The FINTECH Book Includes 85 Global Fintech Experts And Will Be Released On April 1st

by Fintechnews Switzerland March 13, 2016The FINTECH Book, a much-anticipated publication co-authored by 85 global fintech experts from 20 countries, will be released on April 1st by Wiley.

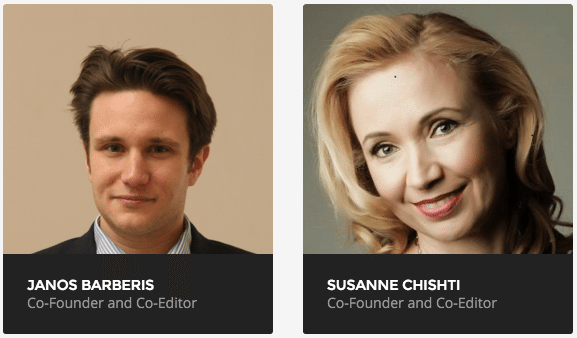

The Fintech book , the first consolidated and globally crowdsourced resource focusing on the disruption, innovation and opportunity in the financial technology sector, was initiated and edited by Susanne Chishti, CEO of FINTECH Circle, and Janos Barberis, founder of Fintech HK and Hong Kong’s SuperCharger Fintech Accelerator program.

According to Chishti, The FINTECH Book is aimed at allowing readers to understand the overall fintech sector and the impact of technology on retail, corporate and investment banking, asset management and private banking.

Chishti and Barberis created The FINTECH Book after realizing that there was no publication explaining the whole fintech sector.

“We wanted to learn more about global fintech entrepreneurs and leading fintech hubs and how fintech addresses the challenge of the unbanked sector,” Chishti said in an interview. “We also wanted to investigate fintech sub-sectors across insurance and regulatory change and fully explore how to invest into FINTECH firms from angel investors to corporate venture arms.”

“We soon realized that our expectations were too much for any single author and this global knowledge and insight could only be found by combining the expertise of the best FINTECH entrepreneurs, investors, and visionaries globally. So The FINTECH Book was born!”

The book explores the overall market dynamics and the key developments in the industry through insights of practitioners and entrepreneurs and is also part of the list “Top 10 Fintech Books”

The book explores the overall market dynamics and the key developments in the industry through insights of practitioners and entrepreneurs and is also part of the list “Top 10 Fintech Books”

It summarizes the latest fintech solutions for both established corporate players and consumers, and explores the latest technologies that are facilitating higher investment performance. It provides a vision to several categories of blockchain technologies that will impact the financial industry: digital currencies, asset registries, application stacks, and asset-centric technologies.

The FINTECH Book also covers established fintech centers like London, discusses France’s fintech-favorable conditions, and examines the Netherlands as an integrated fintech ecosystem.

It reviews hot fintech scenes such as Luxembourg, Austria, India, and Singapore, each having its own unique characteristics that set it apart as a potential frontrunner in the area.

Chapter about Robo Advisor

Paolo Sironi, IBM Thought Leadership – Wealth Management Investment Analytics

Watch this great preview Video about his chapter on Robo-Advisors, disruptive and sustaining innovation.

The Next Chapter in Citi’s Story of Innovation

Jorge Ruiz, Global Head of Digital Acceleration at Citi

Citi Mobile Challenge launched in 2014 with programs in Latin America and the U.S., followed by a Challenge in Europe, the Middle East and Africa in 2015. This groundbreaking global initiative provides registered developers with a suite of tools (APIs) and selected participants are invited to present their concepts at Demo Day events in each region. Finalists from each program compete for an opportunity to take their technologies into production with Citi’s support, plus a share of $100,000 in cash awards and a suite of services from Citi Mobile Challenge sponsors.

Seven Forces for Financial Innovation

Julia Groves, Founding Chair of the UK Crowdfunding Association

Seven forces have created almost perfect conditions for innovation in financial services in the UK. They affect supply and demand at meaningful scale, and align financial, social and policy objectives for arguably the first time.

The API economy: helping financial services companies to build better products

Richard Peers, Director Financial Services Industry at Microsoft

The application programming interface (API) economy is based around four building blocks: social, mobile, analytics and cloud. Apps and services can be linked rapidly and cost-effectively to create an extended value proposition.

Why Fintech Banks Will Rule The World

Philippe Gelis, CEO at KANTOX

Fintech banks, thanks to their banking license, will no longer rely on any bank to be and stay in business, and so will not be at the mercy of incumbents. What is even more powerful, through the marketplace, incumbents will become “clients” of fintech banks, so the system will be completely reversed.

Finance 2.0 and Next Generation Business Models

Marc Bernegger, Senior Advisor of Finleap

The Internet revolution has changed the economy to an extent rarely seen throughout history. Barriers to new business models are lower than before, resulting in numerous innovations and new startups. Although the financial industry is a few years behind, some fundamental adjustments will soon change the existing value chains. This megatrend has only just begun and will define the financial industry in the near future.

Other authors include Jessica Ellerm, partner development manager of Tyro Payments; Dele Atanda, digital innovation officer of IBM Interactive Experience; and Stefano L. Tresca, managing partner of iSeed and a bestselling author.

The FINTECH Book is organizing a global launch event on March 23, 2016, from 6pm to 10pm at The Shard, in London. People will have the opportunity to meet the authors and get a signed copy of The FINTECH Book prior to the official release on April 1st.

If you can’t attend the event, you can pre-order your copy of The FINTECH Book on Amazon

2 Comments so far

Jump into a conversation