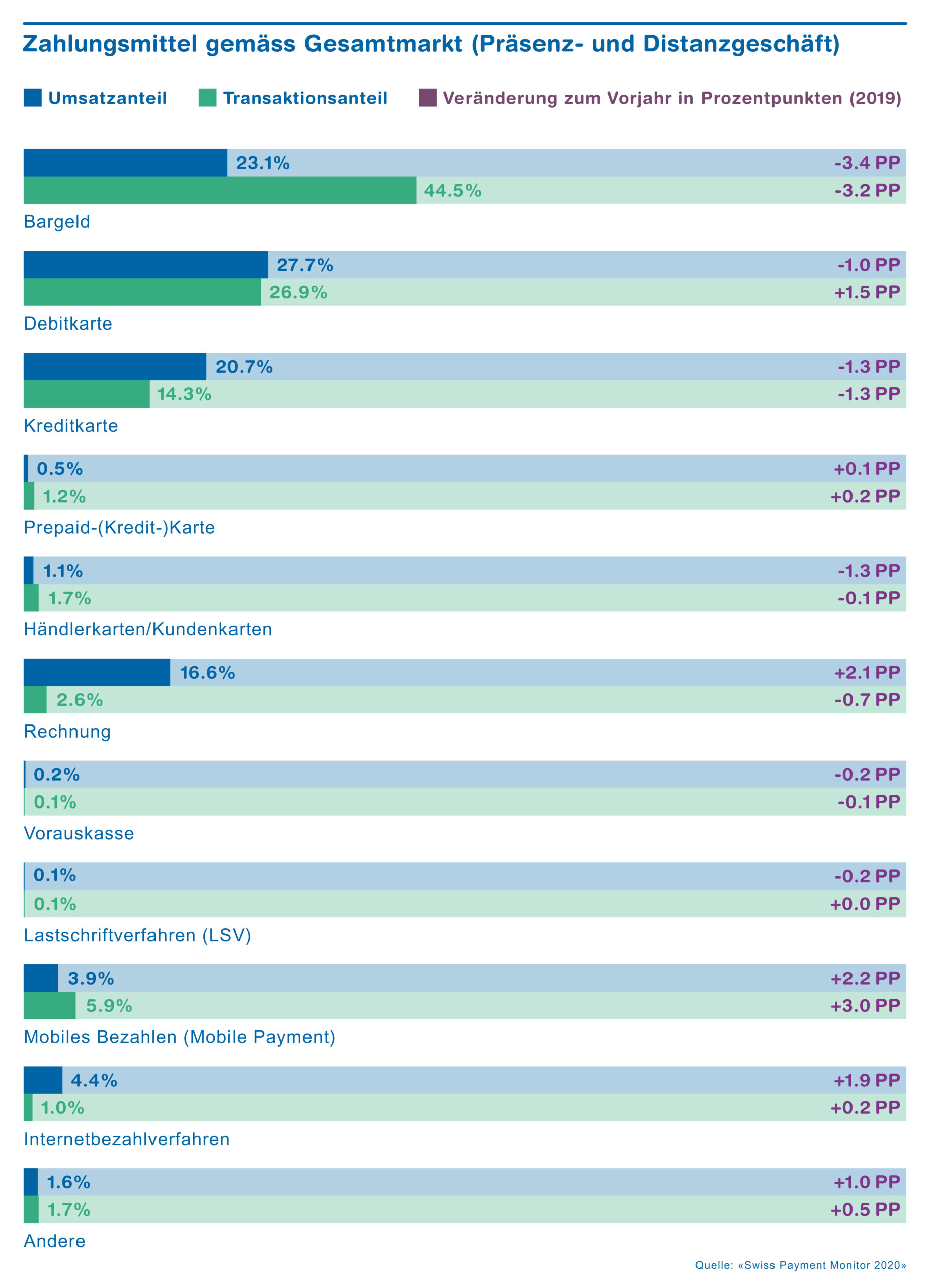

In general, respondents value freedom of choice. Around 75% of the subjects surveyed believe that it should always be possible to pay by cash, or electronically by card. The most popular means of payment is still the debit card. This is the method people use to spend the most money – namely 28 % of their outgoings – followed by cash (23 %) and credit card (21 %). Measured by the number of transactions, cash is the most frequently used payment instrument, accounting for 45 % of all transactions.

However, its use has declined by around three percentage points year-on-year in terms of both revenue and the number of transactions. On average, every Swiss resident still carries around 70 Swiss francs in cash on his or her person.

Most people, especially females and young people, are very mindful of others when choosing how to pay. For example, they assume that service staff in the hospitality sector prefer cash payments, especially for small amounts.

“This is due to the tipping effect,”

says Trütsch.

“The Corona crisis has led to a dilemma for many guests because businesses have been encouraging contactless payments.”