Swiss Fintech Go Beyond Wants to Make Angel Investing an Asset Class

by Fintechnews Switzerland October 1, 2015Zurich-based Go Beyond is more than just an early-stage investing platform; it is a community of investors working towards democratizing early-stage investing. Its ultimate mission: “professionalize and democratize angel investing so that it would become an asset class for all types of investors,” the company claims.

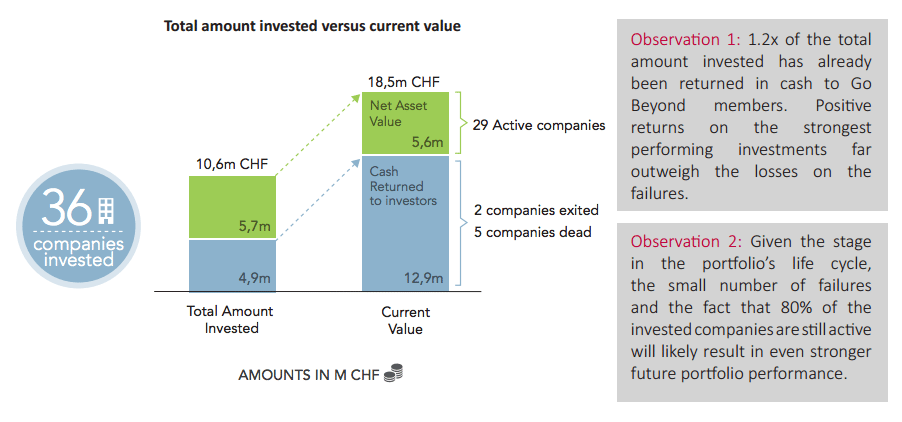

Infographic – the GO BEYOND Investor Report

Launched in 2008 by award-winning business angel Brigitte Baumann, Go Beyond aims to assist investors throughout their journeys by helping them build, manage and exit diversified portfolios of direct investments in young and fast-growing companies.

To make that happen, the company is betting on a five-component business model. This business model includes:

- syndication vehicles for small investment tickets;

- professional deal leadership certification and compensation programs;

- cumulative knowledge-sharing tools to educate investors;

- a one-year training program for novice angels; and

- portfolio strategy tips and tools.

Since its inception, Go Beyond has managed to gather more than 190 business angels from 25 nationalities under one roof, according to the Go Beyond Investor Report.

Released in May, the document looks at every investment made by active member angels and provides reports on the actual returns of each investor, offering thus “a fully auditable set of conclusions.”

Infographic – The GO BEYOND Investor Report

Since 2008, 10.6 million CHF has been invested in 36 companies from 11 different countries, according to the report.

Among these 36 companies, seven have exited (two successfully), returning 12.9 million CHF to investors as of March 2015.

According to the data, investors have made 10,700 investments decisions, which resulted in 1,000 investments tickets in 77 rounds.

In terms of portfolio performance, the company found that out of the 164 investors who have made at least one investment, 87% have a positive annualized return.

Go Beyond claims:

“Of those who have made 5 or more investments, 97% have a positive annualized return and >40% have all of their original investment monies or more returned by the two positive exits achieved to date.”

According to Baumann, the report demonstrates that angel investing can be an asset class for small and large investors.

Baumann said:

“The Go Beyond Investing approach is THE model to unleash the 10X to 20X growth potential for angel investing in Europe and the US and we will continue to lead the way.”

Go Beyond, which currently operated in Europe and the US, focuses on early-stage investments in 5 industry categories: technology, industrial, consumer, and Internet and mobile.

Read the full report: https://go-beyond.biz/report