Artificial intelligence (AI) has become a critical aspect in financial services. Financial institutions around the world are making efforts to adopt AI for task automation, customer services, behavior analysis, as well as fraud finding, and are making large-scale investments in related technologies. The World Economic Forum (WEF) estimates the number to reach US$10 billion by 2020.

In financial services, applications for AI technologies exist across nearly the entire spectrum of business, from algorithmic stock trading applications and credit card fraud detection, to auto investment advisors and market research and sentiment analysis.

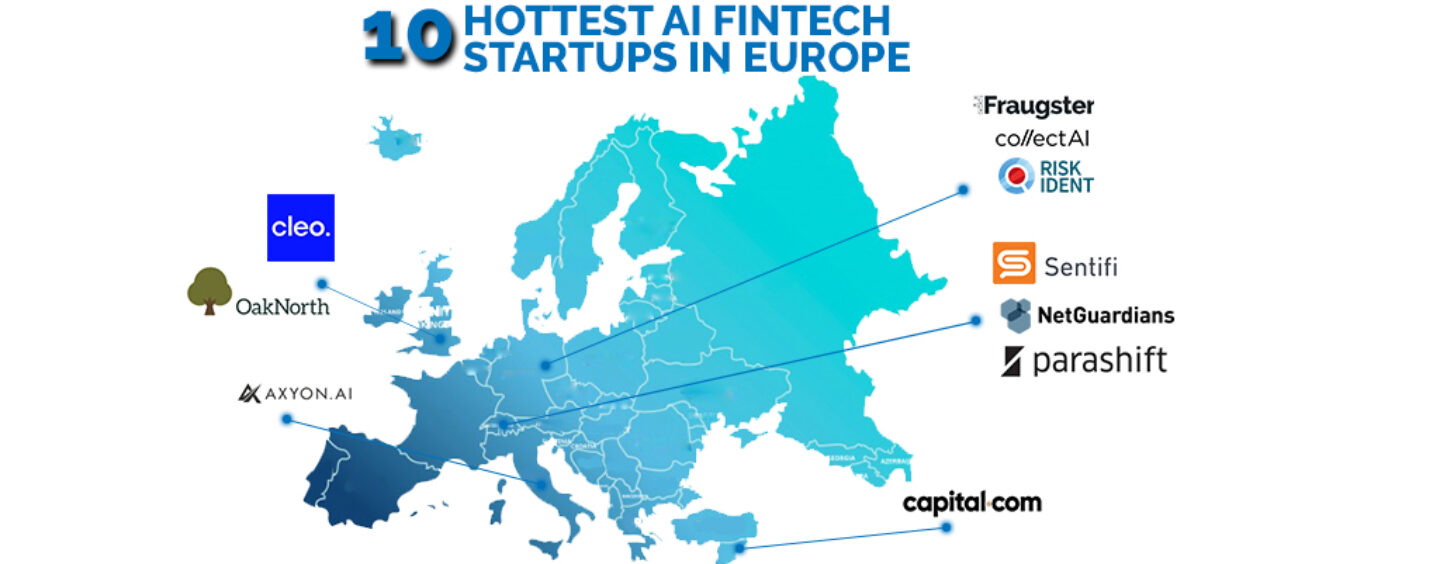

The following 10 AI fintech companies are some of Europe’s rising stars to watch very closely:

Parashift (Switzerland)

Swiss startup Parashift develops AI-based accounting document management technologies which it offers through a SaaS platform and APIs. The company has built a machine learning platform that’s capable of reading all kinds of accounting documents such as invoices, cash receipts and credit card receipts with unprecedented accuracy and extract documents entirely autonomously.

The platform combines simple and efficient data and model management with human annotation of a very large pool of aggregated data. The start-up raised CHF 1M in a seed-round in spring 2018. The founders of Parashift have previously also successfully launched a swiss online-bookkeeping platform called Accounto.io.

Sentifi (Switzerland)

Founded in 2012, Sentifi is a Swiss fintech company that uses AI and machine learning to enable investors and other financial market stakeholders to tap into the online available intelligence of millions of persons and organizations. The platform allows financial analysts, portfolio managers, journalists and other market participants to monitor the market and receive different signals not available in classical financial information systems. The technology also detects risk events that impact global financial markets and assets.

NetGuardians (Switzerland)

NetGuardians is an award winning Swiss fintech established in 2007 helping over 50 Tier 1 to Tier 3 banks worldwide to fight financial crime. NetGuardians has developed an “augmented intelligence” solution made for banks to proactively prevent fraud, empowering clients with machine learning technology together with contextual information and great user experience. The company claims that banks using its solution achieve 83% reduction in false positives and save 93% of the time lost in fraud investigation. NetGuardians is headquartered in Switzerland and also have offices in Nairobi, Warsaw, and Singapore.

OakNorth (UK)

Founded in 2015, OakNorth is a UK digital-focused challenger bank and the developer of an AI-powered platform called ACORN, which leverages process excellence, machine learning, and technology to drive data-driven decision making across the loan lifecycle to help automate banking services. ACORN works by pulling in hundreds of data points on whatever industry the loan is to be applied in to analyze the credit risk. OakNorth has secured US$576 million in funding to date.

Cleo AI (UK)

Founded in 2016, Cleo AI is the developer of an intelligent assistant called Cleo, which currently helps over half a million users be smarter with their money across the UK, US and Canada. Cleo works via a messaging platform which, once given permission to access account information, can answer questions about a user’s finances. Using deep learning techniques allows Cleo to learn and adapt to one’s habits and preferences. The startup raised US$10 million in September, bringing its total capital raised so far to US$15 million.

Fraugster (Germany)

Founded in 2014, Fraugster is a software company that uses AI to prevent fraud for online retailers. The company has developed a proprietary technology that takes data from multiple sources, analyses and cross-checks it in just a few seconds to determine whether a transaction is fraudulent or not. By monitoring thousands of data points, Fraugster’s technology can build a picture of a user’s trustworthiness. According to Handelsblatt, the company handles risk management for payment service providers such as Ingenico ePayments and Six Payments, and hedges payments with an annual volume of EUR 35 billion. It raised US$14 million in a Series B funding round led by CommerzVentures in November 2018 and said it will use the funds to continue its expansion into new markets, including the US, Asia and Europe.

CollectAI (Germany)

Founded in 2016, CollectAI is a fintech startup from Germany that offers a digital, AI-based payment and debt collection software platform to manage accounts receivables. The end-to-end process of e-invoicing, payment reminder mechanisms and debt collection processes helps companies to balance between recovery rate, costs and customer retention. The company claims it has more than EUR 40 million receivables under management. CollectAI is a subsidiary of the Otto Group, Germany’s largest e-commerce retailer. It launched in the UK in February 2018 through a partnership with Pay360 by Capita.

Risk Ident (Germany)

Founded in 2012, Risk Ident is a Hamburg-based fraud prevention. The company specializes in large e-commerce, telecommunication and financial enterprises in identifying and preventing criminal activity like payment fraud, account takeovers and identity theft. Risk Ident has developed two key products: DEVICE IDENT, which identifies customers’ devices through their unique characteristics and analyzes them independently of their personal data, and FRIDA, a self-learning anti-fraud software. In 2017, the company secured more than EUR 50 billion in transaction volume and expanded to the US by opening up a headquarters at Cambridge Innovation Center (CIC) in Boston.

Axyon AI (Italy)

Axyon AI is an AI startup providing deep learning solution for capital markets and asset management. The company collaborates closely with data scientists at the University of Modena in Italy and has built a proprietary platform that provides highly accurate predictive solutions, currently focused on asset allocation strategies and the syndicated loan market. It has partnerships with Refinitiv/Thomson Reuters and IBM. Axyon AI was one of the winners of the 2018 Fintech Fund in September 2018 and recently completed a EUR 1.3 million funding round led by ING Ventures.

Capital.com (Cyprus)

Capital.com is a Cyprian fintech startup offering the Capital.com mobile trading app, which allows investors to trade financial products and receive updates from a patent-pending Smart Feed with news, analysis, and research based on user behavior. The app, the company claims, uses AI to detect common trading biases and patterns. Regulated by the Cyprus Securities and Exchange Commission, the company raised US$25 million in a Series A round led by VP Capital last year.

Featured image credit: Unsplash