Generative AI to Produce up to US$340B Yearly in Additional Revenues for the Banking Sector

by Fintechnews Switzerland June 20, 2023Generative artificial intelligence (AI) is expected to have a significant impact across all industry sectors but banking will be among those the most impacted, a new report by McKinsey and Company says.

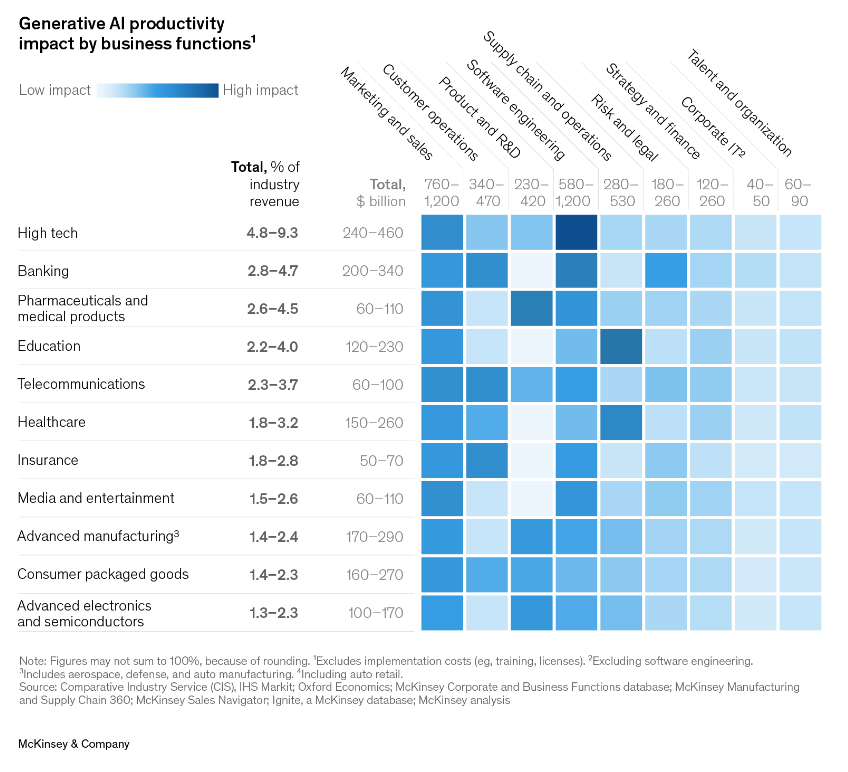

Estimates by the consultancy show that the technology could potentially generate value from increased productivity of 2.8-4.7% of the industry’s annual revenues, translating to an additional US$200-340 billion in revenues annually, the study found.

Generative AI productivity impact by business functions, Source: McKinsey and Company, June 2023

In the banking industry, generative AI has the potential to improve on efficiencies already delivered by AI by taking on lower-value tasks in risk management, the report says, including required reporting, monitoring regulatory developments, and collecting data. On top of that, the use of generative AI tools can also enhance customer satisfaction, improve decision making, boost employee experience, and decrease risks.

A generative AI bot trained on proprietary knowledge such as policies, research, and customer interaction, for example, can provide always-on, deep technical support. Morgan Stanley, for instance, is building an AI assistant using OpenAI’s technology to deliver relevant content and insights to financial advisors, driving efficiency and scale. The solution will leverage the technology to access, process and synthesize content and provide advisors and their teams with answers in an easily digestible format.

In the banking sector, generative AI can also be useful for software development, the report says. It can be used to draft code, helping developers code more quickly, reducing friction but also enabling automatic translations and no- and low-code tools. These tools can also automatically prioritize, run, and review different code tests, accelerating testing and increasing coverage and effectiveness. They are also capable of reviewing code to identify defects and inefficiencies in computing. Finally, generative AI’s natural-language translation capabilities can be used to optimize the integration and migration of legacy frameworks.

In addition to virtual assistants and software development, generative AI tools can be used to provide tailored content at scale, the report says, whether that’s personalized marketing and sales content tailored to specific client profiles and histories, or documentation.

Up to US$4.4 trillion per year in value added to the global economy

McKinsey and Company estimates that generative AI could translate to the addition of up to US$4.4 trillion per year in value to the global economy, with about 75% of this value falling across four areas: customer operations, marketing and sales, software engineering and research and development (R&D).

Impact of generative AI across potential corporate use cases, Source: McKinsey and Company, June 2023

Generative AI can also substantially increase labor productivity across the economy, the consultancy claims, generating a total economic benefits in labor productivity of up to US$7.9 trillion annually as labor productivity grow between 0.1-0.6% annually through 2040.

AI’s potential impact on the global economy, US$ trillion, Source: McKinsey and Company, June 2023

Projections by McKinsey and Company are consistent with those that have been made by other industry experts and observers. A new report by Creative Dock Group (CDG), an independent corporate venture builder in Europe and the Middle East and North Africa (MENA) region, and Rohrbeck Heger, the strategic and foresight arm of Creative Dock, expects generative AI to transform the landscape of finance by 2026 by delivering personalized experiences and optimized management systems.

In particular, AI-powered platforms can provide personalized financial advice and recommendations, catering to each customer’s unique needs and goals, the report says. AI can also be used in financial risk management to improve decision-making, reduce default rates, and automate compliance processes.

Generative AI is a subfield of AI focused on developing algorithms and models that are capable of generating new text, images, or other media in response to prompts. The technology came under the spotlight in November 2022 after the launch of OpenAI’s ChatGPT, an AI-powered chatbot that went viral for its ability to mimic human language and speaking styles, all the while providing coherent and topical information.

ChatGPT surpassed one million users in just five days, and in January, the chatbot surged past the 100 million monthly active users mark, becoming the fastest-growing consumer app in history.

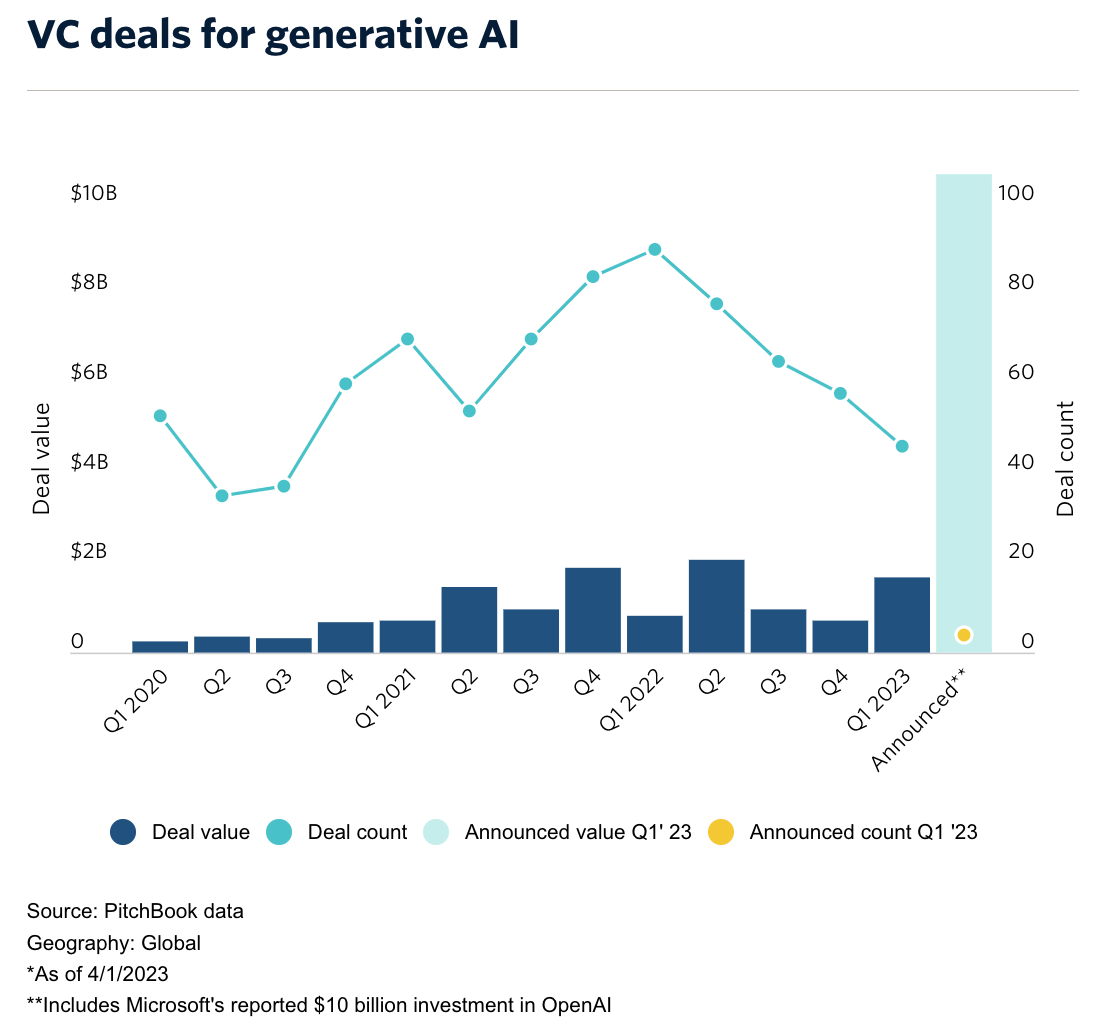

The rise of ChatGPT has sparked a frenzy in the tech community and captured the attention of venture capital (VC) investors globally.

Although AI and ML funding declined last year, generative AI startup VC investment remained resilient in 2022, reaching a total of US$4.5 billion, according to Pitchbook data. This year, VCs increased their positions in the technology, with roughly US$1.7 billion being generated across 46 deals in Q1 2023. An additional US$10.68 billion worth of deals were announced in the quarter but have not completed, PitchBook’s data show.

VC deals for generative AI, Source: Pitchbook, April 2023

Featured image credit: edited from Freepik