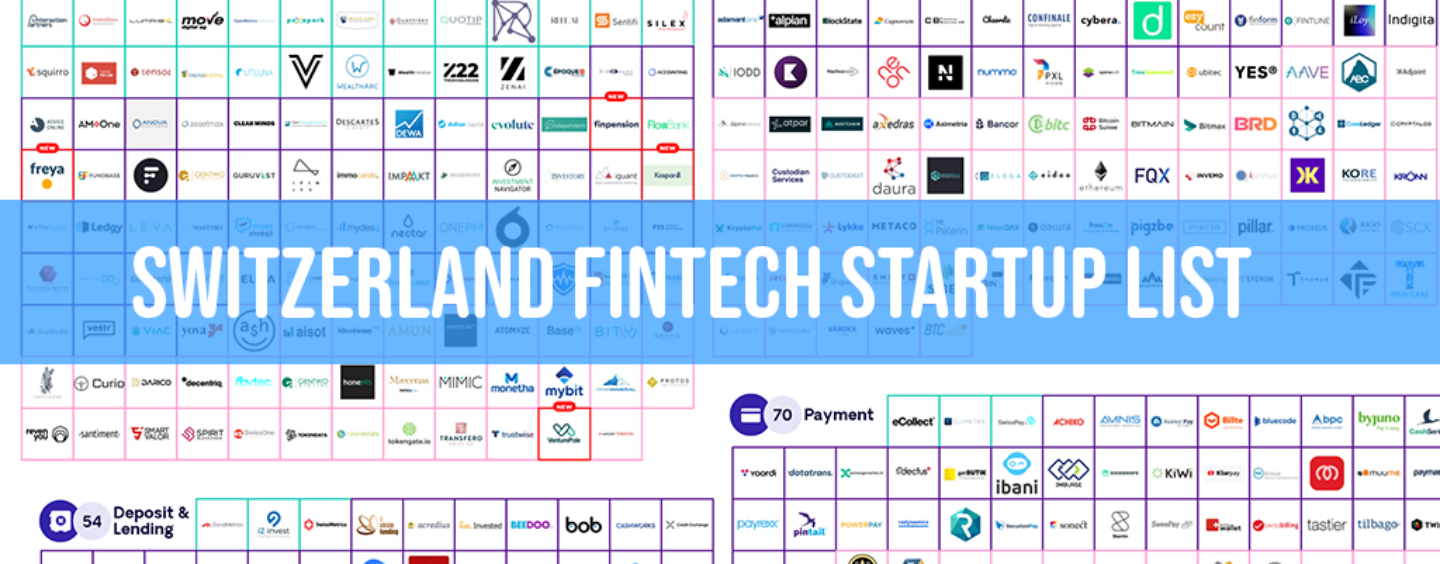

LIST OF FINTECH STARTUPS IN SWITZERLAND

We listed here 376 Swiss Fintech startups and companies based on the Swisscom Fintech Map Dec 2020.

With the aim of giving both borrowers and lenders more freedom and control over their loans, 3circlefunding allows borrowers to set loan interest rates and investors to sell loan parts in its secondary market. This makes 3circlefunding one of the few secondary market providers in Switzerland.

With the aim of giving both borrowers and lenders more freedom and control over their loans, 3circlefunding allows borrowers to set loan interest rates and investors to sell loan parts in its secondary market. This makes 3circlefunding one of the few secondary market providers in Switzerland.

![]()

![]()

Acredius is an online platform that makes investors’ and borrowers’ needs meet in an unconventional, digital, intuitive and safe environment. Investors can diversify their portfolios and enjoy interesting yields. Borrowers get access to fair financing using their traditional and non-traditional data.

Acredius is an online platform that makes investors’ and borrowers’ needs meet in an unconventional, digital, intuitive and safe environment. Investors can diversify their portfolios and enjoy interesting yields. Borrowers get access to fair financing using their traditional and non-traditional data.

ADVANON

![]()

![]()

![]()

Advanon is an authorized financial intermediary that is directly subordinated to FINMA (Directly Subordinated Financial Intermediary, DSFI) according to the Anti Money Laundering Act (AMLA).

Advanon is an authorized financial intermediary that is directly subordinated to FINMA (Directly Subordinated Financial Intermediary, DSFI) according to the Anti Money Laundering Act (AMLA).

![]()

![]()

![]()

Wir sind bob Finance – wir verbinden zuverlässige Finanzlösungen mit modernem, technischen Komfort, um unseren Kunden das Leben zu vereinfachen.

Wir sind bob Finance – wir verbinden zuverlässige Finanzlösungen mit modernem, technischen Komfort, um unseren Kunden das Leben zu vereinfachen.

CASHWORKS

![]()

CashWorks is a digital platform that enables fast and hassle-free early payment of invoices against a dynamic discount to your frequent suppliers. CashWorks leverages existing banking payment infrastructure combined with a modern and digital interface. CashWorks is easy to implement and requires a minimal effort to install and use.

CashWorks is a digital platform that enables fast and hassle-free early payment of invoices against a dynamic discount to your frequent suppliers. CashWorks leverages existing banking payment infrastructure combined with a modern and digital interface. CashWorks is easy to implement and requires a minimal effort to install and use.

Cross-border decentralized credit scoring platform using Blockchain technology to provide a secure and democratic service for the fintech world and transforming the definition of banking.

Creditfolio ist eine seit 2017 aktive Crowdlending-Plattform mit Fokus auf Privatkredite. Die Creditfolio-Plattform ermöglicht Privatpersonen einen Kredit schnell und einfach zu fairen Konditionen aufzunehmen – ganz ohne das Einwirken einer Bank. Die Anleger bzw. Kreditgeber können sich auf der Webseite individuell über aktuelle Kreditprojekte informieren und Finanzierungszusagen abgeben. Nebst fairen und attraktiven Renditen bieten wir so den Anlegern ebenfalls die Möglichkeit ihr bestehendes Portfolio optimal zu diversifizieren.

Creditfolio ist eine seit 2017 aktive Crowdlending-Plattform mit Fokus auf Privatkredite. Die Creditfolio-Plattform ermöglicht Privatpersonen einen Kredit schnell und einfach zu fairen Konditionen aufzunehmen – ganz ohne das Einwirken einer Bank. Die Anleger bzw. Kreditgeber können sich auf der Webseite individuell über aktuelle Kreditprojekte informieren und Finanzierungszusagen abgeben. Nebst fairen und attraktiven Renditen bieten wir so den Anlegern ebenfalls die Möglichkeit ihr bestehendes Portfolio optimal zu diversifizieren.

Wir schaffen eine Verbindung zwischen Hypothekarkunden und institutionellen Kreditgebern und erreichen dadurch den besten Zins in Echtzeit. Dabei stehen wir für Integrität, Neutralität, Transparenz und die Sicherheit des Hypothekarmarktes. Unsere Partner zählen zu den Besten auf ihrem Gebiet, teilen unsere Werte und stehen für unternehmerisches Wachstum.

CROWDLI ist eine Crowdfunding-Plattform zur Vermittlung von Miteigentumsanteilen an Immobilienkapitalanlagen. Bei CROWDLI kannst du mit überschaubaren Investitionsbeträgen erfolgreich in nachhaltige Immobilien investieren und von vierteljährlich ausgezahlten Renditen profitieren.

CROWDLI ist eine Crowdfunding-Plattform zur Vermittlung von Miteigentumsanteilen an Immobilienkapitalanlagen. Bei CROWDLI kannst du mit überschaubaren Investitionsbeträgen erfolgreich in nachhaltige Immobilien investieren und von vierteljährlich ausgezahlten Renditen profitieren.

CreditGate24 connects borrowers with private and institutional investors and offers an efficient and scalable settlement of loans. CreditGate24 operates exclusively online, with no branches or high administrative expenses in order not to diminish the yields on investment and to minimize the cost for borrowers.

CROWD4CASH

![]()

![]()

![]()

Swiss Crowdlending FinTech for private persons and SME. Crowd Solutions is the provider of Crowd4Cash.ch the innovative Crowdlending platform. Crowd4Cash brings investors and borrower together. For better returns for the investors and lower interest rates for borrower. 100% online, easy and simply fair!

Swiss Crowdlending FinTech for private persons and SME. Crowd Solutions is the provider of Crowd4Cash.ch the innovative Crowdlending platform. Crowd4Cash brings investors and borrower together. For better returns for the investors and lower interest rates for borrower. 100% online, easy and simply fair!

creditworld verbindet Schweizer KMUs mit privaten sowie professionellen Investoren. KMUs profitieren von attraktiven Konditionen und fairen Vertragsbedingungen. Investoren erhalten Zugang zu einer neuen Anlageklasse mit interessanten Renditen und unterstützen dabei das Rückgrat der Schweizer Volkswirtschaft.

Bricks & Bytes AG provides with crowdhouse.ch the first real estate crowd funding platform in Switzerland. By democratizing the way of being a real estate owner it makes everyone a happy landlord.

![]()

eGTSA offers an efficient and secured multi-banking communication platform for the Trading industry.

eGTSA offers an efficient and secured multi-banking communication platform for the Trading industry.

Foxstone is a Swiss real estate crowdfunding platform. The platform proposes institutional-grade real estate deals in Switzerland through three types of investments: co-ownership, co-investment and mezzanine debt with a minimum investment amount of CHF 25’000.

Foxstone is a Swiss real estate crowdfunding platform. The platform proposes institutional-grade real estate deals in Switzerland through three types of investments: co-ownership, co-investment and mezzanine debt with a minimum investment amount of CHF 25’000.

GO BEYOND INVESTING

![]()

![]()

![]()

Go Beyond Investing brings together a group of private accredited investors dedicated to providing early-stage capital with entrepreneurs seeking investment capital. Go Beyond Investing enables novice & experienced, small & large investors, to access angel investing as an asset class through its unique platform, tools, training and expert angels.

Go Beyond Investing brings together a group of private accredited investors dedicated to providing early-stage capital with entrepreneurs seeking investment capital. Go Beyond Investing enables novice & experienced, small & large investors, to access angel investing as an asset class through its unique platform, tools, training and expert angels.

![GREEN[]MATCH](https://fintechnews.ch/wp-content/uploads/2019/04/GREENMATCH-150x150.png) Greenmatch combines the perspectives of all market participants on one single platform and allows for an efficient interaction. Thanks to the independent, certified financial model, discussions regarding deviations between the financial models of the buyer and the seller do no longer occur. Detailed risk analysis strengthen the trust of banks and accelerate the closure of the project financing. Thus, each market participant saves valuable time and can focus more on his key competences.

Greenmatch combines the perspectives of all market participants on one single platform and allows for an efficient interaction. Thanks to the independent, certified financial model, discussions regarding deviations between the financial models of the buyer and the seller do no longer occur. Detailed risk analysis strengthen the trust of banks and accelerate the closure of the project financing. Thus, each market participant saves valuable time and can focus more on his key competences.

As a fin-tech venture, Hyposcout has managed to make a name for itself in the digital marketing of mortgages in Switzerland. As an online brokerage platform, Hyposcout AG brings together investors (investors) and real estate owners (borrowers). Private investors, as well as institutional clients from all over the world who want to hedge their investment through a Swiss property and benefit from attractive interest rates, are eligible as investors. On the other hand, capital investors have the opportunity to raise capital at a market-oriented interest rate and provide their Swiss property as collateral.

As a fin-tech venture, Hyposcout has managed to make a name for itself in the digital marketing of mortgages in Switzerland. As an online brokerage platform, Hyposcout AG brings together investors (investors) and real estate owners (borrowers). Private investors, as well as institutional clients from all over the world who want to hedge their investment through a Swiss property and benefit from attractive interest rates, are eligible as investors. On the other hand, capital investors have the opportunity to raise capital at a market-oriented interest rate and provide their Swiss property as collateral.

a new platform by asset manager Vermögenspartner, which allows users to find the best mortgage offers

a new platform by asset manager Vermögenspartner, which allows users to find the best mortgage offers

i2 INVEST

![]()

i2 invest ltd uses a data-driven and AI supported approach to selectively and globally invest into the best loans from Digital Lending Marketplaces. i2 invest ltd has stable, low correlated and constant return.

i2 invest ltd uses a data-driven and AI supported approach to selectively and globally invest into the best loans from Digital Lending Marketplaces. i2 invest ltd has stable, low correlated and constant return.

Instimatch Global was founded in 2017. The inspiration for doing so, stemmed from the liquidity crisis in 2007/2008. Our founder witnessed first-hand how the interbank lending and borrowing system broke down and trust between financial institutions disappeared within a matter of days.

Instimatch Global was founded in 2017. The inspiration for doing so, stemmed from the liquidity crisis in 2007/2008. Our founder witnessed first-hand how the interbank lending and borrowing system broke down and trust between financial institutions disappeared within a matter of days.

Verve Capital Partners Ltd. operates investiere.ch, a disruptive early-stage and equity gap financier. Based in Zug, Switzerland, Verve Capital Partners was launched in December 2007, with the aim to develop and implement innovative financing concepts for small and medium sized enterprises (SMEs) while connecting private investors directly to SME investments.

Verve Capital Partners Ltd. operates investiere.ch, a disruptive early-stage and equity gap financier. Based in Zug, Switzerland, Verve Capital Partners was launched in December 2007, with the aim to develop and implement innovative financing concepts for small and medium sized enterprises (SMEs) while connecting private investors directly to SME investments.

KREDITFABRIK

Die Kreditfabrik bietet anspruchsvollen Auftraggebern einen umfassenden Service zur Abwicklung, Bewirtschaftung und Risikobewertung von Hypotheken. Dank einer modularen Dienstleistungskette, die an modernste Applikationen angebunden wird, werden durchgängige und automatisierte Prozesse geschaffen. Smarte Digitalisierungstools und die Vernetzung bestehender Prozesse bereiten den Weg in eine ertragreiche Zukunft.

LEND

![]()

![]()

![]()

lend.ch (LEND) a registered financial intermediary and a trademark and service of Zurich-based Switzerlend AG, provides a crowdlending platform for private loans that allows borrowers to benefit from fair interest rates (~5-9% compared to 12%, the current average interest rate for consumer loans in Switzerland) and investor from better returns.

lend.ch (LEND) a registered financial intermediary and a trademark and service of Zurich-based Switzerlend AG, provides a crowdlending platform for private loans that allows borrowers to benefit from fair interest rates (~5-9% compared to 12%, the current average interest rate for consumer loans in Switzerland) and investor from better returns.

LENDITY

![]()

![]()

Providing investors with a streamlined system to access tailored loans from multiple P2P loan platforms around the world.

Providing investors with a streamlined system to access tailored loans from multiple P2P loan platforms around the world.

Loanboox is the independent money and capital market platform for public-sector borrowers and institutional investors. In contrast to conventional brokering, financing and investing through Loanboox is simple, transparent, safe and low cost, benefiting both borrowers and lenders alike.

![]()

![]()

![]()

MoneyPark is Switzerland’s first independent provider for personalized financial advice that’s worth its money. MoneyPark offers a thorough and comprehensible analysis of financial products in order to find the optimal product for your needs.

MoneyPark is Switzerland’s first independent provider for personalized financial advice that’s worth its money. MoneyPark offers a thorough and comprehensible analysis of financial products in order to find the optimal product for your needs.

Over the past 10 years, nexo has been providing instant loans to millions of people across Europe. We believe that the expanding digital world helps improve our lives. They would like to contribute by providing the World‘s First Instant Crypto-backed Loans. Nexo – enjoy your crypto wealth today without selling your crypto assets!

Noku creates interfaces to make Blockchain more accessible. Custom Token, TokNraise, Multicurrency web and mobile crypto wallet. With Noku you will never need to be a coder or an expert.

Swiss Crowdfunding is The First Swiss Real Estate Crowdfunding Platform. They have the right of sale of real estate for a total value of over 2 billions Euros: this includes housing estate, for profit, accommodation facilities and many hotels in spread throughout 8 different countries in Europe.

swisspeers ist eine unabhängige Crowdlending Plattform, die es Unternehmen erlaubt, bei Investoren direkt – also ohne Zwischenschaltung eines Finanzinstituts – Fremdkapital zu beschaffen.

SWISS LENDING

SwissLending utilise la méthode de financement participatif (crowdfunding) pour l’investissement immobilier. Cela consiste simplement à rassembler des investisseurs afin de mettre en commun des fonds dans un projet unique et visible.

SwissLending utilise la méthode de financement participatif (crowdfunding) pour l’investissement immobilier. Cela consiste simplement à rassembler des investisseurs afin de mettre en commun des fonds dans un projet unique et visible.SWISSMETRICS

SwissMetrics is a dynamic startup from Switzerland that has a mission to enhance the way companies monitor their credit risk. As finance professionals, they have developed a SaaS platform with the aim of promoting smarter collaboration within companies to work for a common goal – saving money through risk minimization.

Systemcredit ist ein von Anbietern unabhängiger Marktplatz für KMU-Finanzierung. Wir wollen, dass KMU schneller passenden Kredit zu fairen Bedingungen erhalten. Hierzu bringen wir gute Unternehmen mit Kreditgebern und Dienstleistungen zusammen. Kreditgeber können ihr Kreditportfolio ausbauen bei weniger Prozesskosten und geringeren Risiken. Systemcredit senkt Aufwand und Kosten und gibt allen Teilnehmenden mehr Sicherheit.

Systemcredit ist ein von Anbietern unabhängiger Marktplatz für KMU-Finanzierung. Wir wollen, dass KMU schneller passenden Kredit zu fairen Bedingungen erhalten. Hierzu bringen wir gute Unternehmen mit Kreditgebern und Dienstleistungen zusammen. Kreditgeber können ihr Kreditportfolio ausbauen bei weniger Prozesskosten und geringeren Risiken. Systemcredit senkt Aufwand und Kosten und gibt allen Teilnehmenden mehr Sicherheit.

TEYLOR

Teylor is a Swiss technology company focused on building better financial products for small businesses in Europe.

THE GROUNDUP PROJECT

The gound up project partner with local and international business networks and other international organizations to source investments under US $20M that contribute to national SDG roadmaps worldwide.

The gound up project partner with local and international business networks and other international organizations to source investments under US $20M that contribute to national SDG roadmaps worldwide.

Tradeplus24 specialises in providing Swiss KMUs with state of the art Insurance and Receivables Finance solutions. Unlike factoring, our innovative solution offers SMEs the opportunity to get a flexible credit line against their accounts receivable whilst offering them the option to insure their global accounts receivables against default. This way Swiss KMU’s can grow their export business in a financially sound and safe way, even when their buyers demand longer payment terms and want to trade own open account basis.

Tradeplus24 specialises in providing Swiss KMUs with state of the art Insurance and Receivables Finance solutions. Unlike factoring, our innovative solution offers SMEs the opportunity to get a flexible credit line against their accounts receivable whilst offering them the option to insure their global accounts receivables against default. This way Swiss KMU’s can grow their export business in a financially sound and safe way, even when their buyers demand longer payment terms and want to trade own open account basis.

ImmoZins offers property investors three different investment models. Common to all of them is the high level of transparency, for which the start-up company developed its own software, and the assumption of risk. ImmoZins invests in the projects and is 50% co-owner.

Apiax is compliance digitally mastered. We transform complex regulations into easy-to-use digital compliance rules.

Araneum Technologies is a Zurich based machine learning and artificial intelligence company with its origins at ETH and HSG.

Araneum Technologies is a Zurich based machine learning and artificial intelligence company with its origins at ETH and HSG.

BitsaboutMe AG is a Swiss company based in Bern. We are committed to Privacy by Design principles and the highest standards of data security. All user data is protected under strict Swiss data protection and privacy regulations.

Focussing on an automated customer support system for banks that is able to understand and act upon customer queries and is easily integrated into existing infrastructure.

Focussing on an automated customer support system for banks that is able to understand and act upon customer queries and is easily integrated into existing infrastructure.

The New Standard In Usable Authentication Futurae Technologies was founded by ETH Zurich security researchers and offers a strong suite of multi-factor authentication tools that provide a high degree of security and improve the customer experience while protecting the user’s privacy.

We are a boutique data strategy consulting firm with a focus on guiding organizations on their journey towards data-driven business and industry models. More than ever before, success at doing business, at keeping clients engaged and at maintaining an edge over competitors is dependent on the intelligent use (and exploitation) of data. Not in the form most businesses are accustomed to today but as continuous streams of specific intelligence.

We are a boutique data strategy consulting firm with a focus on guiding organizations on their journey towards data-driven business and industry models. More than ever before, success at doing business, at keeping clients engaged and at maintaining an edge over competitors is dependent on the intelligent use (and exploitation) of data. Not in the form most businesses are accustomed to today but as continuous streams of specific intelligence.

OneVisage™ is a leading Swiss cyber-security company that develops a disruptive digital identity platform called 3DAuth™ for Financial Services, Identity & Access Management providers, Integrators and Mobile Operators.

OneVisage™ is a leading Swiss cyber-security company that develops a disruptive digital identity platform called 3DAuth™ for Financial Services, Identity & Access Management providers, Integrators and Mobile Operators.

Swiss startup Parashift develops AI-based accounting document management technologies which it offers through a SaaS platform and APIs. The company has built a machine learning platform that’s capable of reading all kinds of accounting documents such as invoices, cash receipts and credit card receipts with unprecedented accuracy and extract documents entirely autonomously.

Swiss startup Parashift develops AI-based accounting document management technologies which it offers through a SaaS platform and APIs. The company has built a machine learning platform that’s capable of reading all kinds of accounting documents such as invoices, cash receipts and credit card receipts with unprecedented accuracy and extract documents entirely autonomously.

Polixis is a best-in-class RegTech and advisory firm, headquartered in Geneva, Switzerland. We are proud to have served some of the world’s most demanding companies since 2012, ranging from Tier 1 Global Banks to more localised companies in need of Risk & Compliance solutions. The terms ‘automation’ and ‘disruption’ are not merely marketing concepts for us – this approach has helped us break the dominance of the well-established, traditional vendors in the high-end finance sector.

Polixis is a best-in-class RegTech and advisory firm, headquartered in Geneva, Switzerland. We are proud to have served some of the world’s most demanding companies since 2012, ranging from Tier 1 Global Banks to more localised companies in need of Risk & Compliance solutions. The terms ‘automation’ and ‘disruption’ are not merely marketing concepts for us – this approach has helped us break the dominance of the well-established, traditional vendors in the high-end finance sector.

Founded in 2011, Signatys is specialized in digital signature and secured digital exchanges for financial institutions.

The company’s SignMit product is a mobile solution that allows secured verification between banks and clients by connecting documents to their smartphones. Using SignMit, financial institutions can digitalize any kind of workflow requiring a user validation that today requires a manual intervention such as callbacks, advisory, MiFID II / LSFin, documents signatures, and internal validations.

Spitch is a Swiss provider of solutions based on Automatic Speech Recognition (ASR) and voice biometrics, Voice User Interfaces (VUI), and natural language voice data analytics.

Spitch is a Swiss provider of solutions based on Automatic Speech Recognition (ASR) and voice biometrics, Voice User Interfaces (VUI), and natural language voice data analytics.

Accounto Technology provides an automated accounting platformthat leverages machine learning, self-recognition and advanced accounting processes.

Accounto Technology provides an automated accounting platformthat leverages machine learning, self-recognition and advanced accounting processes.

The company provides an online platform that enables organizations to automate all accounting services such as invoice creation, bill payments, salary record keeping, financial statement generation and tax return filing.

The BlockState infrastructure platform is a stack of software and legal modules that automate resource-intensive investment banking processes such as the issuance of products, valuation and custody of assets, clearing & settlement.

Customer transfers money to dedicated Escrow account. Seller sends product. Customer releases payment upon receipt of product.

Customer transfers money to dedicated Escrow account. Seller sends product. Customer releases payment upon receipt of product.

Finform standardizes, industrializes and digitalizes compliance formalities. An optimum combination of software and services ensures efficient processes. Complex cases which cannot be automated by the Finform application are dealt with by our specialists in real time. Downstream verification processes are no longer required.

Finform standardizes, industrializes and digitalizes compliance formalities. An optimum combination of software and services ensures efficient processes. Complex cases which cannot be automated by the Finform application are dealt with by our specialists in real time. Downstream verification processes are no longer required.

![]()

![]()

![]()

indigita is a RegTech company providing banks with digitized regulatory smart data for cross-border banking. It takes the best from its parent companies, BRP and Orbium, experts in regulatory and IT consultancy, to develop the perfect solution to meet the ever-changing cross-border regulatory challenges.

indigita is a RegTech company providing banks with digitized regulatory smart data for cross-border banking. It takes the best from its parent companies, BRP and Orbium, experts in regulatory and IT consultancy, to develop the perfect solution to meet the ever-changing cross-border regulatory challenges.

NUMMO

Nummo is a personal financial management platform that empowers you to live better by helping you manage, maintain and improve your financial health.

YES is a non-profit organisation which develops and supports practice-oriented economic education and opinion-forming programmes for students. The association was founded in 2006 through the merger of the previously independent organizations Junior Achievement Switzerland and Young Enterprise Switzerland.

Aave (former ETHLend, a decentralized digital asset- backed lending platform), a new technology company focused on empowering people through innovation. Their technology-based venture intends to fill the gaps left by centralized fintech industry players such as PayPal, Skrill and Coinbase, by introducing new products and services, such as Aave Pocket, Aave Lending (SaaS), Aave Gaming, Aave Custody and Aave Clearing. ETHLend becoming a subsidiary under Aave (Note: Category based on ETHLand)

To simplify and control enterprise processes — enforcing secure risk management workflows for global treasurers and insurers.

atpar builds financial infrastructure on Ethereum that empowers issuers to tokenize and manage all major financial assets from issuance to maturity at a fraction of today’s cost.

Bancor allows you to convert between any two tokens on their network, with no counterparty, at an automatically calculated price. Thanks to built-in liquidity, the future of user-generated tokens is here.

The Swiss gateway to convert money into cryptocurrencies and digital assets. Buy – sell bitcoins and ethers. Introducing Bity Kiosks, the easiest way to acquire or sell bitcoins with cash. Only a phone number is required. Bitcoin ATMs are currently located in Geneva, Lausanne, Montreux, Neuchâtel, Zürich Hauptbahnhof and Zürich Hardbrücke.

Bitcoin Suisse AG is a Swiss-based financial service provider specializing in crypto-assets. It specialize in alternative finances / non-banking assets, outside of the traditional financial system & banking establishment, so called “decentralized finance” or “digital finance”.

Bitcoin Suisse AG is a Swiss-based financial service provider specializing in crypto-assets. It specialize in alternative finances / non-banking assets, outside of the traditional financial system & banking establishment, so called “decentralized finance” or “digital finance”.

Bitmain is a blockchain and semiconductor company, dedicated to the design and manufacture of high performance computing chips and software. They serve their customers globally with industry-defining technology – blockchain securitization, AI machine learning and more. Bitmain’s Fintech hub including a decentralized exchange is located in Switzerland.

BRD

BRD (formerly Bread) is a decentralized financial services platform that started with the launch of its simple and safe bitcoin wallet, designed to enable anyone and everyone to take advantage of Bitcoin. Bread allows you to perform many of the functions that you would at your local bank, without the middle-man. As the digital asset ecosystem grows, Bread is expanding its offerings to meet the demands of a new, global, decentralized, economy.

![]()

![]()

Confinale is a consultancy and software development company that specialises in digitalisation projects for the banking sector.

Confinale is a consultancy and software development company that specialises in digitalisation projects for the banking sector.

CoreLedger is a blockchain-based infrastructure provider based in Switzerland and Liechtenstein. We provide cost-effective, reliable peer-to-peer transaction solutions for businesses and individuals. Through our infrastructure, businesses can easily document, tokenize and trade any type of assets in a reliable and flexible environment.

CRYPTALGO

CRYPTALGO is building an institutional, highly secure global cryptocurrency & Security Tokens Secondary Trading and Liquidity Platform that leverages the CRYPTALGO’s Galaxy, a distributed parallel computing connectivity backbone that addresses the fragmented nature of the market by interconnecting multiple crypto and security token exchanges and unifying the disparate API’s, data structures and will utilize the regulatory compliance frameworks for security tokens and their issuing protocols.

CRYPTALGO is building an institutional, highly secure global cryptocurrency & Security Tokens Secondary Trading and Liquidity Platform that leverages the CRYPTALGO’s Galaxy, a distributed parallel computing connectivity backbone that addresses the fragmented nature of the market by interconnecting multiple crypto and security token exchanges and unifying the disparate API’s, data structures and will utilize the regulatory compliance frameworks for security tokens and their issuing protocols.

Crypto Finance AG is a financial technology holding company founded in June 2017. The Group provides blockchain-related services through its three subsidiaries: Crypto Fund AG (Asset Management), Crypto Broker AG (Brokerage), and Crypto Storage AG (Storage).

CUSTODIAN SERVICES

Custodian Services Switzerland AG is a FinTech startup specializing in asset digitization on distributed ledgers.

The Custodigit platform enables regulated financial service institutes to provide their customers full access to the Crypto Asset Class covering crypto currencies as well as digital assets.

The Custodigit platform enables regulated financial service institutes to provide their customers full access to the Crypto Asset Class covering crypto currencies as well as digital assets.

DAURA

Daura enables easy access to the OTC capital market for Swiss SMEs and startups. Through tokenization of shares and participation certificates, Swiss companies limited by shares can digitally and automatically keep their share register on a ledger and easily reach global investors registered on daura.

EIDOO

Eidoo is more than a wallet; it’s a multidimensional, multicurrency crypto platform.

Eidoo is more than a wallet; it’s a multidimensional, multicurrency crypto platform.

Founded in 2015, DECENT is a non-profit foundation that has developed an open source blockchain named DCore.

Founded in 2015, DECENT is a non-profit foundation that has developed an open source blockchain named DCore.

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, censorship, fraud or third party interference.

FINTECHNICS

We empower banks with leading IT solutions. We understand our job as an art of engineering and deliver results with a high quality consciousness. Therefore we are building the most advanced core banking software in the market. It is able to handle transactions in cryptocurrencies seamlessly. We have spent over a year to create proof of concepts and benchmark several different software designs, databases and technologies to achieve our very high goals. Every action we take has to be in alignment of our key principles: Performance and Reliability.

FINTUNE

Finny is a physical and digital companion for Kids to master money. We have built multiple elements around Finny to create a protected learning environment for the entire family.

Finny is a physical and digital companion for Kids to master money. We have built multiple elements around Finny to create a protected learning environment for the entire family.

Global ID’s main goal is to bring to market an innovative new technology to reliably identify people using biometric 3D vein finger data.

Bitcoin Integration and Blockchain Intelligence (KYC/AML). Enabling Compliant Bitcoin Transactions.

KRONN

Lykke is a Swiss Fintech company building a global marketplace based on blockchain. It builds on decades of thought and research by company founder Richard Olsen, a pioneer in the field of high-frequency finance. Richard served as co-founder and CEO of OANDA, a leading foreign exchange company. Lykke received initial seed funding in 2015.

Lykke is a Swiss Fintech company building a global marketplace based on blockchain. It builds on decades of thought and research by company founder Richard Olsen, a pioneer in the field of high-frequency finance. Richard served as co-founder and CEO of OANDA, a leading foreign exchange company. Lykke received initial seed funding in 2015.

Mt Pelerin is a Fintech project based in Geneva to launch the first bank to be built on the blockchain in total compliance with the industry’s regulations. More than a crypto bank, it will create an ecosystem bridging the token economy with the legacy world of finance.

Oakura provides a platform where curated startups and vetted experts engage to create next generation businesses.

PASSON

Leveraging on the latest Blockchain and Smart Contracts technologies, PassOn aims to bring inheritance into the digital age and addresses the alarming lack of solutions to easily transmit digital assets should anything happen to you.

Leveraging on the latest Blockchain and Smart Contracts technologies, PassOn aims to bring inheritance into the digital age and addresses the alarming lack of solutions to easily transmit digital assets should anything happen to you.

Pigzbe, originally from London, is a fintech company that enables micro-financing for families worldwide by giving parents and children access to products and services that accelerate financial literacy. Pigzbe is a financial assistant that uses digital pocket money and gamification to create valuable tangible learning experiences. It is comprised of a hand-held “piggy-wallet,” an educational app and a new digital currency called Wollo. Pigzbe has an office in Chiasso.

PXL Vision provides leading solutions for the automation and enhancement of online identity verification and customer onboarding through tailored software solutions powered by the latest developments in Computer Vision and Machine Learning.

PXL Vision provides leading solutions for the automation and enhancement of online identity verification and customer onboarding through tailored software solutions powered by the latest developments in Computer Vision and Machine Learning.

Rigo Investment is an alternative asset manager focused on discretionary global macro, cryptocurrency and blockchain investments and development. We generate uncorrelated returns and develop in the emerging field of blockchain. Our main focus is on cryptocurrencies and blockchain.

SCX (Swiss Crypto Exchange) is the first regulated Swiss exchange platform for blockchain products and crypto currencies.

SEBA Bank, a FINMA licenced Swiss Bank providing a seamless, secure and easy-to-use bridge between digital and traditional assets, is the only global smart bank providing a fully universal suite of regulated banking services in the emerging digital economy.

ShapeShift is a crucial piece of infrastructure in the world of Bitcoin. From start to finish, users can exchange blockchain tokens in seconds, with no account required. No emails or passwords. No lengthy signup process. No accounts. No bid and ask orders. No friction. ShapeShift’s goal is the fastest, safest, and most convenient way to swap digital assets.

Digital Bitbox is a minimalist bitcoin hardware wallet packed with security and privacy. Safely hold and spend your coins with peace of mind.

The current generation of smart devices compromises on user security. The focus is overwhelmingly on user experience, at a huge cost in fraud and cybercrime. They believe the digital economy of the future cannot tolerate this trade-off: device architecture demands a paradigm shift that enables true security, while maintaining excellent user experience. FINNEY™ devices are the first cyber-protected, blockchain-enabled mobile phone and PC. They enjoy the functionality of Android™ OS, plus a suite of cyber security technologies, giving users safe, reliable access to the blockchain.

Swiss Crypto Vault provides hyper secure storage of crypto assets. Our proprietary cold storage solution bases on multiple layers of protection including highest standards of cryptographic, IT and physical security as well as multi-party segregation and multi-signing features.

Switzerland has long since stood for trust, neutrality and security. With its long standing positioning to offering security and safety for international exchange. Swisscom Blockchain leveraging this mindset to export the brand of trust in a technology that is bringing organisations and entire industries together.

Switzerland has long since stood for trust, neutrality and security. With its long standing positioning to offering security and safety for international exchange. Swisscom Blockchain leveraging this mindset to export the brand of trust in a technology that is bringing organisations and entire industries together.

Sygnum develops an integrated solution to securely issue, store, trade and manage digital assets, which meets the highest institutional standards. Sygnum is also building an integrated equity issuance system to help companies raise capital from investors by tokenizing shares.

Systemorph software solutions enable global financial services organizations to structure, synthesize and control business-critical data elements for improved, clearer decision making.

Systemorph software solutions enable global financial services organizations to structure, synthesize and control business-critical data elements for improved, clearer decision making.

Taurus Group is a Geneva-based company building a platform to trade, invest, and protect customers’ digital assets. Taurus aims at delivering institutional-grade solutions in full compliance with the Swiss regulatory standards. The company was founded by experts from the banking, asset management and hedge funds, regulatory, as well as blockchain and cybersecurity fields.

DataLevel offers companies efficient options for organising their financial data in the best way to suit their specific needs, in order to save both time and money.

DataLevel offers companies efficient options for organising their financial data in the best way to suit their specific needs, in order to save both time and money.

Traxia is solving the access to finance issue for Small Medium Enterprises. A market in which the credit gap amounts 1.6 Trillion USD.

At TRUSTLESS.AI we are building the Seevik Pod, an ultra-secure 2mm-thin touch-screen human computing device that seamlessly delivers radically-unprecedented privacy and security to your most sensitive social and business computing, by eliminating the assumption of trust in anything or anyone.

At TRUSTLESS.AI we are building the Seevik Pod, an ultra-secure 2mm-thin touch-screen human computing device that seamlessly delivers radically-unprecedented privacy and security to your most sensitive social and business computing, by eliminating the assumption of trust in anything or anyone.

ACODIS (formerly Turicode)

Acodis developed a document retrieval engine based on Artificial Intelligence that enables companies to extract and analyze data more efficiently and automatically turn them into valuable information.

Acodis developed a document retrieval engine based on Artificial Intelligence that enables companies to extract and analyze data more efficiently and automatically turn them into valuable information.

Acodis is available as SaaS for any document in every language and used in financial services, logistics, real estate, pharma, and public institutions. Customers do not require any coding skills and can, therefore, train and control the AI-powered engine themselves.

The UniCrypt Group has greatly evolved from a small mining company to being an award- winning, fully licensed and regulated financial intermediary and key player in the crypto space in Switzerland and Europe.

The UniCrypt Group has greatly evolved from a small mining company to being an award- winning, fully licensed and regulated financial intermediary and key player in the crypto space in Switzerland and Europe.

Vardex Suisse offer secure access to the world of crypto and the increasing demand for digital assets.Our services providing the easiest way to buy and sell crypto assets.

They create the economics of free, perfect and instant. The Waves Platform is a global public blockchain platform, founded in 2016. Waves Platform’s mission is to reinvent the DNA of entrepreneurship around the world by providing a shared infrastructure, offering easy-touse, highly functional tools to make blockchain available to every person or organisation that can benefit from it.

Xapo has been described by The Wall Street Journal as the Fort Knox of bitcoin storage. So if you’re looking to secure your bitcoins, then look no further than the Xapo Vault. They have developed a new standard of bitcoin security and protect your assets in the Vault so that you are rest assured that your money is safe and sound.

VALIDITY LABS

Validity Labs is a leading provider of blockchain-based decentralized applications and is based in Switzerland.

Validity Labs is a leading provider of blockchain-based decentralized applications and is based in Switzerland.

Kore Technologies AG enables issuers to tokenize, manage and trade digital assets in the most secure and regulatory compliant way. The company is based in Crypto Valley Zug and implements blockchain projects for clients in multiple countries on varied blockchain protocols.

Kore Technologies AG enables issuers to tokenize, manage and trade digital assets in the most secure and regulatory compliant way. The company is based in Crypto Valley Zug and implements blockchain projects for clients in multiple countries on varied blockchain protocols.

Swiss FinTech & AI startup leveraging artificial intelligence to fully automate expense & company credit card processes

Swiss FinTech & AI startup leveraging artificial intelligence to fully automate expense & company credit card processes

21 Analytics develops software for financial crime prevention for virtual asset service providers (VASPs). Our team has been working with virtual assets professionally as software engineers, consultants, and compliance officers since 2014.

21 Analytics develops software for financial crime prevention for virtual asset service providers (VASPs). Our team has been working with virtual assets professionally as software engineers, consultants, and compliance officers since 2014.

Alpian is an innovative Swiss financial services company incubated by the private bank REYL & Cie. It is pioneering a digital experience that combines everyday banking services, a personal wealth management offering, and tailored investment products – all within an easy-to-access app.

Alpian is an innovative Swiss financial services company incubated by the private bank REYL & Cie. It is pioneering a digital experience that combines everyday banking services, a personal wealth management offering, and tailored investment products – all within an easy-to-access app.

Cybera fundamentally changes the way distributed businesses use technology. Our purpose-built network services platform empowers companies with many remote business locations to rapidly deploy, secure, and optimize new cloud-based applications and services.

Cybera fundamentally changes the way distributed businesses use technology. Our purpose-built network services platform empowers companies with many remote business locations to rapidly deploy, secure, and optimize new cloud-based applications and services.

iLoy Group is a Swiss company offering smart and flexible professional services to banks, financial institutions, organizations, schemes, and companies of any size. Our motivated team of high caliber professionals combines cross-functional expertise from the Payment Card Industry, the Digital Payment Industry, the Loyalty Service Industry, and the Information Technologies Industry.

iLoy Group is a Swiss company offering smart and flexible professional services to banks, financial institutions, organizations, schemes, and companies of any size. Our motivated team of high caliber professionals combines cross-functional expertise from the Payment Card Industry, the Digital Payment Industry, the Loyalty Service Industry, and the Information Technologies Industry.

Komgo is a digital network that aims to bring the global commodity trade finance network together for better and safer interactions among companies.

Komgo is a digital network that aims to bring the global commodity trade finance network together for better and safer interactions among companies.

Wage slips, employee insurance, employer references, illness and accident reports, accounting – all these things cost time and energy. Wouldn’t you rather invest that time in your core business? KLARA takes care of the administrative work for you.

Wage slips, employee insurance, employer references, illness and accident reports, accounting – all these things cost time and energy. Wouldn’t you rather invest that time in your core business? KLARA takes care of the administrative work for you.

aXedras is bringing the precious metals trading industry into the era of digital economy – track, trace, and trade precious metals.

aXedras is bringing the precious metals trading industry into the era of digital economy – track, trace, and trade precious metals.

drion.ai

With the Drion technology, providers of financial services process the analysis of SME annual statements within minutes.

With the Drion technology, providers of financial services process the analysis of SME annual statements within minutes.

Unity Investment AG

![]()

![]()

![]()

Unity Investment, based in Canton Schwyz, Switzerland, is an IT services company with the expertise in delivering high-performance crypto-mining infrastructures and solutions to customers and clients. Unity Investment completely takes care of the maintenance of the hardware and software infrastructure for the generation of cryptographic currencies based on blockchain technology.

Numbrs is a customer-centric financial services company. It enables its customers to manage their existing bank accounts and personal finances and to buy any financial product from every provider at the best possible price.

Numbrs is a customer-centric financial services company. It enables its customers to manage their existing bank accounts and personal finances and to buy any financial product from every provider at the best possible price.

ALPHROCKZ

Rockz is a new cryptocurrency that brings solidity and trust into the volatile cryptocurrency market for the first time. Unlike other cryptocurrencies Rocks is pegged in value to one of the world’s strongest and most sustainable currencies, the Swiss Franc, in a 100% transparent and legally enforceable way.

eCollect applies high-end technology to cover the full receivables management cycle for any business: from the initial invoice to the final payment. Our AI-based service surpasses the outdated methods of traditional debt collection employing a proven workflow to take customer communication to the next level. The result is a fully integrated platform, which allows the cost-effective processing of even small-sized and cross-border receivables. Backed up by a professional legal team handling every conceivable aspect of the process, eCollect ensures full compliance with regulatory requirements and offers the highest standards of data protection and system security.

eCollect applies high-end technology to cover the full receivables management cycle for any business: from the initial invoice to the final payment. Our AI-based service surpasses the outdated methods of traditional debt collection employing a proven workflow to take customer communication to the next level. The result is a fully integrated platform, which allows the cost-effective processing of even small-sized and cross-border receivables. Backed up by a professional legal team handling every conceivable aspect of the process, eCollect ensures full compliance with regulatory requirements and offers the highest standards of data protection and system security.

SmartWall is a solution offered by SwissPay.ch SA. The SmartWall solution is a dynamic paywall that automatically optimizes settings based on user engagement, traffic sources, type of content and many other data points. It provides publishers and media with a powerful marketing tool to understand and segment their audience in order to personalize their paywall to find each user’s tipping point towards conversion.

SmartWall is a solution offered by SwissPay.ch SA. The SmartWall solution is a dynamic paywall that automatically optimizes settings based on user engagement, traffic sources, type of content and many other data points. It provides publishers and media with a powerful marketing tool to understand and segment their audience in order to personalize their paywall to find each user’s tipping point towards conversion.

AMNIS provides small and medium enterprises via an electronic platform access on fair terms for currency exchange and foreign currency payments. Various automated systems and APIs (programming interfaces), it also allow the processes involved in dealing with foreign currency easier.

AMNIS provides small and medium enterprises via an electronic platform access on fair terms for currency exchange and foreign currency payments. Various automated systems and APIs (programming interfaces), it also allow the processes involved in dealing with foreign currency easier.

Avance Pay is a fast growing Swiss high-tech company, specialized in innovative NFC-based payment and transaction solutions. Founded in 2011, Avance Pay is a privately held and independent company with headquarters in Bern, Switzerland. The management team has extensive experience in the field of electronic transactions & ticketing, NFC, RFID and high-tech entrepreneurship. Avance Pay is continuously building its IP portfolio.

Avance Pay is a fast growing Swiss high-tech company, specialized in innovative NFC-based payment and transaction solutions. Founded in 2011, Avance Pay is a privately held and independent company with headquarters in Bern, Switzerland. The management team has extensive experience in the field of electronic transactions & ticketing, NFC, RFID and high-tech entrepreneurship. Avance Pay is continuously building its IP portfolio.

billte digitalize paper invoices and to automate the billing chain for small and medium businesses. Since the deal does not end with a bill, we surround the invoices with a wide range of features that are beneficial for both, companies and their customers. By providing Value Added Services, such as bi-directional communication channel, awarding offers, analytics, forecasting, financial support, we help to maintain existing relationships and gain new customers.

billte digitalize paper invoices and to automate the billing chain for small and medium businesses. Since the deal does not end with a bill, we surround the invoices with a wide range of features that are beneficial for both, companies and their customers. By providing Value Added Services, such as bi-directional communication channel, awarding offers, analytics, forecasting, financial support, we help to maintain existing relationships and gain new customers.

Bluecode is a pan-European mobile payment solution for banks and retailers that allows fast, secure, and anonymous payments using mobile devices. At no time does Bluecode transmit or store personal data from the user’s smartphone (iOS and Android). Bluecode can be seamlessly integrated into existing banking apps or retail registers.

Bluecode is a pan-European mobile payment solution for banks and retailers that allows fast, secure, and anonymous payments using mobile devices. At no time does Bluecode transmit or store personal data from the user’s smartphone (iOS and Android). Bluecode can be seamlessly integrated into existing banking apps or retail registers.

Konsumfinanzierungsunternehmen mit Sitz in Zug, lanciert eine neue Bezahllösung und bietet als einziges Unternehmen in der Schweiz alle Dienstleistungen rund um die Zahlungsabwicklung für den Kauf auf Rechnung im E-Commerce sowie am Point of Sale aus einer Hand an. Ziel von Byjuno ist, dem Händler und dessen Kunden, eine effiziente, benutzerfreundliche und unkomplizierte Bezahllösung bereitzustellen.

Konsumfinanzierungsunternehmen mit Sitz in Zug, lanciert eine neue Bezahllösung und bietet als einziges Unternehmen in der Schweiz alle Dienstleistungen rund um die Zahlungsabwicklung für den Kauf auf Rechnung im E-Commerce sowie am Point of Sale aus einer Hand an. Ziel von Byjuno ist, dem Händler und dessen Kunden, eine effiziente, benutzerfreundliche und unkomplizierte Bezahllösung bereitzustellen.

CashSentinel is a fintech startup that developed an innovative payment solution, which is at the crossroads of escrow agents and mobile wallets, to facilitate vehicle transactions. CashSentinel’s service has opened in April 2014 in Switzerland.

At Cryptix we foresee the future of money and realize digital payment solutions based on blockchain & DLT to make life simpler for consumers & businesses.

At Exchange Market we make currency exchange for people like you super easy, fair and flexible.

At Exchange Market we make currency exchange for people like you super easy, fair and flexible.

Our service is based on the premise that each customer is special. We strive every day to take from our customers all worries of changing their francs and euros and make sure that they save real money.

Feathercoin is an upgraded and customised version of Bitcoin. Feathercoin was born with the intent to expand, experiment, and build onto the blockchain technology in a manner open to all for participation. Feathercoin is a powerful open source digital currency with monetary properties likened to Bitcoin, Litecoin and a myriad of countless alt coins, but under the hood is something very different.

Forctis‘ goal is to create a new Blockchain technology for mass adoption and financial inclusion Inspired by the interplay between computational biology, statistical mechanics and the latest thinking in economic theory, we are developing an asset representation model based on a completely new, revolutionary take on the Blockchain.

GORDON NOW

Gordon.now empower organizations to create mutually rewarding interactions with its users by providing a near-zero fee transaction platform.

Gordon.now empower organizations to create mutually rewarding interactions with its users by providing a near-zero fee transaction platform.

ibani.com is a currency exchange and money transfer service with highly competitive rates and zero hidden fees. Through its mobile app and its smart local IBAN system, it enables businesses and individuals to save money quickly and easily on each transaction.

ibani.com is a currency exchange and money transfer service with highly competitive rates and zero hidden fees. Through its mobile app and its smart local IBAN system, it enables businesses and individuals to save money quickly and easily on each transaction.

MUUME with its headquarters in Switzerland, is a platform for digital services for daily consumption that consumers can use to take care of their purchases and orders on their smartphones effortlessly and in a customized manner. MUUME is an expert in digital product data management and digital payment.

MUUME with its headquarters in Switzerland, is a platform for digital services for daily consumption that consumers can use to take care of their purchases and orders on their smartphones effortlessly and in a customized manner. MUUME is an expert in digital product data management and digital payment.

Imburse simplifies the integration of payment technologies into legacy IT systems. Our clients need only the single integration with Imburse to deploy the ability to collect or pay out in any market via any payment technology immediately.

Imburse simplifies the integration of payment technologies into legacy IT systems. Our clients need only the single integration with Imburse to deploy the ability to collect or pay out in any market via any payment technology immediately.

Jibrel is a blockchain and smart contract development company. We aim to leverage the latest innovations in cryptography, distributed ledger and smart contract technology to build the financial networks of the future

Kickshops is the first shop that works on any device form end to end. Take pictures with your smart phone and add them to your products, manage orders on your tablet, or simply check your selling stats on your desktop. Your customers will be able to access your shop from their device of choice without getting slowed down. Reach more customers & make more sales.

Kickshops is the first shop that works on any device form end to end. Take pictures with your smart phone and add them to your products, manage orders on your tablet, or simply check your selling stats on your desktop. Your customers will be able to access your shop from their device of choice without getting slowed down. Reach more customers & make more sales.

Klarpay AG is a modern swiss based merchant payments company with seamless digital accounts for acquiring and multi-currency settlement accounts under Swiss regulation

Klarpay AG is a modern swiss based merchant payments company with seamless digital accounts for acquiring and multi-currency settlement accounts under Swiss regulation

LAPO Blockchain is building a revolutionary financial ecosystem empowering businesses, traders and consumers with a fast and easy payment solution integrated with a secure decentralized exchange powered by artificial intelligence. Thanks to this innovative technology it will be possible to reduce transaction fees and complexity for business and increase access and usability for people. LAPO Coin is the core of the LAPO ecosystem, called the LAPO ePlatform.

LiquidChain builds the Liquidity.Network (http://liquidity.network), a practical global blockchain micropayment system, built on top of Ethereum, supporting millions of users securely, reducing transaction costs significantly and enabling the mainstream adoption of blockchain.

Liquineq™ is an Ethereum-based financial platform optimized to address the flaws in the existing bank-to-bank money transaction system as well as revocation/redemption of lost or stolen tokens and the ability to easily use Liquineq tokens as fiat currency.

MOGLI APP

With Mogli you can manage your private payments easily via your phone. Not only to any other eWallet user but also to make IBAN Bank transfers.

With Mogli you can manage your private payments easily via your phone. Not only to any other eWallet user but also to make IBAN Bank transfers.

PINTAIL

During the World Economic Forum held in Davos, our two founders were pacing the bustling alleys of this usually peaceful Swiss village, when they spontaneously joined in a heated discussion debating the prohibitive costs of financial services and the subsequent lack of accessibility for migrants, refugees and their families still living in their countries of origin.

During the World Economic Forum held in Davos, our two founders were pacing the bustling alleys of this usually peaceful Swiss village, when they spontaneously joined in a heated discussion debating the prohibitive costs of financial services and the subsequent lack of accessibility for migrants, refugees and their families still living in their countries of origin.

Rivero Ltd. is a privately held company based in Switzerland, with a strong focus on the payments and card industry.

Rivero Ltd. is a privately held company based in Switzerland, with a strong focus on the payments and card industry.

Saga is a stablecoin project overseen by the Saga Foundation. Saga is designed to address legitimate concerns expressed by policy makers, regulators and market participants regarding cryptocurrencies, mainly their anonymity, lack of underlying value and high volatility. It aims to promote a low-volatility environment, combining the virtues of blockchain technologies with algorithmic representations of financial tools.

SecurionPay, established in 2014 in Switzerland, is a cross-device payment platform that enables businesses accepting online payments in 160 currencies through the checkout translated into 23 languages.

SecurionPay, established in 2014 in Switzerland, is a cross-device payment platform that enables businesses accepting online payments in 160 currencies through the checkout translated into 23 languages.

Sonect is a P2P matchmaking platform that utilises location to connect those who want to withdraw cash with those who want to deposit it. The platform wants to turn an area’s shops into virtual ATMs using just a smartphone or its POS-system. It democratises the process of cash distribution in order to reduce the “cost of cash”.

Sonect is a P2P matchmaking platform that utilises location to connect those who want to withdraw cash with those who want to deposit it. The platform wants to turn an area’s shops into virtual ATMs using just a smartphone or its POS-system. It democratises the process of cash distribution in order to reduce the “cost of cash”.

Founded in 2017 in Lausanne, Stairlin is building a marketplace for anyone to easily start or run their business online; and to offer their customers a seamless experience to find, book and pay for their services in 15 seconds or less.

Founded in 2017 in Lausanne, Stairlin is building a marketplace for anyone to easily start or run their business online; and to offer their customers a seamless experience to find, book and pay for their services in 15 seconds or less.

Status is an open source, Ethereum-based app that allows users to chat, transact, and access the world of decentralized apps (DApps) on the decentralized web. Status is also an encrypted private messenger that allows users to send payments and smart contracts to friends from within chats, using a peer-to-peer protocol that doesn’t rely on centralized servers.

SweePay designs, delivers and operates payment and distribution services for the digital and physical world. SweePay’s team includes experts in the payment, prepaid services, mobile services, money transfer, WEB, public transportation, telecommunication.

SweePay designs, delivers and operates payment and distribution services for the digital and physical world. SweePay’s team includes experts in the payment, prepaid services, mobile services, money transfer, WEB, public transportation, telecommunication.

Swiss Capital AG ist eine Schweizer Vermögensverwaltungsgesellschaft, die nach den Bestimmungen des Schweizer Finanzmarktaufsichtsgesetzes reguliert ist.

Swiss Crypto Tokens AG was founded by Bitcoin Suisse AG in July 2018 as part of the Bitcoin Suisse Group. It is registered in the Canton of Zug, Switzerland’s “Crypto Valley”. Its purpose is to provide comprehensive services related to the issuing of tokens, including the issuance of own such tokens.

Twint is a digital wallet service launched in 2014 by PostFinance, the banking arm of the Swiss post office. The service is backed by Switzerland’s biggest banks and SIX.

Twint is a digital wallet service launched in 2014 by PostFinance, the banking arm of the Swiss post office. The service is backed by Switzerland’s biggest banks and SIX.

Utrust is a cryptocurrency payment solution offering instant transactions, buyer protection and crypto-to-cash settlements. It uses a dynamic holding system where it holds the funds and release them to a seller, adjusted on a performance-based timeframe. The company was founded in 2017 and is headquartered in Zug.

WECAN ACCELERATE

Launched by Wecan Group, Wecan Accelerate aims to connect key players from the blockchain, as well as companies wishing to develop this technology in Switzerland.

Launched by Wecan Group, Wecan Accelerate aims to connect key players from the blockchain, as well as companies wishing to develop this technology in Switzerland.

Fidectus is a Swiss-based company founded for the purpose of solving the specific problem of electronic settlement matching (eSM) together with and for the European OTC energy trading industry.Fidectus is a Swiss-based company founded for the purpose of solving the specific problem of electronic settlement matching (eSM) together with and for the European OTC energy trading industry.

Fidectus is a Swiss-based company founded for the purpose of solving the specific problem of electronic settlement matching (eSM) together with and for the European OTC energy trading industry.Fidectus is a Swiss-based company founded for the purpose of solving the specific problem of electronic settlement matching (eSM) together with and for the European OTC energy trading industry.

radynamics develops innovative software solutions in the Fintech / DLT sector for national and international applications.

radynamics develops innovative software solutions in the Fintech / DLT sector for national and international applications.

inapay is a mobile app which lets you accept payments in Bitcoin and other Cryptocurrencies in your business.

inapay is a mobile app which lets you accept payments in Bitcoin and other Cryptocurrencies in your business.

3rd-eyes Analytics is the software partner of choice for banks, insurance companies and investment advisers that wish to implement a digital goal based advisory process.

Accointing is the accounting, tracking and tax optimization tool for Bitcoin and other cryptocurrencies.

Accointing is the accounting, tracking and tax optimization tool for Bitcoin and other cryptocurrencies.

adviceonline.ch, the complete and regulatory conform Onboarding, Profiling, Opening Document Management, Advisory and Consolidation Suite for EAM and Banks.

With diverse academic backgrounds ranging from information technology, mathematics, business administration, political sciences and philosophy, economics, design, linguistics and psychology, Adviscent‘s team of experts brings solid domain expertise on board in the banking, pharmaceutical, manufacturing and food industries

A$H is an investment app targeting millennial retail investors. It enables mobile investments in digital assets and offers gamification, as well as social features. The app runs on the Melon protocol, a decentralized fund management system.

Altcoinomy is the premier facilitator in cryptocurrency cash-out and KYC for early adopters and ICOs in Switzerland.

AMUN

Amun makes investing in crypto assets as easy as buying a stock. Investors can invest in crypto easily, safely, and in a regulated way on the SIX Swiss Exchange.

AlgoTrader is an algorithmic trading software system. The company was founded by the CEO Andy Flury in Zurich Switzerland.

AlgoTrader is an algorithmic trading software system. The company was founded by the CEO Andy Flury in Zurich Switzerland.

Altoo has developed its wealth platform in co-creatorship with its clients. Our independence and diversity enables us to connect people, wealth and processes by technology in a unique way.

AM-One offers a unique balance of innovation, agility, experience and value. Innovation because we combine modern intelligent technology with personalized services to digitally transform your business.

Provide a platform where investors and manufacturers meet to achieve better investment decisions facilitated through technologically enabled investment, risk and product management as well as execution services.

Assetmax AG develops and maintains an integrated wealth management software solution for external managers, family offices and banks: Assetmax.

Fyooz is a Blockchain powered tokenization platform designed to democratize humanity’s desire to invest, participate and gain access to anything one can imagine.

Fyooz is a Blockchain powered tokenization platform designed to democratize humanity’s desire to invest, participate and gain access to anything one can imagine.

The Swiss gateway to convert money into cryptocurrencies and digital assets. Buy – sell bitcoins and ethers. Introducing Bity Kiosks, the easiest way to acquire or sell bitcoins with cash. Only a phone number is required. Bitcoin ATMs are currently located in Geneva, Lausanne, Montreux, Neuchâtel, Zürich Hauptbahnhof and Zürich Hardbrücke.

Canopy, formerly Mesitis, is an anonymous account aggregation and analytics platform for financial institutions, wealth management professionals, and high net worth individuals. The technology allows banks like Credit Suisse, with which it has partnered, to give clients an aggregated, real-time view of their investments.

Canopy, formerly Mesitis, is an anonymous account aggregation and analytics platform for financial institutions, wealth management professionals, and high net worth individuals. The technology allows banks like Credit Suisse, with which it has partnered, to give clients an aggregated, real-time view of their investments.

Curio is using blockchain technology to create new Digital Asset Class that opens the global collectors car market to millions of investors around the world in a trustworthy and transparent environment.

CRAIDER

Cradier is a next-gen digital platform consisting of a mobile messenger bot, web based portal and a cloud based exchange, all powered by data driven analytics. Craider’s goal is to expand and support the Digital Currency ecosystem and to enable anyone to participate, whether you are new to the space or an experience trader.

DARICO

Darico, a fully integrated ecosystem of multiple products that enables users to Monitor, Trade, Invest, & Spend with confidence and ease in the crypto economy. Darico is made up of 5 different products that are interlinked within each other to provide users with the full toolkit they need to succeed in the cryptocurrency and blockchain industry.

DEIN ANLAGEBERATER.CH

By leveraging technology, Dein-Anlageberater.ch provides users with personalized investment advisory services and recommendations for asset allocation at a much lower price than traditional investment advisers.

Derizone AG is a Fintech company based in Zurich, Switzerland, founded by a group of structured product and IT experts, who contributed to defining the Swiss structured product standard and to build the SIX Swiss Exchange structured product infrastructure.

Derizone AG is a Fintech company based in Zurich, Switzerland, founded by a group of structured product and IT experts, who contributed to defining the Swiss structured product standard and to build the SIX Swiss Exchange structured product infrastructure.

Descartes is a digital Swiss investment advisor bringing together the latest insights in financial theory, leading technology, and successful investment specialists. An easy, low-cost access to strategies and methods of well-known, independent investment specialists, portfolio managers and economists.

Dufour Capital is an independent investment firm specialized on dynamically and systematically managed ETF and ETC portfolios (Exchange Traded Funds and Exchange Traded Commodities). The company is based in Zurich, Switzerland and fully licensed by the Swiss regulatory authorities as an asset manager.

Dydon currently specializes in automating compliance processing with AI solutions to reduce compliance processing costs significantly while improving efficiency measurably.

Dydon currently specializes in automating compliance processing with AI solutions to reduce compliance processing costs significantly while improving efficiency measurably.

Epoque Plus develops “Artificial Intelligence Trading Services” specialising in Forex and indices.

Epoque Plus develops “Artificial Intelligence Trading Services” specialising in Forex and indices.

EVOLUTE

Evolute is a seamlessly integrated platform covering the entire wealth management value chain. Technology, Operations and Compliance services are unified on a single platform which is perfectly synchronized and modular. Evolute’s unique solution combines intelligent technology, sound knowledge, and personal advice in a tailor-made and solution-oriented offering for independent wealth managers and banks.

Evolute is a seamlessly integrated platform covering the entire wealth management value chain. Technology, Operations and Compliance services are unified on a single platform which is perfectly synchronized and modular. Evolute’s unique solution combines intelligent technology, sound knowledge, and personal advice in a tailor-made and solution-oriented offering for independent wealth managers and banks.

FLINK AI

Flink AI is building a streaming machine learning and AI infrastructure tailored to financial and time series data and develops state of the art AI models and self-learning software agents which translate information from high frequency data streams into actionable insights.

Flink AI is building a streaming machine learning and AI infrastructure tailored to financial and time series data and develops state of the art AI models and self-learning software agents which translate information from high frequency data streams into actionable insights.

INVESTAPEDIA AG

The fintech company Investapedia is an independent and competent financial services company from Switzerland.

The fintech company Investapedia is an independent and competent financial services company from Switzerland.

Maecenas is an art investment platform allowing fractional ownership of artworks. Maecenas leverages blockchain technology to create tamper-proof verifiable provenance and to enable real-time digital settlement of transactions.

MyBit enables the rapid building, testing, and deployment of wealth management applications on the Ethereum Blockchain.

Nectar Financial, formerly Etops, is a Swiss fintech company specializing in wealth and asset management. It provides middle and back office services for more than 30 family offices, independent asset managers and banks and supports them in managing assets in excess of CHF 35 billion.

FinGraphs is a chart application offering a visual methodology to analyse and follow many markets Long term to Intraday. FinGraphs is powered by Management Joint Trust SA (MJT) a market advisory firm founded in Geneva, Switzerland, in 1969.

FinGraphs is a chart application offering a visual methodology to analyse and follow many markets Long term to Intraday. FinGraphs is powered by Management Joint Trust SA (MJT) a market advisory firm founded in Geneva, Switzerland, in 1969.

FINHORIZON

Finhorizon is a finance information firm founded in 2014 and based in Zurich. The company offers two main solutions.

FundBase is a cloud-based platform to ultimately host the complete investment process for high-conviction alternative investments. Fundbase delivers to qualified investors a seamlessly integrated platform to discover, execute and monitor complex investments such as hedge funds, private equity and other high-conviction investments.

FundBase is a cloud-based platform to ultimately host the complete investment process for high-conviction alternative investments. Fundbase delivers to qualified investors a seamlessly integrated platform to discover, execute and monitor complex investments such as hedge funds, private equity and other high-conviction investments.

Fyleen serves the interests of your assets thanks to efficient technology and human pedagogy.

Fyleen serves the interests of your assets thanks to efficient technology and human pedagogy.