Klarpay Simplifies Global Micropayments for Digital Businesses

by Fintechnews Switzerland January 15, 2024In the ever-evolving landscape of digital businesses, micropayments have emerged as a pivotal financial mechanism, particularly on platforms hosting freelancers, creators, and gig workers.

These small-scale transactions are increasingly vital in a world where digital services and content are monetised incrementally, catering to the growing trend of microtransactions in various online economies.

From digital media to freelance services and content creation, micropayments enable a flexible, efficient, and user-friendly approach to handling financial exchanges in the digital domain.

What are Micropayments?

Micropayments refer to small-value transactions, typically below a certain threshold, executed online.

These transactions play a crucial role in the gig and creator economy, where individuals often receive compensation in small amounts for their work or content.

They are essential in online marketplaces, mobile applications, and content platforms (like social media and blogging sites) where transactions are usually frequent but of lower value.

How do Micropayments Work?

Micropayments work by leveraging streamlined and cost-effective payment infrastructures. Micropayments are generally quick, efficient, and low-cost transactions.

These are particularly beneficial for digital businesses that operate in the gig economy, where freelancers and creators may need instant access to their earnings.

The technology behind micropayments often involves secure digital wallets and blockchain technology, enhancing the speed and security of these transactions.

Consider a freelance graphic designer who offers digital art services online. Instead of waiting to accumulate a large sum, they receive small, regular payments for each design they create.

These micropayments allow the designer to access their earnings quickly and efficiently, ensuring their financial security.

Similarly, a content creator on a video platform might receive micropayments based on viewership and engagement, illustrating the diverse applications of this payment method.

Klarpay’s Role in Transforming Micropayments

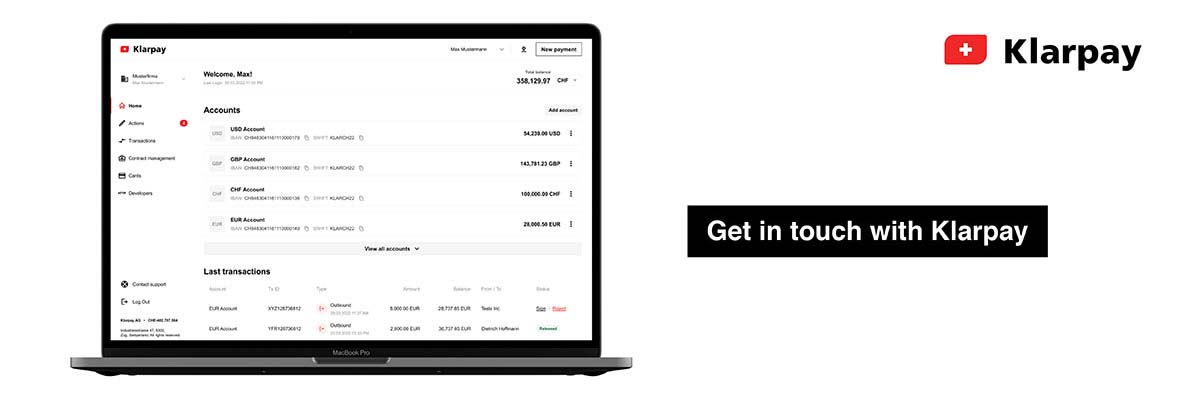

Financial Institution Klarpay specialises in providing Swiss Corporate Accounts in 17+ currencies and 80+ payout currencies with local ACH capability, global payment acceptance, and efficient disbursement solutions, all of which are API-enabled.

Multi-Currency Accounts: Klarpay facilitates transactions in multiple currencies and multiple local clearing systems, enabling digital businesses to operate on a global scale.

This feature is particularly valuable for platforms that send payments to freelancers and creators around the world.

Global Payment Acceptance: Klarpay also ensures that digital businesses can accept payments from alternative sources globally.

This is crucial for platforms hosting freelancers and creators, allowing them to reach a broader audience without the hassle of dealing with currency conversion complexities.

Efficient Disbursement: Klarpay streamlines the disbursement process, making it easy for digital businesses to make micropayments to their freelancers and creators.

With Klarpay’s infrastructure, payments can be processed quickly, automatically (using APIs), and securely while meeting the instant and frequent payout needs of the gig economy.

Micropayments are at the forefront of transforming how digital businesses handle financial transactions.

Klarpay’s role as a financial institution is instrumental in providing the necessary tools for seamless, efficient, and secure multi-currency payouts, ensuring that freelancers and creators can focus on what they do best – creating and contributing to the digital landscape.

Get in touch with Klarpay here.