Emerging fintech players and regulatory reforms are posing new challenges to European retail banks notably in the area of payments. Banks will need to collaborate with other banks and non-banks in order to stay in the game, according to a new report from Deloitte.

Entitled ‘Payments disrupted: The emerging challenge for European retail banks,’ the report is based on interviews with 24 payments experts and sought to understand their perspective on developments in payments.

The report also explores the main scenarios that are likely to emerge as well as the strategies banks could follow to respond to these market changes.

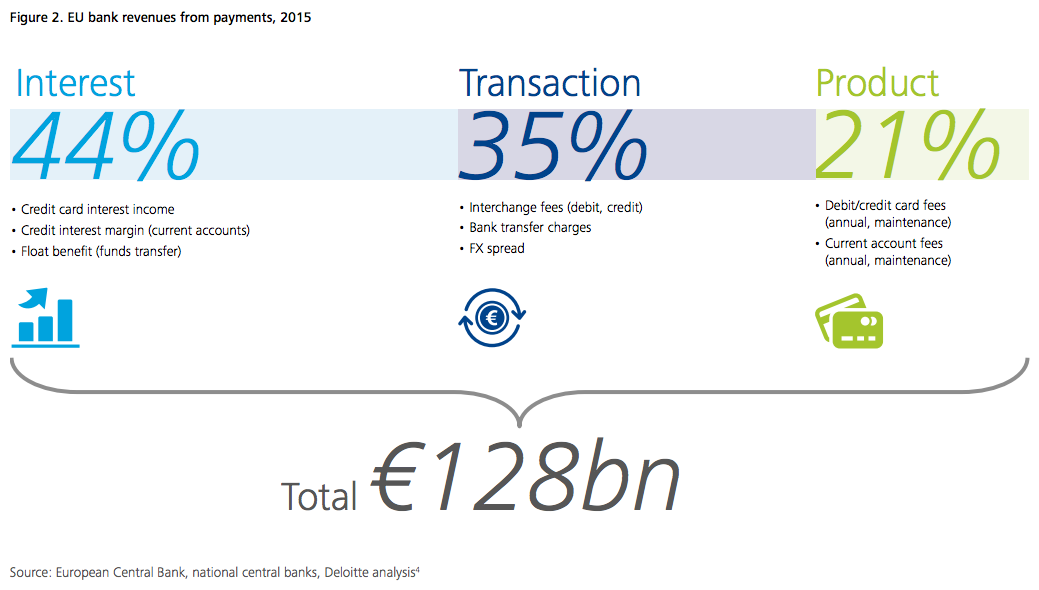

Payments, which represent a key revenue stream for European banks, are now the subject of intense regulatory scrutiny with price caps and structural measures being introduced to boost competition and innovation.

While the impact of capping debit and credit card feed in the EU “will be relatively modest,” Deloitte suggests that the impact of opening up the payments market to non-banks could be substantial.

“Non-bank payment initiation services can offer a simpler, swifter user experience, for example using mobile apps,” the report says. “By contrast, banks, with their heavier compliance obligations, have traditionally invested more in security and resilience.”

“New payments services are accelerating the shift from cash to non-cash payments. Consumer preferences are changing […] Digital payments are enabling much more data to be captured with each payment, such as where the individual was while making the payment.”

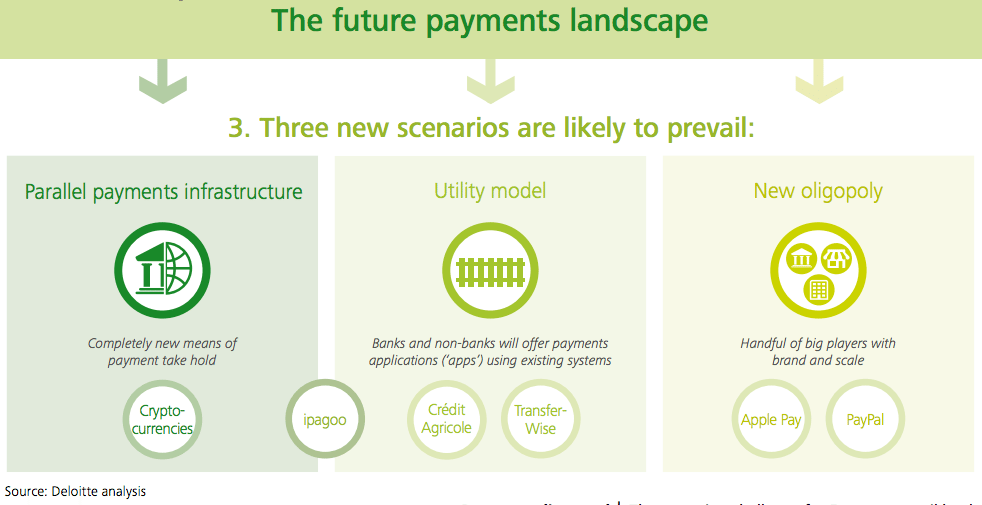

In this fiercely competitive environment, Deloitte says it expects that the status quo, in which payment systems continue to be run by and for the major banks, will not survive “as EU regulations will not permit it.”

Hence, Deloitte predicts three new scenarios:

New oligopoly: Payment systems are opened, but customer trust in non-banks is limited. As a result, the non-bank newcomers will be restricted to a handful of big players with brand and scale. Examples include Apple Pay and PayPal.

Utility model: Both banks and non-banks offer payments applications will offer payments applications that run on existing banking payment ‘rails.’ Examples are Credit Agricole and TransferWise.

Parallel payments infrastructure: If consumers’ desire for change outpaces regulatory pressure to open up payments systems, entirely new methods could emerge. To date, the likeliest candidates are cryptocurrencies, which used blockchain technology to bypass central banks.

The future payments landscape – Deloitte report

Banks need to collaborate

According to the report, banks are lagging behind when it comes to fintech investment. The firm estimates that in 2014, just 19% of the total US$10 billion invested has been towards fintechs.

However, non-banks accounted for 62% and collaboration between banks and non-banks for 19%.

For the biggest banks, Deloitte advises to collaborate with big card payment networks and benefit from the network effect.

For smaller banks, the firm suggests that the dominant strategy is to collaborate with other banks and non-banks.

However, both categories are advised to team up with non-bank players and act as “product manufactures to the non-banks’ retail front-end.”

“Where payment systems are opened up and customers trust non-bankers, it makes less sense for largest banks to ‘go it alone’ in an innovation race that they are unlike to win,” Deloitte argues.

“Rather, it makes sense for some larger banks to build scale as utilities, exploring their competitive advantages in compliance and resilience, providing the essential ‘rails’ in what continued to be a fast-growing area of activity.”

Asia: a growth driver

The payments area has been growing beyond expectations with revenues in 2014 reaching US$1.7 trillion growing 9% from the previous year, according to a McKinsey report.

The report estimates that in 2014, global payments accounted for at least 38% of total bank revenues, a trend that is nowhere near slowing down, the firm said.

“Payments growth is currently a truly global phenomenon,” McKinsey wrote in a report entitled ‘The Global Payments Industry: Healthy Growth, Shifting Drivers.’

“Asia once again—particularly China—is the primary engine propelling the global numbers, but all regions, even those where revenues have recently been in decline, are contributing to the surge. […] McKinsey expects that global payments revenues will begin to reflect the flip side of Asia’s prominence as a growth driver.”

According to the report, the Asia-Pacific region continued to be a major center of growth in 2014, adding approximately US$75 billion in payments revenues, and accounting for about 55% of the industry’s revenue growth worldwide.

Most specifically, China continued to be the driving force to this trend, contributing US$65 billion, or 87% of total regional revenues.

Featured Image credit: Freepik

6 Comments so far

Jump into a conversationThank you for sharing useful knowledge. I would love to learn about it too

The payment landscape is changing rapidly, and European retail banks need to adapt if they want to stay competitive. This could involve collaborating with fintech players, developing their innovative payment solutions, or focusing on their core strengths, such as security and resilience.

Basketball is one of the most popular and exciting sports in the world. It is a game that requires skill, speed, strategy, and teamwork. But what if you don’t have a court, a hoop, or a ball? What if you want to play basketball anytime, anywhere, and with anyone? Well, you can do that with Basketball Stars, a fun and challenging online multiplayer basketball game that you can play on your browser or mobile device

Whether you’re a seasoned gamer or new to the genre, there’s something for everyone to enjoy in this captivating universe.

สล็อตเล่นง่าย เข้าง่าย เว็บเกมสล็อตออนไลน์ยอดฮิตมากที่สุดปัจจุบันนี้ เว็บ pg มาพร้อมเกมส์ออนไลน์ PG SLOT เกมที่มีให้เลือกเล่นมากกว่า 100 เกม

สุขภาพที่ดี